Finance

How Long Do Insurance Companies Keep Records?

Modified: February 21, 2024

Explore how long insurance companies typically keep records in the finance industry. Understand the importance of record retention to ensure proper documentation and compliance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Purpose of Record-Keeping

- Types of Insurance Companies

- Record Retention Periods

- Personal Insurance Records

- Property Insurance Records

- Auto Insurance Records

- Health Insurance Records

- Life Insurance Records

- Business Insurance Records

- Factors that Influence Record Retention Periods

- Regulatory Requirements

- Litigation and Claims Handling

- Data and Information Security

- Conclusion

Introduction

Welcome to the world of insurance, where financial protection and peace of mind are offered to individuals and businesses alike. Insurance companies play a vital role in managing the risks and uncertainties that we face in our daily lives. From personal insurance, such as health and life insurance, to property and auto insurance, these companies are entrusted with safeguarding our interests.

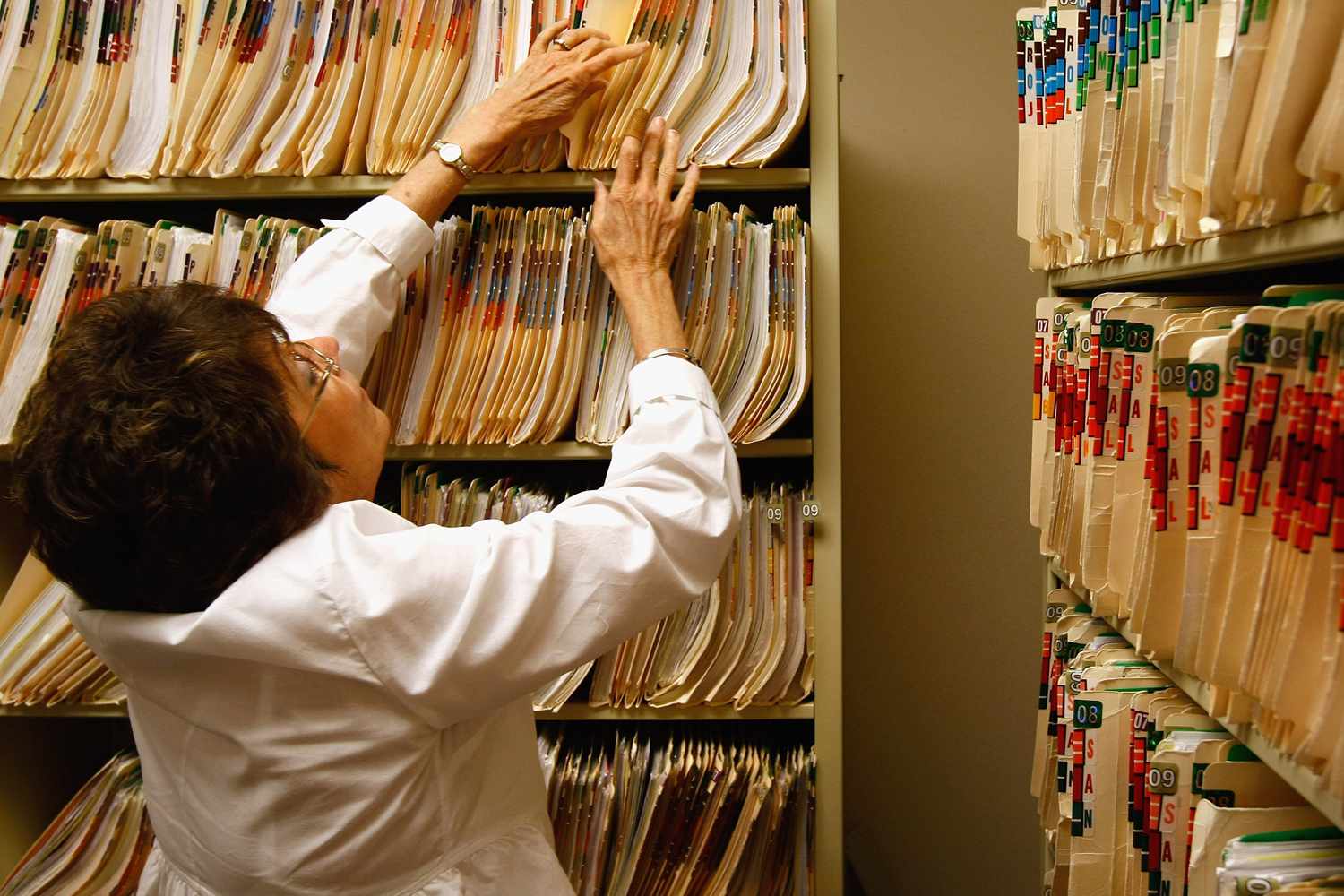

As part of their operations, insurance companies maintain extensive records to document various aspects of their business dealings. These records contain valuable information about policies, claims, and financial transactions. But have you ever wondered how long insurance companies keep these records?

