Home>Finance>What Sets Blockchain Solutions Apart From Conventional Record Keeping Solutions

Finance

What Sets Blockchain Solutions Apart From Conventional Record Keeping Solutions

Published: October 23, 2023

Discover how blockchain solutions revolutionize finance by offering secure and decentralized record-keeping, ensuring transparency and eliminating the need for intermediaries.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Conventional Record Keeping Solutions

- Exploring Blockchain Solutions

- Key Differences Between Conventional Record Keeping Solutions and Blockchain Solutions

- Benefits of Using Blockchain Solutions

- Challenges and Limitations of Blockchain Solutions

- Real-World Examples of Blockchain Solutions

- Conclusion

Introduction

Welcome to the exciting world of finance, where innovation and technology continue to transform the industry. One of the most significant advancements in recent years is the rise of blockchain solutions, revolutionizing the way we handle record-keeping and transactions. In this article, we will explore the key differences between conventional record-keeping solutions and blockchain solutions, as well as the benefits and challenges associated with adopting blockchain technology in the finance sector.

Conventionally, record keeping in the finance industry has relied on centralized databases and systems that are controlled by a single entity, such as a financial institution or a government agency. While this approach has served us well for many years, it has inherent limitations, including the risk of fraud, inefficiency, and lack of transparency.

Blockchain solutions, on the other hand, provide a decentralized and transparent approach to record keeping. A blockchain is a distributed ledger that records transactions across multiple computers or nodes, ensuring that the information is secure, immutable, and accessible to all participants in the network.

Blockchain solutions have gained significant attention due to their potential to disrupt traditional financial systems. They offer a range of advantages that make them stand out from conventional record-keeping solutions. However, it is important to understand the key differences and considerations before adopting blockchain technology in the finance industry.

In this article, we will delve into the intricacies of both conventional record-keeping solutions and blockchain solutions. We will examine the benefits that blockchain provides, as well as the challenges and limitations that need to be overcome. We will also explore real-world examples of blockchain solutions in the finance industry, highlighting their impact and potential for further disruption.

By the end of this article, you will have a clear understanding of how blockchain solutions differ from conventional record-keeping systems, and how they can transform the finance industry with their unique features and benefits. So, let’s dive in and explore the world of blockchain technology in finance!

Understanding Conventional Record Keeping Solutions

Before we delve into the world of blockchain solutions, it’s important to have a solid grasp of how conventional record-keeping solutions function in the finance industry.

Conventionally, record keeping in finance has relied on centralized systems where a single entity, such as a bank or government agency, is responsible for maintaining and managing the records. These centralized databases store transactional data, account information, and other financial details.

One of the main advantages of conventional record-keeping solutions is their familiarity. They have been in place for decades, and financial professionals are accustomed to working within their framework. These systems offer well-established processes and protocols, making them relatively easy to use and understand.

However, conventional record-keeping solutions come with their own set of limitations and challenges:

- Single point of failure: Centralized systems have a single point of failure, meaning that if the central authority or database is compromised or goes offline, it can disrupt the entire record-keeping process.

- Lack of transparency: With conventional systems, it’s often difficult for participants to verify the accuracy and integrity of the records. They have to trust the central authority’s ability to maintain accurate and tamper-proof records.

- Vulnerability to fraud: Centralized systems are more susceptible to fraudulent activities, as malicious actors can exploit the vulnerabilities in the system or collude with insiders to manipulate records.

- Costly intermediaries: The reliance on intermediaries, such as banks or clearinghouses, adds costs and delays to financial transactions. These intermediaries act as trusted third parties to validate and settle transactions, increasing the complexity and expense of the process.

These limitations have led to a growing demand for alternative solutions that can address these challenges and provide a more efficient, transparent, and secure way of record-keeping. This is where blockchain solutions come into play.

Now that we have a clear understanding of the shortcomings of conventional record-keeping solutions, let’s take a closer look at how blockchain solutions differ and why they are gaining traction in the finance industry.

