Home>Finance>What Happens If My 401K Provider Goes Out Of Business

Finance

What Happens If My 401K Provider Goes Out Of Business

Published: October 18, 2023

If your 401K provider goes out of business, there may be potential risks to your retirement funds. Learn how to protect your finances in this situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Planning for retirement is an essential part of financial security. Many individuals rely on employer-sponsored retirement plans, such as a 401(k), to save for their golden years. While these plans offer numerous benefits, including tax advantages and potential employer matching contributions, there is a common concern: What happens if my 401(k) provider goes out of business?

It’s a legitimate worry. After all, you’ve diligently contributed to your retirement account, and the idea of losing those hard-earned savings due to the failure of your plan provider can be unsettling. In this article, we’ll explore the implications of a 401(k) provider going out of business and discuss the options and protections available to individuals in such situations.

Understanding the inner workings of 401(k) providers is important in comprehending the potential impact of such a scenario. These providers are typically financial institutions or investment firms entrusted with managing and administering retirement savings accounts on behalf of employees. They handle tasks such as recordkeeping, investment management, and distributing funds when needed.

While your employer ultimately selects your 401(k) provider, it’s crucial to understand that they are separate entities. Therefore, the financial health and stability of your employer have no direct bearing on the solvency of your plan provider. However, it’s worth noting that employer bankruptcy may indirectly affect the viability of the retirement plan if the employer still owes contributions to the fund.

Next, let’s delve into the potential financial implications faced by individuals if their 401(k) provider were to go out of business.

Understanding 401K Providers

Before diving into the potential ramifications of a 401(k) provider going out of business, it’s important to gain a clear understanding of their role and responsibilities. 401(k) providers are financial institutions or investment firms that administer and manage employer-sponsored retirement plans. They serve as the intermediary between employers and employees, enabling workers to contribute to their retirement savings.

These providers offer a range of services, including recordkeeping, investment management, and participant education. They ensure that contributions are allocated to the appropriate investment options chosen by the employee. They also handle the distribution of funds when employees retire or need to make withdrawals.

Employers typically select a 401(k) provider based on various factors, such as the provider’s reputation, fees, investment options, and customer service. Employees, in turn, rely on these providers to safeguard and grow their retirement savings.

While 401(k) providers play a crucial role in managing retirement plans, it’s important to note that they are separate entities from employers. This distinction is significant because even if your employer faces financial difficulties or goes out of business, it does not automatically mean that your 401(k) provider will face the same fate.

401(k) providers are regulated by government agencies to ensure compliance with laws and regulations. This oversight helps protect employees and their retirement savings, even in the event of a provider’s financial instability or insolvency.

Now that we have a better understanding of 401(k) providers, let’s explore the potential financial implications if a provider were to go out of business.

The Financial Implications

If your 401(k) provider were to go out of business, the immediate concern may be the safety of your retirement savings. While the unthinkable scenario can cause anxiety, it’s important to remember that there are safeguards in place to protect your hard-earned funds.

In the event of a provider’s insolvency, the first step is typically to appoint a new trustee or custodian to oversee the plan and ensure a seamless transition for participants. This ensures that your retirement savings remain intact and accessible to you.

However, it’s essential to understand that the financial implications may vary depending on whether your 401(k) plan is affected or unaffected by the provider’s bankruptcy. An unaffected account refers to a situation where your retirement funds are held separately and are not at risk due to the provider’s financial troubles.

If your account is unaffected, the impact of your provider’s bankruptcy on your retirement savings may be minimal. The new trustee or custodian appointed will take over the management of your account, and you can continue contributing and making investment decisions as before.

On the other hand, if your account is affected, there may be some temporary disruptions or changes. This could include a temporary suspension of contributions or a freeze on withdrawals while the transition to a new provider takes place. However, it’s important to remember that these measures are taken to protect the participants’ best interests and ensure a smooth transfer of assets.

It’s worth noting that the extent of the financial implications also depends on the type of bankruptcy filed by the provider. Chapter 11 bankruptcy allows the company to restructure its debts and continue operations, whereas Chapter 7 bankruptcy involves liquidation of the company’s assets to repay creditors. In the case of Chapter 7, the impact on participants’ accounts may be more significant, as the assets of the provider are sold off to fulfill its obligations.

