Finance

How Much Is Sr22 Insurance In Colorado?

Modified: December 30, 2023

Looking for affordable Sr22 insurance in Colorado? Get the answers you need about finance and find out how much Sr22 insurance costs in Colorado.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is SR22 Insurance?

- Why is SR22 Insurance Required in Colorado?

- Factors Affecting SR22 Insurance Cost

- Average Cost of SR22 Insurance in Colorado

- How to Find Affordable SR22 Insurance in Colorado

- Tips for Saving Money on SR22 Insurance

- Frequently Asked Questions about SR22 Insurance in Colorado

- Conclusion

Introduction

When it comes to driving, it’s crucial to have the proper insurance coverage to protect yourself and others on the road. In some cases, individuals may be required to obtain SR22 insurance, especially if they have been involved in serious traffic offenses or have a history of driving violations. For residents of Colorado, understanding the ins and outs of SR22 insurance is essential.

Sr22 insurance is not like a typical auto insurance policy. It is a certification that verifies an individual has the minimum liability coverage required by the state. In other words, it is a way for the state of Colorado to ensure that high-risk drivers continue to meet their financial responsibilities in case of an accident.

So why is SR22 insurance required in Colorado? The state mandates SR22 filings for drivers who have been convicted of certain offenses, such as DUIs, reckless driving, driving without insurance, or multiple traffic violations within a specific timeframe. By requiring these individuals to obtain SR22 insurance, the state aims to ensure that they are financially responsible and have the necessary coverage to protect themselves and others on the road.

