Finance

How Pension Is Calculated

Published: November 27, 2023

Learn how pension is calculated in this comprehensive finance guide. Understand the factors that contribute to your retirement funds and plan your financial future wisely.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Basic Concepts of Pension Calculation

- Factors Affecting Pension Calculation

- Calculation Methodology

- Step 1: Determining the Pensionable Salary

- Step 2: Evaluating the Number of Service Years

- Step 3: Identifying the Pension Accrual Rate

- Step 4: Calculating the Pension Amount

- Example Calculation

- Common Pension Calculation Formulas

- Considerations and Limitations in Pension Calculation

- Conclusion

Introduction

Welcome to the world of pensions, where financial security awaits after years of hard work and dedication. Understanding how pension is calculated is crucial for individuals planning their retirement and organizations managing employee benefits. This comprehensive guide will provide insights into the basic concepts, factors affecting pension calculation, and the methodology used to determine pension amounts.

Pensions are a form of retirement income that individuals receive after completing a certain number of years in employment. They are typically provided by employers, government entities, or private pension plans. The purpose of a pension is to ensure a steady stream of income for individuals during their retirement years, allowing them to maintain a comfortable lifestyle.

Pension calculations are based on a series of factors, including the employee’s salary, number of years in service, and the pension accrual rate. However, it’s important to note that the methodology and formulas for pension calculation can vary depending on the specific pension plan or system in place.

By understanding how pension is calculated, individuals can make informed decisions about their retirement savings and plan for a financially secure future. Employers can also use this knowledge to effectively design pension plans that meet the needs of their employees and ensure compliance with regulatory requirements.

In the following sections, we will explore the basic concepts of pension calculation, the factors influencing the calculation, and the step-by-step methodology for determining pension amounts. We will also provide example calculations and highlight common pension calculation formulas. Finally, we will discuss considerations and limitations that should be taken into account when calculating pensions. Let’s begin our journey into the world of pension calculation!

Basic Concepts of Pension Calculation

Before diving into the intricacies of pension calculation, it’s important to grasp some fundamental concepts. Let’s explore these key elements:

- Pensionable Salary: The pensionable salary is the portion of an employee’s income that is used to calculate their pension benefits. It is typically based on the average salary earned over a specific period, such as the final years of employment or the entire length of service.

- Service Years: Service years or credited service refers to the number of years an individual has contributed to a pension plan. It represents the duration of an employee’s employment and is a significant factor in determining the pension amount.

- Pension Accrual Rate: The pension accrual rate, also known as the accrual factor or pension factor, is a percentage used to calculate the annual pension benefit. It is usually based on a specific formula or determined by the employer or pension plan administrator.

- Contributions: In some pension systems, employees may be required to contribute a portion of their salary towards the pension plan. These contributions, along with any employer contributions, can impact the final pension amount.

- Vesting Period: The vesting period is the duration of service an employee must complete before becoming eligible for their full pension benefits. It ensures that individuals who leave their employment before reaching the vesting period may receive a reduced or no pension benefit.

Understanding these basic concepts will provide a solid foundation for comprehending the more intricate aspects of pension calculation. It’s important to note that pension systems can vary across different countries, organizations, and industries, resulting in variations in the specific terms and rules.

Now that we have a clear understanding of the fundamental concepts, let’s explore the various factors that can influence pension calculation.

Factors Affecting Pension Calculation

Calculating pensions involves considering several factors that can influence the final pension amount. These factors vary depending on the pension plan or system in place. Let’s take a closer look at some of the key factors that affect pension calculation:

- Salary: The salary earned by an individual during their working years is a significant factor in pension calculation. The higher the salary, the higher the pension amount is likely to be. The pensionable salary, which may differ from the actual salary, is typically used as the basis for calculating the pension benefit.

- Service Years: The number of years an individual has worked, often referred to as service years or credited service, has a direct impact on the pension amount. In general, the longer the employment period, the higher the pension benefit will be. Some pension plans may have a minimum service requirement before employees become eligible for pension benefits.