In this article, we will explore the fascinating world of record-keeping within insurance companies. We will delve into the purpose of record retention and highlight the different types of insurance policies that require documentation. Additionally, we will discuss the various factors that influence the duration that insurance companies keep these records.

Understanding the principles of record-keeping within insurance companies is not only valuable for policyholders but also for insurance professionals and those interested in the finance industry. So, let’s delve into the topic and discover the intriguing details behind the record-keeping practices of insurance companies.

Purpose of Record-Keeping

Record-keeping serves as the backbone of any insurance company’s operations. It involves documenting and preserving important information related to policyholders, policies, claims, and financial transactions. The primary purpose of record-keeping is to ensure transparency, accuracy, and compliance with legal and regulatory requirements.

Here are a few key purposes of record-keeping within insurance companies:

- Policy Administration: Insurance companies use records to effectively administer policies throughout their lifecycle. This includes maintaining accurate policy details, premium payments, policy endorsements, and policyholder contact information. These records are essential for servicing policyholders, such as issuing policy documents, handling inquiries, and updating policy information.

- Claims Management: Records play a crucial role in the claims process. Insurance companies rely on detailed and well-documented records to assess the validity of claims, track claim progress, determine coverage, and calculate claim settlements. These records provide a historical account of the claim and ensure fair and efficient claims handling.

- Financial Reporting and Compliance: Insurance companies are required to adhere to financial reporting standards and regulatory guidelines. Records are vital for accurate financial reporting, including revenue recognition, expense management, and actuarial analysis. These records provide auditors, regulatory authorities, and stakeholders with insights into the financial health and solvency of the insurance company.

- Underwriting and Risk Analysis: Records provide valuable data for insurers to assess risks and determine premium rates. Historical information helps underwriters evaluate policy applicants, identify potential risks, and make informed decisions. By analyzing records of past claims and policyholder behavior, insurance companies can accurately price their policies and manage their risk exposure effectively.

By maintaining comprehensive records, insurance companies can provide accurate and timely information to policyholders, regulators, and internal stakeholders. These records form the basis for effective policy administration, claims management, financial reporting, underwriting, and risk analysis.

Now that we understand the purpose behind record-keeping let’s explore the different types of insurance companies and their specific record retention periods.

Types of Insurance Companies

The insurance industry is diverse, catering to various needs and risks faced by individuals and businesses. Different types of insurance companies specialize in providing coverage for specific areas of risk. Let’s take a closer look at some of the common types of insurance companies:

- Personal Insurance Companies: These companies focus on offering insurance coverage for individuals and families. They provide policies such as health insurance, life insurance, disability insurance, and personal liability insurance. Personal insurance companies play a vital role in protecting individuals from financial hardship resulting from unforeseen events like illness, disability, or death.

- Property and Casualty Insurance Companies: Property insurance companies specialize in providing coverage for physical properties, including homes, buildings, and belongings. They also offer policies to protect against liability claims. Casualty insurance, on the other hand, covers liability-related risks and provides compensation for injuries or property damage caused by an individual or a business. Property and casualty insurance companies work together to provide comprehensive coverage for both property and liability risks.

- Auto Insurance Companies: Auto insurance companies focus on providing coverage for vehicles, including cars, motorcycles, and commercial vehicles. These companies offer various types of policies, such as liability insurance, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Auto insurance is mandatory in most jurisdictions and protects against financial loss resulting from accidents, theft, or damage to vehicles.

- Health Insurance Companies: Health insurance companies play a critical role in providing coverage for medical expenses. These companies offer individual and group health insurance policies that cover hospitalization, doctor visits, medication, and other healthcare services. Health insurance helps individuals and families manage the high costs of medical treatments and ensures access to quality healthcare.

