Finance

What Are Credit Default Swap Spreads

Published: March 4, 2024

Learn about credit default swap spreads and their significance in finance. Understand how CDS spreads impact risk assessment and market trends. Discover more about finance and CDS spreads.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Credit Default Swap Spreads

In the intricate world of finance, Credit Default Swap (CDS) spreads hold a crucial position. These spreads are a vital component of the credit derivatives market, providing valuable insights into the creditworthiness and associated risks of entities. Understanding Credit Default Swap spreads is essential for investors, financial institutions, and market participants, as they offer a window into the perceived stability or vulnerability of debt issuers.

The CDS market plays a pivotal role in assessing and managing credit risk, enabling market participants to hedge against potential credit events such as defaults or bankruptcies. Credit Default Swap spreads essentially represent the cost of insuring against credit defaults, serving as a barometer of market sentiment regarding the credit quality of a particular entity.

By delving into the realm of Credit Default Swap spreads, investors gain access to a wealth of information that aids in making informed decisions regarding investment strategies, risk management, and overall portfolio diversification. These spreads encapsulate the collective wisdom and expectations of market participants, reflecting their assessments of credit risk and the potential for default.

Stay tuned to unravel the intricacies of Credit Default Swap spreads, exploring their significance, determinants, and the indispensable role they play in the modern financial landscape.

Understanding Credit Default Swaps

To comprehend Credit Default Swap (CDS) spreads, it is imperative to first grasp the underlying instrument they are associated with – Credit Default Swaps. A Credit Default Swap is a financial derivative contract that allows an investor to hedge against the risk of a borrower defaulting on its debt obligations. In essence, it functions as a form of insurance against credit risk, where the protection buyer makes periodic payments to the protection seller in exchange for coverage in the event of a credit event, such as default or restructuring.

These contracts are bilateral agreements between two parties, with the protection buyer paying a premium to the protection seller over a specified period. In the event of a credit event, the protection seller is obligated to compensate the protection buyer for the loss incurred due to the default. Credit Default Swaps are valuable risk management tools, providing investors with the flexibility to mitigate credit risk exposure without necessitating the actual ownership of the underlying debt instrument.

Furthermore, Credit Default Swaps are tradable instruments, offering liquidity and the ability to adjust risk positions based on changing market conditions and credit assessments. They serve as a means for investors to express their views on the creditworthiness of entities, thereby influencing the pricing of CDS spreads. The dynamics of Credit Default Swaps are deeply intertwined with the broader credit markets, impacting the cost and availability of credit for corporations, governments, and other debt issuers.

By comprehending the fundamental mechanics and purpose of Credit Default Swaps, individuals can gain a deeper insight into the significance and implications of the associated spreads. The intricate interplay between these financial instruments shapes the landscape of credit risk management and investment strategies, underscoring the pivotal role they play in the global financial ecosystem.

