Finance

What FICO Score Do Rv Lenders Use

Published: March 6, 2024

Find out which FICO score RV lenders use to evaluate your finance options. Understand the impact of your credit score on RV loan approval and terms.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding FICO Scores

When it comes to financing a recreational vehicle (RV), understanding the significance of FICO scores is paramount. As an integral part of the lending process, FICO scores play a pivotal role in determining an individual’s creditworthiness. In essence, a FICO score represents a numerical assessment of an individual’s credit risk, providing lenders with insight into the likelihood of timely loan repayment.

For RV enthusiasts seeking to embark on adventures with their own motorhome or travel trailer, comprehending the impact of FICO scores on loan approval is essential. This article delves into the intricacies of FICO scores and their relevance to RV lending, shedding light on the factors that influence lenders’ decisions and offering valuable tips for improving credit scores to secure favorable loan terms.

Join us as we navigate the realm of FICO scores and unveil the pivotal role they play in the pursuit of RV ownership. Whether you’re a seasoned RVer or a novice contemplating your first purchase, understanding the nuances of FICO scores is a crucial step towards realizing your dream of hitting the open road in your very own recreational vehicle.

Understanding FICO Scores

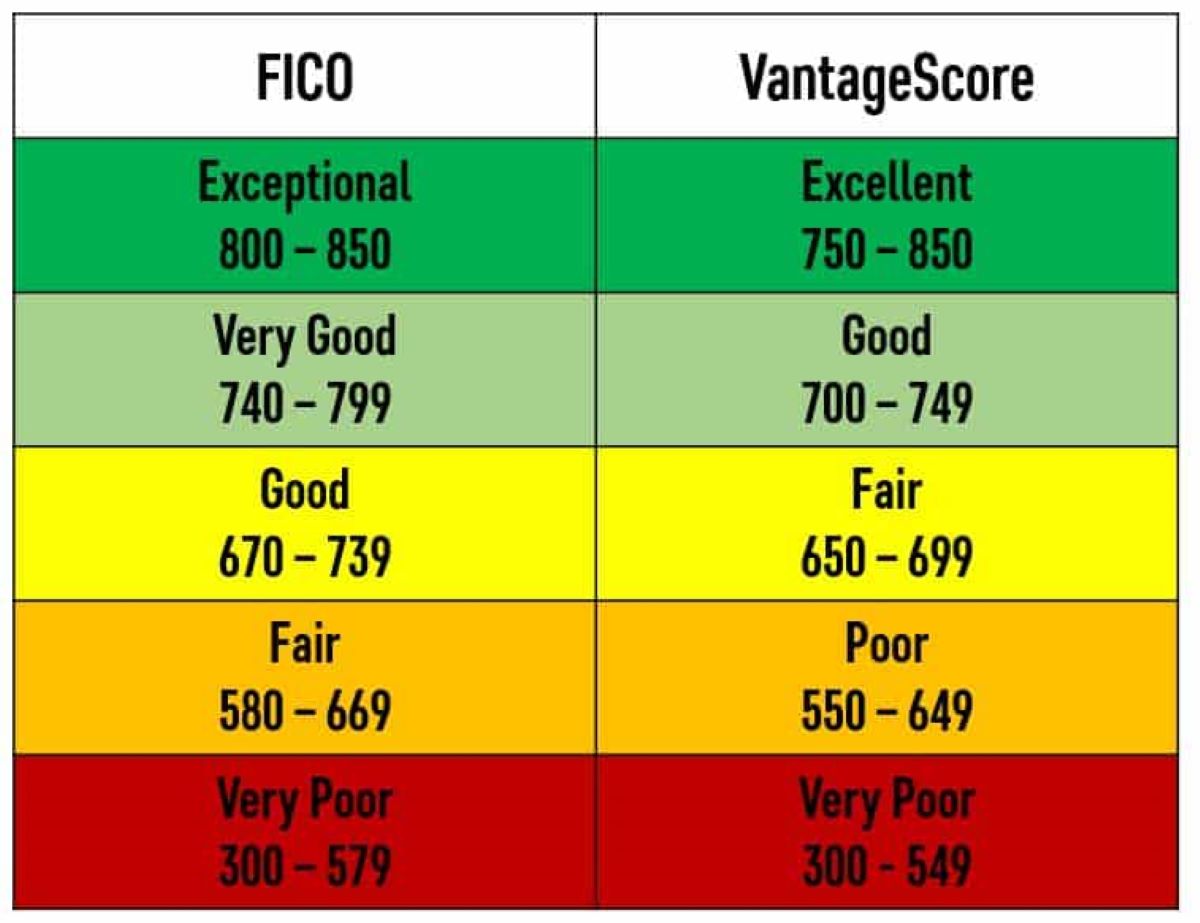

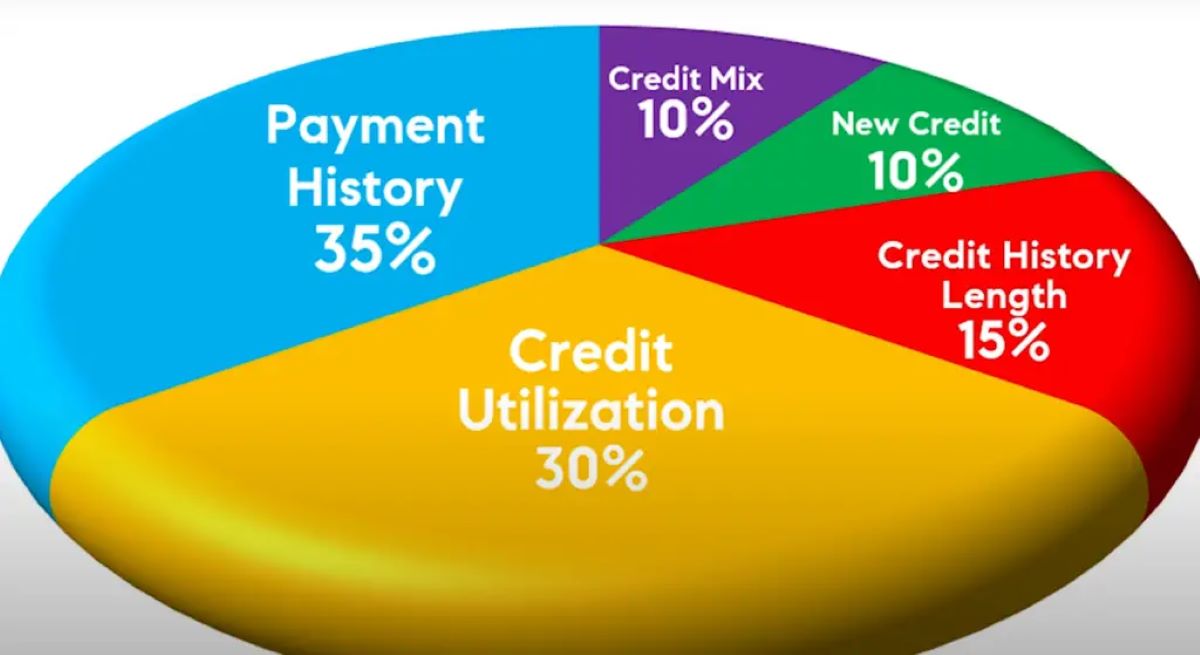

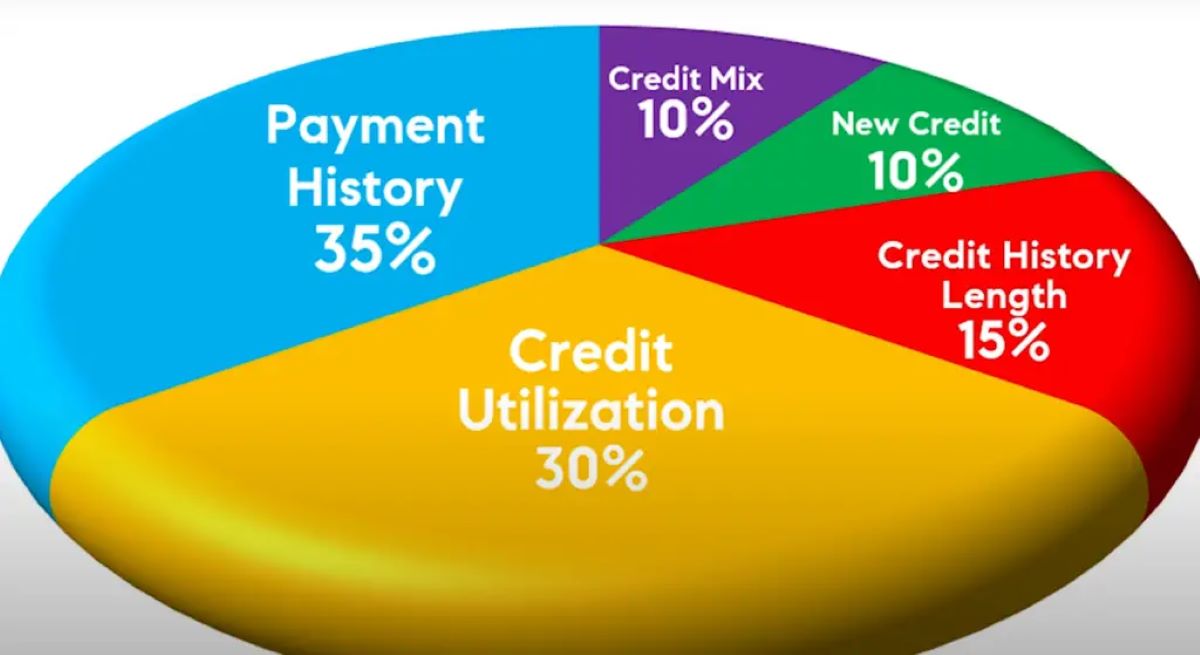

FICO scores, developed by the Fair Isaac Corporation, are widely utilized by lenders to assess the credit risk of potential borrowers. These scores are generated based on the information in individuals’ credit reports, encompassing their credit utilization, payment history, length of credit history, new credit accounts, and credit mix. The numerical range of FICO scores falls between 300 and 850, with higher scores indicating lower credit risk.

