Home>Finance>Origination Fee: Definition, Average Cost, And Ways To Save

Finance

Origination Fee: Definition, Average Cost, And Ways To Save

Published: January 4, 2024

Learn the definition of origination fee, average cost, and effective ways to save on your finance. Gain valuable insights and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Origination Fees in Finance

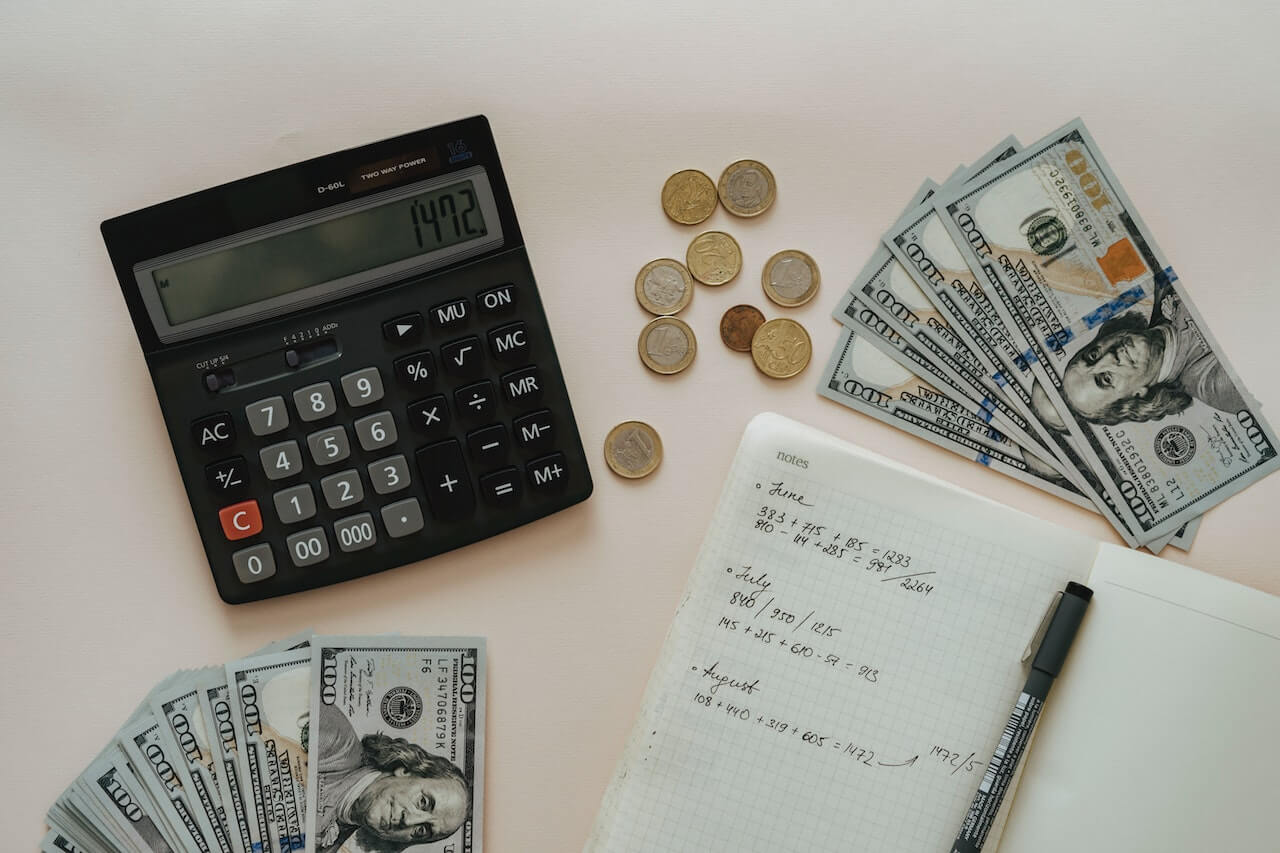

When it comes to obtaining a loan, whether it’s for a mortgage, personal loan, or business loan, there are various costs involved. One such cost that often gets overlooked is the origination fee. In this article, we will explore the definition of an origination fee, discuss the average cost you can expect to pay, and provide some helpful tips on how to save money on these fees. So sit tight, and let’s dive right in!

Key Takeaways:

- An origination fee is a fee charged by lenders to cover the cost of processing a loan application.

- Origination fees typically range from 1% to 5% of the loan amount, but they can vary depending on the lender and the type of loan.

What is an Origination Fee?

An origination fee is a fee charged by lenders to cover the cost of processing a loan application. It is essentially the cost of doing business with a lender. This fee is typically calculated as a percentage of the loan amount, and it can vary depending on the lender and the type of loan. It’s important to note that not all loans come with an origination fee, so it’s crucial to read the fine print before signing any loan agreement.

How much does an Origination Fee Cost?

The average cost of an origination fee ranges from 1% to 5% of the loan amount. For example, if you’re applying for a mortgage loan of $200,000 with a 2% origination fee, you would have to pay $4,000 as the origination fee. Keep in mind that these percentages can vary, so it’s essential to shop around and compare offers from different lenders to find the best deal.

Pro tip: Some lenders may roll the origination fee into the overall loan amount, which means you won’t have to pay it upfront. However, this also means you’ll be paying interest on the fee for the duration of the loan.

Ways to Save on Origination Fees

While origination fees are a standard cost when taking out a loan, there are ways to minimize their impact on your wallet. Here are some practical tips:

- Compare lenders: Shopping around and comparing offers from different lenders can help you find the best deal. Look for lenders that offer lower origination fees or even those that don’t charge an origination fee at all.

- Negotiate the fee: Don’t be afraid to negotiate with your lender. Some lenders may be flexible and willing to reduce or waive the origination fee, especially if you have a solid credit history or are a repeat customer.

- Consider a higher interest rate: In some cases, you may have the option to choose a slightly higher interest rate in exchange for a lower or waived origination fee. This trade-off can be beneficial if you plan to keep the loan for a shorter period.

- Borrow a smaller amount: Origination fees are generally based on a percentage of the loan amount. By borrowing a smaller amount, you automatically reduce the fee you’ll have to pay.

By following these tips, you can potentially save a significant amount of money on origination fees, helping you keep more of your hard-earned cash in your pocket.

Origination fees may seem like just another expense, but being aware of their existence and understanding how they work can help you make better decisions when it comes to obtaining a loan. By comparing offers, negotiating fees, and exploring alternative options, you can save money and find the loan that best suits your needs. So, the next time you’re applying for a loan, don’t forget to consider the origination fee and take steps to save!