Finance

What Is Working Capital Turnover

Modified: February 21, 2024

Find out what working capital turnover is and how it relates to finance. Understand its significance and implications for businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Working Capital?

- What is Working Capital Turnover?

- Importance of Working Capital Turnover

- Calculation of Working Capital Turnover

- Interpretation and Analysis of Working Capital Turnover

- Factors Affecting Working Capital Turnover

- Limitations of Working Capital Turnover

- Example of Working Capital Turnover Calculation

- Conclusion

Introduction

Working capital turnover is a vital metric that every business, regardless of its size or industry, should pay attention to. It measures the efficiency with which a company utilizes its working capital to generate sales revenue. Understanding and optimizing working capital turnover is crucial for maintaining a healthy financial position and ensuring sustainable growth.

To grasp the concept of working capital turnover, it is important to first understand what working capital is. In simple terms, working capital refers to the funds a company has available to meet its short-term financial obligations and support its day-to-day operations. It is calculated by subtracting a company’s current liabilities from its current assets.

Working capital turnover, on the other hand, is a financial ratio that measures the relationship between a company’s net sales and its average working capital during a specific period. It indicates how many times a company’s working capital is being used and replenished within a given time frame.

The importance of working capital turnover cannot be overstated. It provides valuable insights into a company’s operational efficiency and financial health. A high working capital turnover suggests that a company is utilizing its working capital efficiently to generate sales, indicating optimal management of its short-term resources. On the other hand, a low working capital turnover may signify inefficiencies in managing working capital, resulting in potential cash flow issues and reduced profitability.

By knowing how to calculate and analyze working capital turnover, businesses can identify areas for improvement and implement strategies to optimize their working capital management. This includes managing inventory levels, streamlining accounts receivable and accounts payable processes, and negotiating favorable payment terms with suppliers.

However, it is important to note that working capital turnover should not be viewed in isolation. It should be analyzed in conjunction with other financial ratios and industry benchmarks to gain a comprehensive understanding of a company’s financial performance and to make informed decisions.

In the following sections, we will delve deeper into the calculation, interpretation, and analysis of working capital turnover. We will also discuss the factors that can affect working capital turnover and the limitations of this metric. Additionally, we will provide an example of a working capital turnover calculation to illustrate its practical application in real-world scenarios.

What is Working Capital?

Working capital is a fundamental concept in finance and accounting that represents the resources available to a company to fund its day-to-day operations and meet its short-term financial obligations. It is a measure of a company’s liquidity and its ability to cover its current expenses. Working capital is calculated by subtracting a company’s current liabilities from its current assets.

Current assets include cash, inventory, accounts receivable, and other assets that are expected to be converted into cash within the next 12 months. These assets provide the necessary resources for a company to continue its operations and generate sales revenue. On the other hand, current liabilities encompass the short-term obligations that a company is required to fulfill within the next 12 months, such as accounts payable, short-term loans, and accrued expenses.

Having an adequate amount of working capital is crucial for a company’s financial stability and operational efficiency. It enables the company to pay its suppliers, cover its operating expenses, and manage unexpected cash flow fluctuations. Insufficient working capital can lead to liquidity issues, delayed payments to vendors, and even bankruptcy.

While the optimal level of working capital varies depending on factors such as industry and business cycle, maintaining a balance is essential. Excess working capital can indicate inefficiencies and poor capital management, as it implies that the company is not utilizing its available resources effectively. Conversely, inadequate working capital can hinder a company’s ability to meet its obligations and take advantage of growth opportunities.

Managing working capital effectively involves finding a balance between maintaining sufficient liquidity and maximizing the utilization of resources. This includes strategies such as optimizing inventory levels, improving collections from customers, and negotiating favorable payment terms with suppliers.

It is important to note that working capital alone does not provide a holistic view of a company’s financial health. It should be analyzed in conjunction with other financial metrics and industry benchmarks to gain a comprehensive understanding of a company’s liquidity, solvency, and profitability.

Now that we have a clear understanding of what working capital is, let us delve deeper into the concept of working capital turnover, which provides insights into how efficiently a company utilizes its working capital to generate sales revenue.

