Home>Finance>What Is A Good Cap Rate For Investment Property?

Finance

What Is A Good Cap Rate For Investment Property?

Published: October 18, 2023

Learn what a good cap rate is for investment property and how it impacts your financial returns. Find out more about cap rates in finance today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Cap Rate?

- Understanding Cap Rate Calculation

- Factors Influencing Cap Rate

- The Importance of a Good Cap Rate

- What is Considered a Good Cap Rate?

- Evaluating Cap Rates in Different Markets

- Risks and Limitations of Using Cap Rate as a Metric

- How to Improve Cap Rate on Investment Properties

- Conclusion

Introduction

Investing in real estate can be a lucrative venture, offering a stable income stream and potential long-term appreciation. However, before making any investment decisions, it’s crucial to understand key financial metrics that gauge the profitability of a property. One such metric is the capitalization rate, commonly known as the cap rate.

Cap rate is a fundamental concept in real estate investing that helps determine the potential return on investment. It is calculated by dividing the net operating income (NOI) of a property by its market value or purchase price. The resulting percentage represents the rate of return an investor can expect to earn on their investment.

Understanding cap rate can provide valuable insights into the financial performance and valuation of an investment property. Investors use cap rate as a benchmark to evaluate different properties and compare their potential returns. A higher cap rate indicates a higher potential return, while a lower cap rate suggests a lower return.

In this article, we will explore the concept of cap rate in more detail, discuss the factors that influence it, and delve into the importance of a good cap rate for investment properties. Additionally, we will look at what is considered a good cap rate across different markets and highlight some of the risks and limitations associated with relying solely on cap rate as a metric for investment decisions. Finally, we will offer some strategies on how to improve the cap rate of investment properties.

Whether you are a seasoned real estate investor or just starting out, gaining a comprehensive understanding of cap rate and its significance can help you make informed investment decisions and maximize your returns. So let’s dive in and unravel the intriguing world of cap rates in real estate investing.

What is a Cap Rate?

Before delving into the significance of a good cap rate for investment properties, let’s first understand what cap rate actually is. In simple terms, the capitalization rate (cap rate) is a financial metric used in real estate investment to determine the potential return on investment.

The cap rate is calculated by dividing the net operating income (NOI) of a property by its market value or purchase price. The resulting percentage represents the rate of return an investor can expect to earn on their investment. Essentially, cap rate provides a snapshot of the property’s income potential relative to its value.

The net operating income (NOI) is the total income generated by the property minus the operating expenses, excluding any debt service or financing costs. It encompasses rental income, miscellaneous income, and other streams of revenue, less expenses like property taxes, insurance, maintenance costs, and property management fees.

Cap rate is typically expressed as a percentage and is used by real estate investors as a benchmark to evaluate the profitability and risk of different investment opportunities. It helps determine the value of an income-producing property based on its income potential, allowing investors to compare properties and make informed decisions based on their financial objectives.

A higher cap rate indicates a higher potential return on investment, implying that the property generates a greater proportion of income relative to its price. Conversely, a lower cap rate suggests a lower return, as the property’s income is a smaller percentage of its value.

It’s important to note that cap rate solely focuses on the property’s income-generating potential and does not take into account factors such as appreciation, financing costs, or tax implications. Therefore, it is typically used as a starting point for evaluation and should be considered in conjunction with other metrics and factors to make a comprehensive investment decision.

Now that you have a basic understanding of cap rate, let’s explore the factors that influence the calculation and how they impact the profitability of an investment property.