While the immediate financial implications can be unsettling, it’s important to remember that retirement accounts are long-term investments. The actions taken by regulatory authorities and the appointment of a new trustee aim to protect your retirement savings and ensure minimal disruption to your financial future.

In the next section, we’ll explore the options available for individuals with unaffected accounts and how the investment aspect may be affected in the event of a provider’s insolvency.

Options for Unaffected Accounts

If your 401(k) account is unaffected by your provider’s bankruptcy, the good news is that you have several options available to continue managing your retirement savings.

1. Continue contributions: You can still contribute to your 401(k) account as usual. The new trustee or custodian appointed will ensure that your contributions are properly allocated and invested according to your instructions.

2. Investment decisions: You retain control over the investment decisions for your account. While the provider may change, your ability to choose from available investment options should remain intact. However, it’s always a good idea to review your investment strategy periodically to ensure alignment with your retirement goals.

3. Monitor account performance: Keep a close eye on the performance of your retirement account. Reviewing statements and monitoring investment returns can help you gauge the health of your savings and make adjustments if necessary.

4. Seek financial advice: If you’re unsure about how the provider’s bankruptcy may impact your retirement savings or if you need guidance on investment decisions, it’s wise to consult a financial advisor. They can provide personalized advice based on your specific situation and help you navigate through any uncertainties.

It’s important to keep in mind that even if your account is unaffected, there may be temporary disruptions or delays during the transition to a new provider. This could include a temporary suspension of online access or delays in processing transactions. However, such disruptions are typically short-lived and designed to ensure a smooth transfer of assets.

By proactively staying informed and taking advantage of the available options, you can continue managing your retirement savings effectively, regardless of your provider’s bankruptcy.

In the next section, we’ll discuss the potential impact on your investments in the event of a 401(k) provider’s insolvency.

Impact on Investments

In the unfortunate event of a 401(k) provider’s insolvency, you may be concerned about the impact on your investments. While the provider’s bankruptcy can cause temporary uncertainty, it’s crucial to understand the measures in place to safeguard your retirement savings.

Firstly, it’s important to note that your investments are held within your retirement account and are separate from the provider’s own financial situation. This means that even if the provider faces financial difficulties, your investments are typically still protected and held in trust for your benefit.

During the provider’s insolvency proceedings, a new trustee or custodian will be appointed to oversee your retirement account. They will ensure that your investments are properly managed and that any necessary adjustments or transfers are made to protect your interests.

While the investment landscape may experience some temporary disruptions during the transition, the overall impact on your investments should be minimal. The new trustee will work to ensure continuity in terms of investment options and provide guidance on investment decisions.

