Finance

How To Get A Credit Report On Credit Karma

Modified: March 6, 2024

Learn how to access your credit report easily on Credit Karma and get valuable insights into your financial health. Take control of your finances and make informed decisions with our user-friendly platform.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Create an Account on Credit Karma

- Step 2: Verify Your Identity

- Step 3: Provide Personal Information

- Step 4: Agree to the Terms and Conditions

- Step 5: View your Credit Report

- Step 6: Understand the Information on Your Credit Report

- Step 7: Utilize Credit Karma’s Tools and Resources

- Step 8: Monitor Your Credit Score and Report Regularly

- Step 9: Take Action to Improve Your Credit

- Step 10: Frequently Asked Questions

- Conclusion

Introduction

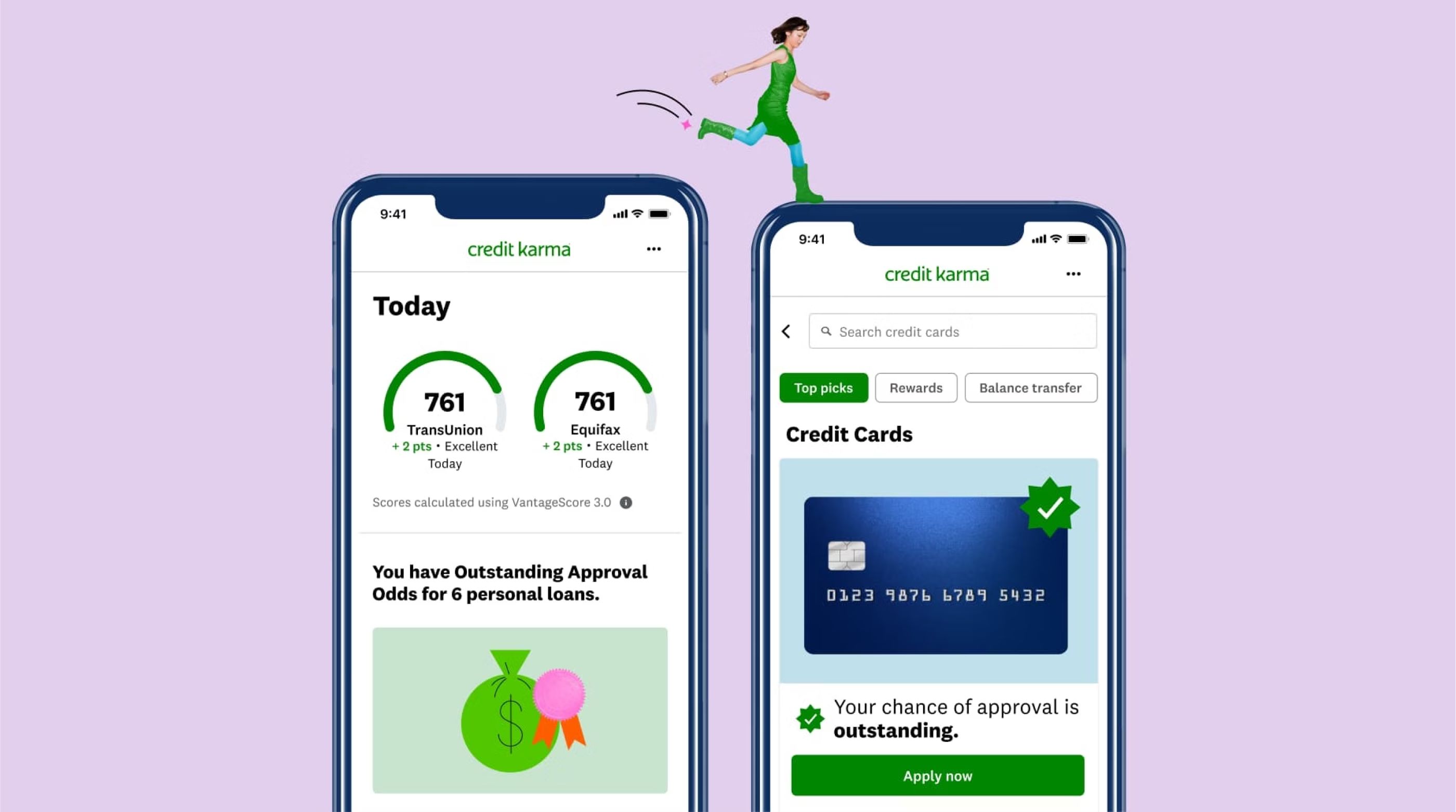

In today’s financial landscape, having a good understanding of your credit report is crucial. Your credit report contains information about your borrowing history, including open accounts, payment history, and credit utilization. It plays a significant role in your financial health and affects your ability to secure loans, mortgages, or even rent an apartment. If you’re looking to access your credit report, Credit Karma is a popular online platform that can provide you with the information you need.

Credit Karma is a free service that allows you to access your credit report and score directly from the three major credit bureaus: Equifax, Experian, and TransUnion. It provides a user-friendly interface and various tools to help you understand and improve your credit. In this article, we will guide you through the steps of getting your credit report on Credit Karma, as well as provide some useful tips to make the most of the platform’s features.

By following the steps outlined in this guide, you can gain valuable insights into your credit history and take control of your financial future. Let’s dive in and explore how you can get your credit report on Credit Karma.

Step 1: Create an Account on Credit Karma

The first step to accessing your credit report on Credit Karma is to create an account on their platform. Visit the Credit Karma website at www.creditkarma.com and click on the “Sign Up” button. You will be prompted to enter your email address and create a password for your account. Make sure to choose a strong, unique password to protect your personal information.

After entering your email and password, you will be asked to verify your email address. Credit Karma will send you a verification link to the email you provided. Simply click on the link to verify your account. If you do not receive the verification email, be sure to check your spam or junk folder.

Once your email is verified, you can proceed to the next step and set up your profile. Credit Karma will ask for some basic information, such as your name, address, and date of birth. Providing accurate information is essential as it will be used to confirm your identity and match it with the information on your credit report.

Finally, you will have the option to opt-in for email updates from Credit Karma. This will allow you to receive notifications about changes to your credit report, credit score updates, and helpful financial tips. It is recommended to enable these notifications to stay informed about any significant changes to your credit.