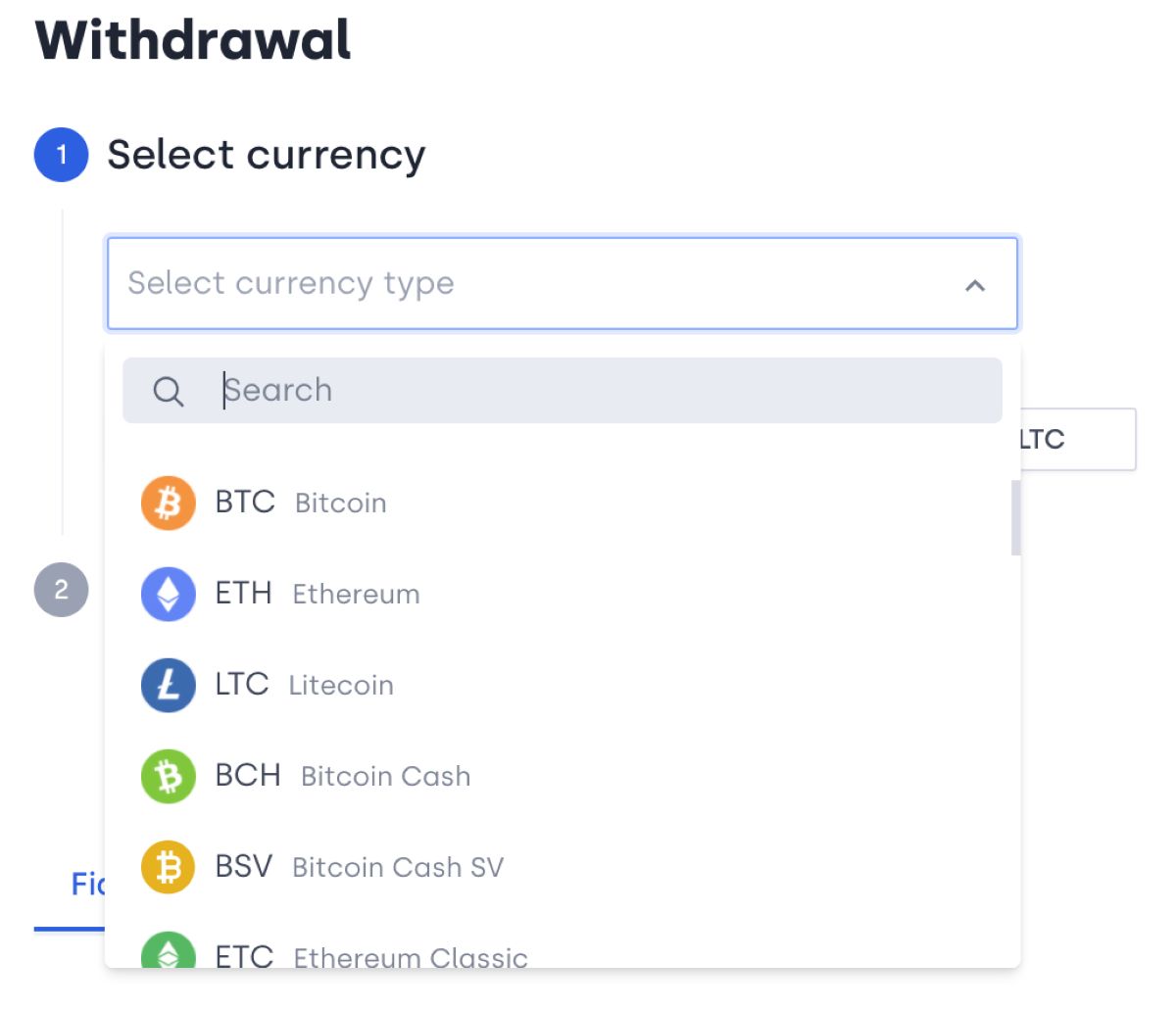

Exploring Blockchain Solutions

Blockchain solutions have emerged as a promising alternative to conventional record-keeping systems in the finance industry. They offer a decentralized and transparent approach to managing and verifying transactions, providing several unique features that set them apart.

At its core, a blockchain is a distributed ledger that records transactions across multiple computers or nodes. Each transaction is bundled with other transactions into a block, which is then added to the chain in a chronological order. Once a block is added, it becomes virtually impossible to alter or tamper with the information stored within it.

