Finance

When Do Municipal Bonds Settle

Published: October 14, 2023

Learn about the settlement process for municipal bonds in finance. Discover when these bonds commonly settle and how it affects investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Municipal bonds play a crucial role in the world of finance, providing an avenue for investors to support the development of essential public infrastructure, such as schools, hospitals, and transportation systems. These bonds are issued by state and local governments, offering a fixed income stream to investors in exchange for financing public projects.

When it comes to investing in municipal bonds, it is important to understand the concept of settlement dates. The settlement date refers to the specific day on which the transfer of ownership and payment for the bonds take place between the buyer and the seller. This date is a critical aspect of the bond transaction process and can impact the timing of your investment.

In this article, we will delve into the intricacies of municipal bond settlement dates, exploring key factors that affect these dates and the importance of understanding them. We will also provide tips on how to effectively manage settlement dates when investing in municipal bonds, ensuring a smooth and hassle-free experience.

Overview of Municipal Bonds

Municipal bonds, commonly referred to as “munis,” are debt instruments issued by state and local governments to raise funds for various public projects and initiatives. These bonds are a form of borrowing on the part of the government, and investors who purchase the bonds essentially lend money to the government entity. In return, investors receive regular interest payments, typically on a semi-annual basis, and the return of the invested principal at maturity.

