Finance

Intermarket Spread Swap Definition

Published: December 11, 2023

Learn the definition of Intermarket Spread Swap in finance. Discover how this financial instrument can help investors optimize their portfolio diversification and risk management strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Intermarket Spread Swap Definition

Welcome to the world of finance! If you’re looking to expand your knowledge in the intricacies of this industry, you’ve come to the right place. Today, we’ll be diving into the concept of an intermarket spread swap, a powerful tool that can help investors manage risk and optimize investment opportunities. So, what exactly is an intermarket spread swap, and how does it work? Let’s find out!

Key Takeaways:

- An intermarket spread swap is a financial derivative that allows investors to trade and profit from the price differences between related market instruments.

- This strategy helps investors manage risk and capitalize on discrepancies in the pricing of assets across different markets.

At its core, an intermarket spread swap is a trading strategy that involves the simultaneous buying and selling of related financial instruments in different markets. The goal is to profit from the price differences between these instruments, often referred to as spreads. By taking advantage of these spreads, investors can mitigate risk and potentially generate positive returns.

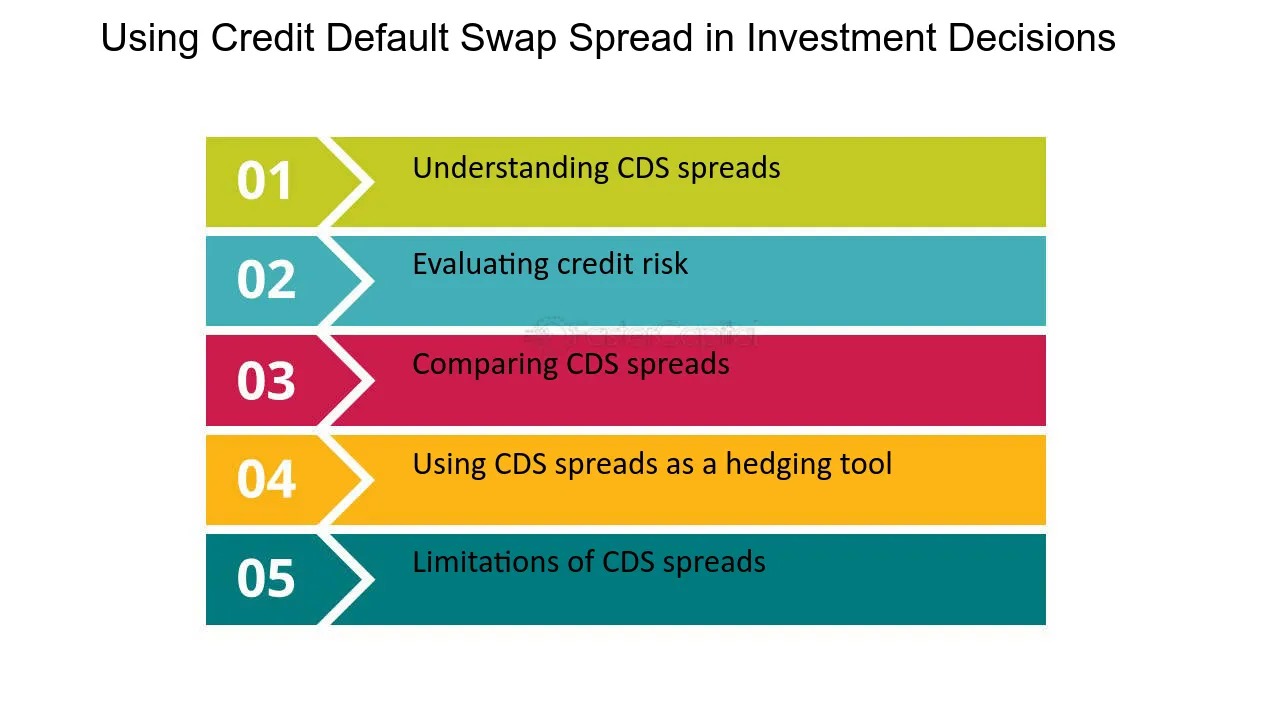

Here’s a breakdown of the intermarket spread swap process:

- Identifying Opportunities: Traders carefully analyze various markets and financial instruments to identify potential spreads that may present profitable opportunities. They look for discrepancies in pricing, interest rates, or any other factors that may affect the relative values of these instruments.

- Executing the Trade: Once a favorable spread opportunity is identified, traders execute the intermarket spread swap by simultaneously buying and selling the related instruments in different markets. This allows them to effectively create a spread position and profit from any price convergence or divergence.

- Managing Risk: Risk management is a crucial aspect of intermarket spread swaps. Traders implement stop-loss orders and other risk control measures to protect their positions from excessive losses. Additionally, diversifying the spread portfolio across multiple markets and asset classes can further help mitigate risk.

- Monitoring and Adjusting: Spread traders closely monitor their positions and continuously evaluate market conditions. They may make adjustments to their positions as market dynamics change, capitalizing on new spread opportunities or closing positions that are no longer favorable.

Intermarket spread swaps offer several benefits to investors, including:

- Risk management: This strategy allows investors to hedge against market volatility by taking positions in different markets simultaneously, thereby diversifying risk.

- Opportunistic trading: By capitalizing on price discrepancies, investors can potentially profit from market inefficiencies.

- Enhanced returns: Successful intermarket spread swaps can generate positive returns through both capital appreciation and income resulting from the spreads.

It’s essential to note that engaging in intermarket spread swaps requires a deep understanding of the markets, instruments, and factors impacting their pricing. Therefore, conducting thorough research and seeking advice from experienced professionals is highly recommended.

So, there you have it – a glimpse into the world of intermarket spread swaps. Remember, financial markets are constantly evolving, presenting new opportunities and challenges. By staying informed and adapting to changing market conditions, investors can leverage intermarket spread swaps to their advantage. Good luck on your financial journey!