It’s important to note that FICO scores are not static and can fluctuate over time in response to individuals’ financial behaviors. Timely bill payments, responsible credit utilization, and a diverse credit mix can contribute to an improved FICO score, while late payments, high credit card balances, and frequent credit inquiries may have adverse effects.

Understanding the components that influence FICO scores empowers individuals to make informed decisions regarding their financial habits. By maintaining a keen awareness of these factors, individuals can take proactive steps to enhance their creditworthiness, thereby increasing their eligibility for favorable loan terms when pursuing an RV purchase.

Aspiring RV owners can leverage their understanding of FICO scores to proactively manage their financial standing, positioning themselves for success when seeking financing for their dream recreational vehicle. By comprehending the dynamics of FICO scores, individuals can embark on their RV ownership journey with confidence, knowing that they are equipped to navigate the lending landscape with a clear understanding of the metrics that lenders prioritize.

Importance of FICO Scores for RV Lenders

For RV lenders, FICO scores serve as a crucial tool for evaluating the creditworthiness of loan applicants. These scores provide lenders with a comprehensive assessment of an individual’s financial responsibility and repayment habits, enabling them to gauge the level of risk associated with extending a loan for the purchase of a recreational vehicle.

When individuals apply for RV financing, lenders rely on FICO scores to make informed decisions regarding loan approval and the terms offered. Higher FICO scores typically signal a lower credit risk, instilling confidence in lenders and potentially leading to more favorable loan terms, such as lower interest rates and more flexible repayment options. On the other hand, lower FICO scores may raise concerns for lenders, leading to heightened scrutiny and less advantageous loan terms.

From the perspective of RV lenders, FICO scores are instrumental in assessing the likelihood of timely loan repayment and mitigating the risk of default. By leveraging FICO scores as a reliable metric for evaluating borrowers’ creditworthiness, lenders can make sound lending decisions while safeguarding their financial interests.

As such, individuals aspiring to secure RV financing should recognize the pivotal role of FICO scores in the lending process. By prioritizing responsible financial habits and actively working to improve their FICO scores, prospective RV owners can enhance their appeal to lenders, positioning themselves for more favorable loan terms and a smoother path to realizing their RV ownership aspirations.

Factors Considered by RV Lenders

When evaluating loan applications for RV financing, lenders take various factors into account to assess the creditworthiness of potential borrowers. While FICO scores play a significant role in this assessment, lenders consider additional elements to gain a holistic understanding of applicants’ financial profiles.

1. FICO Scores: As a primary indicator of credit risk, FICO scores carry substantial weight in the lending decision. Higher scores generally reflect a history of responsible financial management, potentially leading to more favorable loan terms.

2. Income and Employment Stability: Lenders evaluate applicants’ income levels and employment history to ascertain their ability to meet loan obligations. Stable employment and a sufficient income stream enhance applicants’ prospects for loan approval.