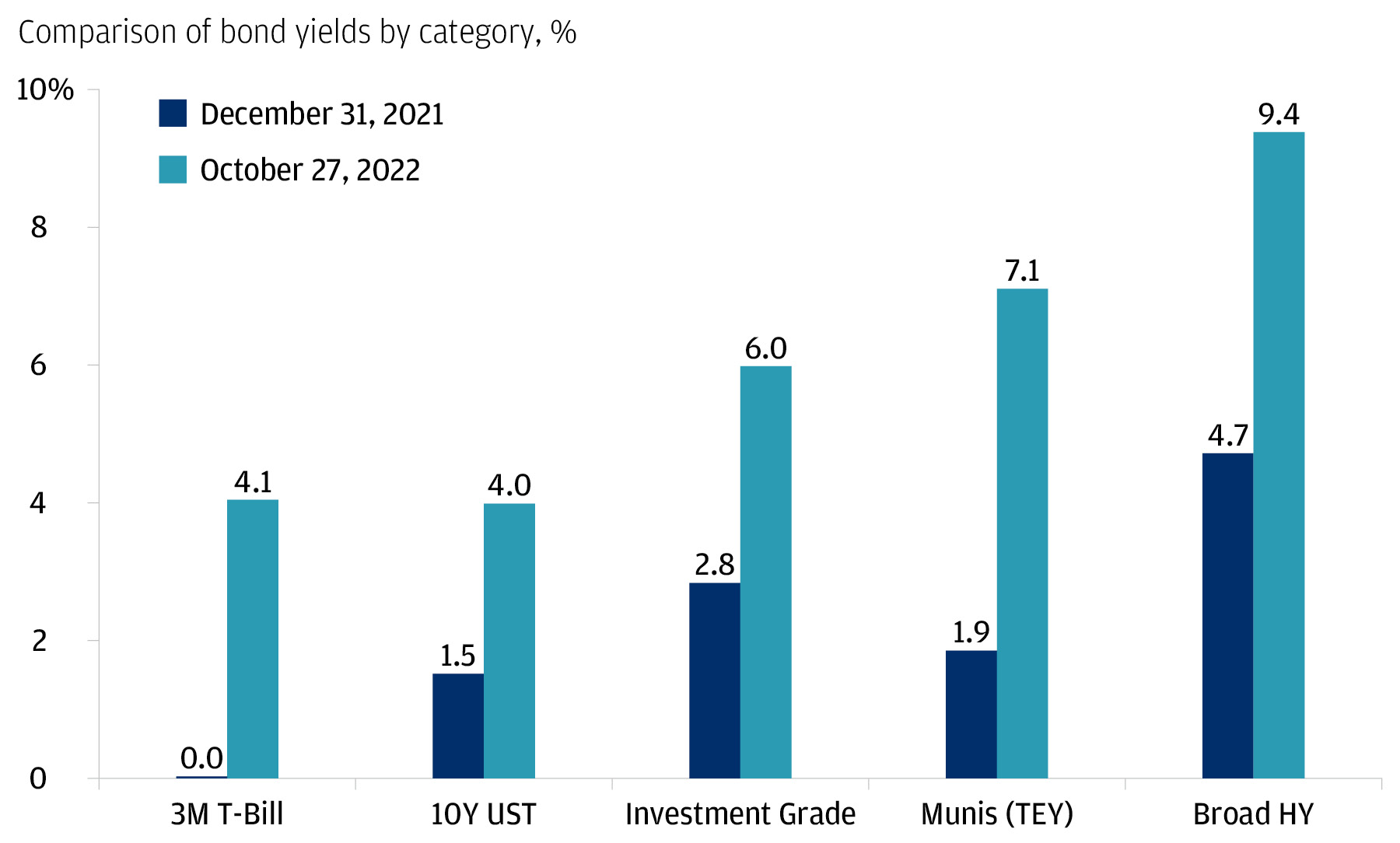

One of the key attractions of municipal bonds is their tax advantages. Interest income earned from municipal bonds is often exempt from federal income tax, and in some cases, from state and local taxes as well. This tax-exempt status makes municipal bonds particularly appealing to investors in higher tax brackets, as it can enhance overall investment returns.

Municipal bonds come in various forms, including general obligation bonds and revenue bonds. General obligation bonds are backed by the full faith and credit of the issuer and are generally considered less risky. Revenue bonds, on the other hand, are backed by specific revenue sources, such as tolls or user fees, associated with the project being financed. These bonds may carry more risk but often offer higher yields.

The prices of municipal bonds can fluctuate based on factors such as interest rate changes, credit ratings of the issuer, and market demand. It’s important for investors to conduct thorough research and analyze the financial health of the issuing entity before investing in municipal bonds.

Now that we have a basic understanding of municipal bonds, let’s explore the concept of settlement dates in greater detail.

Settlement Date Explained

The settlement date is the specific date on which the transfer of ownership and payment for a municipal bond transaction occurs. It is the moment when the buyer becomes the legal owner of the bond, and the seller receives the agreed-upon payment for the bond.

Settlement dates play a crucial role in the overall bond transaction process, as they determine when the buyer’s funds are transferred and when the seller delivers the bond. The settlement period for municipal bonds can vary, but it is typically within a few days to a couple of weeks after the trade date.

During the settlement period, the parties involved in the transaction work together to ensure a smooth and accurate exchange. The buyer usually pays the agreed-upon purchase price for the bond, which includes any accrued interest up to the settlement date. Once the payment is made, the seller delivers the bond to the buyer.

It is important to note that the settlement date is different from the trade date. The trade date is the day on which the buyer and seller agree to the terms of the bond transaction, including the purchase price and quantity. However, the actual transfer of ownership and payment happens on the settlement date.

Settlement dates are determined by industry standards and regulations, with the goal of ensuring efficient and orderly bond transactions. The specific settlement date for a municipal bond trade is typically agreed upon at the time of the transaction, allowing both parties to plan and prepare for the exchange.

The settlement process for municipal bonds is facilitated by various intermediaries, including broker-dealers, clearinghouses, and custodian banks. These entities help facilitate the transfer of funds and securities between the buyer and the seller, ensuring the proper settlement of the bond transaction.

Now that we understand the concept of settlement dates, let’s explore some key factors that can affect these dates.

Key Factors Affecting Settlement Date

Several factors can influence the settlement date for municipal bond transactions. It is important for investors to be aware of these factors, as they can impact the timing of investment proceeds and the overall management of their bond portfolios. Here are some key factors that can affect settlement dates:

Market Practices:

The settlement date for municipal bond transactions is often determined by market practices and industry standards. These practices may vary depending on the region, market participants, and the type of bond being traded. It is essential for investors to familiarize themselves with the prevailing market practices to effectively manage their settlement dates.

Holidays and Weekends:

The occurrence of holidays and weekends can affect the settlement date for bond transactions. If the settlement date falls on a holiday or a non-business day, the actual transfer of funds and securities may be delayed until the next business day. Investors should consider the impact of holidays and weekends on their settlement dates and plan accordingly.

Trade Volume and Market Conditions:

Higher trade volumes and market volatility can impact settlement dates for municipal bond transactions. Increased trading activity can lead to processing delays and longer settlement periods. Similarly, turbulent market conditions or disruptions in the financial markets may affect the timely settlement of bond transactions. Investors should keep these factors in mind when managing their settlement dates and be prepared for potential delays.