- Life Insurance Companies: Life insurance companies provide coverage for the financial well-being of beneficiaries in the event of the policyholder’s death. Life insurance policies offer a lump sum payment or periodic payouts to beneficiaries, providing financial support for funeral expenses, mortgage payments, education, or income replacement. Some life insurance policies also offer investment components, allowing policyholders to accumulate savings or earn returns on their premiums.

- Business Insurance Companies: Business insurance companies specialize in providing coverage for businesses of all sizes. They offer a range of policies, including general liability insurance, property insurance, professional liability insurance, and workers’ compensation insurance. Business insurance protects against potential risks and losses, providing financial security and enabling businesses to operate without the fear of significant financial setbacks.

Each type of insurance company has its unique record-keeping requirements based on the policies they offer and the regulatory frameworks they operate within. In the following sections, we will explore the specific record retention periods for different types of insurance policies.

Record Retention Periods

Insurance companies are responsible for retaining records for a certain period of time to meet legal, regulatory, and business requirements. The duration for which records need to be kept varies depending on the type of insurance policy and the jurisdiction in which the company operates. Let’s take a closer look at the general record retention periods for different types of insurance policies:

- Personal Insurance Records: Records related to personal insurance policies, such as health insurance and life insurance, are typically required to be retained for at least 7 years. This includes policy applications, policyholder information, premium payment records, policy endorsements, and claim documents.

- Property Insurance Records: Records related to property insurance, including homeowners insurance and renters insurance, are generally required to be maintained for a minimum of 5 years. These records include policy details, property valuations, claims information, and any related correspondence.

- Auto Insurance Records: Auto insurance records, covering policies for cars, motorcycles, and other vehicles, are typically retained for a period of 5 years or more. This includes policy documents, vehicle information, accident reports, claims information, and proof of insurance.

- Health Insurance Records: Health insurance companies are usually required to retain records for a minimum of 6 years. This includes policyholder information, claims history, approvals/denials, medical assessments, and payment records.

- Life Insurance Records: Records related to life insurance policies are typically required to be retained for a minimum of 10 years or even longer. These records include policy contracts, beneficiary designations, premium payment records, policy borrowing records, and death claims documents.

- Business Insurance Records: Records related to business insurance policies, such as general liability insurance and workers’ compensation insurance, are generally retained for at least 7 years. This includes policy documents, claims information, loss control records, certificates of insurance, and policy endorsements.

It’s important to note that the specific record retention periods can vary depending on factors such as local regulations, industry practices, and the unique circumstances surrounding each policy. Insurance companies must ensure compliance with applicable laws and regulations when determining the duration for which records should be retained.

Factors such as litigation, claims handling, and data security also influence record retention periods within insurance companies. In the following sections, we will explore these factors in more detail to understand their impact on record-keeping practices.

Personal Insurance Records

When it comes to personal insurance, such as health insurance and life insurance, insurance companies maintain a variety of records to ensure efficient policy administration and claims management. These records, which typically need to be retained for at least 7 years, play a crucial role in providing accurate and timely services to policyholders. Let’s explore the key types of personal insurance records:

- Policy Applications: Insurance companies retain copies of policy applications submitted by individuals seeking coverage. These applications contain important information such as personal details, medical history, and coverage preferences. Retaining these records helps insurance companies ensure accurate policy administration and address any discrepancies or inconsistencies that may arise.

- Policyholder Information: Personal insurance records include detailed information about policyholders, such as names, addresses, contact details, and beneficiary designations. These records enable insurance companies to easily communicate with policyholders, issue policy documents, and provide effective customer service.

- Premium Payment Records: Records pertaining to premium payments are essential for personal insurance policies. These records document the payment history of policyholders, ensuring accurate billing and maintaining a clear financial trail. In case of any disputes or discrepancies, these records act as evidence and help resolve payment-related issues.

- Policy Endorsements: Changes or modifications to personal insurance policies are documented through policy endorsements. These records reflect any amendments made to the original policy, such as changes in coverage, policy limits, or additional riders. Maintaining these records helps insurance companies keep track of policy revisions and provide updated policy information to policyholders.

- Claim Documents: Personal insurance claims involve a wide range of documents, including claim forms, medical records, bills, and other supporting documentation. These records are critical for reviewing and processing claims, ensuring proper coverage assessment, and validating the authenticity of the claim. Retaining claim documents is essential in case of any subsequent audits, investigations, or legal proceedings.

