Finance

How Much Is A Police Pension

Published: November 27, 2023

Discover the financial aspects of police pensions and find out how much a police pension typically amounts to. Explore the intricacies of police pension finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Police Pensions

- Factors Affecting Police Pension Amounts

- Calculating Police Pension Benefits

- Pension Contributions for Police Officers

- Early Retirement Options for Police Officers

- Spousal Benefits for Police Pensions

- Taxation of Police Pension Benefits

- Adjustments and Cost-of-Living Increases

- Financial Planning for Police Pensions

- Conclusion

Introduction

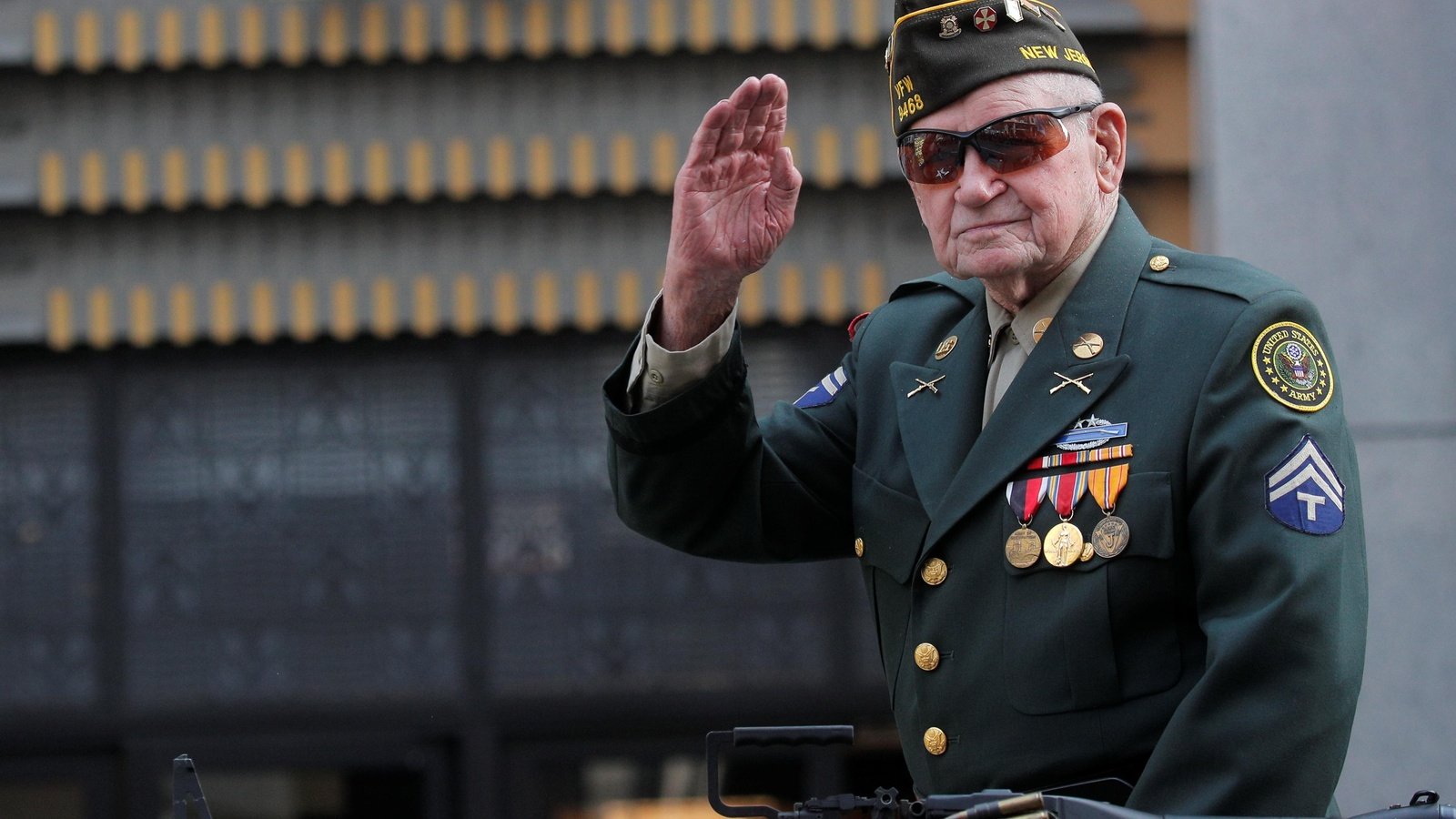

Police pensions play a crucial role in providing financial security to retired police officers who have dedicated their lives to protecting their communities. These pensions are designed to compensate law enforcement officers for their years of service and the risks they face on a daily basis. Understanding the intricacies of police pensions is essential for both current police officers and individuals planning for retirement.