- Pension Accrual Rate: The pension accrual rate, sometimes expressed as a percentage or a specific formula, determines how much of the pensionable salary is accrued for each year of service. A higher accrual rate results in a higher pension benefit. The accrual rate may vary based on factors such as age, job category, or length of service.

- Contributions: Pension plans may require both employees and employers to contribute towards the pension fund. The amount of these contributions can impact the pension amount. In some cases, employers may match the employee’s contributions, providing additional funds for the retirement benefit.

- Inflation: Inflation can significantly impact the purchasing power of pension benefits. Some pension systems include provisions to adjust the pension amount periodically to account for inflation. This ensures that the pension remains relatively stable and maintains its value over time.

- Retirement Age: The age at which an individual chooses to retire can also affect the pension calculation. Some pension plans have specific rules regarding the retirement age and offer incentives for individuals who choose to retire later, such as higher accrual rates or bonus payments.

It is essential to consider these factors when calculating pensions to ensure that the final amount accurately reflects an individual’s contributions and years of service. Each pension plan may have its own unique combination of factors and rules, making it important for individuals to familiarize themselves with the specific guidelines of their pension scheme.

Now that we understand the factors that influence pension calculation, let’s delve into the methodology used to determine pension amounts.

Calculation Methodology

Determining the pension amount requires following a specific calculation methodology that takes into account the various factors discussed earlier. Although the exact methodology may vary depending on the pension plan or system, the following steps generally outline the process:

- Step 1: Determining the Pensionable Salary: The first step involves identifying the portion of an employee’s salary that is considered pensionable. This may be the average salary earned over a specific period or the salary at the time of retirement.

