Home>Finance>Rule Of 78: Definition, How Lenders Use It, And Calculation

Finance

Rule Of 78: Definition, How Lenders Use It, And Calculation

Published: January 22, 2024

Learn about the Rule of 78 in finance, its definition, how lenders utilize it, and its calculation. Discover the insights you need on this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Rule of 78 in Finance: A Guide for Borrowers

When it comes to navigating the world of personal finance, there are often terms and concepts that can be confusing to the average consumer. One such concept is the Rule of 78, a term that is frequently used by lenders in calculating early repayment penalties. In this blog post, we will break down the Rule of 78, explain how lenders use it, and provide a step-by-step guide to calculating it. Whether you’re a borrower who wants to understand the terms of your loan or simply looking to expand your knowledge of finance, this post will help demystify the Rule of 78.

Key Takeaways:

- The Rule of 78 is a mathematical principle used by lenders to calculate early repayment penalties on loans.

- Understanding how the Rule of 78 works can help borrowers make informed decisions about their loans and avoid unnecessary fees.

What is the Rule of 78 and How Do Lenders Use It?

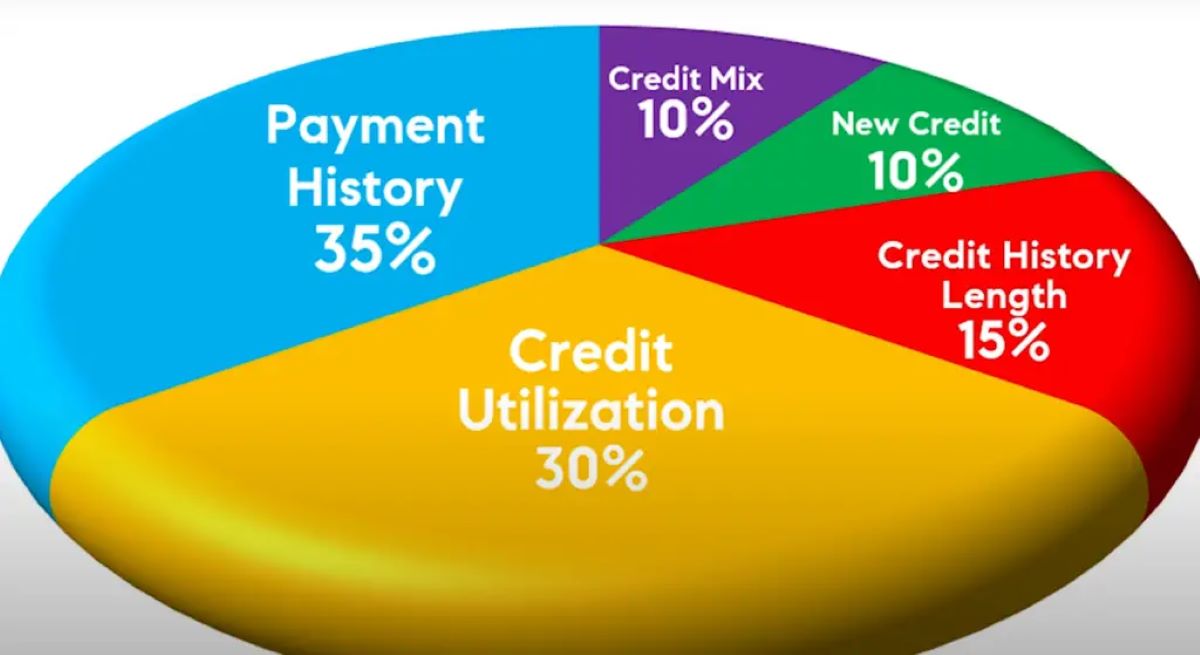

The Rule of 78 is a methods used by lenders to calculate the amount of interest owed to them when a borrower pays off a loan early. It is based on the assumption that interest is front-loaded in the early months of the loan. In simple terms, the Rule of 78 calculates a borrower’s interest obligation for each month by assigning a weight to each month of the loan term. The weights are based on the remaining balance of the loan at each month, and the earlier months have a higher weight.

So, how do lenders use the Rule of 78 to calculate early repayment penalties? When a borrower decides to pay off their loan before the agreed-upon term, the lender may charge a penalty to compensate for the interest they would have earned if the borrower had made regular payments for the full term. The penalty is calculated using the Rule of 78, with the borrower’s interest obligation for each month being multiplied by the corresponding weight. This results in a higher penalty for early repayment, especially in the earlier months of the loan.

How to Calculate the Rule of 78

Calculating the Rule of 78 can seem daunting at first, but with the right understanding, it becomes much more manageable. Here’s a step-by-step guide on how to calculate the Rule of 78:

- Start with the original loan amount.

- Divide the loan into equal periods based on the loan term (e.g., monthly, quarterly).

- Assign a weight to each period by summing the digits from 1 up to the number of periods (e.g., for a 12-month loan, the weights would be 1+2+3+…+12 = 78).

- Calculate the total interest paid over the loan term by summing the weighted interest for each period.

- Calculate the remaining balance for each month of the loan term.

- Assign the weighted interest to each month by multiplying the remaining balance by the corresponding weight.

- Sum up the weighted interest for all months to get the final early repayment penalty.

By following this step-by-step guide, borrowers can gain a clearer understanding of how lenders calculate early repayment penalties using the Rule of 78. Armed with this knowledge, borrowers can better evaluate their options and potentially negotiate better terms when they decide to pay off their loan ahead of schedule.

In Conclusion

While the Rule of 78 may seem complex at first, it is an important concept to understand for borrowers. Knowing how lenders use this rule to calculate early repayment penalties empowers borrowers to make informed decisions about their finances. If you’re considering paying off your loan early, it’s crucial to assess if the potential penalty is worth the benefits of early repayment. Remember, being aware of your financial rights and educating yourself about financial concepts like the Rule of 78 can make all the difference when managing your personal finances.