In this article, we will delve into the key aspects of police pensions, including how they are calculated, the factors that affect the pension amount, early retirement options, spousal benefits, taxation implications, adjustments, and cost-of-living increases. We will also provide guidance on financial planning to help police officers make the most of their pension benefits.

It is important to note that police pension plans may vary depending on the jurisdiction and specific department. Different states and municipalities may have different pension systems in place for their police officers. Therefore, it is crucial to consult with your local pension authority or financial advisor to understand the specifics of your police pension.

Whether you are a police officer nearing retirement or an individual interested in learning more about police pensions, this article will serve as a comprehensive guide to help you navigate the complex world of police retirement benefits. Let’s dive in and explore the ins and outs of police pensions.

Understanding Police Pensions

Police pensions are retirement benefits provided to police officers upon their retirement from active service. These pensions are typically funded through a combination of employee contributions, employer contributions, and investment returns. The primary objective of a police pension is to provide financial security to retired officers and their families after years of dedicated service.

A police pension is a defined benefit plan, which means that the retirement benefit is predetermined based on factors such as years of service, final average salary, and a specific benefit formula established by the pension plan. This differs from a defined contribution plan, where the retirement benefit is dependent on the contributions made and the investment performance of the individual’s account.

One of the key advantages of a police pension is that it provides a guaranteed and stable income for the rest of an officer’s life. This can be especially beneficial considering the unpredictable nature of a career in law enforcement. The pension allows retired police officers to maintain their standard of living and meet their financial obligations during retirement.

Another important aspect to understand is vesting in a police pension plan. Vesting refers to the point at which an officer becomes eligible to receive pension benefits. Typically, officers become vested in their pension after completing a certain number of years of service, such as 20 or 25 years. Once vested, officers are entitled to receive their pension benefits upon retirement, regardless of their age at retirement.

It is essential for police officers to be aware of the specific eligibility requirements and guidelines of their pension plan. Understanding the vesting period, retirement age, and the calculations used to determine the pension amount will help officers plan for their retirement effectively.

Overall, police pensions serve as a valuable mechanism to reward and support police officers for their dedicated service. They provide a stable and reliable source of income during retirement, ensuring that officers can enjoy their retirement years with financial peace of mind.

Factors Affecting Police Pension Amounts

The amount of a police pension is influenced by various factors that can vary depending on the specific pension plan and jurisdiction. It is important for police officers and those planning for retirement to understand these factors to estimate their potential pension benefits accurately. Here are some key factors that can impact the amount of a police pension:

- Years of Service: One of the primary factors that determine the amount of a police pension is the number of years of service the officer has completed. Generally, the more years of service, the higher the pension benefit.

- Final Average Salary: The final average salary is another crucial factor in calculating a police pension. It represents the average salary earned by the officer over a certain period, typically the last three to five years of service. A higher final average salary generally results in a higher pension benefit.

- Pension Formula: Each pension plan has a specific formula used to calculate the pension benefit. This formula can consider factors such as years of service, final average salary, and a predetermined percentage or multiplier. It is important to understand the formula used by the specific pension plan to calculate the pension amount accurately.

- Cost-of-Living Adjustments: Some police pension plans offer cost-of-living adjustments (COLAs) to help offset the impact of inflation on pension benefits. These adjustments can vary depending on the pension plan and may be provided annually or on a periodic basis.

- Early Retirement: Some pension plans allow police officers to retire early with reduced benefits. The age and service requirements for early retirement can vary, so it is essential to understand the implications of early retirement on the pension amount.

- Survivor Benefits: Many police pension plans provide survivor benefits to the spouse or dependents of a retired police officer in the event of the officer’s death. These benefits may include a percentage of the pension or a lump-sum payment. Understanding the survivor benefit provisions is crucial for officers planning for the financial security of their loved ones.