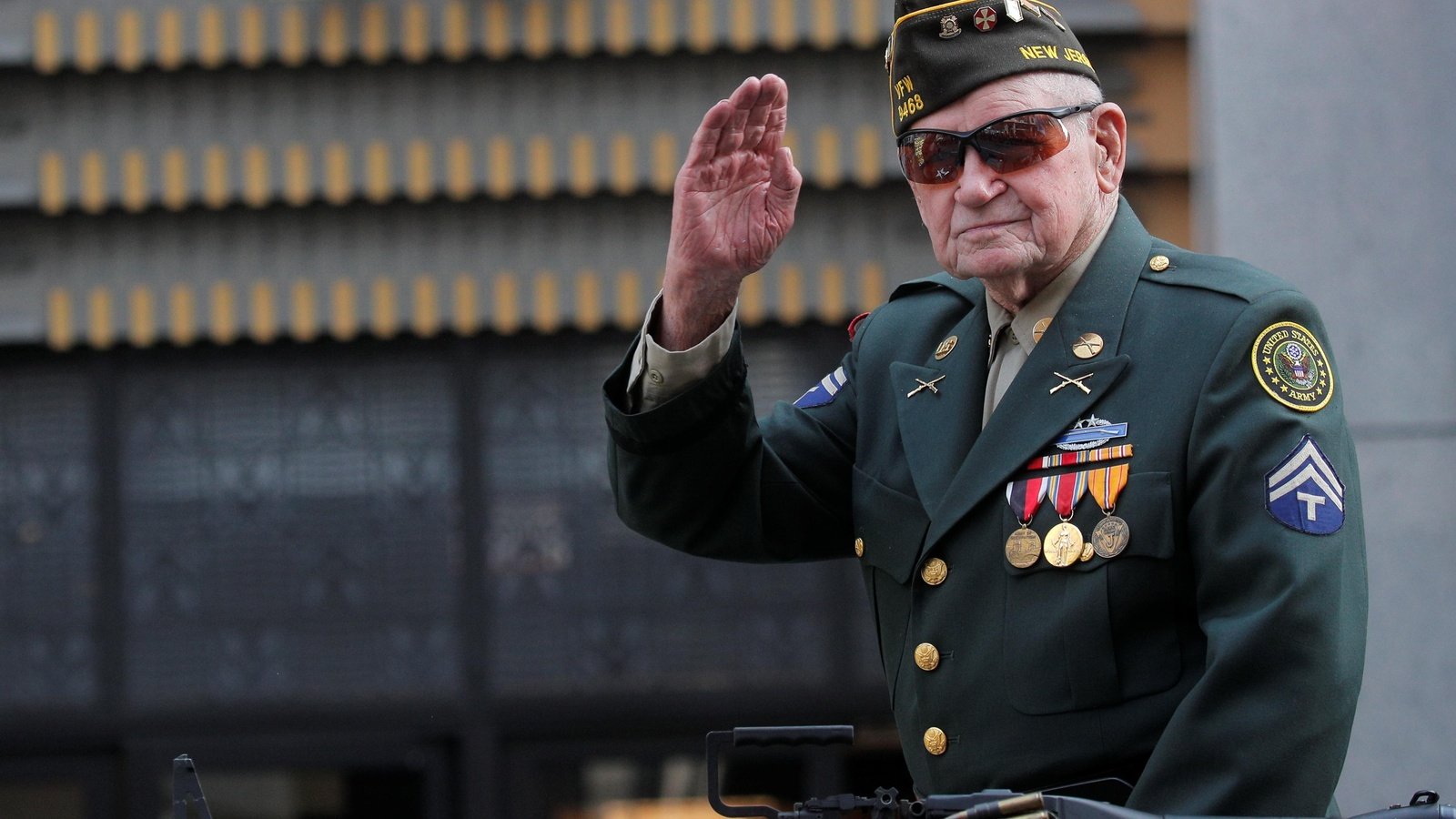

- Step 2: Evaluating the Number of Service Years: The next step is to determine the number of years an individual has contributed to the pension plan. This includes both credited service and any additional years or credits that may be taken into account, such as military service or buyback provisions.

- Step 3: Identifying the Pension Accrual Rate: Once the pensionable salary and service years are established, the pension accrual rate is applied. This rate determines how much of the pensionable salary will be accrued for each year of service.

- Step 4: Calculating the Pension Amount: Using the above information, the final pension amount is calculated. This is often done by multiplying the pensionable salary by the pension accrual rate and then adjusting for any other factors, such as inflation or additional contributions.

It’s important to note that this is a simplified representation of the calculation methodology. Pension plans may have unique formulas or rules that affect the actual calculation, such as additional factors for early retirement, disability benefits, or survivor benefits.

Let’s now look at an example to better understand how the calculation methodology works in practice.

Step 1: Determining the Pensionable Salary

The first step in calculating a pension involves determining the pensionable salary. The pensionable salary is the portion of an employee’s income that is used as the basis for calculating their pension benefits. This salary can be determined in a variety of ways, depending on the pension plan or system in place.

One common method of determining the pensionable salary is by considering the average salary earned over a specific period of time, often referred to as the “final average salary” or “career average salary.” This period may be the final few years of employment or the employee’s entire length of service. By taking the average of these earnings, it provides a fair representation of the employee’s income over their working years.

For example, let’s say an employee’s final average salary is determined based on their earnings in the last five years of employment. The sum of the salaries earned during those years would be divided by five to calculate the average. This average salary would then be considered the pensionable salary for the purpose of calculating the pension benefits.

It’s important to note that in some cases, the pensionable salary may differ from the actual salary earned by an employee. Certain components of income, such as bonuses or overtime pay, may not be included in the pensionable salary calculation. This is done to ensure that the pension benefits are based on a more stable and consistent income stream.

Additionally, the pensionable salary may also be subject to certain limitations or caps imposed by the pension plan or system. These caps may place a maximum limit on the amount of salary that can be considered for pension calculation purposes.

By determining the pensionable salary accurately, pension administrators can establish the foundation for calculating the pension benefits. It provides a fair representation of an employee’s income and ensures that the pension benefits align with their earnings during their working years.