One of the key features of blockchain solutions is decentralization. Instead of relying on a single authority or central entity, blockchain networks are governed by a consensus mechanism, where multiple participants or nodes validate and agree on the accuracy of transactions. This decentralized nature eliminates the need for intermediaries, reduces costs, and enhances transparency and security.

Another notable feature of blockchain solutions is transparency. The distributed nature of blockchain allows all participants to have access to the same record, ensuring that transactions are visible and verifiable by anyone in the network. This transparency increases trust among participants and minimizes the risk of fraud or manipulation.

Furthermore, blockchain solutions provide enhanced security through cryptographic algorithms. Each transaction added to the blockchain is encrypted and linked to the previous block, forming a chain of blocks that is resistant to tampering. This immutability and security make blockchain solutions highly attractive for storing sensitive financial data.

Smart contracts are another aspect of blockchain solutions that offer significant advantages. Smart contracts are self-executing contracts with predefined rules and conditions. Once these conditions are met, the contract is automatically enforced, reducing the need for third-party intermediaries and streamlining the execution of contractual agreements.

Overall, blockchain solutions offer several benefits over conventional record-keeping systems in the finance industry. They provide decentralization, transparency, security, and efficiency, improving the overall integrity and trustworthiness of financial transactions.

Now that we have explored the key features and advantages of blockchain solutions, let’s dive deeper into the differences between conventional record-keeping solutions and blockchain solutions in the next section.

Key Differences Between Conventional Record Keeping Solutions and Blockchain Solutions

While conventional record-keeping solutions and blockchain solutions share the goal of maintaining accurate financial records, there are significant differences between the two approaches. Understanding these differences is crucial for grasping the advantages offered by blockchain solutions.

1. Centralization vs. decentralization: Conventional record-keeping solutions rely on a centralized authority, such as a bank or government agency, to control and manage the records. In contrast, blockchain solutions are decentralized, with multiple participants or nodes validating and maintaining the transaction records. This decentralized nature eliminates the need for a central authority and reduces the risk of single points of failure or manipulation.

2. Transparency: Conventional record-keeping solutions often lack transparency, as participants must rely on the central authority to provide accurate and verifiable records. In contrast, blockchain solutions offer transparency by allowing all participants to access and verify the transactions stored on the blockchain. Each transaction is recorded in a transparent and immutable manner, increasing trust and reducing the risk of fraudulent activities.

3. Security: Traditional record-keeping solutions are vulnerable to security breaches and unauthorized access, as they rely on centralized databases that can be a target for hackers. In contrast, blockchain solutions provide enhanced security through cryptographic algorithms and consensus mechanisms. The distributed nature of blockchain makes it difficult for attackers to compromise the entire network, ensuring the integrity and immutability of the stored information.

4. Efficiency and cost: Conventional record-keeping solutions often involve a complex network of intermediaries, resulting in delays and increased costs for financial transactions. On the other hand, blockchain solutions streamline the process by removing the need for intermediaries. Smart contracts, a feature of blockchain solutions, automate the execution of contractual agreements, reducing paperwork, delays, and costs associated with traditional methods.

5. Trust and accountability: In conventional systems, participants must trust the central authority responsible for maintaining the records. Blockchain solutions, however, provide a higher level of trust and accountability through the decentralized validation mechanism. Each transaction is verified by multiple participants in the network, ensuring that fraudulent or erroneous transactions are rejected.

Understanding these key differences between conventional record-keeping solutions and blockchain solutions highlights the unique advantages that blockchain technology brings to the finance industry. The decentralized, transparent, and secure nature of blockchain solutions has the potential to revolutionize record-keeping and transaction management, paving the way for a more efficient and trusted financial system.

Now that we have examined the differences, let’s explore the benefits of using blockchain solutions in the next section.

Benefits of Using Blockchain Solutions

Blockchain solutions offer numerous benefits that make them an attractive option for the finance industry. Let’s explore the advantages that adopting blockchain technology can bring:

1. Enhanced security: Blockchain technology provides high levels of security through its decentralized and cryptographic nature. Transactions recorded on the blockchain are encrypted and linked to previous transactions, making it extremely difficult for hackers to alter or tamper with the data. This enhanced security reduces the risk of fraud and unauthorized access to financial records, protecting the integrity of the system.