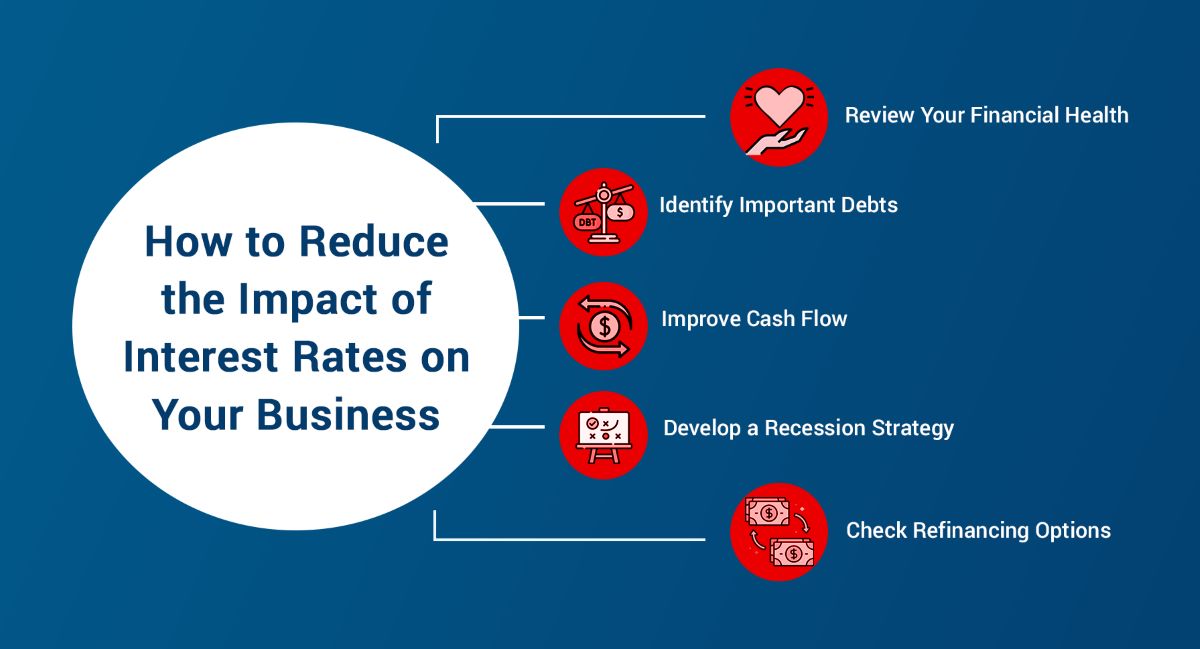

However, it’s always wise to review your investment strategy periodically, regardless of any disruptions caused by a provider’s insolvency. This allows you to assess your risk tolerance, reassess your financial goals, and make any necessary adjustments to your investment portfolio.

Additionally, it’s important to diversify your investments to mitigate risks. By spreading your investments across different asset classes, such as stocks, bonds, and mutual funds, you can reduce the potential impact of any single investment or provider’s insolvency on your overall portfolio.

Throughout any transition period, it’s crucial to stay informed and maintain open lines of communication with the new trustee or custodian appointed for your retirement account. They can provide updates, address any concerns you may have, and guide you through any necessary actions, such as updating investment elections or reviewing beneficiary designations.

Remember, while the provider’s bankruptcy may cause short-term uncertainty, the long-term growth and stability of your investments should remain the primary focus. By staying informed, diversifying your portfolio, and seeking professional advice if needed, you can help safeguard your retirement savings and navigate through any potential impacts on your investments.

Next, we’ll discuss the responsibilities of employers in the event of their 401(k) provider going out of business.

Employer Responsibilities

In the event that a 401(k) provider goes out of business, employers have certain responsibilities to their employees to ensure the continuity and security of their retirement savings.

Firstly, employers are responsible for selecting a reliable and financially stable 401(k) provider in the first place. This decision should be made after careful consideration of factors such as the provider’s reputation, track record, fees, investment options, and customer service. By conducting proper due diligence, employers can minimize the risk of their chosen provider encountering financial difficulties.

Additionally, employers have an obligation to act in the best interests of their employees as plan sponsors. This includes regularly monitoring the performance and financial health of the chosen provider. Employers should stay informed about any potential red flags, such as discrepancies in account statements, delays in processing transactions, or adverse news about the provider’s financial standing.

If an employer becomes aware of their 401(k) provider’s financial instability or insolvency, they have a duty to take appropriate action to protect their employees’ retirement savings. This can involve initiating a transition to a new provider and appointing a new trustee or custodian to oversee the plan. The employer should ensure that the new provider meets the necessary regulatory requirements and has the capability to manage the retirement savings accounts effectively.

Employers also play a vital role in communicating with their employees throughout the transition period. Clear and timely communication is crucial for addressing any concerns or questions employees may have regarding the impact of the provider’s bankruptcy on their retirement savings. Employers should provide updates, guidance, and access to resources to help employees understand the situation and navigate through any necessary actions, such as updating beneficiary information or making adjustments to their investment allocations.

It’s important to note that employers have a fiduciary duty to act prudently and solely in the best interests of their employees when it comes to their retirement plans. This includes closely monitoring the financial stability of the chosen provider and taking prompt action to protect employees’ retirement savings if necessary. Failure to fulfill these responsibilities can result in legal consequences and potential liability for the employer.

In summary, employers have a crucial role to play in safeguarding their employees’ retirement savings in the event of a 401(k) provider’s insolvency. By exercising due diligence, monitoring the provider’s financial health, initiating a transition if needed, and effectively communicating with employees, employers can fulfill their responsibilities as plan sponsors and help ensure the security of their employees’ future.

Next, we’ll explore the potential transfer of assets and what safeguards are in place to protect employees’ retirement savings.