Now that we have determined the pensionable salary, let’s move on to the next step of the pension calculation process: evaluating the number of service years.

Step 2: Evaluating the Number of Service Years

The next step in calculating a pension is evaluating the number of service years. This involves determining the length of time an individual has contributed to the pension plan or system. The service years, also known as credited service, play a crucial role in determining the pension benefits.

Service years represent the total duration of an individual’s employment, which includes the years of service with the employer offering the pension plan. These years are typically considered the period in which an employee actively contributes to the plan, making them eligible for pension benefits in the future.

The process of evaluating the number of service years involves considering the actual years an individual has worked for the employer. In most cases, only the years of service that fall within the employment period for the specific employer are counted. However, there are instances where additional years or credits may be considered.

Some pension plans allow for the inclusion of certain non-employment periods or buyback provisions in the calculation of service years. This can include periods such as military service, leaves of absence, or other approved absences from work. By accounting for these additional years or credits, individuals may be able to increase their total service years, thereby potentially increasing their pension benefits.

It’s important to note that different pension plans may have different criteria for counting service years. Some plans may require employees to complete a minimum number of service years before becoming eligible for pension benefits. Additionally, there may be rules regarding how service years are calculated for part-time or contract employees.

Once the number of service years is determined, it is used as a factor in the pension calculation. Typically, the longer an individual’s service years, the higher their pension benefits will be. This is because the pension benefits are often based on a percentage of the pensionable salary, multiplied by the number of service years.

Now that we have evaluated the number of service years, let’s move on to the next step in the pension calculation process: identifying the pension accrual rate.

Step 3: Identifying the Pension Accrual Rate

In the pension calculation process, the next step after determining the pensionable salary and evaluating the number of service years is to identify the pension accrual rate. The pension accrual rate is a crucial factor that determines the percentage or formula used to calculate the annual pension benefit.

The pension accrual rate, also known as the accrual factor or pension factor, represents how much of the pensionable salary is accrued for each year of service. It is typically expressed as a percentage or a specific formula specified by the pension plan or system.

The pension accrual rate can vary based on several factors, such as the age of the employee, job category, or length of service. For example, younger employees may have a lower accrual rate, which gradually increases as they gain more service years. This is often done to incentivize long-term employment and provide a higher pension benefit for individuals with more years of service.

The formula used to calculate the pension accrual rate can also differ depending on the pension plan or system. Some pension plans may use a fixed percentage that is applied to the pensionable salary for each year of service. For instance, if the accrual rate is set at 2%, then the pension benefit would be calculated as 2% of the pensionable salary for each year of service.

In other cases, the pension accrual rate may be determined by a more complex formula that takes into account various factors. This can include a combination of age-related factors, such as the employee’s final salary, the number of years worked, or a multiplier based on a specific calculation method.

It’s important for individuals to understand the pension accrual rate applicable to their pension plan or system. This information allows them to estimate the annual pension benefits they can expect to receive based on their pensionable salary and service years.

Now that we have identified the pension accrual rate, let’s move on to the final step in the pension calculation process: calculating the pension amount.

Step 4: Calculating the Pension Amount

The final step in the pension calculation process is determining the actual pension amount. This step involves using the information gathered in the previous steps, such as the pensionable salary, number of service years, and the pension accrual rate, to calculate the pension benefit.

To calculate the pension amount, the pensionable salary is typically multiplied by the pension accrual rate for each year of service. This determines the annual pension benefit that an individual is entitled to receive. The resulting amount may be adjusted for factors like inflation or additional contributions, depending on the specific pension plan or system.

For example, let’s say the pensionable salary is $50,000, and the pension accrual rate is set at 1.5% for each year of service. If an individual has worked for 20 years, the calculation would be as follows:

Annual Pension Benefit = Pensionable Salary x Pension Accrual Rate x Service Years

= $50,000 x 1.5% x 20

= $15,000

In this case, the individual would be eligible for an annual pension benefit of $15,000.

