Finance

Saving For Retirement The Smart Way

Published: September 6, 2023

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

When it comes to saving for retirement, we feel that there are two types of people: those who have planned to a tee and those who paid a little less attention to saving. If you’re reading this article, chances are that you’re part of the latter.

You might have spent the better part of your life thinking that you had a long way to go before the issue of retirement came up. While you may be a long way away from actually retiring (unfortunately), it is definitely never too early to be thinking about saving for retirement.

You’ve already taken the first step by seeking out and reading this article. Now, we need you to decide what exactly your retirement goals are. Some people might feel that by the time they’re retired, their house will be paid off when their children are grown. They might then decide to live a relatively quiet life with just basic necessities.

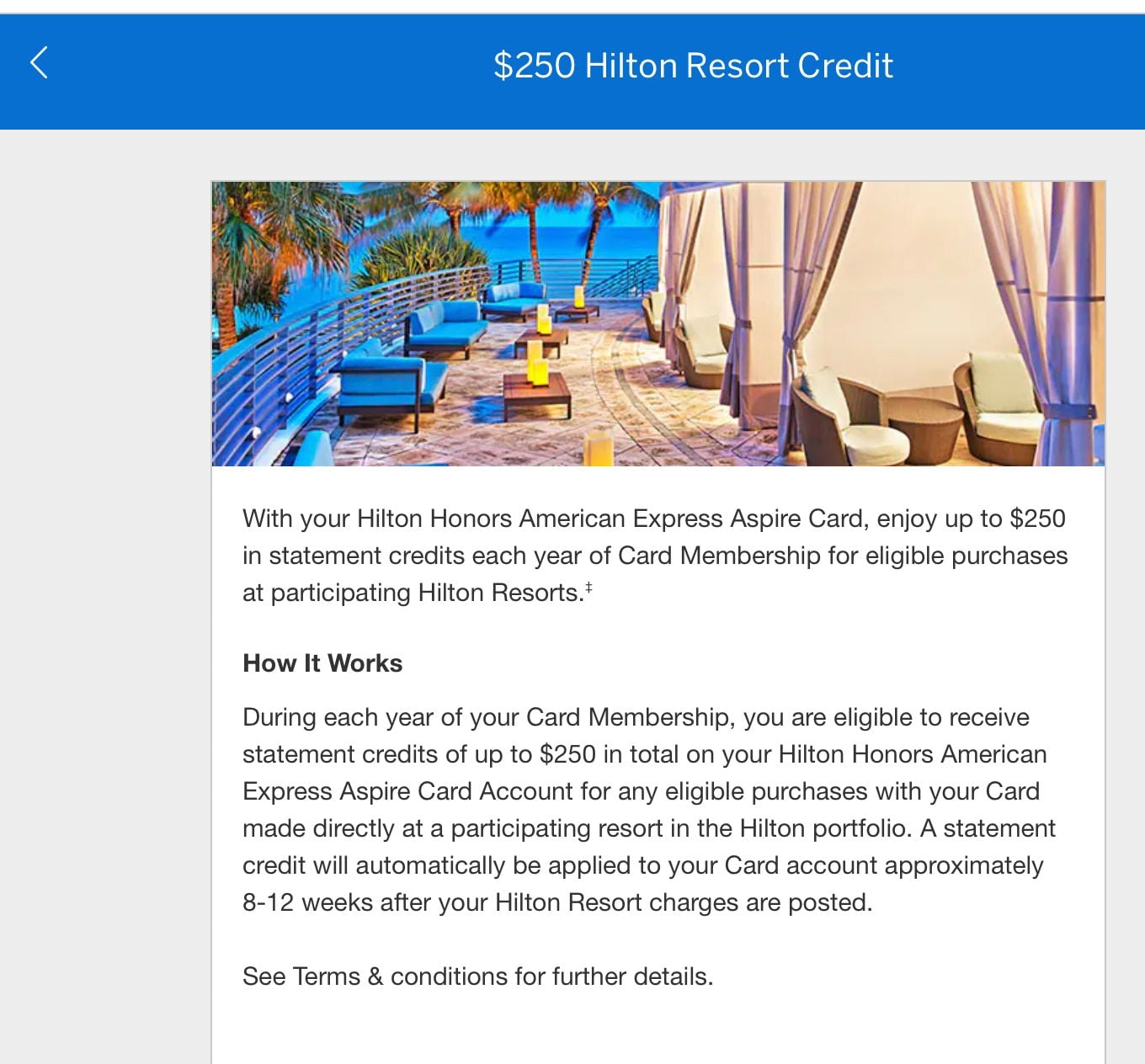

However, you, on the other hand, might be on the other side of the fence. To you, retirement might be a time to finally make all those dreams of travel and luxury come true. Alternatively, you might just want to have extra savings in case of a rainy day.

Whatever the case, we know it can be stressful and tedious to save for retirement so we’ve done the work and broken it down for you. Here’s how you can save for retirement in the smartest way possible.