Once you have completed the sign-up process and set up your profile, you are now ready to access your credit report on Credit Karma. In the next step, we will guide you on how to verify your identity, which is necessary to ensure the security of your personal information.

Step 2: Verify Your Identity

Verifying your identity is an essential step in accessing your credit report on Credit Karma. It helps ensure that only you can access your personal credit information. To verify your identity, Credit Karma requires you to provide some personal information and answer a few security questions. Here’s how to complete the identity verification process:

1. Once you have created your account and set up your profile, Credit Karma will prompt you to verify your identity. Click on the “Verify Your Identity” button to begin the process.

2. You will be asked to provide personal information such as your social security number, address, and date of birth. It is crucial to enter this information accurately to prevent any issues with verification.

3. After entering the required information, Credit Karma will generate a set of security questions based on your credit history and other public records. You will need to answer these questions correctly to verify your identity. The questions might include inquiries about previous addresses, loan accounts, or other personal details.

4. Take your time to read each question carefully and provide the most accurate response. If you are unsure about an answer, you can use the “I’m not sure” option, but keep in mind that correctly answering these questions increases the chances of successful identity verification.

5. Once you have answered all the security questions, Credit Karma will review your responses and verify your identity. If you provided the correct information and answered the questions accurately, you will proceed to the next step of accessing your credit report.

In some instances, Credit Karma may not be able to verify your identity solely based on the information provided. If this happens, you will need to follow their instructions to manually verify your identity. This might involve providing additional documents, such as a government-issued ID or proof of address, to confirm your identity.

By completing the identity verification process, you can ensure that your personal credit information remains secure and that you are the only one with access to your credit report on Credit Karma. Once your identity is verified, you can move on to the next step and provide the necessary personal information required to access your credit report.

Step 3: Provide Personal Information

After successfully verifying your identity, the next step in accessing your credit report on Credit Karma is to provide the necessary personal information. This information is required to match your identity with the credit report information from the three major credit bureaus. Here’s how to provide your personal information:

1. Once you have completed the identity verification process, you will be prompted to enter additional personal details. This may include your full name, address, social security number, and date of birth. It is important to provide accurate and up-to-date information to ensure the correct retrieval of your credit report.