It’s important to keep in mind that this is a simplified example, and the actual pension calculation may involve additional factors or formulas specific to the pension plan. Some pension plans may also offer various payment options, such as lump sum or monthly installments, which may influence the pension amount.

Additionally, different pension plans may have limitations or caps on the maximum pension amount that can be received. These limitations protect the financial sustainability of the pension plan and ensure fair distribution of pension benefits among members.

By going through the process of calculating the pension amount, individuals can gain a clear understanding of the pension benefits they can expect to receive upon retirement. This information is crucial for effective retirement planning and financial decision-making.

Now that we have covered the four steps of the pension calculation process, let’s move on to an example calculation to illustrate how these steps come together.

Example Calculation

Let’s walk through an example calculation to demonstrate how the pension calculation process works. In this example, we will consider a hypothetical scenario with the following information:

- Pensionable Salary: $60,000

- Number of Service Years: 25 years

- Pension Accrual Rate: 2%

Based on these figures, we can calculate the annual pension benefit:

Annual Pension Benefit = Pensionable Salary x Pension Accrual Rate x Service Years

= $60,000 x 2% x 25

= $30,000

In this example, the individual would be entitled to an annual pension benefit of $30,000.

Keep in mind that this is a simplified calculation, and the actual pension calculation may involve additional factors or formulas specific to the pension plan. It’s also important to note that the pension benefits may be subject to taxes and other deductions, depending on the local regulations and policies.

Calculating the pension amount provides individuals with a clearer understanding of the financial benefits they will receive during retirement. This information enables better financial planning and helps individuals make informed decisions about their retirement savings and overall financial well-being.

Now that we have seen an example calculation, let’s explore some common pension calculation formulas that are used in various pension systems and plans.

Common Pension Calculation Formulas

When it comes to calculating pension benefits, different pension plans or systems may employ specific formulas or methods. These formulas can vary based on factors such as the pension plan design, industry standards, or legal requirements. Here are some of the common pension calculation formulas used:

- Final Average Salary Formula: This formula determines the pension benefit based on the average salary earned over a specified period, such as the final few years of employment. The calculation generally involves multiplying the average salary by a percentage factor or pension accrual rate.

- Career Average Salary Formula: In this formula, the pension benefit is based on the average salary earned throughout the entire career. The average salary is typically calculated by dividing the total salary earned by the number of service years. This method ensures that the pension benefits reflect the individual’s overall career earning trajectory.

- Defined Benefit Formula: Defined benefit pensions provide a predetermined monthly income based on a formula specified by the pension plan. The formula typically takes into account factors such as years of service, final average salary, and an accrual rate. For example, the formula may be expressed as a percentage of the final average salary multiplied by the number of service years.

- Point-Based Formula: In some pension systems, a point-based formula is used, where points are assigned based on factors such as age, service years, and salary. These points are then multiplied by a certain value (often called a point value) to determine the pension benefit amount.

- Pension Multiplier Formula: This formula uses a multiplier value to calculate the pension benefit. The multiplier is typically based on factors such as the employee’s age at retirement, years of service, or a combination of both. The pensionable salary is multiplied by the multiplier to determine the pension benefit.

- Flat Benefit Formula: In some cases, pension plans may offer a flat benefit, where the pension amount is a fixed, predetermined amount per year of service. The formula is straightforward, with no variable factors related to salary or career progression.

These are just a few examples of the common pension calculation formulas used in different pension systems. It’s important to note that the specific formulas and methods for pension calculation may vary based on the rules and regulations set forth by the pension plan or system.

Understanding the formula used in your specific pension plan is essential for accurately estimating your pension benefits and making informed retirement decisions. If you are unsure about the formula or need detailed information, it is recommended to consult with the plan administrator or a financial advisor experienced in pensions.