2. Transparency and immutability: Blockchain solutions provide transparent and immutable records of transactions. All participants in the network have access to the same set of records, eliminating the need to trust a centralized authority. This transparency increases trust among participants and reduces the potential for disputes and errors. Additionally, once a transaction is recorded on the blockchain, it cannot be altered, ensuring the integrity and immutability of the data.

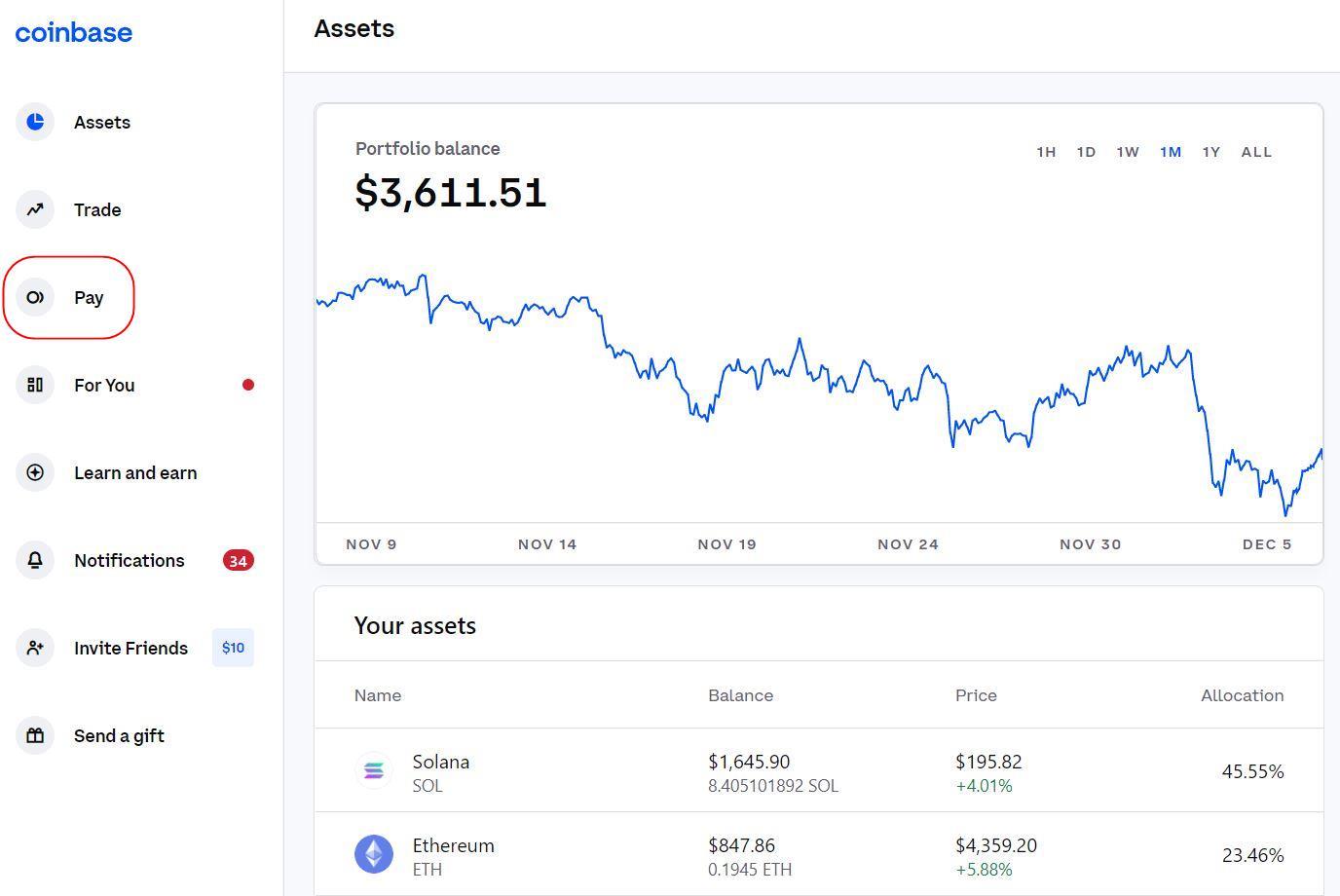

3. Efficiency and speed: Blockchain solutions eliminate the need for intermediaries and streamline the process of financial transactions. By removing intermediaries, such as banks or clearinghouses, blockchain technology reduces the complexity, delays, and costs associated with traditional systems. Smart contracts, a feature of blockchain solutions, automate the execution of contractual agreements, making the process more efficient and reducing the need for manual intervention.

4. Cost savings: Adopting blockchain solutions can result in significant cost savings for financial institutions. By eliminating intermediaries and automating processes, blockchain reduces administrative and operational costs. Additionally, the decentralized nature of blockchain eliminates the need for expensive infrastructure and maintenance associated with centralized systems.

5. Improved auditability: Blockchain technology provides a comprehensive audit trail of transactions, allowing for easy tracking and verification of financial records. This auditability reduces the risk of fraudulent activities and makes compliance with regulatory requirements more efficient. The transparent nature of blockchain also makes it easier to detect irregularities or discrepancies in the transaction history.

6. Global accessibility: Blockchain solutions have the potential to facilitate global financial transactions by eliminating geographical barriers. The decentralized network allows participants from different parts of the world to interact and transact without the need for intermediaries or complex cross-border processes. This accessibility can provide financial services to the unbanked or underbanked populations, promoting financial inclusion.

These benefits demonstrate the potential of blockchain solutions to transform the finance industry. By leveraging the decentralized, transparent, and secure nature of blockchain technology, financial institutions can improve efficiency, reduce costs, enhance security, and increase trust among participants.

Now that we understand the benefits, it’s important to acknowledge the challenges and limitations of blockchain solutions, which we will explore in the next section.

Challenges and Limitations of Blockchain Solutions