It’s important to note that these factors can vary significantly depending on the specific pension plan and jurisdiction. It is recommended to consult with the pension plan administrator or a financial advisor who specializes in police pensions to fully understand the factors affecting the pension amount.

By understanding the various factors that influence police pension calculations, officers can make informed decisions about their career, retirement planning, and financial goals. It is crucial to have a clear understanding of how these factors apply to your specific pension plan to ensure accurate retirement planning and financial security in the future.

Calculating Police Pension Benefits

The calculation of police pension benefits is a complex process that involves various factors specific to each pension plan. While the precise formula may vary, the following are some common elements taken into account when determining the pension benefits for police officers:

- Years of Service: The number of years the police officer has served is a pivotal factor in calculating the pension benefit. Pension plans often provide a certain percentage for each year of service. For example, a pension plan may offer 2% of the final average salary for each year of service.

- Final Average Salary: The pension plan typically considers the average salary of the police officer during a specific period, such as the last three to five years of service, to determine the final average salary. This average is then used in the pension calculation formula.

- Pension Multiplier: Many police pension plans use a multiplier to calculate the pension benefit based on the years of service and final average salary. The multiplier reflects the percentage of the final average salary that will be paid out as the pension benefit for each year of service. For example, a pension plan with a multiplier of 2% would yield a pension benefit of 2% of the final average salary for each year of service.

- Vesting Period: To qualify for a pension, a police officer must complete a specific vesting period, typically 20 to 25 years of service. Once vested, the officer becomes eligible to receive pension benefits upon retirement, regardless of their age at retirement.

- Early Retirement Reductions: Some pension plans allow police officers to retire before reaching the standard retirement age, but with a reduction in their pension benefit. The reduction is typically based on the number of years the officer retires early.

- Spousal and Survivor Benefits: Many police pension plans provide benefits for spouses and dependents in the event of the officer’s death. These benefits could include a percentage of the pension or a lump-sum payment to ensure the financial well-being of the officer’s loved ones.

It’s essential to remember that these calculations are general examples. Each pension plan may have its unique formulas and provisions. Police officers should consult their pension plan’s administrator or a financial advisor well-versed in police pensions to understand the specific calculations applied in their pension plan.

Understanding how police pension benefits are calculated can help officers plan for retirement effectively and make informed decisions about their finances. By considering factors such as years of service, final average salary, and the pension multiplier, officers can estimate their potential pension benefits and take steps to ensure financial security during retirement.

Pension Contributions for Police Officers

Police officers typically contribute a portion of their salary towards their pension plan. These contributions play a vital role in funding their future pension benefits. The specific contribution rates can vary depending on factors such as the jurisdiction, pension plan, and collective bargaining agreements. Here are some key points to consider regarding pension contributions for police officers:

- Employee Contributions: Police officers are responsible for making regular contributions from their salary towards their pension plan. These contributions are deducted from their paycheck and are typically a percentage of their salary. The exact contribution rate can vary but is usually set by the pension plan or negotiated through collective bargaining agreements.

- Employer Contributions: In addition to the employee contributions, police pension plans are also funded by contributions from the employer, which is typically the police department or the municipality. The employer contributions are intended to supplement the pension fund and help ensure the financial stability of the plan.

- Matching Contributions: Some pension plans may have a matching contribution structure, where the employer matches a percentage of the employee’s contributions. For example, if an officer contributes 5% of their salary, the employer may match that amount, effectively doubling the contribution to 10% of the officer’s salary.

- Tax Advantages: Employee pension contributions are typically made on a pre-tax basis, meaning they are deducted from the officer’s salary before taxes are applied. This provides a tax advantage, as the officer’s taxable income is reduced, resulting in potentially lower tax liability in the current year.

- Investment of Contributions: The contributions made by police officers and employers are invested by the pension plan to generate returns for the fund. These investments can encompass various asset classes, such as stocks, bonds, and real estate, with the goal of growing the pension fund over time.

- Collective Bargaining Agreements: Pension contribution rates for police officers may be negotiated through collective bargaining agreements between the police unions and the jurisdiction. These agreements can establish the contribution rates, terms, and any potential changes to the pension plan.

It is essential for police officers to keep detailed records of their pension contributions throughout their career. These records can help ensure accurate calculations of their pension benefits and assist in financial planning for retirement.