2. Ensure that the information you provide matches the details on your identification documents, such as your driver’s license or passport. Any discrepancies in the provided information may cause issues with accessing your credit report.

3. Credit Karma may also require you to provide your employment information, such as your employer’s name and your job title. This information helps in confirming your identity and providing a more accurate analysis of your credit profile.

4. Be cautious when entering your social security number and other sensitive information. Credit Karma takes privacy and security seriously, but it is always important to practice safe online behavior and ensure you are utilizing a secure internet connection.

5. Double-check all the information you have provided for accuracy before proceeding. Making sure all fields are filled correctly helps to ensure that the credit report you receive is accurate and belongs to you.

Once you have successfully entered your personal information, Credit Karma will securely retrieve your credit report from the three major credit bureaus. This process may take a few moments. Once the retrieval is complete, you will be able to view your credit report and dive deeper into your financial history.

It is crucial to provide accurate and up-to-date personal information to ensure the accuracy of your credit report. By doing so, you can make more informed financial decisions and take proactive steps to improve your credit health. Now that you have provided the necessary personal information, you are ready to proceed to the next step and review your credit report on Credit Karma.

Step 4: Agree to the Terms and Conditions

Before gaining access to your credit report on Credit Karma, you will need to agree to the platform’s terms and conditions. The terms and conditions outline the rights, responsibilities, and limitations of both Credit Karma and its users. It is essential to read and understand these terms before proceeding. Here’s how to agree to the terms and conditions and gain access to your credit report:

1. After providing your personal information, Credit Karma will present you with its terms and conditions. These may include disclosures on how your personal information is used, the scope of services provided, and any limitations or disclaimers.

2. Take the time to read through the terms and conditions carefully. It’s important to understand how Credit Karma may use your personal information and what you can expect from their platform.

3. If you agree to the terms and conditions, you can indicate your acceptance by clicking on the “I Agree” or similar button. By doing so, you are acknowledging that you have read and understood the terms and are willing to abide by them.

4. If you do not agree to the terms and conditions, you may not be able to proceed with accessing your credit report on Credit Karma. In such cases, you may consider exploring other platforms or methods for retrieving your credit report.

It is important to note that Credit Karma’s terms and conditions may be subject to change. It’s a good practice to review them periodically to stay informed about any updates or modifications. Additionally, Credit Karma may ask for your consent to provide you with personalized offers and advertisements based on your credit information. You have the option to opt-in or opt-out of these offers.

By agreeing to the terms and conditions, you can now move forward and explore the valuable information contained within your credit report. In the next step, we will guide you on how to view your credit report on Credit Karma and make the most of its features.

Step 5: View your Credit Report

Now that you have agreed to the terms and conditions, it’s time to view your credit report on Credit Karma. This step allows you to access a comprehensive overview of your credit history, including your open accounts, payment history, and any negative marks that may be impacting your credit score. Here’s how to view your credit report on Credit Karma:

1. After accepting the terms and conditions, Credit Karma will redirect you to the dashboard or homepage of your account. Look for a section or tab labeled “Credit Report” or something similar. Click on it to access your credit report.