Now that we have explored common pension calculation formulas, let’s discuss some considerations and limitations that should be taken into account when calculating pensions.

Considerations and Limitations in Pension Calculation

While calculating pensions, there are several considerations and limitations that individuals need to keep in mind. These factors can impact the accuracy of the pension calculation and the actual pension benefits received. Let’s explore some of these considerations:

- Assumptions and Variables: Pension calculations are based on a range of assumptions and variables that can influence the final pension outcome. These can include factors such as interest rates, mortality rates, future salary growth, and inflation rates. It’s important to be aware that any changes in these assumptions can have an impact on the calculated pension amount.

- Regulatory Requirements: Pension plans are subject to legal and regulatory requirements, which can affect the structure and calculation of pension benefits. Changes in legislation or regulations can lead to adjustments in pension calculation methodologies or benefit formulas.

- Vesting Periods: Some pension plans require individuals to meet a vested period before becoming eligible for their full pension benefits. This means that employees must work for a certain number of years to qualify for their full pension entitlement. If an individual leaves employment before reaching the vested period, they may receive a reduced or no pension benefit.

- Retirement Age: The retirement age chosen by an individual can impact the pension calculation. Some pension plans offer incentives for individuals who choose to retire later, providing higher accrual rates or bonuses. Conversely, retiring before the normal retirement age may result in a reduced pension benefit.

- Early Retirement Options: Some pension plans offer early retirement options, allowing individuals to retire before the normal retirement age. However, early retirement may result in a reduction in pension benefits due to the longer payout period.

- Social Security and Other Benefits: Pension benefits may be impacted by other retirement benefits an individual receives, such as social security. Some pension systems have provisions to integrate social security or offset pension benefits accordingly.

- Additional Contributions: In certain pension plans, individuals can make voluntary additional contributions to boost their pensions. These contributions may result in increased pension benefits and can be a consideration for those seeking to enhance their retirement income.

- Transferability and Portability: Individuals changing jobs or countries may need to consider the transferability and portability of their pension benefits. Understanding the rules and options for transferring or merging pensions is crucial to ensure a seamless transition and maximum benefit accumulation.

It’s important to note that pension calculations can be complex, incorporating various legal, regulatory, and financial variables. It is advisable to consult with pension plan administrators, financial advisors, or experts to understand the specific considerations and limitations that apply to your pension plan.

By being aware of these considerations and limitations, individuals can obtain a more comprehensive understanding of their pension benefits and make well-informed decisions regarding their retirement planning.

Now, let’s conclude our exploration of pension calculations.

Conclusion

Calculating pensions is a crucial aspect of retirement planning for both individuals and organizations. Understanding how pensions are calculated enables individuals to estimate their future retirement income and make informed financial decisions. Likewise, organizations can design effective pension plans that meet the needs of their employees.

In this comprehensive guide, we explored the basic concepts of pension calculation, including the pensionable salary, service years, and the pension accrual rate. We also examined the calculation methodology, which involves determining the pensionable salary, evaluating the number of service years, identifying the pension accrual rate, and calculating the final pension amount.

Throughout the process, we discussed common pension calculation formulas used in various pension systems and highlighted considerations and limitations that impact the accuracy of pension calculations. Factors such as regulatory requirements, retirement age, vesting periods, and additional contributions should be taken into account when estimating pension benefits.

It’s important to note that pension calculations can be complex, and specific rules and formulas may vary depending on the pension plan or system. Consulting with pension plan administrators or financial advisors experienced in pensions can provide personalized guidance and ensure accurate calculations.

By understanding the intricacies of pension calculation and considering the various factors at play, individuals can feel more confident in their retirement plans. They can make informed decisions about retirement savings, understand the potential impact of different factors, and work towards a financially secure future.

Remember, when it comes to pensions, knowledge is power. Take the time to understand your pension plan, ask questions, and seek professional advice if needed. With a solid understanding of pension calculation, you can confidently move forward in building a comfortable and secure retirement.