Understanding the pension contribution structure is crucial for police officers to make informed decisions about their financial planning and retirement readiness. By maximizing their contributions and taking advantage of any employer matching programs, officers can build a solid foundation for a secure retirement.

Early Retirement Options for Police Officers

Police officers often have the opportunity to retire before reaching the standard retirement age, thanks to early retirement options available through their pension plans. Early retirement can provide officers with the flexibility to transition into the next phase of their lives sooner. Here are some key points to consider regarding early retirement options for police officers:

- Age and Service Requirements: Early retirement options typically have specific age and service requirements that officers must meet to be eligible. For example, a pension plan may require a minimum of 20 years of service and a minimum age of 50 or 55 to qualify for early retirement.

- Reduced Pension Benefits: One important consideration is that early retirement often comes with a reduction in pension benefits. The reduction is usually calculated based on the number of years the officer retires early. As officers retire earlier, they receive a smaller monthly pension benefit due to the longer payout period.

- Actuarial Reductions: Pension plans typically use actuarial reductions to calculate the reduced pension benefits for early retirees. Actuarial calculations take into account factors such as life expectancy and projected investment returns to determine the reduced benefit amount.

- Survivor Benefits: Early retirement options may impact the survivor benefits provided by the pension plan. The reduction in pension benefits can also affect the amount that spouses or dependents receive in the event of the officer’s death. It is essential for officers to understand the impact on survivor benefits when considering early retirement.

- Healthcare Coverage: Early retirement may also affect access to healthcare coverage. Officers should check whether their pension plan offers healthcare benefits for early retirees or explore alternative healthcare options available to them.

- Financial Considerations: Retiring early requires careful financial planning. Officers considering early retirement should assess their financial readiness and ensure they have sufficient savings and investments to support their lifestyle during retirement.

- Consultation: It is crucial for police officers to consult with the pension plan administrator or a financial advisor specializing in police pensions to understand the specific factors and implications of early retirement options. They can provide personalized guidance based on the officer’s individual circumstances and inform them about the potential impact on their pension benefits and overall retirement plan.

Early retirement can be an attractive option for police officers looking to start the next chapter of their lives earlier. However, it is important for officers to carefully weigh the financial and lifestyle implications before making this decision. By understanding the age and service requirements, reductions in pension benefits, survivor benefits, healthcare coverage, and engaging in comprehensive financial planning, officers can make informed choices about their retirement timeline.

Spousal Benefits for Police Pensions

Police pension plans often provide spousal benefits to ensure the financial security of the officer’s spouse in the event of the officer’s death. These benefits are designed to support the surviving spouse and help maintain their standard of living. Here are some key points to consider regarding spousal benefits for police pensions:

- Survivor Pension: One of the primary spousal benefits is the survivor pension. This benefit ensures that the surviving spouse will continue to receive a portion of the officer’s pension after their death. The percentage of the pension benefit that the surviving spouse will receive can vary depending on the specific pension plan.

- Lump-Sum Payment: Some pension plans may offer a lump-sum payment option instead of a survivor pension. In this case, the surviving spouse will receive a one-time payment, typically a percentage of the officer’s accumulated pension contributions or a predetermined amount.

- Eligibility Requirements: To qualify for spousal benefits, the officer’s spouse must typically be legally married to the officer at the time of retirement or death. Some pension plans may also require a minimum timeframe of marriage before spousal benefits become applicable.

- Beneficiary Designation: It is crucial for police officers to designate their spouse as the primary beneficiary when completing pension paperwork. Ensuring that proper beneficiary designations are in place will help streamline the process of providing spousal benefits in the event of the officer’s death.

- Divorce and Spousal Benefits: In the case of divorce, the spousal benefits provided by the pension plan may be influenced by the divorce settlement. It is important for officers to understand how divorce can impact spousal benefits and consult with legal professionals to ensure the proper allocation of benefits.

- Healthcare Coverage: Spousal benefits may include continued access to healthcare coverage. Some pension plans offer healthcare benefits to surviving spouses, allowing them to maintain insurance coverage after the officer’s death. Officers should review their pension plan’s provisions to understand the availability and extent of healthcare coverage for their spouse.

It is crucial for police officers to consult with their pension plan administrator or a financial advisor specializing in police pensions to understand the specific spousal benefits provided by their pension plan. They can provide guidance on beneficiary designations, survivor pension options, and any additional provisions related to spousal benefits.