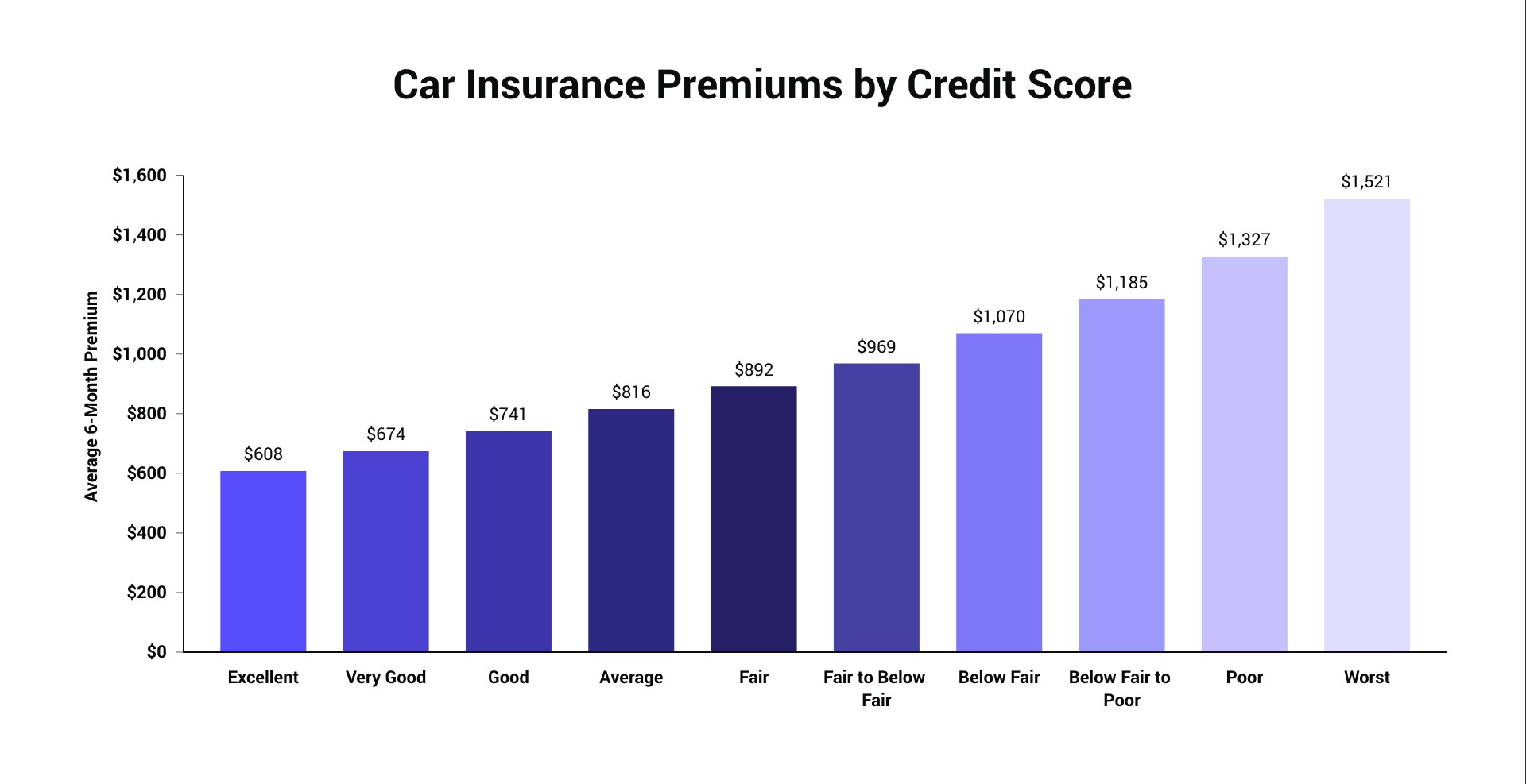

The cost of SR22 insurance in Colorado can vary significantly based on various factors. Insurance companies assess these factors to determine the risk associated with insuring a specific individual. Some common factors that can affect the cost of SR22 insurance include the individual’s driving record, age, location, and the type of offense that led to the SR22 requirement. For example, someone with a DUI conviction will typically pay higher premiums compared to someone with a history of minor traffic violations.

On average, the cost of SR22 insurance in Colorado can range from $300 to $800 per year. However, it’s essential to note that this cost is in addition to the regular auto insurance premiums. SR22 insurance is typically required for a specific period, usually three years, and the premiums must be paid on time to maintain compliance with state requirements.

To find affordable SR22 insurance in Colorado, it’s crucial to shop around and compare quotes from different insurance providers. Each company may have different rates and policies, so it’s essential to find the one that offers the best coverage at the most reasonable price. Working with an experienced insurance agent can also be beneficial, as they can help navigate the complexities of obtaining SR22 insurance and find the most cost-effective options.

So, if you’re required to carry SR22 insurance in Colorado, it’s essential to understand the associated costs and how to find affordable coverage. By ensuring that you meet the state’s requirements, you can maintain your driving privileges and protect yourself and others on the road.

What is SR22 Insurance?

SR22 insurance is a specific type of insurance certification required by certain states for high-risk drivers. It is not an insurance policy on its own, but rather a document that proves a driver has the minimum required liability coverage. In Colorado, SR22 insurance is required for drivers who have committed serious traffic violations or have had their driver’s license suspended or revoked.

When a driver is required to obtain SR22 insurance, they must contact their insurance provider and request the filing. The insurance company then files the SR22 form with the state’s Department of Motor Vehicles (DMV) to demonstrate that the driver has the appropriate coverage. This filing is to ensure that the driver will maintain continuous liability coverage during the mandated period.

It is important to note that not all drivers need SR22 insurance. The requirement is typically imposed on those who have been convicted of offenses such as driving under the influence (DUI) or driving without insurance. Additionally, if a driver has accumulated a certain number of points on their driving record within a specific timeframe, they may also be required to carry SR22 insurance.

SR22 insurance serves as a safety net for both the driver and others on the road. If the driver is involved in an accident, the insurance policy will cover the damages and injuries sustained by the other party involved. This insurance filing helps ensure that high-risk drivers are financially responsible and have the necessary coverage to protect themselves and others on the road.

It’s important to note that SR22 insurance is not permanent. The length of time a driver must maintain SR22 insurance can vary depending on the offense committed and the state’s requirements. In Colorado, the typical duration is three years. During this period, the driver must ensure that their insurance policy remains active and that they make their premium payments on time. Failure to do so may result in their driving privileges being suspended again.

While SR22 insurance may seem like an additional burden for high-risk drivers, it is a crucial requirement that helps maintain safety on the roads. By ensuring that these drivers have the appropriate coverage, the state can hold them accountable for their actions and help protect other drivers from potential financial losses in the event of an accident. It’s important for high-risk drivers to understand the requirements and obligations associated with SR22 insurance and to work with a reputable insurance provider to fulfill their obligations.

Why is SR22 Insurance Required in Colorado?

In Colorado, SR22 insurance is required for individuals who have been involved in serious traffic offenses or have a history of driving violations. The state mandates SR22 filings to ensure that high-risk drivers continue to meet their financial responsibilities in case of an accident.

One of the primary reasons SR22 insurance is required in Colorado is to ensure the safety of other motorists on the road. Drivers who have committed offenses such as DUIs, reckless driving, or driving without insurance pose a higher risk of being involved in accidents. By requiring these individuals to obtain SR22 insurance, the state aims to ensure that they have the necessary coverage to protect themselves and others in case of an accident.