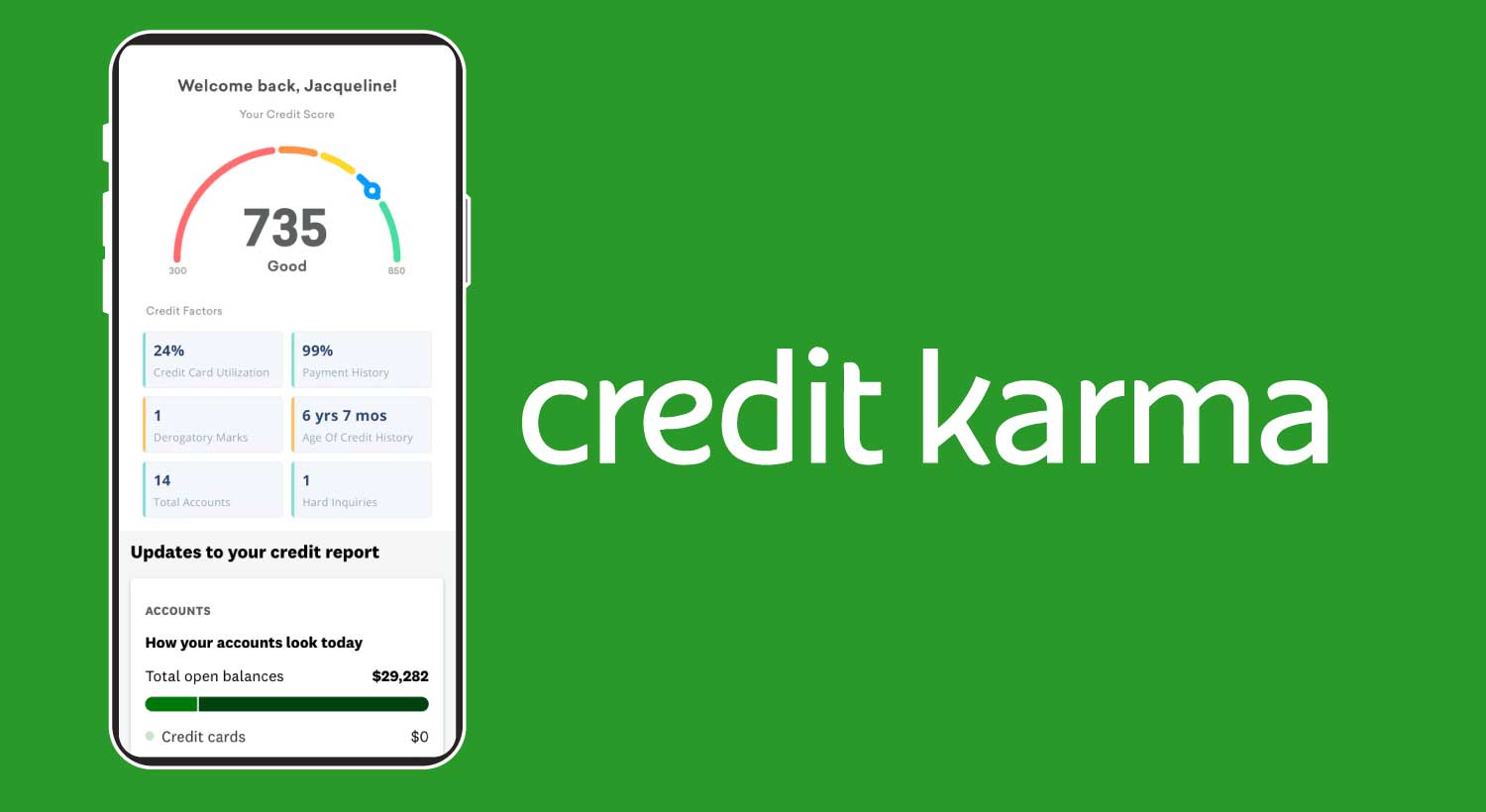

2. Once you are on the credit report page, you will see a summary of your credit information. This may include your credit score, credit utilization, and any derogatory marks on your report. Take a moment to review this summary and familiarize yourself with the overall snapshot of your credit health.

3. To delve deeper into your credit report, Credit Karma provides different sections or tabs where you can explore specific aspects of your credit history. These sections may include open accounts, closed accounts, payment history, and public records. Click on each section to view more details about your credit activity.

4. As you navigate through your credit report, you may come across unfamiliar accounts or discrepancies in your credit history. It’s important to review these entries carefully and report any inaccuracies to the credit bureaus. Credit Karma provides options to dispute inaccuracies directly from their platform.

5. Take the time to go through each section of your credit report and gain a comprehensive understanding of your financial status. It’s essential to identify any negative factors that are impacting your credit score and take appropriate measures to address them.

Credit Karma offers additional features and tools to help you better understand your credit report. These include personalized recommendations for improving your credit, simulators to see how certain actions may affect your credit score, and educational resources to increase your financial literacy.