1) Take Advantage Of Employer-matched Retirement Plans

Photo from Pixabay

Most big companies offer employer-matched retirement plans. These plans are easy to get on since you simply specify the amount you wish to put away and the funds are automatically deducted each month. This means that you don’t ever actually see the money in your account.

If you’re someone who struggles with managing your finances, this is one of the best things for you. Additionally, many of these plans require your employer to match the amount you put in. This means that you’re essentially receiving free money!

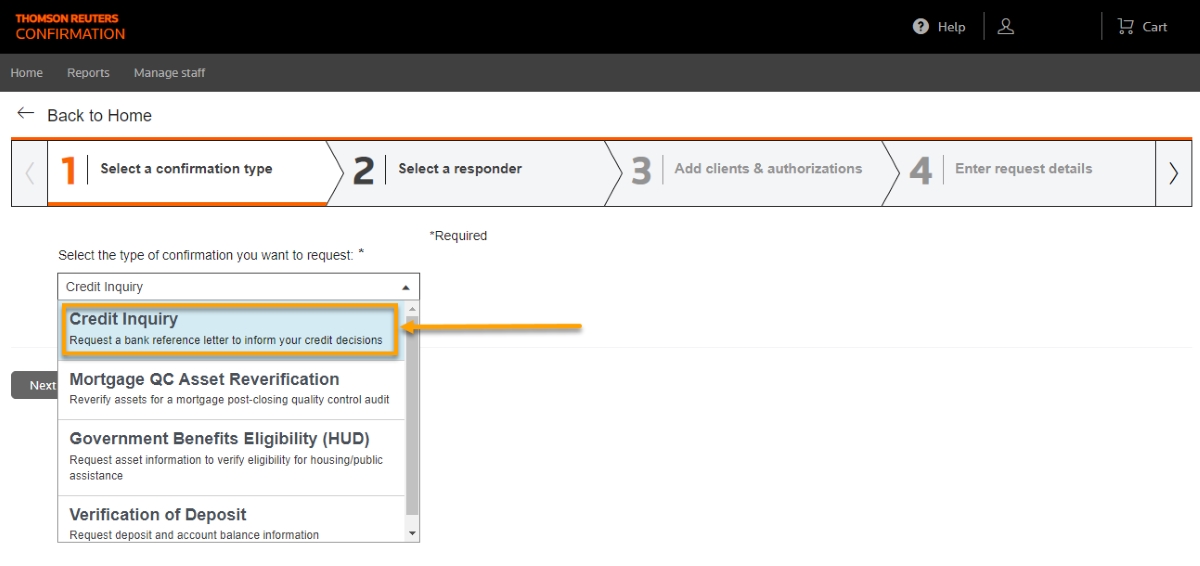

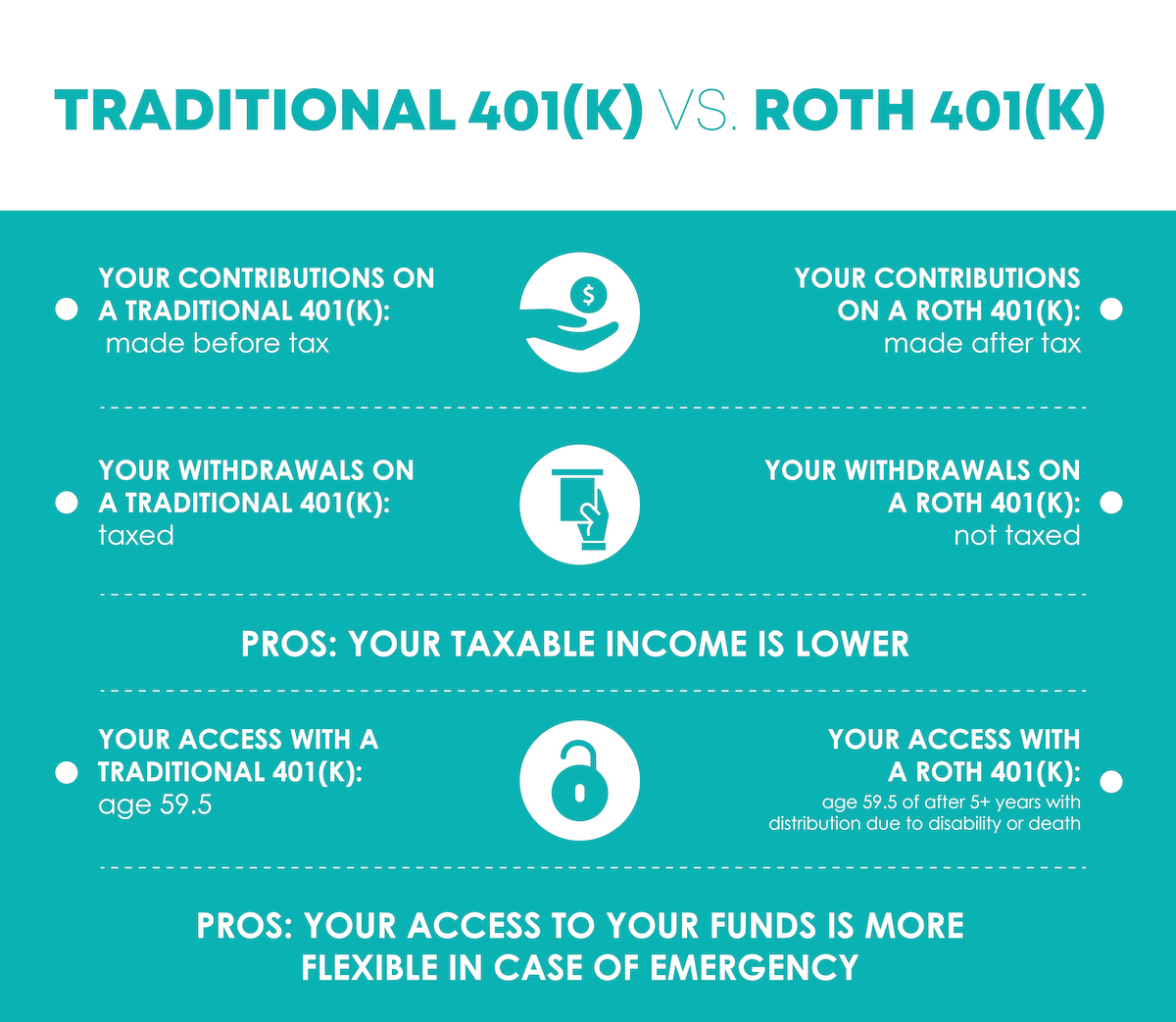

Depending on your company, you might have the option of a traditional 401(k) or a Roth 401(k) plan. If you find yourself within a company that offers both, which one you choose depends on which plan you think benefits you the most.

While both plans share several similarities, the most prominent difference between a traditional 401(k) and the Roth 401(k) plan are that the former’s contributions are made before tax.

What this essentially means is that your taxable income is lowered. However, with the Roth 401(k) your access to your funds is more flexible.

Essentially, it boils down to what works best for you at this point in time. You might find yourself more comfortable with the flexibility of the Roth 401(k) plan. On the other hand, you might enjoy the idea that your taxable income is less on a traditional 401(k) plan.

Whichever option you find yourself leaning towards, both are good ways to take advantage of employer-matched retirement plans.

2) Realise The Power Of Compound Interest

Photo from piqsels.com

If you’re not the kind of person who finds himself/herself as being concerned with the likes of a retirement fund, then you probably only have a vague recollection of the concept of compound interest back from when you were in high school.

Fret not, we are here to help refresh and explore that memory of yours! If you’re already investing in a 401(k) plan or are on an employer’s plan, you’re basically taking advantage of the power of tax-deferred compound interest.

To elaborate, you’re essentially allowing your money to grow faster as money, that might have been otherwise taxed, is reinvested. With a larger sum being put in monthly, your overall sum becomes larger and the compounded interest you earn grows by default.