What is Working Capital Turnover?

Working capital turnover is a financial ratio that measures the efficiency with which a company utilizes its working capital to generate sales revenue. It indicates how many times a company’s working capital is being used and replenished within a specific period. In other words, it measures how effectively a company is able to convert its short-term assets into sales revenue.

The working capital turnover ratio is calculated by dividing a company’s net sales by its average working capital during a given period. The net sales figure represents the total sales revenue generated by a company after deducting any returns, discounts, and allowances.

For example, if a company has $1,000,000 in net sales and an average working capital of $200,000 during a year, the working capital turnover ratio would be 5 (1,000,000 / 200,000 = 5). This means that the company is generating $5 of sales revenue for every dollar of working capital invested.

A higher working capital turnover ratio indicates that a company is efficiently utilizing its working capital to generate sales revenue. It suggests that the company is able to generate a significant amount of sales with relatively less working capital, which can lead to improved financial performance and profitability.

On the other hand, a lower working capital turnover ratio may indicate inefficiencies in managing working capital. It could imply that the company is holding excessive inventory, experiencing delays in collecting receivables, or facing difficulties in managing its cash flow. This can negatively impact the company’s profitability and financial stability.

It is important to note that the optimal working capital turnover ratio varies across industries. Some industries, such as retail or fast-moving consumer goods, typically have higher turnover ratios due to their faster inventory turnover and shorter sales cycles. Other industries, such as manufacturing or construction, may have lower turnover ratios due to longer production cycles and slower customer payments.

By calculating and monitoring the working capital turnover ratio, businesses can gain insights into their operational efficiency and financial performance. It can help identify potential areas for improvement, such as streamlining operations, reducing inventory holding costs, and improving cash flow management.

However, it is crucial to analyze the working capital turnover ratio in conjunction with other financial ratios, industry benchmarks, and historical data to make informed decisions. It is also important to consider the specific characteristics and requirements of the industry in which the company operates.

In the next section, we will explore the importance of working capital turnover and how it can impact a company’s financial health and sustainability.

Importance of Working Capital Turnover

Working capital turnover is a crucial metric that holds significant importance for businesses. It offers valuable insights into a company’s operational efficiency, financial health, and sustainability. Understanding the importance of working capital turnover can help organizations make informed decisions to optimize their working capital management and improve overall performance.

Here are some key reasons why working capital turnover is important:

1. Efficiency Measurement: Working capital turnover provides a measure of how efficiently a company utilizes its working capital to generate sales revenue. A higher turnover ratio indicates that the company is able to generate more sales revenue with less investment in working capital. This suggests that the company is using its resources effectively and maximizing their productivity.

2. Cash Flow Management: Maintaining a healthy working capital turnover helps in managing cash flow effectively. A high turnover ratio indicates that the company is quickly converting its working capital into sales revenue and replenishing its resources. This reduces the risk of cash flow shortages and ensures smoother operations, allowing the company to meet its financial obligations on time.

3. Profitability Indicator: Working capital turnover is closely linked to profitability. A higher turnover ratio implies that the company is generating more sales revenue, which can lead to increased profitability. By efficiently using its working capital, a company can optimize its resources and improve its profit margins.

4. Risk Reduction: Inefficient working capital management can increase the risk of financial instability. A low working capital turnover can indicate excessive investment in inventory, slow collections from customers, or poor cash flow management. By monitoring and improving the turnover ratio, companies can mitigate these risks and enhance their financial stability.

5. Performance Comparison: Working capital turnover allows for benchmarking and comparison with industry peers. Understanding how a company’s turnover ratio compares to industry standards can provide insights into its competitiveness and efficiency. It can help identify areas where the company may be underperforming and guide efforts to improve operational processes and enhance overall performance.

6. Strategic Decision Making: The working capital turnover ratio helps in making informed business decisions. By analyzing the ratio over time and identifying trends, companies can assess the effectiveness of their strategies and make adjustments when necessary. It can guide decisions related to inventory management, credit policies, and supplier relationships, leading to improved financial outcomes.