By keeping comprehensive records of personal insurance policies, insurance companies can efficiently manage policy administration, accurately evaluate claims, and provide timely customer service. The retention of these records for a minimum of 7 years ensures compliance with regulatory requirements, addresses potential disputes or claims inquiries, and enables effective communication with policyholders.

It’s important for insurance companies to prioritize data security and privacy when retaining personal insurance records. Robust data protection measures and adherence to relevant data protection regulations are crucial in maintaining the confidentiality and integrity of policyholder information.

Now that we understand the significance of personal insurance records, let’s explore the specific record retention requirements for property insurance policies.

Property Insurance Records

Property insurance plays a crucial role in providing coverage for homes, buildings, and personal belongings. Insurance companies maintain various records related to property insurance policies to ensure accurate policy administration and efficient claims management. These records, typically retained for a minimum of 5 years, help insurance companies assess property values, determine coverage, and process claims effectively. Let’s take a closer look at the key types of property insurance records:

- Policy Details: Insurance companies keep comprehensive records of property insurance policies, including policy numbers, coverage limits, effective dates, and renewal information. These records provide a detailed history of the policy and serve as a reference for insurance professionals and policyholders.

- Property Valuations: To accurately assess property values, insurance companies maintain records of property evaluations and appraisals. This includes information about the property’s condition, replacement cost estimation, and any additional factors that may impact the coverage. These records are crucial in determining the appropriate coverage amount and premium rates.

- Claims Information: Property insurance claims involve a range of records, including claim forms, documentation of damages, repair estimates, and settlement details. These records facilitate the claims process, allowing insurance companies to assess the validity of the claim, determine coverage, and calculate the appropriate settlement amount.

- Correspondence: Insurance companies retain records of all communication related to property insurance policies. This includes policy change requests, policy endorsements, premium payment reminders, and any other correspondence with policyholders or third parties. These records serve as a vital source of information for resolving policy-related inquiries or disputes.

By maintaining these property insurance records for a minimum of 5 years, insurance companies ensure compliance with legal and regulatory requirements and enable effective policy administration. These records help insurance professionals accurately evaluate policy risks, address customer inquiries, and process claims promptly and efficiently.

It’s worth noting that property insurance records may need to be retained for a longer period in certain circumstances. For example, in the case of properties with ongoing claims, it’s common for insurance companies to retain related records until the claims are fully resolved. Additionally, insurance companies must follow local regulations and industry best practices pertaining to record retention.

Given the sensitive nature of property insurance records, insurance companies must prioritize data security and privacy. Implementing robust information security measures and adhering to relevant data protection regulations is essential to protect policyholder information from unauthorized access or misuse.

Now that we have explored property insurance records, let’s move on to the specific record retention periods for auto insurance policies.

Auto Insurance Records

Auto insurance is a vital form of coverage that protects individuals and their vehicles from various risks on the road. Insurance companies maintain detailed records related to auto insurance policies to ensure proper policy administration and effective claims handling. These records, typically retained for a minimum of 5 years, provide essential information for insurance professionals to accurately assess coverage, process claims, and address policyholder inquiries. Let’s delve into the key types of auto insurance records:

- Policy Documents: Auto insurance records include policy documents that outline the terms, conditions, and coverage details of the insurance policy. These records provide important information such as policy limits, deductible amounts, named drivers, and specific coverage endorsements. Maintaining accurate and up-to-date policy documents enables insurance companies to efficiently manage policy administration and provide policyholders with the necessary information.

- Vehicle Information: Insurance companies retain records containing detailed information about insured vehicles. This includes vehicle make, model, identification numbers (such as VIN), year of manufacture, and vehicle registration details. Maintaining these records ensures that insurance companies have accurate information regarding the insured vehicle, which is crucial for processing claims and evaluating policy risks.

- Accident Reports: Auto insurance records include accident reports, which provide details of any incidents or accidents involving insured vehicles. These reports document date, time, location, parties involved, and a description of the accident. Accident reports are vital for investigating claims, determining liability, and assessing the extent of damages, helping insurance companies make fair and accurate claim settlements.

- Claims Information: Records related to auto insurance claims are essential for efficient claims handling. These records include claim forms, supporting documentation, estimates for repairs, and settlement details. Claims information provides a complete history of the claim and helps insurance companies assess the validity of the claim, determine coverage, and calculate the appropriate settlement amount.

