Finance

What Is A Lender Credit

Published: January 13, 2024

Explore what a lender credit is and how it can impact your finances. Find out how this financial tool can help you save money on your loans and achieve your financial goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, there are numerous terms and concepts that can be confusing for both new and experienced individuals. One such term is “lender credit.” Whether you’re a first-time homebuyer or a seasoned investor, understanding what a lender credit is and how it works is crucial when it comes to making informed financial decisions.

A lender credit is essentially a sum of money that a lender offers to the borrower as an incentive or benefit to choose their loan. It is typically in the form of a credit toward the borrower’s closing costs or mortgage rate. While many people are familiar with borrower obligations such as down payments and fees, lender credits can provide a significant advantage by reducing the upfront expenses associated with obtaining a loan.

While lender credits can be advantageous, it’s important to understand the intricacies and implications of utilizing them effectively. In this article, we will delve deeper into the concept of a lender credit, explore its purpose, examine how it works, and weigh the advantages and disadvantages. Additionally, we will discuss the factors that borrowers should consider when evaluating lender credits.

So, whether you’re considering purchasing a new home, refinancing your mortgage, or simply looking to expand your knowledge of the finance industry, let’s explore the world of lender credits together and unravel the benefits and considerations associated with this financial tool.

Definition of a Lender Credit

A lender credit is a financial incentive offered by a lender to the borrower. It is a sum of money that the lender provides to the borrower to cover a portion of their closing costs or reduce their mortgage interest rate. Essentially, the lender is extending a credit to the borrower, which can help make the loan more affordable and reduce the upfront expenses associated with obtaining a loan.

When a borrower takes out a loan, there are various costs involved, such as origination fees, appraisal fees, and title insurance. These costs can add up and create a significant financial burden. However, with a lender credit, the borrower may receive a predetermined amount of money from the lender to help offset these costs.

Lender credits can be applied in different ways. In some cases, the lender may offer to cover a portion or all of the closing costs, such as appraisal fees, loan origination fees, or title insurance fees. Alternatively, the lender credit can be used to reduce the borrower’s mortgage interest rate, resulting in lower monthly payments over the life of the loan.

It’s important to note that lender credits are not provided without any conditions. Typically, lenders require borrowers to meet certain criteria or agree to specific terms in exchange for the credit. This could include staying with the lender for a specified period of time or agreeing to a higher interest rate in exchange for a larger credit.

Overall, a lender credit is a financial tool utilized by lenders to attract borrowers and make their loan offers more competitive. By providing a credit towards closing costs or reducing the mortgage interest rate, lenders can make financing more accessible and affordable for borrowers.

Purpose of a Lender Credit

The primary purpose of a lender credit is to provide borrowers with a financial benefit that helps reduce the upfront expenses associated with obtaining a loan. Lender credits are designed to make financing more affordable and accessible for borrowers. Here are some key purposes of a lender credit:

- Reducing Closing Costs: One of the main purposes of a lender credit is to offset a portion or all of the borrower’s closing costs. Closing costs can include fees related to the loan origination, appraisal, title insurance, and other administrative expenses. By offering a lender credit, the lender effectively reduces the financial burden on the borrower, making homeownership more attainable.

- Lowering Interest Rates: In some cases, a lender credit can be used to lower the borrower’s mortgage interest rate. By offering a reduced interest rate, the lender can help the borrower save money over the life of the loan. This can result in lower monthly mortgage payments and potentially significant long-term savings.

- Competitive Advantage: Lenders use lender credits as a way to attract borrowers and gain a competitive edge in the market. In a highly competitive mortgage industry, lenders often offer incentives, such as lender credits, to entice borrowers to choose their loan products over those of their competitors.

- Flexibility for Borrowers: Lender credits provide borrowers with more flexibility in managing their finances. By reducing closing costs or lowering interest rates, borrowers can allocate their funds to other pressing financial needs, such as home improvements or debt consolidation.

- Assisting First-Time Homebuyers: Lender credits are particularly beneficial for first-time homebuyers who may be facing financial constraints or have limited funds available for closing costs. By offering a lender credit, lenders can help remove some of the barriers to homeownership and make the process more accessible for first-time buyers.