Another reason for requiring SR22 insurance is to hold high-risk drivers accountable for their actions. By requiring them to obtain SR22 insurance, the state can monitor their insurance coverage and ensure that they meet their financial responsibilities. This requirement serves as an additional deterrent to prevent repeat offenses and encourage safer driving behavior.

SR22 insurance also helps protect innocent victims in case of an accident involving a high-risk driver. By mandating the minimum liability coverage, the state ensures that these drivers have the means to compensate for damages and injuries caused to others. This helps protect the rights and financial well-being of those who may be affected by the actions of high-risk drivers.

Additionally, SR22 insurance is required as a condition for reinstating a driver’s license after a suspension or revocation. When a driver has their license suspended, they must fulfill certain requirements, such as completing a driver’s education course or serving a suspension period. Obtaining SR22 insurance is often one of these requirements to demonstrate that the driver is taking responsibility for their actions and has the necessary coverage to resume driving.

It’s important for individuals in Colorado to understand that SR22 insurance is not an optional requirement. Failure to obtain and maintain SR22 insurance, when required, can result in severe consequences, including further penalties and even extended license suspensions. By complying with the SR22 insurance requirement, drivers can regain their driving privileges, demonstrate their commitment to responsible driving, and protect themselves and others on the road.

Factors Affecting SR22 Insurance Cost

The cost of SR22 insurance in Colorado can vary significantly based on several factors. Insurance companies consider these factors to assess the risk associated with insuring a particular individual. Understanding these factors can help drivers get an idea of what influences their SR22 insurance premiums.

1. Driving Record: One of the primary factors determining SR22 insurance cost is the driver’s past driving record. Drivers with a history of serious traffic offenses, such as DUIs or reckless driving, are considered high-risk and will typically face higher premiums compared to those with a clean driving record.

2. Offense Type: The specific offense that led to the SR22 requirement can also impact insurance costs. Offenses like DUIs or driving without insurance are considered more serious, resulting in higher premiums compared to less severe offenses.

3. Age: Age is another important factor considered by insurance providers. Younger drivers, especially those under the age of 25, tend to have higher insurance rates overall, and this applies to SR22 insurance as well.

4. Gender: Although it might not seem fair, some insurance companies may consider gender when calculating premiums for SR22 insurance. In some cases, males may face higher premiums than females due to statistical data indicating that male drivers tend to have more accidents.

5. Location: Insurance rates can also vary based on where a driver lives. If the driver resides in an urban area with more traffic congestion and higher accident rates, their SR22 insurance premiums may be higher compared to someone living in a rural area.

6. Coverage Limits: The coverage limits selected by the driver also affect SR22 insurance costs. Higher coverage limits will generally result in higher premiums, as the insurance company would have to pay out more in the event of an accident or claim.

7. Insurance Provider: Insurance companies have different rating structures and calculations, which means that the cost of SR22 insurance can vary between providers. Shopping around and comparing quotes from different insurance companies can help find the most affordable option.

It’s important to note that while these factors can influence the cost of SR22 insurance, the specific impact may vary between insurance providers. Each provider has its own underwriting guidelines and rating systems, so it’s essential to obtain quotes from multiple companies to find the most competitive rates.

Average Cost of SR22 Insurance in Colorado

The cost of SR22 insurance in Colorado can vary depending on several factors. However, on average, individuals can expect to pay an annual premium ranging from $300 to $800 for SR22 coverage.

It is important to note that the cost of SR22 insurance is in addition to the regular auto insurance premiums that individuals are required to pay. SR22 insurance is typically required for a specific period, often three years, depending on the offense committed and the state’s requirements.

Several factors can influence the average cost of SR22 insurance in Colorado:

1. Driving Record: The driving record of the individual plays a significant role in determining SR22 insurance premiums. If the individual has a history of traffic violations, accidents, or DUI convictions, the insurance premium is likely to be higher compared to someone with a clean driving record.

2. Offense Type: The specific offense that led to the SR22 requirement also affects the cost of insurance. More severe offenses, such as DUIs or driving without insurance, generally lead to higher premiums compared to less serious violations.

3. Age: Age is another factor that can impact SR22 insurance costs. Younger drivers, especially those under the age of 25, often face higher insurance rates across the board, including SR22 insurance.

4. Gender: Although it might seem unfair, some insurance companies may consider gender when determining premiums for SR22 insurance. In certain cases, males may face higher rates than females due to statistical data indicating higher accident rates among male drivers.