Spousal benefits are an important component of police pension plans, ensuring the financial well-being of the officer’s spouse after their death. By understanding the eligibility requirements, beneficiary designations, and available options, officers can take the necessary steps to protect their spouse and provide them with the support they need during difficult times.

Taxation of Police Pension Benefits

The taxation of police pension benefits is an important aspect for retired police officers to consider as they plan their finances in retirement. The tax treatment of pension benefits can vary depending on the jurisdiction and the specific rules governing pension taxation. Here are some key points to consider regarding the taxation of police pension benefits:

- Federal Income Tax: In the United States, police pension benefits are generally subject to federal income tax. The portion of the pension benefit considered taxable depends on several factors, including the contributions made by the employee and employer, as well as the investment earnings accumulated within the pension plan over the officer’s career.

- State Income Tax: State income tax treatment of police pension benefits varies from state to state. Some states fully exempt pension benefits from state income tax, while others may impose a partial or full tax on the benefits received. It is crucial for retired officers to understand the specific tax regulations in their state of residence.

- Retirement Age: The age at which a police officer begins receiving pension benefits can impact the taxation of those benefits. Depending on the jurisdiction, there may be specific rules regarding the taxation of benefits received before or after a certain age.

- Income Thresholds: In some cases, the taxation of police pension benefits can be affected by the retiree’s overall income. Higher-income individuals may be subject to higher tax rates or additional taxes on their pension benefits.

- Withholding Taxes: Retired police officers have the option to request income tax withholding from their pension payments. Withholding taxes can help retirees meet their tax obligations and prevent potential underpayment penalties.

- Rollovers and Roth Conversions: In certain situations, retirees may have the option to roll over their pension benefits into an individual retirement account (IRA) or convert their traditional pension benefits into a Roth IRA. These options can have specific tax implications and should be evaluated in consultation with a tax advisor.

- Consultation with a Tax Professional: Due to the complexities surrounding the taxation of pension benefits, it is highly recommended that retired police officers consult with a qualified tax professional who has expertise in retirement taxation. They can provide personalized advice based on the retiree’s circumstances and help navigate the tax regulations effectively.

Understanding the taxation of police pension benefits is critical to properly plan for retirement expenses and ensure compliance with tax laws. By seeking professional guidance and staying informed about the tax regulations in their jurisdiction, retired police officers can optimize their financial strategies and minimize tax burdens on their pension benefits.

Adjustments and Cost-of-Living Increases

Adjustments and cost-of-living increases are important factors that impact the value of police pension benefits over time. These adjustments are designed to help pension recipients keep up with inflation and maintain the purchasing power of their benefits. Here are some key points to consider regarding adjustments and cost-of-living increases for police pensions:

- Cost-of-Living Adjustments (COLAs): Many police pension plans provide COLAs to pension recipients to address the effects of inflation. COLAs increase pension benefits each year in line with a specified index, such as the Consumer Price Index (CPI). The purpose of COLAs is to ensure that the purchasing power of pension benefits remains consistent throughout retirement.

- Automatic COLAs: Some pension plans have automatic COLA provisions, which provide for regular increases without the need for additional action by the pension recipient. These automatic COLAs are typically tied to specific economic indicators and are applied annually or at regular intervals.

- Discretionary COLAs: In some cases, pension plan administrators have the authority to grant discretionary COLAs based on the financial health of the pension plan and other factors. The decision to award discretionary COLAs may be determined by factors such as investment returns, plan funding levels, or other financial considerations.

- Limitations on COLAs: Some pension plans may impose limitations on the amount or frequency of COLAs. For example, there may be a maximum percentage increase or a cap on the number of COLAs granted within a certain timeframe.

- Non-Cola Plans: It’s worth noting that not all pension plans include automatic or discretionary COLAs. Some pension plans have fixed benefit amounts that do not increase over time. In these cases, pension recipients need to plan their finances accordingly to account for potential inflationary effects.

- Impact on Financial Planning: COLAs and adjustments can significantly impact retirement financial planning. Including anticipated COLAs in retirement projections helps retirees estimate their future income and plan their expenses accordingly. It is important to consider the potential impact of inflation and the effectiveness of COLAs in maintaining the purchasing power of pension benefits.

- Plan Specifics: The rules and provisions regarding adjustments and COLAs can differ among pension plans. It is essential for retired police officers to review the specific details of their pension plan to understand how adjustments and COLAs are applied and how they may impact their pension benefits over time.