In summary, working capital turnover is a significant metric that offers insights into a company’s operational efficiency, financial health, liquidity, and profitability. By monitoring and optimizing the working capital turnover ratio, businesses can enhance their cash flow management, reduce financial risks, and make informed decisions to strengthen their overall performance and competitiveness in the market.

Calculation of Working Capital Turnover

The working capital turnover ratio is calculated by dividing a company’s net sales by its average working capital during a specific period. This ratio provides insight into how effectively a company utilizes its working capital to generate sales revenue.

Here is the formula to calculate working capital turnover:

Working Capital Turnover Ratio = Net Sales / Average Working Capital

Let’s break down the components of the formula:

Net Sales: Net sales refers to the total sales revenue generated by the company after deducting any discounts, returns, and allowances. This figure represents the actual sales revenue that contributes to the company’s profitability.

Average Working Capital: Average working capital is the average amount of working capital a company holds during a specific period. It is calculated by adding the beginning working capital to the ending working capital and dividing the sum by 2.

For example, if the beginning working capital is $100,000 and the ending working capital is $150,000, the average working capital would be $125,000 (($100,000 + $150,000) / 2).

Once you have the values for net sales and average working capital, you can plug them into the formula to calculate the working capital turnover ratio.

It is important to note that the working capital turnover ratio can be calculated for different periods, such as annually, quarterly, or monthly, depending on the reporting needs of the company.

The working capital turnover ratio provides a benchmark for businesses to assess their efficiency in utilizing their working capital. A higher ratio indicates that the company generates more sales revenue for every dollar invested in working capital, while a lower ratio suggests potential inefficiencies in managing working capital.

By monitoring the working capital turnover ratio over time and comparing it to industry benchmarks, businesses can evaluate their operational efficiency, identify areas for improvement, and implement strategies to optimize their working capital management.

In the next section, we will discuss the interpretation and analysis of the working capital turnover ratio and how it can provide insights into a company’s financial performance.

Interpretation and Analysis of Working Capital Turnover

The working capital turnover ratio provides valuable insights into a company’s operational efficiency and financial performance. Analyzing this ratio can help in understanding how effectively a company utilizes its working capital to generate sales revenue. Let’s explore how to interpret and analyze the working capital turnover ratio:

High Working Capital Turnover Ratio: A high working capital turnover ratio indicates that a company generates a significant amount of sales revenue for every dollar invested in working capital. This suggests that the company efficiently utilizes its short-term resources to generate revenue. A high ratio can be an indicator of strong operational efficiency and effective management of working capital.

Low Working Capital Turnover Ratio: On the other hand, a low working capital turnover ratio indicates potential inefficiencies in working capital management. It implies that the company is not effectively utilizing its short-term resources to generate sales revenue. A low ratio may suggest issues such as excess inventory, slow collections from customers, or poor cash flow management. This can negatively impact the company’s profitability and financial stability.

Industry Comparison: It is important to compare the working capital turnover ratio to industry benchmarks and competitors to gain meaningful insights. Different industries have varying turnover ratios based on factors such as the nature of products or services, production cycles, and customer payment terms. Analyzing the ratio relative to industry standards helps evaluate a company’s competitiveness and efficiency.

Trend Analysis: Monitoring the working capital turnover ratio over time can reveal trends and patterns. A consistent or increasing ratio indicates that the company is maintaining or improving its operational efficiency. However, a decreasing ratio may raise concerns and indicate a deterioration in working capital management. Trend analysis helps in identifying areas for improvement and implementing corrective measures.

Comparing Ratios with Competitors: Comparing the working capital turnover ratio with competitors in the industry can provide further insights. If a company’s ratio is significantly higher or lower than its competitors, it signifies a potential competitive advantage or disadvantage. Understanding the reasons behind the differences can guide strategic decision-making and help in improving operational efficiency.

Additional Analysis: The working capital turnover ratio should be analyzed in conjunction with other financial ratios and metrics to obtain a comprehensive view of the company’s financial health. Metrics like gross margin, return on assets, and debt ratios can provide further context and help in assessing the company’s overall performance and profitability.