Credit Default Swap Spreads

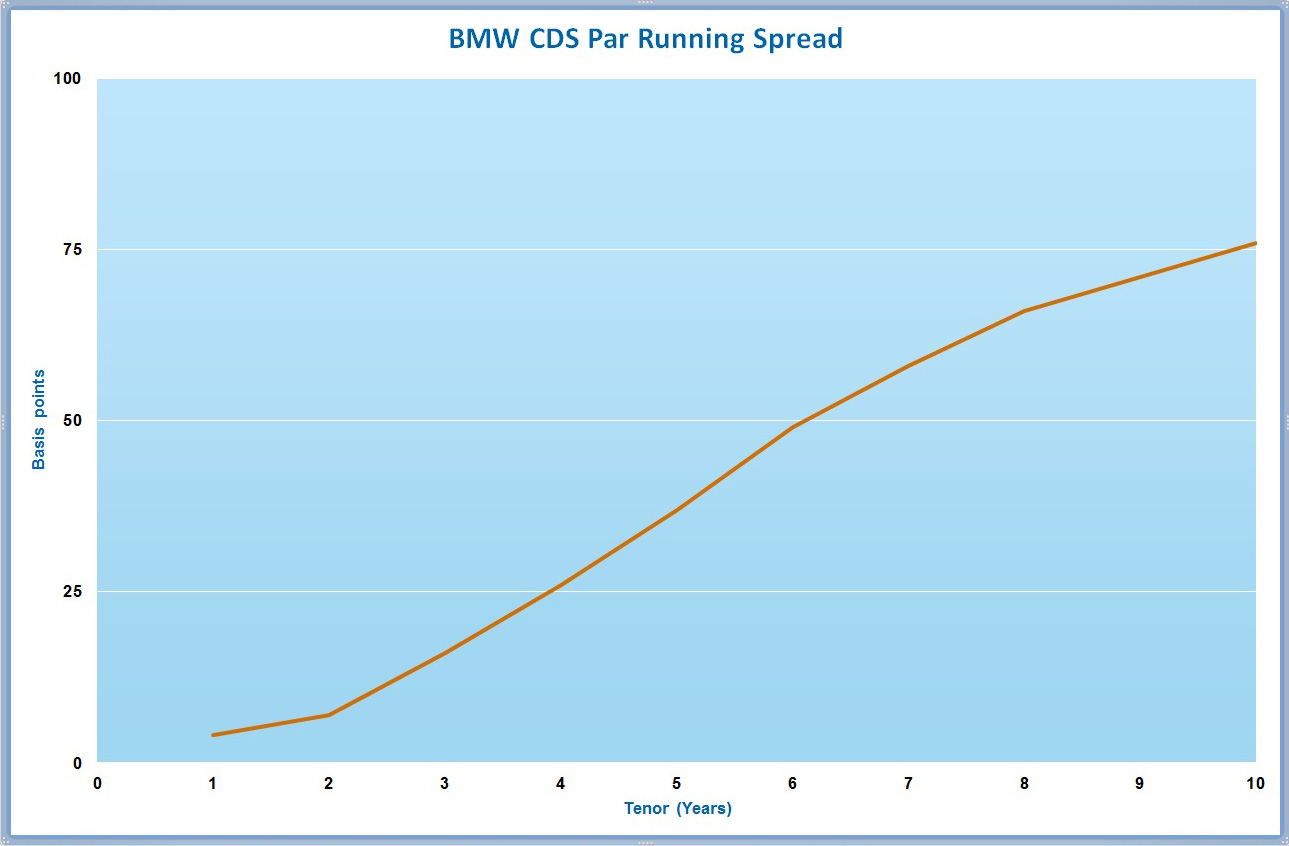

Credit Default Swap (CDS) spreads serve as a key metric for assessing the credit risk associated with debt issuers. These spreads represent the cost of obtaining protection against potential credit defaults and are indicative of market perceptions regarding the creditworthiness of entities. Widening CDS spreads signify a higher cost of insuring against defaults, reflecting heightened concerns about credit quality and increased risk of default. Conversely, narrowing spreads suggest improved market sentiment and lower perceived credit risk.

Market participants closely monitor CDS spreads as they provide valuable insights into the prevailing credit conditions and the perceived stability of debt issuers. These spreads are quoted in basis points (bps), with 1 basis point equal to 0.01% or 0.0001 in decimal form. For instance, a CDS spread of 150 bps implies a cost of 1.5% per annum to insure against default on a specific amount of debt.

Moreover, CDS spreads are not solely influenced by the credit risk of the underlying entity but are also impacted by broader market dynamics, investor sentiment, and macroeconomic factors. They reflect the intersection of credit-specific considerations and systemic risks, making them a comprehensive gauge of credit market conditions.

Understanding the nuances of CDS spreads empowers investors and financial institutions to make informed decisions regarding credit exposure, risk management strategies, and the pricing of debt instruments. These spreads are integral to the functioning of the credit derivatives market, providing a mechanism for market participants to express their views on credit risk and actively manage their portfolios in response to changing market conditions.

As such, Credit Default Swap spreads play a pivotal role in shaping investment decisions, influencing the pricing of debt securities, and contributing to the overall efficiency and stability of the credit markets.

Factors Affecting Credit Default Swap Spreads

Credit Default Swap (CDS) spreads are influenced by a myriad of factors that collectively shape the perceived credit risk and the cost of insuring against potential defaults. Understanding these determinants is essential for comprehending the dynamics of CDS spreads and their implications for investors and market participants.

1. Credit Quality of the Issuer: The creditworthiness of the underlying entity is a primary driver of CDS spreads. Entities with lower credit ratings or deteriorating financial health typically exhibit wider spreads, reflecting heightened credit risk and the increased cost of obtaining protection against defaults.