- Proof of Insurance: Insurance companies retain records related to the proof of insurance provided to policyholders. This includes insurance cards or electronically generated proof of insurance documents. These records serve as evidence of insurance coverage and are typically required to be carried by vehicle owners as proof of financial responsibility.

By retaining these auto insurance records for a minimum of 5 years, insurance companies ensure compliance with regulatory requirements and facilitate efficient policy administration and claims handling. These records provide a comprehensive history of the policy, vehicle information, accidents, and claims, allowing insurance professionals to readily access and analyze the information as needed.

It’s important to note that auto insurance records may need to be retained for a longer period when there are ongoing claims or legal proceedings related to the policy. Insurance companies must adhere to local laws and regulations, as well as industry best practices, to determine the appropriate record retention period.

Data security and privacy are vital considerations when it comes to auto insurance records. Insurance companies employ robust information security measures to protect policyholder information from unauthorized access or misuse and ensure compliance with data protection regulations.

Now that we have explored auto insurance records, let’s move on to the specific record retention periods for health insurance policies.

Health Insurance Records

Health insurance is a vital form of coverage that helps individuals manage the costs of medical treatments and healthcare services. Insurance companies maintain comprehensive records related to health insurance policies to ensure accurate policy administration, claims processing, and compliance with regulatory requirements. These records, typically retained for a minimum of 6 years, play a crucial role in providing timely and efficient services to policyholders. Let’s dive into the key types of health insurance records:

- Policyholder Information: Health insurance records contain detailed information about policyholders, including names, addresses, contact details, and policy enrollment details. These records enable insurance companies to maintain accurate policyholder records, facilitate effective communication, and provide personalized customer service.

- Claims History: Health insurance records include detailed information about past claims made by policyholders. This encompasses claim forms, medical bills, explanation of benefits (EOB) documents, and other relevant claim-related correspondence. Claims history records help insurance companies assess the utilization of healthcare services, verify the legitimacy of the claims, and address any billing discrepancies or fraudulent activities.

- Approvals/Denials: Records related to approvals or denials of medical treatments or procedures are essential in health insurance. These records document the review and decision-making process, including medical necessity assessments, pre-authorization approvals, and claim adjudication decisions. Retaining these records ensures transparency and enables insurance companies to provide explanations for coverage decisions if required.

- Medical Assessments: Health insurance records may include medical assessments conducted for policy underwriting purposes or claims evaluation. These records may include medical reports, laboratory test results, diagnostic imaging findings, and other relevant medical information. Retaining these records ensures accurate and comprehensive documentation of the insured individual’s health status during policy issuance or claim evaluation.

- Payment Records: Health insurance records include records of premium payments made by policyholders, as well as payment records for healthcare services. These records ensure proper accounting, accurate billing, and provide evidence of financial transactions. They also serve as a reference in case of any payment-related inquiries or disputes.

By retaining health insurance records for a minimum of 6 years, insurance companies comply with regulatory requirements and ensure the availability of accurate information for policy administration and claims handling. These records assist insurance professionals in verifying policy coverage, assessing medical necessity, resolving billing disputes, and providing efficient customer service.

In addition to regulatory requirements, insurance companies must prioritize data security and privacy when it comes to health insurance records. Compliance with relevant data protection laws and implementing robust information security measures ensures the confidentiality and integrity of policyholder information.

Now that we have explored health insurance records, let’s move on to the specific record retention periods for life insurance policies.

Life Insurance Records

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. Insurance companies maintain comprehensive records related to life insurance policies to ensure accurate policy administration, beneficiary payouts, and regulatory compliance. These records, typically retained for a minimum of 10 years or longer, play a critical role in managing policy information and facilitating efficient claims processing. Let’s explore the key types of life insurance records:

- Policy Contracts: Life insurance records include the original policy contracts outlining the terms, conditions, and coverage details of the insurance policy. These contracts are legally binding agreements between the insurance company and the policyholder and provide a comprehensive understanding of the policy provisions and beneficiary designations.

- Beneficiary Designations: Insurance companies maintain records of the designated beneficiaries for each life insurance policy. These records identify the individuals or entities entitled to receive the death benefit in the event of the policyholder’s demise. Policyholders often have the option to update beneficiary information as necessary, and these records help ensure accurate and up-to-date beneficiary designations.