Clearing and Custodian Processes:

Clearinghouses and custodian banks play a crucial role in facilitating the settlement of bond transactions. The efficiency and effectiveness of these processes can impact settlement dates. Any delays or issues in the clearing and custodian processes can lead to delays in the settlement of bond transactions. Investors should be aware of the clearing and custodian procedures involved and choose reliable intermediaries to minimize settlement delays.

Specific Issuer Requirements:

Some municipal bond issuers may have specific requirements or procedures that can affect settlement dates. These requirements can include additional documentation, verification processes, or internal procedures that need to be followed before the bond transaction can be settled. Investors should research and understand any issuer-specific requirements to ensure a smooth settlement process.

By considering these key factors, investors can better manage their settlement dates for municipal bond transactions and avoid any unnecessary complications or delays. Having a clear understanding of the factors that affect settlement dates empowers investors to make informed decisions and effectively navigate the bond market.

Common Settlement Dates for Municipal Bonds

While the specific settlement dates for municipal bond transactions can vary, there are several common settlement dates that are widely used in the market. These settlement dates have been established to promote standardization and streamline the bond transaction process. Here are some of the most common settlement dates for municipal bonds:

T+2 Settlement:

The T+2 settlement date is one of the most prevalent in the municipal bond market. T+2 refers to the settlement date that occurs two business days after the trade date. For example, if a bond trade takes place on a Monday, the settlement date would be on Wednesday. This settlement timeline allows for efficient processing and ensures timely transfer of funds and securities between the buyer and the seller.

T+3 Settlement:

The T+3 settlement date is another commonly used settlement period for municipal bonds. It refers to the settlement date that occurs three business days after the trade date. For instance, if a bond trade takes place on a Monday, the settlement date would be on Thursday. The T+3 settlement period provides a slightly longer timeframe for processing and settlement compared to the T+2 settlement.

T+4 Settlement:

Less commonly used, the T+4 settlement date occurs four business days after the trade date. It allows for a slightly longer settlement period compared to T+2 and T+3 settlements. This settlement date may be used for certain types of municipal bond transactions or in specific market conditions where extended processing time is needed.

T+1 Settlement:

T+1 settlement date refers to the settlement that occurs one business day after the trade date. While less common in the municipal bond market, T+1 settlement is often employed in other financial markets, such as stocks and corporate bonds. It offers a faster settlement period, allowing for more immediate transfer of funds and securities.

It’s important for investors to be aware of these common settlement dates and understand their implications. The choice of settlement date can impact the timing of investment proceeds and the overall management of bond portfolios. Investors should communicate their preferred settlement date with their brokers or financial institutions to ensure alignment and avoid any confusion or delays.

In addition to these common settlement dates, there might be variations and exceptions depending on specific bond issuers, market conditions, and regulatory requirements. It’s recommended for investors to stay updated with any changes or special considerations that may arise in the settlement process.

Importance of Understanding Settlement Dates

Understanding settlement dates is essential for investors in municipal bonds. It allows investors to effectively manage the timing of their investment proceeds, plan for potential delays, and ensure a smooth and efficient transaction process. Here are some key reasons why understanding settlement dates is important:

Timely Receipt of Investment Proceeds:

By understanding the settlement dates, investors can have a clear expectation of when they will receive their investment proceeds. This knowledge is crucial for managing cash flows and making informed decisions about reinvesting or utilizing the funds. It helps investors align their financial plans and ensures that they can access their returns in a timely manner.

Planning for Market Changes:

The settlement period provides investors with a window of time during which market conditions may change. By understanding settlement dates, investors can plan accordingly and take advantage of any favorable market movements. It allows them to assess market trends, monitor interest rate changes, and make more informed decisions based on current market conditions.

Minimizing Potential Trading Risks:

Settlement delays can introduce trading risks for investors. If there are delays in the settlement process, investors may be exposed to market fluctuations and potential price volatility. By understanding settlement dates, investors can minimize these risks by carefully timing their trades and ensuring that all necessary documentation and processes are completed in a timely manner.

Building Efficient Investment Strategies:

Understanding settlement dates can help investors build more efficient investment strategies. It allows them to manage their bond holdings effectively, including bonds with different settlement dates. By considering settlement dates, investors can strategically plan bond purchases or sales to optimize their portfolios and align with their investment objectives.