Understanding Cap Rate Calculation

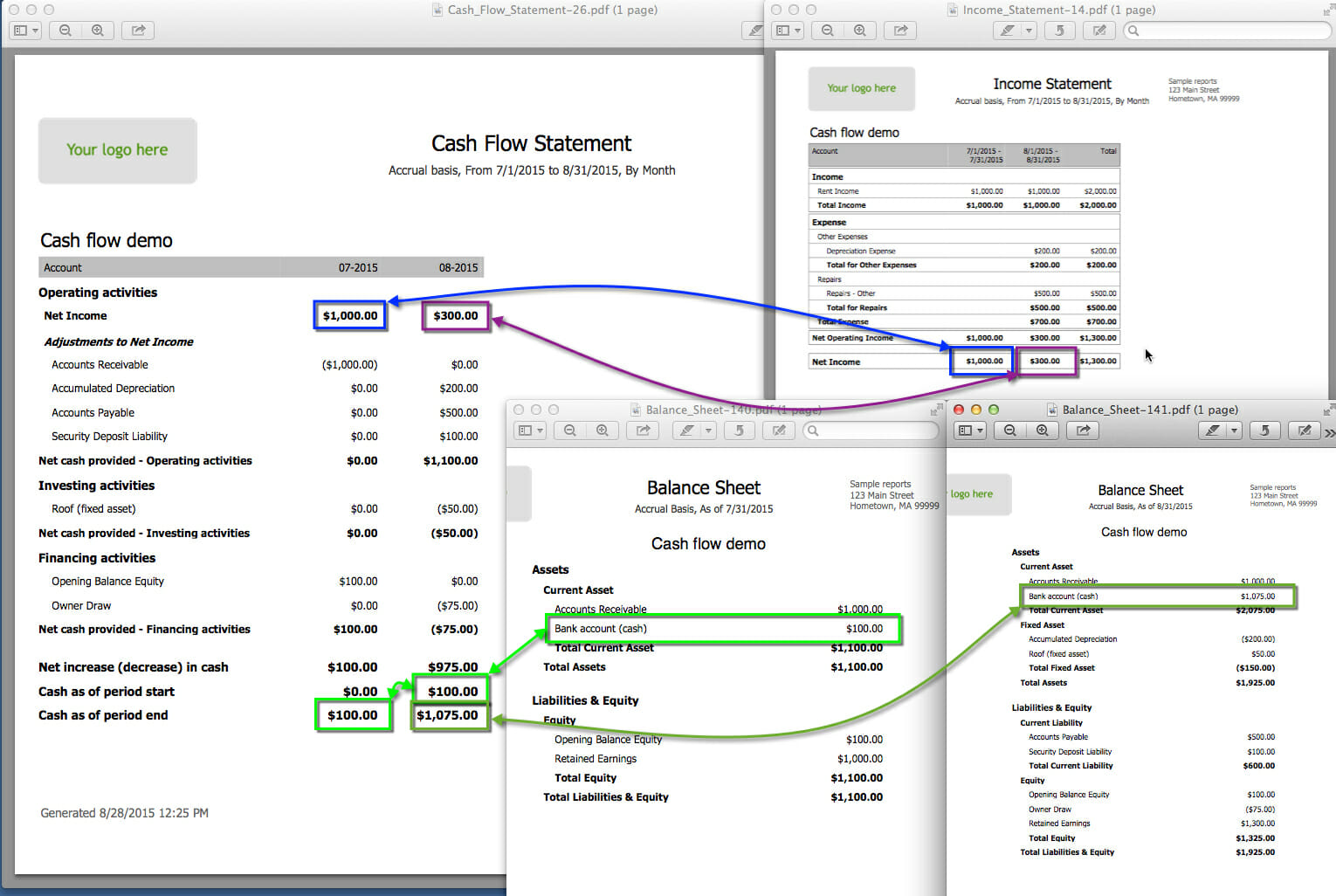

Calculating the cap rate of an investment property is relatively straightforward once you have the necessary financial information. As mentioned earlier, cap rate is determined by dividing the property’s net operating income (NOI) by its market value or purchase price.

To calculate the NOI, you need to calculate the total income generated by the property and deduct the operating expenses. This includes factors such as rental income, miscellaneous income, property taxes, insurance, maintenance costs, property management fees, and other expenses related to the property’s ongoing operations. The resulting figure represents the net income available to the investor.

Let’s consider an example to better understand the cap rate calculation. Suppose you are evaluating a commercial property with an annual rental income of $100,000. The operating expenses including taxes, insurance, maintenance, and management fees amount to $30,000 per year. The resulting NOI would be $70,000 ($100,000 – $30,000).

Next, you need to determine the market value or purchase price of the property. This can be based on recent sales data of similar properties in the area or appraisals conducted by certified professionals. Let’s assume the property’s market value is $1 million.