While blockchain solutions offer numerous benefits, it’s important to recognize the challenges and limitations associated with their implementation in the finance industry. Understanding these challenges can help organizations adopt a more realistic approach and develop strategies to overcome them. Let’s explore some of the key challenges:

1. Scalability: Blockchain technology faces scalability issues, particularly in public blockchains such as Bitcoin and Ethereum. As the number of transactions increases, the network can become slower and less efficient. The scalability challenge requires innovative solutions to handle a large volume of transactions without compromising the performance of the system.

2. Regulatory compliance: Blockchain solutions often operate across borders, posing challenges in terms of regulatory compliance. Compliance with various financial regulations and data protection laws in different jurisdictions can be complex and may require additional efforts to ensure legal compliance in the implementation of blockchain solutions.

3. Energy consumption: Blockchain networks, especially those using proof-of-work consensus mechanisms, require substantial computational power and energy consumption. This high energy consumption has raised concerns about the environmental impact of blockchain technology. Efforts are underway to develop more energy-efficient consensus mechanisms.

4. Privacy concerns: While blockchain is touted for its transparency, there are legitimate concerns about privacy. Certain financial transactions require confidentiality, and storing sensitive data on a public blockchain may not be suitable in those cases. Solutions such as privacy-enhancing techniques and permissioned blockchains are being explored to address these concerns.

5. Interoperability: The lack of interoperability among different blockchain networks poses challenges for widespread adoption. Seamless integration between different blockchain solutions and legacy systems is essential to ensure a smooth transition and efficient operation in the finance industry.

6. Evolving technology: Blockchain technology is still in its early stages of development, and the technology itself is continuously evolving. This rapid pace of change requires organizations to stay updated with the latest developments and adapt their strategies accordingly to harness the full potential of blockchain solutions.

Despite these challenges, organizations are actively exploring solutions to overcome these limitations. Collaborative efforts among industry stakeholders, regulators, and technology providers are driving innovation and addressing these challenges to accelerate the adoption of blockchain solutions in the finance industry.

Now that we have discussed the challenges and limitations, let’s explore some real-world examples of blockchain solutions in the finance industry.