Overall, lender credits serve the purpose of making financing more affordable, improving the borrower’s ability to purchase or refinance a property, and providing a competitive advantage for lenders in the mortgage market.

How Lender Credits Work

Understanding how lender credits work is essential for borrowers who want to take advantage of this financial tool. Here is a step-by-step breakdown of how lender credits typically function:

- Borrower Applies for a Loan: The borrower initiates the loan application process with a lender. This typically involves submitting financial documents, such as income verification, credit history, and employment records.

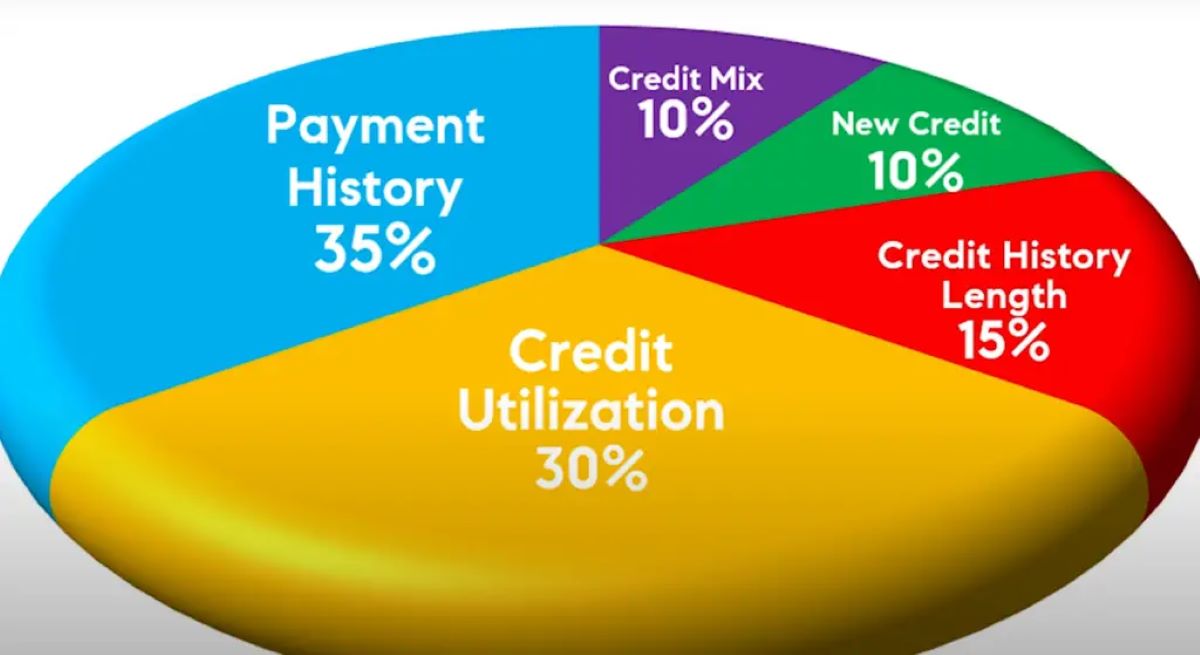

- Lender Determines Eligibility: The lender evaluates the borrower’s eligibility for the loan and assesses their financial profile. This includes factors such as credit score, debt-to-income ratio, and the loan amount requested.

- Lender Offers a Loan Package: Based on the borrower’s financial profile, the lender presents a loan package that includes details about the loan amount, interest rate, and associated costs.

- Lender Credit is Discussed: During the loan package discussion, the lender may introduce the concept of a lender credit if it is available for the specific loan program. The lender explains the amount of the credit and the conditions attached to it.

- Borrower Considers the Lender Credit: The borrower evaluates the lender credit offer and weighs its benefits against other loan offers they may have received. They consider factors such as the credit amount, the impact on closing costs or interest rates, and any specific terms or requirements.

- Borrower Agrees to the Lender Credit: If the borrower decides to proceed with the loan that includes the lender credit, they formally accept the lender’s offer and comply with any necessary documentation or agreements.

- Lender Applies the Credit: Once the loan process moves forward, the lender applies the agreed-upon lender credit. This can either be directly deducted from the borrower’s closing costs or used to reduce the mortgage interest rate.