- Premium Payment Records: Records of premium payments made by the policyholder are essential in life insurance. These records document the payment history, ensuring that premiums are accounted for accurately and enabling the insurance company to assess the policy’s active status. In the event of any discrepancies or issues, these records serve as evidence of payment and can help resolve billing disputes.

- Policy Borrowing Records: Life insurance policies that offer cash value accumulation may allow policyholders to borrow against the policy’s cash value. Insurance companies maintain records of policy loans, including the loan amounts, interest rates, repayment terms, and outstanding loan balances. These records help track policy loans and ensure accurate accounting.

- Death Claims Documents: Life insurance records include documentation related to death claims made by beneficiaries. This includes death claim forms, proof of death, beneficiary identification, and any necessary supporting documentation. These records are critical for evaluating the validity of death claims, determining the payout amount, and facilitating the timely and accurate distribution of the death benefit.

By retaining these life insurance records for a minimum of 10 years or longer, insurance companies ensure compliance with regulatory requirements and facilitate efficient policy administration and claims processing. These records serve as a historical repository of policy and beneficiary information, enabling insurance professionals to accurately manage policyholder details and effectively process death claims.

Insurance companies must prioritize data security and privacy when maintaining life insurance records. Implementing robust information security measures and complying with applicable data protection regulations safeguards policyholder information and reduces the risk of unauthorized access or misuse.

Now that we have explored life insurance records, let’s move on to the specific record retention periods for business insurance policies.

Business Insurance Records

Business insurance provides coverage for a wide range of risks and liabilities faced by businesses. Insurance companies maintain detailed records related to business insurance policies to ensure proper policy administration, claims handling, and compliance with regulatory requirements. These records, typically retained for at least 7 years, play a crucial role in managing policy information and facilitating efficient claims processing. Let’s explore the key types of business insurance records:

- Policy Documents: Business insurance records include policy documents that outline the terms, conditions, and coverages of the insurance policy. These documents provide important information such as policy limits, coverage specifics, and exclusions. Maintaining accurate and up-to-date policy documents enables insurance companies to effectively manage policyholder information and provide necessary details to policyholders.

- Claims Information: Records related to business insurance claims are crucial for efficient claims handling. These records include claim forms, documentation of damages or losses, estimates for repairs or replacements, and settlement details. Claims information allows insurance companies to assess the validity of the claim, determine coverage, and calculate the appropriate claim settlement amount.

- Loss Control Measures: Business insurance records may include records of loss control measures taken by the insured business. These measures aim to mitigate risks and prevent potential losses by implementing safety protocols, conducting regular inspections, or implementing risk management strategies. Maintenance of these records serves as evidence of the business’s commitment to risk mitigation.

- Certificates of Insurance: Insurance companies issue certificates of insurance as proof of coverage to businesses and their third-party partners, customers, or vendors. These records serve as evidence that the business is adequately insured and may be required for legal or contractual purposes. Retaining copies of certificates of insurance ensures accurate documentation and facilitates easy access, if needed.

- Policy Endorsements: Business insurance policies may be amended or modified through policy endorsements. These records reflect any changes made to the original policy and specify the updated terms, conditions, or additional coverages. Maintaining records of policy endorsements ensures that both the insurance company and the policyholder are aware of any modifications made to the policy.

By retaining comprehensive business insurance records for a minimum of 7 years, insurance companies meet regulatory requirements and maintain a historical record of policy contracts, claims, and related information. These records enable insurance professionals to accurately manage policy details, assess claims, and provide effective customer service.

Data security and privacy are of utmost importance when it comes to business insurance records. Insurance companies implement robust information security measures and adhere to relevant data protection regulations to safeguard policyholder information and mitigate the risk of unauthorized access or misuse.

Now that we have explored business insurance records, let’s move on to the factors that influence record retention periods within insurance companies.

Factors that Influence Record Retention Periods

The duration for which insurance companies retain records can vary based on several factors. These factors determine the specific record retention periods within insurance companies and help ensure compliance with legal, regulatory, and business requirements. Let’s explore some key factors that influence record retention periods:

- Regulatory Requirements: Insurance companies must adhere to specific regulations set forth by governing bodies in their jurisdiction. These regulations often include guidelines on record retention periods for different types of insurance policies. Insurance companies must stay updated and comply with these requirements to avoid penalties or legal repercussions.