Now, to calculate the cap rate, divide the NOI by the property’s market value and multiply by 100 to get the percentage. In this case, the cap rate would be 7% ($70,000 / $1,000,000 x 100).

It is worth mentioning that cap rate calculations may vary based on the specific circumstances of the investment. For example, some investors may prefer to use the purchase price of the property rather than the market value, especially if the property was acquired recently. Additionally, in certain cases, the cap rate may be based on projected income and expenses rather than historical figures.

Now that you have a clear understanding of how to calculate the cap rate, let’s move on to explore the factors that influence the cap rate of an investment property.

Factors Influencing Cap Rate

The cap rate of an investment property is influenced by various factors that impact the property’s income potential and perceived risk. Understanding these factors can help investors make informed decisions and accurately evaluate the profitability of a property. Let’s explore some of the key factors that influence the cap rate:

1. Location: The location of the property plays a significant role in determining its cap rate. Properties in high-demand areas or prime locations with strong rental markets tend to have lower cap rates. This is because investors are willing to accept a lower return in exchange for the potential for long-term appreciation and rental income stability.

2. Property Type: The type of property also impacts the cap rate. Different property types, such as residential, commercial, or industrial, have varying income potential and associated risks. For example, commercial properties tend to have higher cap rates due to the higher operating expenses and perceived risks associated with leasing commercial spaces.

3. Market Conditions: The overall real estate market conditions can influence cap rates. In a seller’s market where demand exceeds supply, cap rates may be lower as investors are willing to pay a premium for properties. On the other hand, in a buyer’s market with increased supply, cap rates may be higher as investors have more bargaining power.

4. Property Condition and Age: The condition and age of the property can impact the cap rate. Well-maintained properties with modern amenities and infrastructure may demand lower cap rates as they are perceived to have less risk and attract higher-quality tenants. Older properties or those in need of significant repairs may have higher cap rates to compensate for the additional maintenance expenses.

5. Tenant Quality and Stability: The quality and stability of the property’s tenants also affect the cap rate. Properties with long-term, creditworthy tenants or tenants operating in stable industries tend to have lower cap rates as they offer income stability. Properties with a higher risk of tenant turnover or tenants in volatile industries may have higher cap rates to account for the potential income fluctuations.

6. Financing Costs: The cost of financing or interest rates can impact the cap rate. Higher financing costs can increase expenses and lower the property’s net operating income, resulting in a higher cap rate. Conversely, lower interest rates can reduce financing costs, increase cash flow, and lower the cap rate.

These are some of the key factors that influence the cap rate of an investment property. It’s essential to consider these factors when evaluating potential investments and comparing cap rates across different properties and markets. By understanding these influences, investors can make more informed decisions and accurately assess the potential returns and risks associated with an investment property.

The Importance of a Good Cap Rate

A good cap rate is crucial for real estate investors as it provides insights into the financial viability and profitability of an investment property. Here are some key reasons why a good cap rate is important:

1. Measure of Investment Performance: Cap rate serves as a measure of investment performance, indicating the rate of return an investor can expect from a property. A higher cap rate indicates a higher return, while a lower cap rate suggests a lower return. By evaluating the cap rate, investors can compare different properties and assess their potential profitability.

2. Risk Assessment: Cap rate is also a valuable tool for assessing the risk associated with an investment property. A higher cap rate may indicate a higher level of risk, as the property’s income stream may be less stable or the property may require extensive repairs. Conversely, a lower cap rate may indicate a lower risk investment, as the property generates a more stable and consistent income.

3. Market Valuation: Cap rate plays a critical role in the market valuation of properties. Real estate appraisers and investors use cap rate as a benchmark to determine the fair market value of an income-producing property. A property’s value can be estimated by dividing its net operating income (NOI) by the cap rate. Therefore, a good cap rate can help determine an accurate market value and assist in negotiations and investment decisions.

4. Comparing Investment Opportunities: Cap rate allows investors to compare investment opportunities across different properties and markets. By evaluating the cap rates of similar properties, investors can gauge which ones offer better returns and make more informed investment decisions. This comparison helps identify properties with the potential for higher income and a better return on investment.