Adjustments and cost-of-living increases are factors that can greatly influence the value and stability of police pension benefits. By understanding the COLA provisions and adjustment mechanisms in their pension plan, retired police officers can make informed decisions and effectively plan for their financial future throughout retirement.

Financial Planning for Police Pensions

Financial planning plays a crucial role in ensuring retired police officers make the most of their pension benefits and achieve a comfortable and secure retirement. Proper financial planning can help officers make informed decisions about budgeting, investments, healthcare, and other essential aspects of their financial lives. Here are some key points to consider regarding financial planning for police pensions:

- Evaluate Retirement Expenses: A crucial first step in financial planning is to assess expected retirement expenses. This includes regular living expenses such as housing, utilities, healthcare, transportation, and groceries, as well as discretionary expenses such as travel and hobbies. Understanding these expenses will help retirees budget and allocate their pension income appropriately.

- Budgeting: Create a realistic budget based on expected retirement income, including pension benefits and any other sources of income such as Social Security or personal savings. Tracking expenses and adjusting the budget as needed will help retirees maintain financial stability throughout retirement.

- Investment Strategies: Police officers should evaluate their investment options for any additional retirement savings they may have, such as a 401(k) or Individual Retirement Account (IRA). Working with a financial advisor, retirees can develop an appropriate investment strategy based on their risk tolerance, time horizon, and financial goals.

- Consider Healthcare Costs: Healthcare expenses can be a significant part of retirement expenses. Retired police officers should explore healthcare options and assess the coverage provided by their pension plan. Additionally, considering long-term care insurance can help mitigate potential healthcare costs in the future.

- Debt Management: Evaluate and manage any existing debts, such as mortgages or loans. Creating a plan to pay off debts before or during retirement can help reduce financial stress and provide greater financial flexibility in retirement.

- Legal and Estate Planning: Review and update legal documents such as wills, powers of attorney, and healthcare directives. Engaging with a qualified estate planning attorney can ensure that retiree’s wishes are accurately reflected in their estate plan.

- Professional Advice: Seeking guidance from a financial advisor who specializes in retirement planning and police pensions can provide valuable insights and help create a comprehensive financial plan tailored to individual circumstances.

- Flexible Adjustments: Financial planning for police pensions requires periodic reviews and adjustments. Retirees should regularly monitor and reassess their financial situation to adapt to changing circumstances or unexpected events.

Developing a comprehensive financial plan is essential for retired police officers to ensure they make informed decisions and maintain financial security in retirement. By evaluating expenses, budgeting effectively, optimizing investments, managing debt, considering healthcare costs, and seeking professional advice, retirees can navigate their financial journey confidently and enjoy a fulfilling retirement.

Conclusion

Police pensions play a critical role in providing financial security and peace of mind for retired police officers who have dedicated their lives to protecting their communities. Understanding the intricacies of police pensions is essential for both current officers and individuals planning for retirement.

In this comprehensive guide, we have explored key aspects of police pensions, including factors that affect pension amounts, the calculation of pension benefits, early retirement options, spousal benefits, taxation implications, adjustments and cost-of-living increases, and the importance of financial planning. We have emphasized the need for officers to consult with pension plan administrators and financial advisors to fully understand the specifics of their pension plan and make informed decisions about their financial future.

Police pensions are designed to reward officers for their years of service and provide a stable and reliable income during retirement. Factors such as years of service, final average salary, and pension formula all contribute to determining the pension amount. Early retirement options can grant flexibility, but retirees must consider the potential reduction in pension benefits. Spousal benefits are crucial for providing financial security to the surviving spouse of a retired officer. Taxes, adjustments, and cost-of-living increases are important considerations in maintaining the value of pension benefits over time. And finally, sound financial planning is key to making the most of pension benefits and effectively managing retirement finances.

Individual circumstances, pension plan rules, and jurisdictional variations can influence the specifics of each police pension. It is essential for police officers to engage with their pension plan administrators, financial advisors, and legal professionals to gain a comprehensive understanding of their pension benefits and plan their retirement with confidence.

By navigating the complexities of police pensions and taking a proactive approach to financial planning, retired police officers can enjoy a secure and fulfilling retirement after a dedicated career of serving and protecting their communities.