3. Debt-to-Income Ratio: The ratio of an individual’s monthly debt payments to their gross monthly income serves as a measure of financial health. Lenders assess this ratio to gauge applicants’ capacity to take on additional debt without becoming overburdened.

4. Credit History and Payment Patterns: Beyond FICO scores, lenders scrutinize applicants’ credit reports to assess their credit utilization, payment history, and the presence of any derogatory marks, such as bankruptcies or foreclosures. Consistent, on-time payments and a positive credit history are viewed favorably by lenders.

5. Down Payment: The amount of upfront cash that applicants can put towards the RV purchase influences lenders’ perceptions of risk. A larger down payment may mitigate concerns and enhance loan approval prospects.

6. Loan-to-Value Ratio: This ratio, which compares the loan amount to the appraised value of the RV, helps lenders gauge the level of risk associated with the loan. A lower loan-to-value ratio may strengthen the application’s appeal to lenders.

By considering these multifaceted factors, RV lenders strive to make well-informed lending decisions while assessing the risk and potential for timely repayment associated with each loan application. Aspiring RV owners can position themselves for success by proactively addressing these factors and presenting strong financial credentials when seeking RV financing.

Tips to Improve FICO Scores for RV Loan Approval

For individuals aspiring to secure RV financing, enhancing their FICO scores can significantly bolster their prospects for loan approval and favorable terms. Implementing proactive strategies to improve creditworthiness can pave the way for a smoother and more advantageous lending experience. Here are valuable tips to elevate FICO scores and strengthen eligibility for RV loan approval:

- Monitor Credit Reports Regularly: Routinely reviewing credit reports allows individuals to identify and rectify errors, detect potential fraud, and gain insights into areas for improvement.

- Make Timely Payments: Consistently paying bills on time is one of the most impactful actions individuals can take to enhance their FICO scores. Setting up automatic payments or reminders can help maintain a pristine payment history.

- Manage Credit Utilization: Keeping credit card balances low in relation to credit limits can positively influence FICO scores. Aim to maintain a utilization rate below 30% to demonstrate responsible credit management.

- Diversify Credit Mix: Having a healthy mix of credit types, such as revolving credit and installment loans, can contribute to a more robust credit profile. However, it’s important to manage these accounts responsibly.

- Limit New Credit Inquiries: While shopping for RV loans, minimizing new credit inquiries can help prevent unnecessary dings to FICO scores. Multiple inquiries within a short timeframe can raise red flags for lenders.

- Address Outstanding Debts: Prioritizing the repayment of outstanding debts, such as credit card balances and personal loans, can lead to gradual score improvements and demonstrate responsible financial management.

- Seek Professional Guidance: Consulting with a financial advisor or credit counselor can provide valuable insights and tailored strategies for optimizing FICO scores and strengthening financial health.

By diligently implementing these tips and maintaining a proactive approach to managing their credit profiles, individuals can elevate their FICO scores over time, positioning themselves for greater success in securing RV financing. As FICO scores improve, the likelihood of favorable loan terms and a seamless path to RV ownership increases, empowering individuals to embark on their recreational adventures with confidence and financial stability.

Conclusion

Aspiring RV owners embarking on the journey to secure financing for their dream recreational vehicle must recognize the pivotal role of FICO scores in the lending process. Understanding the nuances of FICO scores and their impact on loan approval empowers individuals to take proactive steps to enhance their creditworthiness, thereby increasing their eligibility for favorable loan terms.

By comprehending the multifaceted factors considered by RV lenders, from FICO scores and credit history to income stability and down payments, individuals can strategically position themselves for success when seeking RV financing. Proactively addressing these factors and presenting strong financial credentials can bolster applicants’ appeal to lenders, paving the way for a smoother and more advantageous lending experience.

Moreover, implementing actionable tips to improve FICO scores, such as monitoring credit reports, making timely payments, and managing credit utilization, can yield tangible enhancements to individuals’ credit profiles. As FICO scores ascend, the prospects for securing RV loan approval with favorable terms are amplified, enabling individuals to embark on their RV ownership journey with confidence and financial prudence.

Ultimately, the pursuit of RV ownership is enriched by a comprehensive understanding of FICO scores and their significance in the lending landscape. Armed with knowledge, proactive strategies, and a commitment to financial responsibility, individuals can navigate the process of securing RV financing with clarity and purpose, propelling them closer to the realization of their recreational adventures on the open road.