- Litigation and Claims Handling: Records play a crucial role in the resolution of legal disputes or claims. Insurance companies may need to retain records for a longer period if there are ongoing litigation or claims associated with a particular policy. These records provide evidence and support for the insurance company’s position during legal proceedings.

- Data and Information Security: The retention period of records can be influenced by data security considerations. Insurance companies must take measures to protect policyholder information from unauthorized access, data breaches, or misuse. When determining record retention periods, insurance companies often strike a balance between retaining records for a reasonable duration and minimizing the risk of data exposure.

- Business Needs and Operations: Record retention periods can also be influenced by the unique business needs and operations of an insurance company. Some companies may choose to keep records for a longer duration to support internal processes, audits, or customer inquiries. This ensures that the necessary information is readily available to address internal or external demands.

It’s important for insurance companies to carefully assess these factors and implement appropriate record retention policies. By doing so, they can ensure compliance with regulations, support claims handling and litigation processes, maintain data security, and effectively manage their operations.

Additionally, insurance companies should regularly review and update their record retention policies to align with any changes in regulatory requirements or industry best practices. This ensures that the record retention practices remain up to date and effective in meeting the evolving needs of the business and policyholders.

Now that we have explored the factors influencing record retention periods, let’s summarize the key points discussed in this article.

Regulatory Requirements

Regulatory requirements play a significant role in shaping the record retention periods within the insurance industry. Government bodies and regulatory authorities impose specific guidelines to ensure that insurance companies maintain records for a designated period of time. These requirements serve several purposes, including transparency, accountability, and compliance. Let’s delve into the influence of regulatory requirements on record retention:

Regulatory authorities establish guidelines and regulations to govern the insurance industry, ensuring that insurers follow best practices and protect the interests of policyholders. These regulations often include provisions related to record retention, specifying the minimum duration for which insurance companies must retain various types of records.

The specific regulatory requirements can vary depending on the jurisdiction and regulatory framework in place. For example, in the United States, the National Association of Insurance Commissioners (NAIC) provides model regulations and guidelines that shape the record retention periods for different types of insurance policies.

Regulatory requirements may not only define the minimum record retention periods but also outline the types of records that must be retained. The regulations may specify the retention of policy documents, claims records, premium payments, underwriting information, and other relevant documents essential for the administration and oversight of insurance policies.

Insurance companies must stay informed about the regulatory requirements in the jurisdictions where they operate and ensure compliance with these mandates. Failure to adhere to these requirements can result in penalties, fines, or other legal consequences.

In addition to regulatory requirements, insurance companies may also follow industry best practices or voluntarily adopt record retention periods longer than the minimum regulatory requirements. This is often done to maintain accurate historical records, support business needs, and provide exemplary customer service.

It is essential for insurance companies to undertake periodic reviews of regulatory requirements to stay updated on any changes or updates. This ensures that their record retention policies remain in compliance with the current regulations.

By adhering to regulatory requirements and adopting robust record retention practices, insurance companies can demonstrate transparency, accountability, and regulatory compliance. These practices help protect the interests of policyholders, facilitate efficient claims handling, and ensure accurate administration of insurance policies.

Now that we have explored the influence of regulatory requirements on record retention, let’s conclude with a summary of the key points covered in this article.

Litigation and Claims Handling

Litigation and claims handling are important aspects of the insurance industry, where records play a crucial role in resolving legal disputes and effectively processing claims. Insurance companies often retain records for extended periods when litigation or claims are involved, ensuring the availability of essential documentation to support their positions. Let’s delve into the influence of litigation and claims handling on record retention:

Insurance companies may face legal disputes and litigation related to policy coverage, claim settlements, or other matters. During these legal proceedings, records become vital pieces of evidence that support the insurance company’s position. To ensure a fair resolution, insurance companies retain records related to the specific case until its full resolution, even if it exceeds the regular record retention periods. Keeping these records allows insurers to reference specific details, correspondence, and past actions related to the case.

Claims handling is another critical area where records play a significant role. Insurance companies require documents and records to assess the validity of claims, investigate the circumstances surrounding the loss, determine coverage, and evaluate claim amounts. These records are retained for the duration of the claims process to provide a comprehensive history that guides decision-making and ensures fair and efficient claims handling.

Insurance companies often collaborate with legal and claims professionals during litigations or complex claims handling. These professionals rely on records to build their cases, support their arguments, and analyze the details of the situation. By retaining records for an extended period, insurance companies can ensure that all the necessary documentation is accessible when needed.