5. Financing Considerations: Lenders and financial institutions often take cap rate into account when evaluating loan applications for investment properties. A good cap rate demonstrates the property’s ability to generate sufficient income, making it more attractive to lenders. This can improve financing options and potentially lower interest rates, reducing the overall cost of borrowing.

6. Exit Strategy and Asset Valuation: Cap rate is crucial when formulating an exit strategy for an investment property. When the time comes to sell a property, potential buyers will consider the cap rate as an indicator of its investment potential. A property with a good cap rate is more likely to attract buyers and fetch a higher selling price, providing a greater return on investment.

Overall, having a good cap rate is essential in assessing the financial performance and value of an investment property. It helps investors make informed decisions, evaluate risk, and identify the most lucrative opportunities. By understanding the importance of a good cap rate, real estate investors can maximize their returns and build a profitable investment portfolio.

What is Considered a Good Cap Rate?

When it comes to determining what constitutes a good cap rate, it’s essential to consider various factors, including market conditions, property type, and the investor’s financial goals and risk tolerance. While there is no universal standard for a good cap rate, certain guidelines can help investors assess the attractiveness of an investment property. Here are a few considerations:

Market Factors: Cap rates can vary significantly depending on the real estate market. In high-demand markets or prime locations with limited supply, cap rates may be lower. In contrast, in markets with higher vacancies or lower demand, cap rates may be higher. It’s crucial to research and understand the specific market dynamics to establish realistic expectations for a good cap rate.

Property Type: Different property types typically have different cap rate ranges. For example, residential properties tend to have lower cap rates compared to commercial or industrial properties. Residential properties may have cap rates ranging from 4% to 8%, while commercial properties might have cap rates ranging from 6% to 12% or even higher. Consider the property type and the associated risks and income potential when determining a good cap rate.

Investor Goals and Risk Tolerance: A good cap rate is relative and dependent on an individual investor’s financial goals and risk tolerance. Some investors may prioritize stable, lower-yielding investments with lower cap rates as they seek consistent cash flow and long-term appreciation. Other investors may be more inclined towards riskier, higher-yielding investment opportunities with higher cap rates. It’s important to align the cap rate with your investment objectives and risk appetite.

Comparative Analysis: A comparative analysis of cap rates within a specific market and property type can provide further insights into what is considered a good cap rate. Reviewing recent sales data, industry reports, and speaking with local real estate professionals can help determine the average cap rates for similar properties in the area. This analysis allows for a more accurate assessment of a property’s cap rate in relation to the market as a whole.

Future Growth Potential: Consider the potential for future growth and appreciation when assessing a property’s cap rate. A property with a lower cap rate may have stronger prospects for appreciation due to factors such as upcoming infrastructure developments, revitalization projects, or expected rent increases. Evaluating the long-term growth potential can help justify a lower cap rate as a good investment opportunity.

Ultimately, the definition of a good cap rate depends on a combination of market conditions, property type, investor goals, and risk tolerance. It’s important to carefully consider these factors and conduct thorough due diligence before determining what cap rate aligns with your investment strategy and offers a suitable return on investment.

Evaluating Cap Rates in Different Markets

When evaluating cap rates in different markets, it’s crucial to understand that cap rates can vary significantly from one location to another. Real estate markets are influenced by numerous factors, including supply and demand dynamics, economic conditions, local regulations, and investor sentiment. Here are some key considerations when evaluating cap rates in different markets:

Market Research: Conduct thorough market research to understand the specific dynamics of each market you are considering. Look at historical cap rate trends, vacancy rates, rental growth, and other relevant market indicators. This research will provide insights into the overall health and attractiveness of the market and help you gauge whether the cap rates in that market align with your investment goals.

Comparative Analysis: One effective way to evaluate cap rates in different markets is by conducting a comparative analysis. Look at similar property types and compare the average cap rates in each market. This analysis will give you a sense of how cap rates in a particular market stack up against other markets. Keep in mind that cap rates should be evaluated in the context of other factors such as rental demand, economic growth, and market stability.