- Closing and Loan Disbursement: The loan goes through the necessary closing procedures, and the borrower completes the transaction. The lender credits are reflected on the Closing Disclosure, providing transparency and clarity regarding the financial arrangement.

It’s important to note that the availability and terms of lender credits can vary depending on the lender, loan program, and the borrower’s financial circumstances. Therefore, it’s crucial for borrowers to carefully read and understand the terms and conditions associated with any lender credit offer before making a decision.

By understanding the process of how lender credits work, borrowers can make informed choices that align with their financial goals and circumstances.

Advantages of Lender Credits

Lender credits offer several advantages for borrowers that can make a significant impact on their financial situation. Here are some key advantages to consider:

- Reduced Upfront Costs: One of the primary benefits of a lender credit is the reduction in upfront costs. By covering a portion or all of the closing costs, borrowers can conserve their funds for other expenses, such as home improvements or emergencies.

- Lower Monthly Payments: When lender credits are used to reduce the mortgage interest rate, borrowers can enjoy lower monthly mortgage payments. This allows for increased cash flow, which can be directed towards savings, investments, or other financial goals.

- Increased Affordability: Lender credits can make homeownership more affordable, particularly for first-time homebuyers or individuals with limited funds. By reducing upfront costs and lowering interest rates, lenders provide borrowers with more options and flexibility to purchase a property that meets their needs.

- Competitive Loan Offers: Lender credits give borrowers the opportunity to access competitive loan offers that may not have been affordable otherwise. With lenders offering credits to attract borrowers, it becomes easier to compare loan terms and choose the most favorable option.

- Flexibility in Financial Planning: By utilizing lender credits, borrowers have more flexibility in managing their finances. They can allocate saved funds towards other financial goals, such as debt repayment, building an emergency fund, or making investments.

- Short-Term Savings: Lender credits can provide immediate savings by reducing closing costs. This can be especially beneficial for individuals who are working within a tight budget or looking to save money during the home buying or refinancing process.

- Improved Cash Reserves: By reducing upfront costs, lender credits help borrowers maintain a healthy cash reserve. Having sufficient cash reserves can provide a financial cushion and peace of mind in case of unexpected expenses or changes in financial circumstances.

It’s important to note that while there are notable advantages to utilizing lender credits, borrowers should carefully evaluate the terms and conditions associated with these offers. Understanding the long-term implications and potential trade-offs of lender credits will help borrowers make informed decisions about their loan choices.

In summary, lender credits provide borrowers with tangible benefits, including reduced upfront costs, lower monthly payments, increased affordability, and enhanced financial flexibility. These advantages can make a significant difference in a borrower’s ability to achieve their homeownership or refinancing goals while effectively managing their finances.

Disadvantages of Lender Credits

While lender credits offer various advantages, it’s essential to consider the potential disadvantages before making a decision. Here are some key disadvantages to be aware of:

- Higher Interest Rates: In some cases, lenders may offer a lender credit in exchange for a higher interest rate. This means that while upfront costs may be reduced, borrowers may end up paying more in interest over the life of the loan. It’s crucial to carefully evaluate the long-term financial implications of a higher interest rate.

- Low Loan Amount Limitations: Some lender credits may have restrictions on the loan amount. This means that borrowers with higher loan amounts may not qualify for certain lender credit offers or may receive a lower credit amount. It’s important to determine if the lender credit can adequately offset the closing costs for the specific loan amount.

- Longer Break-Even Periods: If lender credits are used to lower the interest rate, there may be a longer break-even period before borrowers start experiencing real savings. It’s essential to calculate the break-even point to determine if the reduced monthly payments justify the upfront costs or potential trade-offs.

- Loan Lock-in Periods: Some lender credits may come with specific requirements, such as a minimum lock-in period. This means that borrowers may need to stay with the lender for a certain period to fully benefit from the lender credit. If borrowers decide to refinance or sell their property before the lock-in period expires, they may need to repay a portion or all of the lender credit.

- Limited Loan Options: Not all loan programs or lenders offer lender credits. This means that borrowers may have limited options when it comes to choosing lenders or loan products if they specifically want to take advantage of a lender credit. It’s important to weigh the benefits of a lender credit against other essential factors, such as loan terms, interest rates, and overall suitability.