Potential Transfer of Assets

In the event that a 401(k) provider goes out of business, the transfer of assets becomes a critical step to ensure the continuity and security of employees’ retirement savings. While the specifics of the transfer process may vary depending on the circumstances, there are regulatory safeguards in place to protect participants and their investments.

When a provider becomes insolvent, the first step is typically the appointment of a new trustee or custodian to oversee the plan. This new trustee assumes responsibility for managing the assets and ensuring a smooth transition for participants.

The transfer of assets involves the movement of retirement savings from the previous provider to the new one. The priority is to protect the integrity of participants’ funds and ensure that they are accurately and securely transferred. This includes preserving the value of investments and maintaining investment performance during the transfer process.

Regulatory bodies, such as the Department of Labor and the Internal Revenue Service, have established guidelines and requirements to safeguard the transfer of assets. These regulations help protect participants’ interests, prevent mismanagement or loss of funds, and ensure transparency throughout the transition.

During the transfer process, participants typically experience minimal disruptions to their retirement savings. Their account balances, investment options, and contribution elections should remain intact. However, there may be temporary limitations on certain account activities, such as withdrawals or changes to investment allocations, to ensure the accuracy and security of the transfer.

It’s important for participants to stay informed about the transfer process and any updates from the new trustee or custodian. Employers play a key role in communicating these updates to ensure that employees have the necessary information and clarity regarding the transfer of their retirement savings.

Participants should review their account statements and monitor the transfer process to verify that the values and allocations are accurately reflected. If there are any discrepancies or concerns, individuals should reach out to the new trustee or custodian for clarification and resolution.

It’s worth noting that the vast majority of transfers are completed successfully and without major disruptions. However, it’s always prudent for participants to review their investment strategies, reassess their risk tolerance, and seek professional advice if needed to ensure that their retirement savings align with their financial goals.

By following the regulatory safeguards in place and staying informed throughout the transfer process, participants can have peace of mind that their retirement savings will be transferred securely and that the value of their investments will be preserved.

In the next section, we’ll discuss the regulatory safeguards that help protect employees’ retirement savings in the event of a 401(k) provider’s bankruptcy.

Regulatory Safeguards

When it comes to protecting employees’ retirement savings in the event of a 401(k) provider’s bankruptcy, regulatory safeguards are in place to ensure the integrity and security of these funds. These safeguards help mitigate potential risks and provide participants with reassurance about the safety of their investments.

The Department of Labor (DOL) and the Internal Revenue Service (IRS) play crucial roles in overseeing retirement plans and setting guidelines to protect participants’ interests. Here are some key regulatory safeguards in place:

1. Fiduciary Duties: Plan providers and employers have fiduciary duties to act prudently and solely in the best interests of plan participants. This includes carefully selecting and monitoring the financial health of the 401(k) provider, regularly reviewing investment options, and ensuring compliance with applicable laws and regulations.

2. ERISA Requirements: The Employee Retirement Income Security Act (ERISA) sets standards for employer-sponsored retirement plans, including 401(k) plans. ERISA requires transparency in plan operations, disclosure of fees and expenses, and rules for the timely deposit of employee contributions to the plan.

3. Qualified Trust: Retirement savings held within a 401(k) plan are typically placed in a qualified trust. This means that the funds are held separately from the assets of the provider and are protected from the claims of creditors in the event of the provider’s bankruptcy.

4. SIPC Protection: In some cases, if the 401(k) provider is also a broker-dealer and a member of the Securities Investor Protection Corporation (SIPC), participant investments may be protected by certain coverage limits. The SIPC can step in to protect securities and cash held by the provider in case of a bankruptcy or insolvency situation.

5. Transition Assistance: When a 401(k) provider goes out of business, regulatory authorities work to ensure a smooth transition of accounts to a new trustee or custodian. This assistance helps minimize disruptions and ensures that participants’ retirement savings are properly managed and accessible to them.

By adhering to regulatory safeguards, retirement plan providers and employers help protect participants’ interests and provide reassurance regarding the safety and continuity of their investments. These safeguards aim to maintain the integrity of retirement savings and mitigate risks associated with a provider’s financial instability or bankruptcy.

In addition to these regulatory safeguards, it’s important for participants to stay informed about their rights and seek guidance or support when needed. By being proactive and engaged in their retirement planning, individuals can help ensure the long-term security and growth of their savings.