It is essential to note that while working capital turnover is a valuable measure, it should not be the sole basis for decision-making. Contextual factors, industry dynamics, and specific business circumstances should also be considered when interpreting the ratio and making informed decisions.

By regularly monitoring and analyzing the working capital turnover ratio, businesses can identify areas for improvement, develop strategies to optimize working capital management, and enhance their operational efficiency and financial performance.

In the next section, we will explore the key factors that can impact the working capital turnover ratio.

Factors Affecting Working Capital Turnover

The working capital turnover ratio is influenced by various factors that can impact a company’s operational efficiency and financial performance. Understanding these factors is crucial for businesses to optimize their working capital turnover and drive sustainable growth. Let’s explore some key factors that can affect the working capital turnover ratio:

1. Inventory Management: Efficient inventory management plays a significant role in working capital turnover. Holding excessive inventory can tie up working capital and lead to a lower turnover ratio. On the other hand, maintaining lean inventory levels can improve the turnover ratio by reducing the time it takes to convert inventory into sales revenue.

2. Accounts Receivable: The time it takes to collect payments from customers can impact the working capital turnover ratio. Slow collections can increase the cash conversion cycle and reduce the frequency at which working capital is replenished. Implementing effective credit policies, offering discounts for early payment, and monitoring accounts receivable can help improve the turnover ratio.

3. Accounts Payable: The payment terms negotiated with suppliers can affect the working capital turnover ratio. Longer payment terms can free up working capital and improve the ratio, while shorter payment terms increase the frequency of working capital replenishment but may strain liquidity. Balancing cash flow requirements and maintaining good relationships with suppliers are key considerations in managing accounts payable effectively.

4. Cash Flow Management: Effective cash flow management is essential for optimizing working capital turnover. Businesses that efficiently manage their cash flow can meet their financial obligations on time, reduce the need for excessive working capital, and improve the ratio. Adequate cash flow forecasting, monitoring expenses, and optimizing the timing of payments and collections are essential in optimizing cash flow and working capital turnover.

5. Sales and Revenue Growth: The growth rate of sales and revenue can impact the working capital turnover ratio. Rapid growth can strain working capital resources, leading to a decrease in the ratio. Businesses must plan for the working capital requirements of expanding sales volume to ensure sufficient liquidity and optimize the turnover ratio.

6. Industry and Business Model: Different industries and business models have varying working capital requirements and turnover ratios. Understanding industry dynamics and the inherent characteristics of the business model is important for benchmarking the working capital turnover ratio against industry peers and identifying areas for improvement.

7. Seasonality and Cyclical Nature: Businesses that experience seasonal or cyclical fluctuations in demand may witness variations in their working capital turnover ratio. It is essential to consider the specific patterns and requirements of the business cycle to manage working capital effectively and maintain an optimal turnover ratio throughout the year.

8. Operational Efficiency: Overall operational efficiency has a direct impact on the working capital turnover ratio. Efficient processes, streamlined operations, and effective resource utilization can improve the turnover ratio by minimizing waste, reducing costs, and generating sales revenue more efficiently.

By considering these factors and implementing strategies to optimize inventory management, accounts receivable and payable, cash flow, and operational efficiency, businesses can enhance their working capital turnover ratio and improve their overall financial performance.

In the next section, we will explore the limitations of the working capital turnover ratio and its practical application in a real-world example.

Limitations of Working Capital Turnover

While the working capital turnover ratio is a useful metric for assessing a company’s operational efficiency and financial performance, it comes with certain limitations that should be considered when interpreting the ratio and making business decisions. Understanding these limitations is crucial to avoid misinterpretation and ensure a comprehensive analysis. Let’s explore the limitations of the working capital turnover ratio:

1. Industry Differences: The optimal working capital turnover ratio varies across industries due to differences in business models, production cycles, and customer payment terms. Comparing the ratio between companies in different industries may not provide accurate insights. It is important to consider industry benchmarks and compare the ratio within the same industry for meaningful interpretation.