3) Make Smart Investments When Saving For Retirement

Photo from Pexels

Investments are an extremely smart way to start saving for your retirement. Once again, depending on your retirement goals, what you choose to invest your funds in is going to vary.

There are a few places that you could choose to invest your money. The most common one being interest and dividends from savings. Alternatively, you could rely on interest from dividend-paying stocks and bonds.

Another one of the smartest ways to save for retirement through investments would be through the appreciation of value from real estate. If you’re fortunate enough to own property, you could also rely on the direct income from renting out.

Always, remember that whatever income you make from renting out a property you own should go directly towards your nest egg!

Additionally, in this day and age of technology, we are exposed to so many more options than during our parents’ time. Thus, you might want to consider the idea of investing in cryptocurrency. In fact, a single bitcoin currently goes for over 11,000 USD.

You might be surprised (or not) to learn that there exists a wide variety of cryptocurrency, many of which are far more affordable and accessible. Just be sure to do your research and stick with one that follows the US dollar as these tend to be more stable in the long run.

Conclusion

There you have it, our 3 favourite tips on saving for retirement the smart way. When it comes down to it, it’s all about taking advantage of the plans you have around you and the various options you’re presented with.

As we’ve mentioned, some of the options we have today are something our parents never dreamed of, cryptocurrency being one of them. Therefore, the least we can do is to take advantage of them!

Saving for retirement doesn’t have to be particularly difficult. More often than not, all one has to do is be smart about it. So seize and ride opportunities handed to you by your employer and don’t forget to figure out which plans work for you personally. Don’t also forget to consider the pros and cons before jumping on any bandwagon!

If you have any tips that you have found beneficial to you, please feel free to drop them in the comment section below. We would love to hear from you. Frankly, you can never have too many options when it comes to saving for retirement the smart way.