Home>Finance>Short-Form Prospectus Distribution System (SFPDS) Definition

Finance

Short-Form Prospectus Distribution System (SFPDS) Definition

Published: January 28, 2024

Discover the definition of Short-Form Prospectus Distribution System (SFPDS) in the world of finance. Unlock the benefits and use cases of this innovative financial tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of the Short-Form Prospectus Distribution System (SFPDS)

When it comes to navigating the world of finance, staying informed about the latest tools and systems is crucial. One such system that plays an essential role in the financial industry is the Short-Form Prospectus Distribution System, also known as SFPDS. In this blog post, we will delve into the definition and significance of SFPDS, providing you with a comprehensive understanding of how it operates and why it matters.

Key Takeaways:

- SFPDS streamlines the process of distributing prospectuses, making it more efficient for issuing companies and investors.

- It offers investors a concise and streamlined version of a prospectus, providing key information necessary for making investment decisions.

What is the Short-Form Prospectus Distribution System?

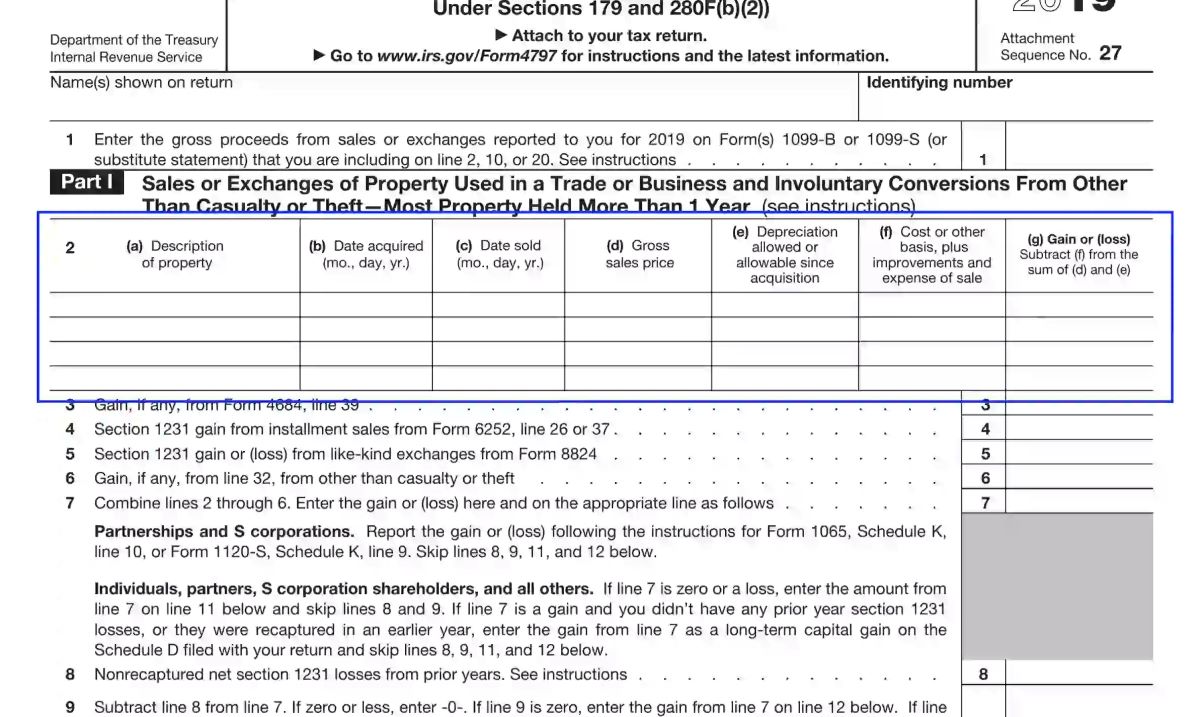

The Short-Form Prospectus Distribution System (SFPDS) is a mechanism used by companies to efficiently distribute and offer their securities to potential investors. In simple terms, it is a streamlined version of a prospectus that contains essential information about the securities being offered.

How Does SFPDS Work?

The SFPDS simplifies the process of distributing prospectuses by allowing companies to provide condensed versions of their full prospectus documents. These abbreviated versions highlight the most crucial details, making it easier for investors to quickly assess the offering.

Companies utilizing SFPDS are required to provide a summary of the prospectus, key financial information, risk factors, and other material details in a clear and concise manner. This ensures that investors can make informed decisions without having to sift through lengthy and complex documents.

Why Is SFPDS Important?

Now that we understand what SFPDS is and how it functions, let’s explore why it holds significant relevance in the financial landscape:

- Efficiency: By condensing the prospectus information, SFPDS streamlines the process of distributing securities, saving time and resources for both companies and investors.

- Accessibility: SFPDS provides potential investors with a simplified version of the prospectus, making it more accessible for individuals who may not have the time or expertise to analyze lengthy financial documents.

In conclusion, the Short-Form Prospectus Distribution System (SFPDS) is an invaluable tool in the finance industry that enhances the efficiency of distributing securities and improves accessibility for potential investors. By condensing pertinent information into a concise format, SFPDS empowers investors to make informed decisions quickly and effectively. Stay tuned to our finance category for more insightful articles on the latest trends and tools in the financial world.