2. Time Period Consideration: The working capital turnover ratio provides a snapshot of a company’s efficiency during a specific time period. Fluctuations in working capital requirements throughout the year may impact the ratio. Analyzing the ratio over multiple periods helps in identifying trends and making more accurate assessments of a company’s working capital management.

3. Seasonality and Cyclicality: Businesses that experience significant seasonality or cyclical variations in demand may witness fluctuations in their working capital turnover ratio. The ratio may be higher or lower during certain periods, which can impact the overall interpretation. Adjusting for seasonality and understanding the specific business cycle is important to get a comprehensive view of working capital efficiency.

4. Incomplete Snapshot: The working capital turnover ratio considers only the relationship between net sales and average working capital. It does not encompass other aspects of a company’s financial health, such as profitability, solvency, or long-term investment potential. Complementary financial ratios and analysis are needed to gain a comprehensive understanding of a company’s overall performance.

5. Quality and Accuracy of Financial Statements: The accuracy and quality of a company’s financial statements can impact the working capital turnover ratio. Inaccurate or unreliable financial data can lead to misleading ratios. It is important to ensure the integrity of financial statements and perform due diligence in analyzing the ratio based on accurate and reliable data.

6. External Factors: The working capital turnover ratio does not account for external factors that may impact a company’s financial performance. Economic fluctuations, changes in market demand, industry disruptions, or regulatory changes can influence a company’s working capital efficiency. External factors should be considered alongside the ratio to gain a holistic view of the company’s performance.

Despite these limitations, the working capital turnover ratio remains a valuable metric for evaluating a company’s efficiency in utilizing its working capital. By understanding these limitations and considering them in the analysis, businesses can make more informed decisions and optimize their working capital management effectively.

In the next section, we will provide an example of a working capital turnover calculation to illustrate its practical application.