5. Location: Where a driver lives can also affect the cost of SR22 insurance. Insurance premiums can be higher for individuals residing in densely populated urban areas with more traffic congestion and a higher likelihood of accidents.

6. Coverage Limits: The coverage limits chosen by the driver can impact the cost of SR22 insurance. Opting for higher coverage limits will generally result in higher premiums, as it means the insurance company would have to pay out more in the event of an accident or claim.

It’s important to keep in mind that the average cost of SR22 insurance in Colorado is an estimate, and individual premiums may vary depending on the specific circumstances. To find the most accurate and competitive rates, it is crucial to request quotes from multiple insurance providers and compare their offerings.

Lastly, it is essential to prioritize getting SR22 coverage from a reputable insurance provider. While cost is an important consideration, individuals should also ensure that the insurance company has a strong financial standing and a track record of reliable customer service. This will help provide the necessary protection and peace of mind during the SR22 insurance period.

How to Find Affordable SR22 Insurance in Colorado

Finding affordable SR22 insurance in Colorado is crucial, as it helps you fulfill the state’s requirements while also minimizing the financial burden. Here are some strategies to help you find cost-effective SR22 insurance:

1. Shop Around and Compare Quotes: One of the most effective ways to find affordable SR22 insurance is to shop around and obtain quotes from multiple insurance providers. Each company may have different rates and policies, so comparing them will give you an idea of the range of prices available.

2. Consider Different Coverage Options: While it’s necessary to maintain the minimum required liability coverage, you may have flexibility in choosing additional coverage options. By considering different coverage limits and deductibles, you can find a balance between cost and adequate protection.

3. Work with an Independent Insurance Agent: Independent insurance agents have access to multiple insurance companies and can help you find the most affordable SR22 insurance options. They can tailor coverage to your needs and provide valuable advice throughout the process.

4. Check for Discounts: Ask insurance providers about any available discounts that can help lower your SR22 insurance premiums. For example, some companies offer safe driving discounts, bundling discounts for multiple insurance policies, or discounts for completing defensive driving courses.

5. Improve Your Driving Record: Over time, maintaining a clean driving record can help lower your insurance rates, including SR22 insurance premiums. Focus on safe driving habits and avoid any violations or accidents that could negatively impact your insurance rates.

6. Maintain Continuous Coverage: Keeping your insurance coverage active and making premium payments on time is essential. Maintain a good payment history and avoid any lapses in coverage, as this can lead to higher premiums or coverage denials in the future.

7. Consider a High Deductible: Opting for a higher deductible can help reduce your SR22 insurance premiums. However, keep in mind that you should choose a deductible amount that is affordable and manageable for you in the event of a claim.

8. Seek Assistance Programs: Some states offer assistance programs for low-income individuals who are required to have SR22 insurance but cannot afford high premiums. Check for eligibility criteria and see if you qualify for any such programs in Colorado.

Remember, affordability should not be the sole factor when choosing SR22 insurance. It’s important to select a reputable insurance provider that offers reliable coverage, good customer service, and a strong financial standing. By combining affordability with quality coverage, you can meet the SR22 insurance requirements in Colorado without breaking the bank.

Tips for Saving Money on SR22 Insurance

Obtaining SR22 insurance in Colorado can be a financial burden, but there are several strategies you can employ to save money on your premiums while still meeting the state’s requirements. Here are some tips to help you reduce the cost of SR22 insurance:

1. Compare Insurance Quotes: Shop around and compare quotes from different insurance providers. Each company has its own pricing structure, so obtaining multiple quotes will help you identify the most affordable options for SR22 insurance coverage.

2. Opt for a Higher Deductible: Choosing a higher deductible can help lower your SR22 insurance premiums. However, be sure to select a deductible amount that you can comfortably afford to pay in case of an accident or claim.

3. Bundle Insurance Policies: Consider bundling your SR22 insurance policy with other policies you may have, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling multiple policies, which can help reduce your overall insurance costs.

4. Maintain a Good Driving Record: A clean driving record is important for keeping insurance premiums low. Avoid traffic violations, accidents, and DUI charges, as these can significantly increase your SR22 insurance rates. Practice safe driving habits to maintain a clean record and avoid future premium hikes.

5. Take a Defensive Driving Course: Some insurance providers offer discounts to drivers who have completed a defensive driving course. Consider enrolling in such a course to not only improve your driving skills but also potentially reduce your SR22 insurance premiums.

6. Ask About Available Discounts: Inquire with insurance providers about any available discounts for which you may qualify. Examples of common discounts include safe driver discounts, good student discounts, or discounts for installing anti-theft devices in your vehicle. Take advantage of these opportunities to save money.