By viewing your credit report on Credit Karma, you gain valuable insights into your credit history, which can empower you to take control of your financial well-being. In the next step, we will explore how to utilize Credit Karma’s tools and resources to further enhance your credit management journey.

Step 6: Understand the Information on Your Credit Report

Understanding the information on your credit report is crucial to managing your credit effectively. It allows you to identify potential red flags, track your financial progress, and make informed decisions to improve your credit health. Here’s how to interpret the information on your credit report:

1. Personal Information: The first section of your credit report contains your personal information, such as your name, address, and social security number. Ensure that this information is accurate and up to date.

2. Account Information: This section provides details about your open and closed credit accounts, including credit cards, loans, and mortgages. It includes information about the account type, balance, credit limit, payment history, and account status. Review this information to ensure it aligns with your records.

3. Payment History: This section shows your payment history on each account, indicating whether payments were made on time or if there were any late or missed payments. A positive payment history is crucial for maintaining a good credit score.

4. Credit Inquiries: This section lists any inquiries made by lenders, landlords, or other organizations when you apply for credit. It is important to monitor this section and ensure that you recognize all the inquiries. Multiple inquiries within a short period could impact your credit score.

5. Public Records: This section includes information about bankruptcies, tax liens, and civil judgments. Negative items in this section can significantly impact your credit score and may require additional attention.

6. Credit Utilization: This refers to the percentage of your available credit that you are currently using. It is calculated by dividing your credit card balances by your credit limits. Maintaining a low credit utilization ratio, ideally below 30%, is beneficial for your credit score.

7. Credit Score: Your credit score provides a numerical representation of your creditworthiness. Credit Karma uses the VantageScore model to provide your credit score. It is essential to monitor your credit score regularly and strive to improve it over time.

Understanding the information on your credit report empowers you to identify areas of improvement and take proactive steps to enhance your credit health. It enables you to spot errors or discrepancies that require attention and provides insights into how creditors perceive your creditworthiness.

Now that you have a better understanding of the information contained within your credit report, the next step is to utilize Credit Karma’s tools and resources to further optimize your credit management strategy.

Step 7: Utilize Credit Karma’s Tools and Resources

Credit Karma offers a variety of tools and resources to help you better manage and improve your credit. These tools can provide valuable insights, personalized recommendations, and educational resources. Here’s how you can make the most of Credit Karma’s offerings:

1. Credit Score Simulator: This tool allows you to simulate various scenarios and see how they may impact your credit score. For example, you can test the effects of paying off a loan or increasing your credit card balances. Use this tool to make informed decisions about your financial actions.

2. Credit Monitoring: Credit Karma provides ongoing monitoring of your credit report. You can opt-in to receive email alerts or push notifications for changes to your credit report, such as new accounts, late payments, or public records. Regular monitoring helps you stay informed about any potential issues and take immediate action, if necessary.

3. Credit Score Factors: Credit Karma highlights the key factors that influence your credit score. This information can help you understand what areas to focus on for credit improvement. It may include factors such as payment history, credit utilization, age of accounts, and credit mix.

4. Credit Score Comparisons: Credit Karma allows you to compare your credit score with national averages and similar age groups. This feature provides an additional perspective on how your credit score stacks up against others in similar demographics.

5. Personalized Recommendations: Based on your credit profile, Credit Karma offers personalized recommendations to help you enhance your credit health. These recommendations may include actions such as paying off high-interest debt, applying for a new credit card, or disputing inaccuracies on your credit report. Review and consider these suggestions as part of your credit improvement strategy.

6. Financial Education: Credit Karma offers a wealth of educational resources to help you build your financial knowledge. From articles and guides to videos and quizzes, you can enhance your understanding of credit, loans, budgeting, and other financial topics. Take advantage of these resources to expand your financial literacy and make more informed financial decisions.

7. Community Forums: Credit Karma features a community forum where you can connect with other users, ask questions, and share insights and experiences. Participating in these forums can provide valuable tips, advice, and support from individuals who may have encountered similar credit challenges.

By utilizing Credit Karma’s tools and resources, you can gain valuable insights, personalize your credit improvement strategy, and enhance your financial knowledge. Make it a habit to explore these offerings regularly to stay on top of your credit management journey.