Real-World Examples of Blockchain Solutions

Blockchain technology has gained momentum in the finance industry, and several real-world examples highlight its potential to transform various aspects of financial services. Let’s explore some notable examples:

1. Payment and Remittance: Blockchain solutions are being used to streamline cross-border payments and remittances. Ripple, for instance, utilizes blockchain technology to enable faster, more secure, and cost-effective international transfers. By eliminating intermediaries and reducing settlement times, Ripple’s blockchain-based solution has the potential to revolutionize the traditional correspondent banking system.

2. Trade Finance: The trade finance industry often involves complex and time-consuming processes. Blockchain solutions like TradeLens, developed by IBM and Maersk, provide an efficient and transparent platform for managing and tracking trade documents and transactions. By digitizing and securing trade documentation on a blockchain, TradeLens reduces paperwork, enhances transparency, and improves the overall efficiency of global trade.

3. Supply Chain Management: Blockchain technology is being employed to enhance supply chain efficiency and traceability. Walmart, for instance, has implemented a blockchain solution to track and authenticate its food products from farm to store shelves. This enables faster recalls, ensures product authenticity, and enhances food safety by providing end-to-end visibility and accountability in the supply chain.

4. Identity Management: Blockchain-based identity management systems offer secure and reliable digital identities. Self-sovereign identity platforms like Sovrin provide individuals with control over their personal information while enabling trusted interactions with organizations. This technology has the potential to streamline processes like customer onboarding, Know Your Customer (KYC) compliance, and secure access to digital services.

5. Asset Tokenization: Blockchain technology allows for the fractional ownership and trading of assets through tokenization. Real estate, artwork, and even intellectual property rights can be represented as digital assets on a blockchain. This opens up new opportunities for liquidity, fractional ownership, and transparency in traditionally illiquid markets.

These real-world examples demonstrate the diverse applications of blockchain solutions in the finance industry. They showcase the potential of blockchain technology to streamline processes, enhance transparency, reduce costs, and revolutionize traditional financial systems.

As blockchain continues to evolve and mature, we can expect further innovation and adoption of this technology in various financial sectors, transforming the way we conduct business and interact with financial services.

Now, let’s summarize the key takeaways and wrap up our exploration of blockchain solutions in finance.

Conclusion

The rise of blockchain solutions has paved the way for a new era in finance, offering a decentralized, transparent, and secure approach to record keeping and transactions. In this article, we explored the key differences between conventional record-keeping solutions and blockchain solutions, highlighting the unique advantages that blockchain brings to the table.

Conventional record-keeping solutions have served us well for many years, but they have limitations, including centralization, lack of transparency, vulnerability to fraud, and reliance on costly intermediaries. Blockchain solutions address these challenges by providing decentralization, transparency, enhanced security, and efficiency.

Blockchain solutions offer several benefits for the finance industry. They enhance security, ensure transparency and immutability, improve efficiency and speed, reduce costs, improve auditability, and facilitate global accessibility. These benefits make blockchain technology an attractive option for financial institutions looking to transform their operations and deliver enhanced services to their customers.

However, blockchain solutions also come with their own set of challenges and limitations. Scalability, regulatory compliance, energy consumption, privacy concerns, interoperability, and the evolving nature of the technology need to be carefully addressed to fully unlock the potential of blockchain in finance.

Real-world examples have showcased the power of blockchain solutions in areas such as payment and remittance, trade finance, supply chain management, identity management, and asset tokenization. These examples demonstrate how blockchain technology can revolutionize traditional finance processes, streamline operations, and create new opportunities for innovation.

As blockchain technology continues to evolve, collaboration among industry stakeholders, regulators, and technology providers is key to addressing challenges, fostering innovation, and driving wider adoption. The finance industry stands at the forefront of this transformation, embracing blockchain solutions to create a more efficient, transparent, and secure financial ecosystem.

In conclusion, blockchain solutions offer exciting possibilities for the finance industry, presenting a paradigm shift in record keeping, transaction management, and financial services. By embracing this technology, financial institutions can unlock numerous benefits and pave the way towards a more inclusive, efficient, and trusted financial future.