Avoiding Potential Penalties or Consequences:

Misunderstanding or ignoring settlement dates can lead to potential penalties or consequences. Failing to settle a bond transaction within the agreed timeframe may result in contractual breaches, financial penalties, or legal complications. Investors who understand settlement dates can ensure compliance with the terms of their transactions and avoid potential negative consequences.

Overall, understanding settlement dates is crucial for investors in municipal bonds. It helps manage cash flows, plan for market changes, minimize trading risks, build efficient investment strategies, and avoid penalties or consequences. By being knowledgeable about settlement dates, investors can navigate the bond market effectively and make informed decisions that align with their financial goals.

Tips for Managing Municipal Bond Settlements

Managing municipal bond settlements requires careful attention to detail and proactive planning. By following these tips, investors can effectively navigate the settlement process and ensure a smooth and successful transaction:

1. Understand Market Practices:

Be familiar with the prevailing market practices for municipal bond settlements. Stay informed about common settlement dates, processing timelines, and any specific requirements or procedures that may apply to your transactions.

2. Communicate with Your Broker or Financial Institution:

Establish open lines of communication with your broker or financial institution. Discuss and confirm the settlement dates for your bond transactions to ensure alignment and avoid any confusion or delays.

3. Allow Sufficient Time for Settlement:

Consider the settlement period when planning your bond transactions. Allow enough time for processing, documentation, and any necessary reviews or verifications to be completed before the settlement date.

4. Be Mindful of Holidays and Weekends:

Take into account holidays and weekends when scheduling settlement dates. Be aware that these non-business days can extend the settlement period and plan accordingly to avoid any potential disruptions or delays.

5. Choose Reliable Intermediaries:

Select reputable clearinghouses, custodian banks, and broker-dealers to facilitate your bond settlements. Conduct thorough research and choose intermediaries with a strong track record of efficient and secure settlement processing.

6. Review Documentation Carefully:

Thoroughly review all settlement documentation, including purchase agreements, confirmations, and settlement instructions. Ensure that the details are accurate, and promptly notify your broker or financial institution of any discrepancies or issues.

7. Monitor Your Account and Confirm Settlement:

Regularly monitor your investment account to verify that the settlement process has been completed as expected. Confirm that the funds have been transferred and that you are the legal owner of the municipal bonds.

8. Seek Professional Advice:

If you are new to municipal bond investing or have complex transactions, consider seeking professional advice from a financial advisor or bond specialist. They can provide valuable insights and guidance to help you navigate the settlement process effectively.

9. Stay Informed and Be Proactive:

Stay updated on changes in market practices, regulatory requirements, and any issuer-specific settlement procedures. Being proactive and informed will help you stay ahead of potential issues and ensure smooth settlement experiences.

By following these tips, investors can effectively manage their municipal bond settlements and mitigate potential risks or complications. Remember, a well-executed settlement process is crucial for successful bond transactions and maintaining a solid investment portfolio.

Conclusion

Understanding settlement dates is essential for investors in municipal bonds. The settlement date is the specific day on which the transfer of ownership and payment for a bond transaction occurs. By comprehending settlement dates, investors can effectively manage the timing of their investment proceeds, plan for potential delays, and ensure a smooth and efficient transaction process.

This article has provided an overview of municipal bonds, explained settlement dates, and highlighted key factors that can affect these dates. It has also outlined common settlement dates for municipal bonds and emphasized the importance of understanding settlement dates in managing bond investments.

Investors should be aware of market practices, holidays, and weekends that can impact settlement dates. By choosing reliable intermediaries, reviewing documentation carefully, and monitoring their accounts, investors can minimize potential risks and ensure timely and accurate settlement of their bond transactions.

Furthermore, staying informed about changes in market practices, regulations, and issuer-specific requirements is crucial for managing municipal bond settlements effectively. Seeking professional advice when needed can also provide valuable insights and guidance.

Successfully navigating municipal bond settlement dates is important for maintaining cash flows, planning for market changes, minimizing trading risks, building efficient investment strategies, and avoiding penalties or consequences.

In conclusion, by understanding and effectively managing settlement dates, investors can enhance their experience in the world of municipal bonds. A well-executed settlement process is key to maintaining a strong and secure municipal bond portfolio that aligns with investment goals and financial objectives.