Regional Variations: Cap rates can vary even within the same city or region. Different neighborhoods or submarkets may have distinct characteristics that impact property values and cap rates. Consider factors such as proximity to amenities, schools, transportation, and the overall desirability of the area. Understanding these regional variations will allow you to make more informed decisions about which markets offer the best opportunities based on their cap rates.

Risk Assessment: Cap rates can be an indicator of risk in a particular market. Lower cap rates may suggest a more stable and competitive market with limited opportunities for higher returns. Higher cap rates may indicate markets with more risk factors, such as economic instability or higher vacancies. Consider your risk tolerance and evaluate whether the potential rewards of a higher cap rate outweigh the associated risks in a given market.

Local Market Conditions: It’s essential to stay up to date with local market conditions and any specific factors that may impact cap rates. Factors such as industry trends, changes in local regulations, or major infrastructure projects can influence cap rates. Stay informed about these local market conditions to make educated decisions about investing in a particular market.

Long-Term Investments: Consider the long-term prospects of a market when evaluating cap rates. Some markets may have lower cap rates but offer strong growth potential and appreciation over time. It’s important to assess the economic fundamentals, job growth, population trends, and planned developments in a market to determine its long-term investment viability.

Remember that evaluating cap rates in different markets requires a comprehensive understanding of the factors that influence each market’s dynamics. Take into account the local market conditions, regional variations, and long-term prospects to ensure that the cap rates align with your investment strategy and financial objectives.

Risks and Limitations of Using Cap Rate as a Metric

While cap rate is a widely used metric in real estate investing, it’s important to recognize its limitations and consider other factors when making investment decisions. Here are some key risks and limitations associated with relying solely on cap rate:

1. Simplified Analysis: Cap rate provides a simplified analysis of an investment property’s financial performance. It focuses on the income potential and does not take into consideration factors such as appreciation, financing costs, tax implications, or potential changes in market conditions. To gain a more comprehensive understanding, investors should conduct a thorough analysis considering other financial metrics and qualitative factors.

2. Market Volatility: Cap rates can be influenced by market volatility. During economic downturns or times of uncertainty, cap rates can fluctuate significantly. Low cap rates during stable market conditions can quickly turn into high cap rates when the market experiences a downturn. Relying solely on cap rate without considering market conditions can lead to misaligned investment decisions.

3. Lack of Context: Cap rate does not provide context or insights into the specific factors that drive the rate. Different markets, property types, and investment strategies can significantly impact cap rates. Without a deeper understanding of the local market conditions, rental demand, and property-specific factors, relying solely on cap rate may lead to inaccurate assessments of an investment’s potential profitability.

4. Inaccurate Property Valuation: Cap rates can be affected by subjective valuations or inaccurate calculations of a property’s net operating income. A slight variation in income or expense estimates can significantly impact the cap rate, leading to an inaccurate valuation of the property. It is crucial to conduct thorough due diligence and ensure accurate financial information when calculating cap rates.

5. Lack of Future Projection: Cap rate reflects the current income and value of a property, but it does not account for future projections. Economic conditions, rental market trends, and other factors can change over time, impacting the future income potential of the property. Investors should use cap rate as a starting point but consider additional analysis to assess the long-term viability of an investment.

6. Property-Specific Factors: Cap rate does not consider property-specific factors that can impact its performance. Each property has its unique characteristics, such as location, tenant quality, lease terms, and condition, which can affect its income stability and potential for future growth. It’s essential to evaluate these property-specific factors in conjunction with cap rate to form a complete investment picture.

7. Financing Considerations: Cap rate does not directly consider financing costs or the impact of leverage on investment returns. Financing terms and conditions can significantly affect cash flow, overall return on investment, and risk exposure. Investors should consider the financing aspects alongside cap rate to assess the true financial performance of an investment property.

While cap rate is a useful metric for comparing investment properties, it’s essential to recognize its limitations and consider other factors in conjunction. Investors should conduct comprehensive due diligence, analyze market conditions, consider property-specific factors, and evaluate long-term viability to make informed investment decisions.