In the next step, we will discuss the importance of regularly monitoring your credit score and report to maintain a healthy credit profile.

Step 8: Monitor Your Credit Score and Report Regularly

Monitoring your credit score and report regularly is essential for maintaining a healthy credit profile. It allows you to stay informed about any changes or discrepancies in your credit history and take appropriate actions. Here’s how you can effectively monitor your credit score and report using Credit Karma:

1. Set up Credit Monitoring: Once you have registered on Credit Karma and accessed your credit report, enable credit monitoring. This feature will notify you of any significant changes to your credit report, such as new accounts, late payments, or derogatory marks. It is crucial to stay informed about these changes to protect yourself against identity theft or fraudulent activities.

2. Review Your Credit Report: Regularly review your credit report on Credit Karma to ensure its accuracy. Look for any discrepancies or errors in your personal information, account details, or payment history. If you identify any inaccuracies, report them to the credit bureaus and Credit Karma as soon as possible.

3. Check Your Credit Score: Monitor your credit score on Credit Karma to track your creditworthiness. Changes in your score can be an indication of changes in your credit behavior or the accuracy of reported information. Understanding your credit score fluctuations can help you identify areas for improvement and take appropriate actions to maintain or improve your credit standing.

4. Assess Credit Factors: Credit Karma provides insights into the key factors affecting your credit score, such as payment history, credit utilization, and length of credit. Regularly review how these factors impact your credit score and make adjustments in your financial habits to improve them. This may include making timely payments, reducing credit card balances, or diversifying your credit mix.

5. Act on Recommendations: Credit Karma offers personalized recommendations based on your credit profile. These recommendations are designed to help you improve your credit health. Take the time to review these suggestions and consider implementing them into your financial strategy. Addressing areas of concern can positively impact your credit score over time.

6. Stay Informed: Credit Karma provides educational resources, articles, and community forums to keep you informed about credit-related topics. Take advantage of these resources to deepen your understanding of credit management, financial wellness, and best practices. The more knowledgeable you are, the better equipped you will be to make informed financial decisions and maintain a healthy credit profile.

Regularly monitoring your credit score and report on Credit Karma allows you to stay proactive in managing your credit. It empowers you to identify and address potential issues early, improve your creditworthiness, and work towards your financial goals. Remember, maintaining good credit requires consistent effort and vigilance.

Lastly, in the next step, we will discuss the importance of taking action to improve your credit based on the insights and tools provided by Credit Karma.

Step 9: Take Action to Improve Your Credit

Once you have gained insights from your credit report and utilized the tools and resources provided by Credit Karma, it’s time to take action to improve your credit. Making positive changes to your credit habits can have a significant impact on your credit score and overall financial well-being. Here are some steps you can take to improve your credit:

1. Make Timely Payments: Paying your bills on time is one of the most important factors in maintaining a good credit score. Set up reminders or automatic payments to ensure you never miss a payment. Consistently making payments by their due dates shows responsible financial behavior.

2. Reduce Credit Card Balances: High credit card balances can negatively impact your credit score. Aim to pay down your balances, especially on accounts with high utilization rates. Keeping your credit utilization below 30% is beneficial for your credit health.

3. Manage Debt Responsibly: If you have multiple debts, create a plan to manage them effectively. Prioritize paying off high-interest debts first and consider consolidating or refinancing loans to potentially lower interest rates. Responsible debt management demonstrates your ability to handle credit responsibly.

4. Establish a Strong Credit History: Length of credit history is an important factor in calculating your credit score. Keep your oldest accounts open and active to build a long and positive credit history. Avoid closing accounts unless necessary, as it may shorten your credit history and impact your credit score.

5. Diversify Your Credit Mix: Having a healthy mix of different types of credit can positively impact your credit score. Consider adding a different type of credit, such as a small personal loan or a secured credit card, to diversify your credit portfolio. However, be cautious and only take on new credit if you can manage it responsibly.

6. Limit New Credit Applications: Avoid applying for multiple new credit accounts within a short period. Each credit application generates a hard inquiry on your credit report, which can temporarily lower your credit score. Only apply for credit when necessary and when you are confident of being approved.