Some types of insurance claims may have longer record retention requirements due to their nature. For example, claims involving long-tail liabilities, such as environmental or asbestos claims, may require extended record retention to address potential claims that manifest years after the policy has expired.

Insurance companies must also consider any legal hold or preservation obligations that arise during litigation or claims handling. In such cases, records relevant to the legal proceedings must be retained, even if they would typically fall outside the regular record retention periods.

By retaining records for an extended period during litigation and claims handling, insurance companies ensure they have access to critical information, promote fair resolutions, and meet their legal obligations. These records serve as valuable evidence and aid in efficient claims processing and effective defense during legal proceedings.

Now that we have explored the influence of litigation and claims handling on record retention, let’s conclude with a summary of the key points covered in this article.

Data and Information Security

Data and information security are paramount considerations in the insurance industry, where the protection of sensitive policyholder information is of utmost importance. When determining record retention periods, insurance companies must balance the need to retain records with the imperative of safeguarding data and maintaining compliance with data protection regulations. Let’s delve into the influence of data and information security on record retention:

Insurance companies hold vast amounts of personal and confidential information about their policyholders. This data includes personal details, financial information, medical records, and other sensitive information. To protect this information from unauthorized access, data breaches, or misuse, insurance companies must implement robust information security measures.

Regulatory bodies, such as data protection authorities, impose requirements and standards for the secure handling, storage, and disposal of personal data. Insurance companies must ensure compliance with these regulations, which often include specific guidelines for record retention and data privacy. For certain types of personal data, data protection laws may stipulate specific retention periods to minimize the risk of privacy violations.

Insurance companies must undertake a risk-based approach when determining the appropriate record retention periods. They consider the sensitivity of the information being retained and the potential risks associated with unauthorized access or disclosure. Striking a balance between retaining records for an adequate duration and minimizing the risk of data exposure is crucial for data and information security.

Insurance companies employ a range of security measures to protect sensitive information, including access controls, encryption, firewalls, and intrusion detection systems. These measures help safeguard records from unauthorized access or cyber-attacks. Additionally, companies conduct regular security audits and assessments to identify vulnerabilities and address potential gaps in their data protection practices.

Insurance companies must also have processes in place to securely destroy or dispose of records once the retention period expires. This ensures that the records are no longer accessible and minimizes the risk of data breaches. Secure disposal methods may include shredding physical records or permanent deletion of digital records using industry-recognized standards.

Compliance with data protection laws, such as the General Data Protection Regulation (GDPR), is crucial for insurance companies. These regulations require companies to implement appropriate technical and organizational measures to protect personal data and ensure its lawful and secure processing. Failure to comply with these regulations can result in substantial fines and reputational damage.

By prioritizing data and information security, insurance companies demonstrate their commitment to protecting policyholder privacy and maintaining the confidentiality of sensitive information. Implementing robust security measures, complying with data protection regulations, and securely disposing of records at the end of their retention period are essential for effective data and information security.

Now that we have explored the influence of data and information security on record retention, let’s conclude with a summary of the key points covered in this article.

Conclusion

Record retention is a critical aspect of the insurance industry, ensuring accurate policy administration, efficient claims handling, and regulatory compliance. Insurance companies maintain various types of records related to personal, property, auto, health, life, and business insurance policies.

The retention periods for these records vary depending on factors such as regulatory requirements, litigation and claims handling, data and information security, and business needs. Regulatory requirements dictate the minimum duration for record retention, while litigation and claims handling may require records to be kept longer to support legal proceedings or claims processing.

Data and information security play a pivotal role in record retention. Insurance companies must protect sensitive policyholder information, comply with data protection regulations, and implement robust security measures to prevent unauthorized access or data breaches.

By retaining records for the appropriate duration, insurance companies ensure compliance with regulations, support efficient policy administration, enable effective claims handling, and safeguard policyholder information.

It’s important for insurance companies to regularly review and update their record retention policies to align with changes in regulations and industry best practices. They must also prioritize data privacy and security to mitigate risks and protect policyholder confidentiality.

In conclusion, record retention within insurance companies is a multifaceted endeavor. Balancing regulatory requirements, litigation and claims handling, data and information security, and business needs is crucial for effective and secure record management. By doing so, insurance companies can uphold transparency, accuracy, and efficiency in policy administration and claims processing, ultimately providing reliable and trusted services to policyholders.