- Non-Transferability: Lender credits are typically not transferable to another property or borrower. If a borrower decides to change their home purchase or refinance plans, they may lose the lender credit and need to reassess their financial situation. This lack of transferability can limit flexibility in future housing decisions.

It’s crucial for borrowers to carefully evaluate the terms and conditions associated with lender credits and assess their individual financial circumstances and goals. Understanding the potential disadvantages can help borrowers make an informed decision that aligns with their needs and priorities.

In summary, while lender credits offer considerable benefits, including reduced upfront costs and increased affordability, borrowers should be aware of potential drawbacks such as higher interest rates, limitations on loan amounts, longer break-even periods, lock-in periods, limited loan options, and non-transferability. By weighing the advantages against the disadvantages, borrowers can make an informed choice that best suits their financial situation.

Factors to Consider when Evaluating Lender Credits

When considering lender credits, it’s essential to thoroughly evaluate various factors to make an informed decision. Here are some key factors to consider when evaluating lender credits:

- Total Cost Analysis: Calculate the total cost of the loan, including closing costs, interest rates, and lender credits. Compare this with other loan options to determine which provides the best long-term financial benefits.

- Impact on Monthly Payments: Evaluate how the lender credit affects your monthly mortgage payments. Consider whether the reduction in upfront costs or lower interest rate justifies any potential trade-offs in monthly payments.

- Loan Duration and Financial Goals: Consider the duration of the loan and how it aligns with your financial goals. If you intend to stay in the property for a short period, a lender credit may have less impact than if you plan to stay for a longer term.

- Lock-in Period: Understand if there is a lock-in period associated with the lender credit and determine if it aligns with your housing plans. Consider the potential disadvantages of being locked into the loan for a certain period.

- Loan Amount and Eligibility: Determine if the lender credit is suitable for your loan amount and eligibility. Certain lender credits may have limitations or requirements based on your loan size or financial profile.

- Lender Reputation: Research the reputation and reliability of the lender offering the credit. Read reviews, seek recommendations, and assess their customer service track record.

- Future Flexibility: Consider how the lender credit may impact your future financial flexibility. Evaluate if the reduced upfront costs and lower interest rates provide the flexibility you need for potential changes in financial circumstances or future housing decisions.

- Comparison Shopping: Don’t settle for the first lender credit offer you receive. Shop around and compare lender credits from multiple lenders to ensure you secure the most advantageous terms and conditions.

- Professional Advice: Consult with a mortgage professional or financial advisor who can evaluate your unique situation and provide personalized guidance. They can help you understand the implications of lender credits and make an informed decision.

By considering these factors and conducting a comprehensive evaluation, you can determine if a lender credit is the right choice for your specific needs and financial goals. Remember, making an informed decision based on your individual circumstances is crucial when evaluating lender credits.

Conclusion

Lender credits can play a significant role in making financing more affordable and accessible for borrowers. By reducing upfront costs or lowering interest rates, lender credits can help individuals achieve their homeownership or refinancing goals while managing their finances effectively.

However, it’s important to thoroughly evaluate lender credits and consider various factors before making a decision. Understanding the advantages and disadvantages, calculating the long-term financial implications, and assessing how lender credits align with your financial goals are crucial steps in the evaluation process.

Factors such as the total cost analysis, impact on monthly payments, loan duration, and future flexibility all come into play when weighing the benefits of lender credits. Additionally, researching and comparing lender reputation, eligibility requirements, and seeking professional advice can provide valuable insights to help you make an informed choice.

Remember that lender credits are not one-size-fits-all solutions and their suitability will vary depending on your individual circumstances. What may be beneficial for one borrower may not be the best option for another. Thus, taking the time to assess your financial situation, goals, and the terms and conditions of lender credit offers is crucial in making the right decision.

In conclusion, lender credits can be powerful financial tools that provide borrowers with opportunities to reduce upfront costs, lower interest rates, and increase affordability. By evaluating the advantages, disadvantages, and important factors, you can confidently determine if a lender credit is the right choice for your specific needs and enhance your financial journey in the world of homeownership or property refinancing.