7. Maintain Continuous Coverage: Avoid any lapses in your insurance coverage, as this can result in higher premiums when obtaining SR22 insurance. Ensure that your payments are made on time and keep your insurance policy active to maintain consistent coverage and avoid future financial penalties.

8. Work with an Independent Insurance Agent: Independent insurance agents have access to multiple insurance carriers and can help you find the most competitive rates for SR22 coverage. They can help navigate the complexities of SR22 insurance and find the best options that fit your budget and coverage needs.

Remember, while saving money is important, it’s equally important to ensure that you have adequate coverage. Balancing affordability with sufficient protection will help you meet the SR22 insurance requirements in Colorado without compromising your financial stability or safety on the road.

Frequently Asked Questions about SR22 Insurance in Colorado

1. What is SR22 insurance, and who needs it?

SR22 insurance is a certification that verifies a driver has the minimum liability coverage required by the state. It is typically required for individuals who have been convicted of serious traffic offenses or have had their driver’s license suspended or revoked.

2. How long do I need to carry SR22 insurance in Colorado?

The duration of SR22 insurance requirement varies depending on the offense committed and the state’s requirements. In Colorado, it is typically required for three years. However, the exact duration can vary, so it’s essential to confirm with the state’s Department of Motor Vehicles (DMV).

3. Can I drive without SR22 insurance?

No, if you are required to carry SR22 insurance and you drive without it, you will be in violation of the law. Failure to maintain SR22 insurance can result in additional penalties, license suspension, or even jail time.

4. How much does SR22 insurance cost in Colorado?

The cost of SR22 insurance in Colorado can vary depending on factors such as driving record, offense type, age, and location. On average, the annual premiums can range from $300 to $800 or more. It’s important to obtain quotes from multiple insurance providers to find the most affordable coverage.

5. Will SR22 insurance affect my regular auto insurance premiums?

Yes, SR22 insurance is an additional requirement on top of your regular auto insurance. Your regular auto insurance premiums may increase due to factors such as driving record and offense history, which led to the requirement of SR22 insurance.

6. Can I switch insurance providers while carrying SR22 insurance?

Yes, you can switch insurance providers while carrying SR22 insurance. However, it’s important to ensure that your new insurer is aware of the SR22 requirement and can file the necessary paperwork with the state’s DMV to avoid any lapses in coverage.

7. Can I get SR22 insurance if I don’t own a vehicle?

Yes, it is still possible to obtain SR22 insurance even if you don’t own a vehicle. You can purchase a non-owner SR22 policy, which provides liability coverage when you drive someone else’s vehicle.

8. What happens if I let my SR22 insurance policy lapse?

If your SR22 insurance policy lapses, it will be considered a violation of the requirement. This can result in serious consequences, including additional penalties, potential license suspension, and even having to restart the SR22 insurance period from the beginning.

It’s important to check with the state’s DMV or consult with an insurance professional to get accurate and up-to-date information about SR22 insurance requirements and their implications in Colorado.

Conclusion

Obtaining SR22 insurance in Colorado may seem like a daunting and expensive requirement, but it is essential for high-risk drivers to meet their financial responsibilities and maintain their driving privileges. Understanding the ins and outs of SR22 insurance, including the factors that affect its cost, can help individuals navigate this process more effectively.

Factors such as driving record, offense type, age, and location play a significant role in determining the cost of SR22 insurance. By maintaining a good driving record, comparing quotes from multiple insurers, and considering available discounts, individuals can find more affordable options while still meeting state requirements.

Additionally, maintaining continuous insurance coverage, opting for higher deductibles, and bundling policies can further help in saving money on SR22 insurance. Working with an independent insurance agent can provide valuable insights and assistance in finding the most affordable coverage that fits individual needs.

It’s important to note that SR22 insurance is not permanent, and individuals should fulfill the requirements for the specified period to regain their unrestricted driving privileges. Failure to comply with SR22 requirements can result in severe consequences, including extended license suspensions and further penalties.

By understanding the purpose and importance of SR22 insurance, individuals can approach the process with clarity and make informed decisions. Remember to prioritize not only affordability but also the reliability and reputation of the insurance providers to ensure adequate coverage.

Lastly, always consult with the state’s Department of Motor Vehicles or an insurance professional to get accurate and up-to-date information about SR22 insurance requirements and regulations in Colorado. With the right approach and the necessary coverage, individuals can fulfill their obligations, drive safely, and protect themselves and others on the road.