Example of Working Capital Turnover Calculation

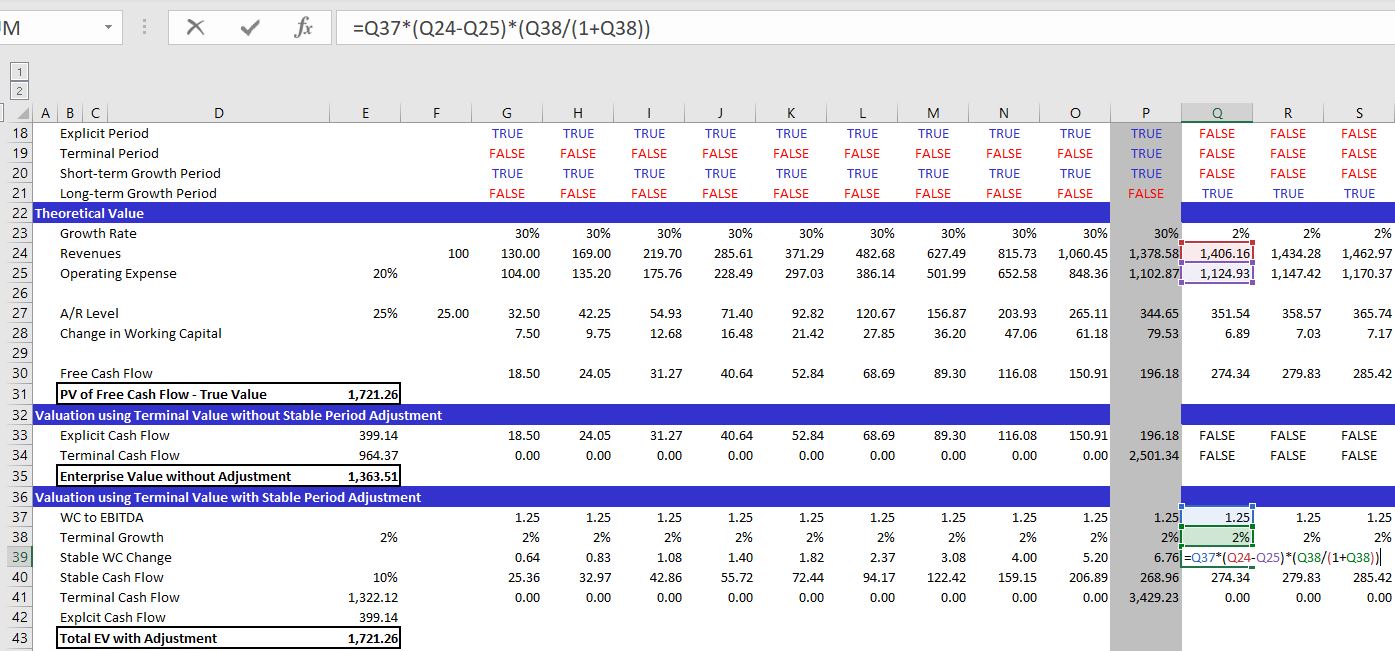

To better understand how the working capital turnover ratio is calculated and its practical application, let’s consider an example:

Company XYZ is a retail business that sells clothing and accessories. For the fiscal year 2020, the company reported net sales of $2,000,000. The beginning working capital for the year was $500,000, and the ending working capital was $700,000. We can calculate the working capital turnover ratio using these numbers.

The average working capital is calculated by adding the beginning working capital and ending working capital and dividing the sum by 2:

Average Working Capital = ($500,000 + $700,000) / 2 = $600,000

Now, we can calculate the working capital turnover ratio:

Working Capital Turnover Ratio = Net Sales / Average Working Capital

Working Capital Turnover Ratio = $2,000,000 / $600,000

Working Capital Turnover Ratio = 3.33

In this example, Company XYZ has a working capital turnover ratio of 3.33. This means that the company generates $3.33 of sales revenue for every dollar invested in working capital during the fiscal year 2020.

Interpreting this ratio, we can say that Company XYZ efficiently utilizes its working capital to generate sales revenue. However, it is important to compare this ratio with industry benchmarks and analyze trends over time for a more accurate assessment.

If, in the following year, Company XYZ’s net sales increase to $2,500,000, and the average working capital increases to $650,000, the updated calculation would be as follows:

Working Capital Turnover Ratio = $2,500,000 / $650,000

Working Capital Turnover Ratio = 3.85

With a higher ratio of 3.85, we can see that Company XYZ has improved its efficacy in utilizing working capital to generate sales revenue.

By analyzing and comparing the working capital turnover ratio over time, businesses can identify trends, assess the impact of their working capital management strategies, and make informed decisions to improve operational efficiency and financial performance.

Remember, the working capital turnover ratio should be analyzed in conjunction with other financial metrics, industry benchmarks, and specific business circumstances for a comprehensive evaluation of a company’s performance.

In the final section, we will conclude our discussion on the importance and implications of working capital turnover.

Conclusion

The working capital turnover ratio is a vital metric that provides insights into a company’s operational efficiency, financial health, and sustainability. By measuring how effectively a company utilizes its working capital to generate sales revenue, businesses can assess their working capital management and make informed decisions to optimize performance.

We have explored the components and calculation of the working capital turnover ratio, along with its interpretation and analysis. A high ratio indicates efficient working capital utilization, while a low ratio may point to inefficiencies that impact profitability and stability.

Factors such as inventory management, accounts receivable and payable, cash flow management, and industry dynamics can influence the working capital turnover ratio. It is essential to consider these factors and adjust strategies accordingly to improve efficiency.

While the working capital turnover ratio is a valuable metric, it does come with certain limitations. Industry differences, time period considerations, and external factors should be taken into account for accurate interpretation and decision-making.

Through practical examples, we have seen how the working capital turnover ratio is calculated and its application in evaluating a company’s performance. By monitoring and analyzing the ratio over time, businesses can identify trends, benchmark against industry peers, and implement strategies to optimize working capital management.

In conclusion, the working capital turnover ratio is a key tool for assessing a company’s working capital efficiency and financial performance. By understanding its importance, analyzing the ratio in conjunction with other metrics, and adapting strategies as needed, businesses can enhance their operational efficiency, maximize profitability, and drive sustainable growth in today’s competitive business landscape.