2. Market Sentiment and Economic Conditions: Broader market dynamics and macroeconomic factors can significantly impact CDS spreads. Economic downturns, geopolitical instability, or sector-specific challenges can lead to elevated spreads as market participants reassess credit risk in response to prevailing conditions.

3. Liquidity and Market Supply: The liquidity of CDS contracts and the availability of protection in the market can affect spreads. Scarce liquidity and limited supply of protection may lead to wider spreads, as market participants demand higher compensation for assuming credit risk in such conditions.

4. Volatility and Risk Appetite: Heightened market volatility and fluctuations in risk appetite can influence CDS spreads. Increased uncertainty and risk aversion often translate into wider spreads, reflecting the market’s cautious stance towards credit risk.

5. Regulatory and Legal Framework: Changes in regulatory requirements, legal precedents, and government interventions can impact CDS spreads. Regulatory reforms aimed at enhancing transparency and risk management in the derivatives market may influence the pricing and availability of CDS protection.

By considering these multifaceted factors, market participants can gain a comprehensive understanding of the dynamics driving CDS spreads, enabling them to navigate the complexities of credit risk management and make well-informed investment decisions.

Importance of Credit Default Swap Spreads

Credit Default Swap (CDS) spreads hold immense significance in the realm of finance and play a pivotal role in shaping investment decisions, risk management strategies, and the functioning of credit markets. The importance of CDS spreads stems from their ability to provide valuable insights into credit risk, market sentiment, and the overall health of the financial system.

1. Risk Assessment and Pricing: CDS spreads serve as a critical tool for assessing credit risk and pricing debt instruments. They offer market participants a means to gauge the creditworthiness of entities and adjust their risk exposure based on prevailing spread levels, thereby facilitating informed investment decisions and risk management strategies.

2. Market Transparency and Information Efficiency: The transparency and real-time nature of CDS spreads contribute to market efficiency by providing a clear and accessible measure of credit risk. This transparency enhances market liquidity and fosters a more informed and efficient allocation of capital within the financial system.

3. Risk Mitigation and Hedging: CDS spreads enable investors and institutions to hedge against credit risk, offering a mechanism to transfer and mitigate potential losses associated with defaults or credit events. This risk mitigation capability enhances the stability and resilience of the financial system, promoting a more secure and robust market environment.

4. Indicator of Market Sentiment: The movement of CDS spreads reflects market sentiment and expectations regarding credit conditions. Widening spreads may signal deteriorating credit quality and heightened risk aversion, while narrowing spreads can indicate improving credit sentiment and reduced perceived risk, providing valuable insights for market participants.

5. Systemic Risk Monitoring: CDS spreads serve as a tool for monitoring systemic risk within the financial system. By tracking the behavior of spreads across different entities and sectors, regulators and market participants can assess the interconnectedness of credit risk and potential vulnerabilities, contributing to the overall stability of the financial system.

Given their multifaceted role in risk assessment, market efficiency, and systemic stability, Credit Default Swap spreads are integral to the modern financial landscape, influencing investment strategies, credit pricing, and risk management practices.

Conclusion

In conclusion, Credit Default Swap (CDS) spreads represent a fundamental pillar of the credit derivatives market, offering invaluable insights into credit risk, market sentiment, and the broader financial landscape. Understanding the dynamics of CDS spreads is essential for investors, financial institutions, and market participants, as they serve as a barometer of credit quality and a mechanism for risk management and pricing of debt instruments.

By delving into the intricacies of CDS spreads, individuals gain access to a comprehensive framework for assessing credit risk, monitoring market sentiment, and actively managing their risk exposure. The multifaceted factors influencing CDS spreads, including credit quality, market dynamics, liquidity, and regulatory considerations, underscore the complexity and depth of these essential metrics.

Moreover, the importance of CDS spreads extends beyond risk assessment and pricing, encompassing their role in market transparency, risk mitigation, and systemic risk monitoring. These spreads contribute to the efficiency and stability of the financial system, fostering a more informed and resilient market environment.

As such, the significance of CDS spreads cannot be overstated, as they shape investment decisions, influence credit market dynamics, and contribute to the overall functioning of the global financial ecosystem. Embracing a holistic understanding of Credit Default Swap spreads empowers market participants to navigate the complexities of credit risk, make informed investment choices, and contribute to the robustness and efficiency of the financial markets.