Home>Finance>Provision For Credit Losses (PCL): Definition, Uses, Example

Finance

Provision For Credit Losses (PCL): Definition, Uses, Example

Modified: January 15, 2024

Learn about Provision for Credit Losses (PCL) in finance - its definition, uses, and example. Discover how PCL impacts financial statements and loan portfolios.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Provision for Credit Losses (PCL): Definition, Uses, Example

When it comes to managing finances, understanding the concept of Provision for Credit Losses (PCL) is crucial. But what exactly is PCL, and how is it used in the finance industry? In this blog post, we will dive into the definition, applications, and provide an example of PCL in action. So, let’s get started!

Key Takeaways

- The Provision for Credit Losses (PCL) is an accounting measure used by financial institutions to estimate potential losses from loans and other credit-related assets.

- PCL is designed to provide a buffer for potential losses and ensure that financial institutions are adequately prepared to absorb any credit-related risks.

What is Provision for Credit Losses (PCL)?

Provision for Credit Losses (PCL), also known as loan loss provisions or allowances for credit losses, is an accounting technique used by banks, credit unions, and other lending institutions to estimate potential losses arising from loans and other credit exposures. It is an important measure that helps financial institutions assess and manage the risks associated with lending activities.

How is PCL Used?

Now that we understand the definition of PCL, let’s explore its applications in the finance industry:

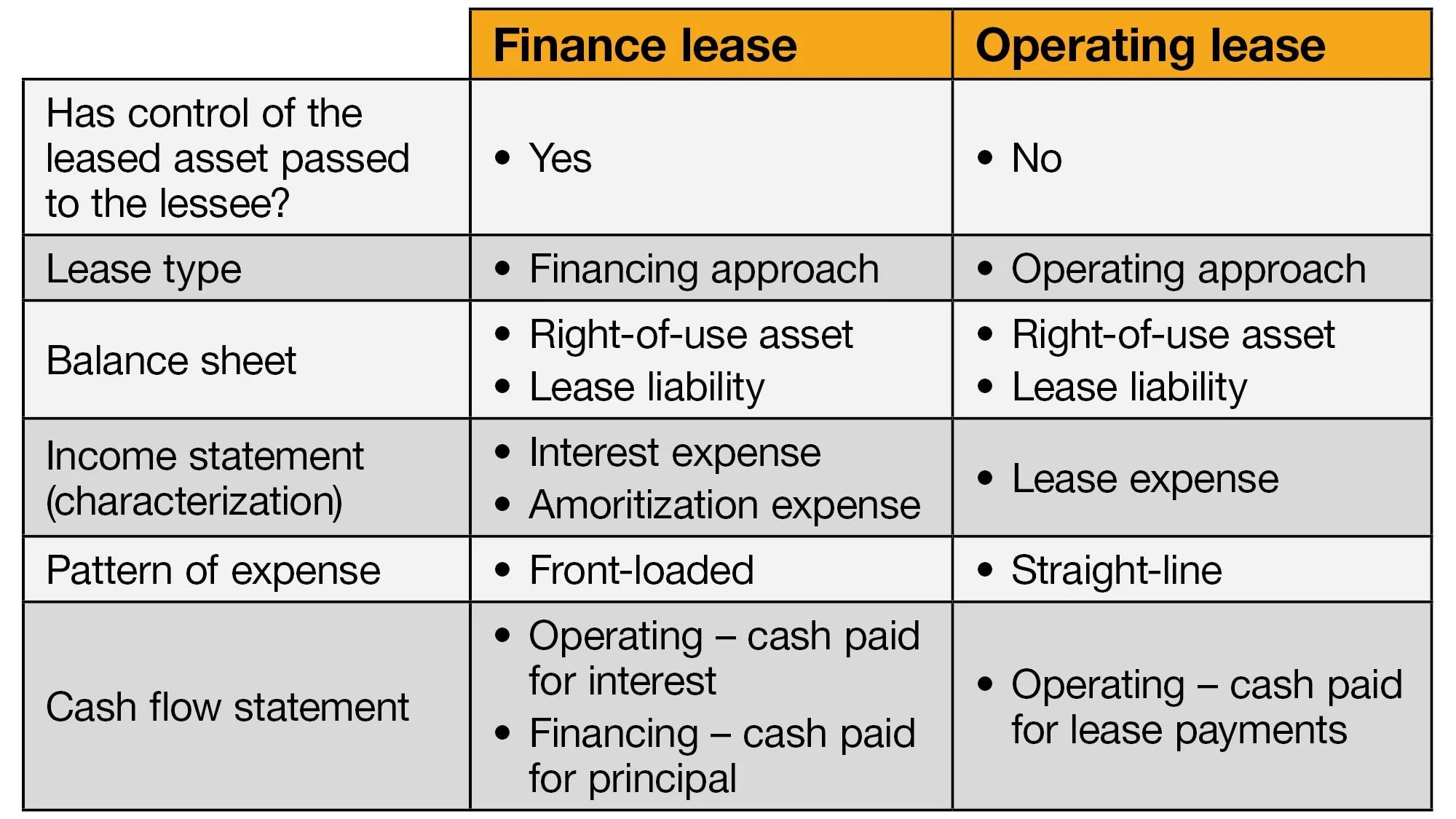

- Risk Assessment: PCL plays a crucial role in evaluating the credit risk exposure of financial institutions. By estimating potential losses, banks can assess the quality of their loan portfolio and identify areas that require additional risk management measures.

- Regulatory Compliance: Financial regulatory authorities require banks and other lending institutions to maintain adequate provisions for potential credit losses. PCL helps ensure compliance with these regulations and promotes the stability of the financial system.

- Financial Reporting: PCL is an essential component of financial statements, providing stakeholders, such as investors and analysts, with insights into the credit quality and financial health of a financial institution.

- Capital Adequacy: Estimating credit losses through PCL aids banks in determining their capital requirements. By considering potential losses, banks can maintain appropriate capital buffers to absorb credit-related risks.

By utilizing PCL effectively, financial institutions can make informed decisions, mitigate potential losses, and protect their financial stability.

Example of Provision for Credit Losses (PCL)

Let’s walk through a simple example to illustrate how PCL works:

ABC Bank has a loan portfolio consisting of various types of loans. As part of their risk management process, they estimate potential losses for each loan category by considering factors such as historical default rates, economic conditions, and recovery rates. Based on their analysis, ABC Bank determines that they need to set aside a provision of $500,000 for credit losses.

By having this provision in place, ABC Bank can absorb any credit losses that may occur in the future without adversely impacting their financial stability. This provision acts as a safeguard, protecting the bank’s financial health and ensuring they can continue to fulfill their lending obligations.

Conclusion

Provision for Credit Losses (PCL) is a critical component of financial management for lending institutions. By estimating potential losses and setting aside provisions, banks can assess and manage credit risk effectively. PCL ensures regulatory compliance, aids in financial reporting, and helps maintain capital adequacy. Understanding PCL is essential for anyone involved in the finance industry, as it plays a fundamental role in evaluating the credit quality and stability of financial institutions.