How to Improve Cap Rate on Investment Properties

Investors always strive to improve the cap rate on their investment properties to maximize returns and enhance the overall financial performance. Here are some strategies to consider when looking to improve the cap rate:

1. Increase Rental Income: One of the most effective ways to improve the cap rate is to increase the rental income generated by the property. This can be achieved by conducting a thorough market analysis to determine if rental rates can be increased in line with market trends. Renovating or upgrading the property to provide additional amenities or desirable features can also justify higher rental rates.

2. Reduce Operating Expenses: Lowering the operating expenses of a property can help improve the cap rate. Evaluate all expenses, including property management fees, utilities, maintenance costs, and insurance premiums. Look for opportunities to reduce expenses without compromising the quality of the property. For instance, implementing energy-efficient solutions can lower utility costs, improving the property’s overall profitability.

3. Enhance Property Management: Efficient property management can have a significant impact on the cap rate. Properly managing tenant relationships, ensuring timely rent collections, and proactively addressing maintenance issues can minimize vacancies and increase cash flow. Consider leveraging technology and outsourcing to professional property management companies to streamline operations and optimize the property’s performance.

4. Optimize Tenant Mix: Analyzing the tenant mix can help improve the cap rate. Aim for a mix of long-term, creditworthy tenants to reduce tenant turnover and vacancy rates. Evaluate leases, rental terms, and tenant qualifications to ensure a stable income stream. By attracting quality tenants, property owners can minimize the risk of income disruption and enhance the overall profitability of the property.

5. Consider Value-Add Opportunities: Value-add strategies can significantly improve the cap rate. Look for opportunities to enhance the property’s value through renovations, expansions, or conversions. By increasing the overall attractiveness and market value of the property, investors can justify higher rental rates, resulting in a better cap rate. Engage with professionals such as architects and contractors to assess potential value-add opportunities.

6. Improve Overall Efficiency: Improving the efficiency of operations can positively impact the cap rate. Implementing technology solutions for bookkeeping, record-keeping, and rental management can streamline processes and reduce administrative costs. Utilize predictive maintenance practices to prevent major repairs and minimize expenses. By optimizing the property’s efficiency, investors can enhance the overall profitability and cap rate.

7. Refinance or Recapitalize the Property: Assessing financing options can lead to improved cap rates. Refinancing the property at a lower interest rate or finding alternative financing sources with more favorable terms can reduce financing costs and increase cash flow. Consider exploring options such as loan restructuring, accessing equity, or seeking partnerships with other investors to optimize the property’s financing structure and improve the cap rate.

It’s crucial to note that improving the cap rate requires careful analysis, market research, and strategic decision-making. Investors should assess the potential costs and benefits of any improvement strategies and consider the overall investment objectives and risk tolerance. By implementing these strategies effectively, investors can enhance the cap rate and ultimately maximize the profitability of their investment properties.

Conclusion

Understanding and evaluating the cap rate of an investment property is essential for real estate investors. It provides valuable insights into the property’s income potential, risk profile, and overall profitability. While cap rate is a widely used metric, it is important to consider its limitations and use it in conjunction with other financial metrics and qualitative factors when making investment decisions.

A good cap rate is subjective and depends on various factors such as market conditions, property type, investor goals, and risk tolerance. Conducting thorough market research, analyzing comparative data, and considering regional variations are crucial in evaluating cap rates across different markets.

While cap rate is a useful tool, it’s important to recognize that it provides a simplified analysis of an investment property’s financial performance. Investors should conduct comprehensive due diligence, evaluate property-specific factors, and incorporate future projections to make well-informed investment decisions.

Furthermore, improving the cap rate on investment properties can be achieved through strategies such as increasing rental income, reducing operating expenses, optimizing tenant mix, implementing value-add opportunities, and enhancing overall efficiency. Each property is unique, and the effectiveness of these strategies may vary depending on specific circumstances.

In conclusion, cap rate is a valuable metric to assess the financial viability and profitability of an investment property. However, it should be used as part of a comprehensive analysis and considered alongside other factors such as market conditions, property-specific characteristics, and long-term growth potential. By understanding the importance and limitations of cap rate and implementing appropriate strategies, investors can make informed decisions to maximize the returns on their investment properties.