In the next section, we’ll outline the steps participants can take in the unfortunate event of a 401(k) provider’s bankruptcy.

Steps to Take in Case of Provider Bankruptcy

Experiencing a 401(k) provider’s bankruptcy can be challenging and unsettling, but there are steps you can take to navigate through the situation and protect your retirement savings. Here are some key steps to consider:

1. Stay Informed: Stay updated on the latest developments regarding the bankruptcy of your 401(k) provider. Pay attention to communications from your employer, the new trustee or custodian appointed, and regulatory authorities. This will help you understand the impact on your retirement savings and any necessary actions you need to take.

2. Assess Account Status: Determine whether your account is affected or unaffected by the provider’s bankruptcy. If your account is unaffected, you may experience minimal disruptions and can typically continue making contributions and managing your investments as usual. If your account is affected, there may be temporary limitations on certain activities, such as withdrawals or investment changes.

3. Review Investment Strategy: Take the opportunity to review your investment strategy and ensure it aligns with your financial goals and risk tolerance. Consider seeking advice from a financial advisor to help you make any necessary adjustments to your portfolio in response to the provider’s bankruptcy. Diversifying your investments across different asset classes can help mitigate risks.

4. Understand Employee Protections: Familiarize yourself with the regulatory safeguards in place, such as ERISA requirements and the protection provided by qualified trusts or SIPC coverage. Understand your rights as a plan participant and ensure that the new trustee or custodian appointed to oversee your account adheres to these protections.

5. Communicate with the New Trustee/Custodian: Establish communication with the new trustee or custodian appointed for your retirement account. Keep their contact information handy and reach out to them if you have any questions or concerns regarding the transfer of your assets, any changes to fees or investment options, or general updates on the status of your account.

6. Monitor Account Activity: Stay vigilant and regularly monitor your account activity after the transition to the new trustee or custodian. Review your account statements, confirm that contributions are being allocated correctly, and ensure that investment transactions are accurately reflected. If you notice any discrepancies or issues, report them to the new trustee or custodian promptly.

7. Seek Professional Advice if Needed: If you feel uncertain or overwhelmed by the bankruptcy situation, it can be helpful to seek advice from a financial professional. They can provide personalized guidance based on your specific circumstances and help you navigate through any challenges or uncertainties.

Remember that the steps you take in response to a provider’s bankruptcy will depend on the specific situation and the guidance provided by the new trustee or custodian overseeing your retirement account. Staying informed, remaining proactive, and seeking advice when needed will empower you to protect your retirement savings and make informed decisions during this challenging time.

Finally, let’s conclude the article with a summary of the key points discussed.

Conclusion

Experiencing the bankruptcy of a 401(k) provider can be a distressing situation, but it’s important to remember that there are safeguards and steps you can take to protect your retirement savings. By understanding the role of 401(k) providers, their responsibilities, and the regulatory safeguards in place, you can navigate through these challenges with confidence.

If your 401(k) account is unaffected by the provider’s bankruptcy, you have the option to continue contributing to your account, make investment decisions, and monitor your account performance. By staying informed, reviewing your investment strategy, and seeking professional advice if needed, you can ensure the long-term growth and stability of your retirement savings.

In the unfortunate event that your account is affected, temporary disruptions may occur while a new trustee or custodian is appointed and assets are transferred. However, there are measures in place to protect your funds and ensure a smooth transition. By staying informed, communicating with the new trustee or custodian, and monitoring your account activity, you can navigate through this process while minimizing any potential impact on your investments.

Employers also play a crucial role in protecting their employees’ retirement savings by selecting a reliable provider, monitoring their financial health, and ensuring clear communication during the transition. Employers have fiduciary duties to act prudently and solely in the best interests of their employees, and failure to fulfill these responsibilities can have legal consequences.

Throughout the entire process, regulatory safeguards, such as ERISA requirements and protections provided by qualified trusts or SIPC coverage, are in place to ensure the integrity and security of participants’ retirement savings. These safeguards help mitigate risks and provide reassurance during uncertain times.

In conclusion, while the bankruptcy of a 401(k) provider can lead to temporary disruptions and concerns, it’s important to stay informed, take necessary steps to protect your savings, and seek professional guidance when needed. By doing so, you can safeguard your retirement funds and ensure a secure financial future as you continue on your journey towards retirement.