7. Monitor Your Credit Regularly: Continuously monitor your credit report and credit score on Credit Karma to track your progress. Review any changes, address inaccuracies, and stay updated on your credit status. Regular monitoring allows you to take quick action if discrepancies or potential issues arise.

Remember, improving your credit takes time and consistent effort. Be patient with the process and celebrate small victories along the way. By implementing positive credit habits and staying committed to your financial goals, you can steadily improve your creditworthiness and open up opportunities for better loan terms, lower interest rates, and financial stability.

In the final step, we will address some frequently asked questions related to accessing credit reports on Credit Karma.

Step 10: Frequently Asked Questions

Here are some commonly asked questions about accessing credit reports on Credit Karma:

Q: Is Credit Karma really free?

A: Yes, Credit Karma is a free service. They generate revenue by providing personalized offers and recommendations based on your credit profile. However, there is no cost to access your credit report, credit score, or the majority of their tools and resources.

Q: Does using Credit Karma affect my credit score?

A: No, using Credit Karma to access your credit reports and scores does not impact your credit score. The inquiries made by Credit Karma are considered soft inquiries, which do not affect your creditworthiness.

Q: Is Credit Karma a reliable source for credit reports?

A: Credit Karma is a reputable platform that provides credit reports directly from Equifax, Experian, and TransUnion, which are the three major credit bureaus. The information provided by Credit Karma is generally accurate, but it’s always a good idea to verify any discrepancies with the credit bureaus themselves.

Q: How often can I check my credit reports on Credit Karma?

A: Credit Karma allows you to access your credit reports as often as once a week. However, it is generally recommended to check your credit reports at least once every few months to stay proactive and monitor any changes.

Q: Can I access my credit reports on Credit Karma from a mobile device?

A: Yes, Credit Karma has a user-friendly mobile app available for iOS and Android devices. You can download the app and access your credit reports, credit scores, and other features conveniently on your mobile device.

Q: Does Credit Karma provide credit reports for businesses?

A: No, Credit Karma primarily focuses on providing credit reports and scores for individuals, not businesses. Their services are tailored to personal credit monitoring and improvement.

Q: How long does it take to see changes in my credit report after taking actions to improve it?

A: The timeline for changes to appear on your credit report varies. Generally, it can take a few weeks to several months for the impact of your actions to be reflected in your credit report. Consistent positive credit behavior over time will yield long-term improvements in your credit health.

It’s essential to note that while these answers address common questions, individual circumstances may vary. If you have specific concerns or unique situations, it’s always best to reach out to Credit Karma directly or consult with a financial professional for personalized guidance.

Congratulations on completing all ten steps to access your credit report on Credit Karma and take control of your credit health. By regularly monitoring your credit, reviewing your credit report, and taking proactive steps to improve your credit, you are on the path to achieving your financial goals.

Remember, building and maintaining good credit is a journey that requires consistent effort and responsible financial habits. Stay disciplined, informed, and proactive, and you will pave the way towards a stronger financial future.

Conclusion

Accessing your credit report on Credit Karma is an essential step towards managing and improving your credit health. By creating an account, verifying your identity, and providing the necessary information, you can gain valuable insights into your credit history and take control of your financial future.

Credit Karma offers a user-friendly platform that allows you to view your credit report, monitor your credit score, and utilize a range of tools and resources to make informed financial decisions. By regularly monitoring your credit, reviewing your credit report, and taking action to improve your credit, you can work towards achieving your financial goals.

Remember to pay your bills on time, maintain low credit utilization, manage your debts responsibly, and diversify your credit mix. Utilize Credit Karma’s personalized recommendations and educational resources to enhance your financial knowledge and stay informed about credit-related topics.

Regularly monitoring your credit report allows you to identify potential issues, address inaccuracies, and track your progress towards a healthier credit profile. Take advantage of the numerous features and benefits offered by Credit Karma to optimize your credit management strategy and improve your financial well-being.

By following the ten steps outlined in this guide, you are equipped with the knowledge and tools necessary to access your credit report on Credit Karma and take proactive steps towards achieving a strong credit profile. Remember, the journey to good credit takes time and effort, but with consistency and responsible financial habits, you can pave the way towards a more secure and prosperous financial future.