Finance

How Much Is SR-22 Insurance A Month?

Published: November 28, 2023

Find out how much SR22 insurance costs per month and get the best finance options for your needs. Compare and save today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to car insurance, there are different types of coverage you can choose from to meet your specific needs. One such type is SR22 insurance. If you have found yourself in certain driving-related predicaments, such as getting a DUI or driving without insurance, you may be required to obtain SR22 insurance as part of the reinstatement process for your driver’s license.

SR22 insurance is not actually a type of insurance policy, but rather a certificate that proves you have the necessary coverage to meet the state’s minimum liability requirements. It is a way for the state to ensure that high-risk individuals, who have had serious driving violations, maintain insurance coverage for a specific period.

The cost of SR22 insurance can vary significantly depending on various factors. Understanding these factors will help you determine how much you’ll have to pay for SR22 insurance each month. This article will explore the factors that affect SR22 insurance rates and provide an insight into the average cost of SR22 insurance per month. Additionally, we will discuss some ways to lower your SR22 insurance premiums.

What is SR22 Insurance?

SR22 insurance is a certificate that is required by certain states for drivers who have been involved in serious driving violations. It serves as proof that the driver has the necessary insurance coverage to meet the state’s minimum liability requirements. SR22 insurance is not an insurance policy itself; rather, it is an add-on to an existing auto insurance policy.

The need for SR22 insurance typically arises when a driver has committed serious offenses such as driving under the influence (DUI), driving without insurance, or being involved in an at-fault accident without insurance. In these situations, the state may require the driver to file an SR22 form with the Department of Motor Vehicles (DMV) to reinstate their driver’s license.

Once the SR22 form is filed, the insurance company will provide the driver with an SR22 certificate. The certificate is then submitted to the DMV as proof of insurance coverage. The duration of time that SR22 insurance is required can vary depending on the severity of the offense and the state’s regulations. Typically, it is required for a minimum of three years.

It’s important to note that not all states require SR22 insurance. The states that require SR22 filing include California, Florida, Illinois, Ohio, and many others. If you are unsure whether your state requires SR22 filing, it’s best to check with your local DMV or consult with an insurance agent.

It’s crucial to understand that SR22 insurance does not cover damages or injuries caused by the driver. Instead, it serves as a guarantee to the state that if the driver is involved in any future incidents, the insurance company will notify the DMV of any policy cancellations or lapses in coverage. This added layer of monitoring ensures that high-risk individuals maintain their insurance coverage for the required period.

Factors Affecting SR22 Insurance Rates

When it comes to determining SR22 insurance rates, there are several factors that insurance companies take into consideration. Understanding these factors can help you better understand why your rates may be higher or lower than others. Here are the main factors that affect SR22 insurance rates:

- Driving Record: One of the biggest factors that insurers consider is your driving record. If you have a history of serious violations such as DUIs, reckless driving, or multiple at-fault accidents, you will likely be considered a high-risk driver, leading to higher SR22 insurance rates.

- Location: Insurance rates can vary depending on where you live. If you reside in an area with high crime rates or a history of accidents, your SR22 insurance rates may be higher compared to someone in a safer location.

- Age and Gender: Younger drivers, especially those under the age of 25, are generally considered riskier to insure. Additionally, males tend to have higher insurance rates compared to females due to statistical data showing that men are more likely to be involved in accidents.

- Type of Vehicle: The make and model of your vehicle can also impact SR22 insurance rates. Cars with high performance capabilities or a higher risk of theft or vandalism may lead to higher insurance premiums.

- Coverage Limits: The level of coverage you choose will also affect your SR22 insurance rates. Opting for higher coverage limits will result in higher premiums.

- Insurance History: If you have a history of insurance lapses or cancellations, insurance companies may see you as a higher risk, resulting in higher SR22 insurance rates.

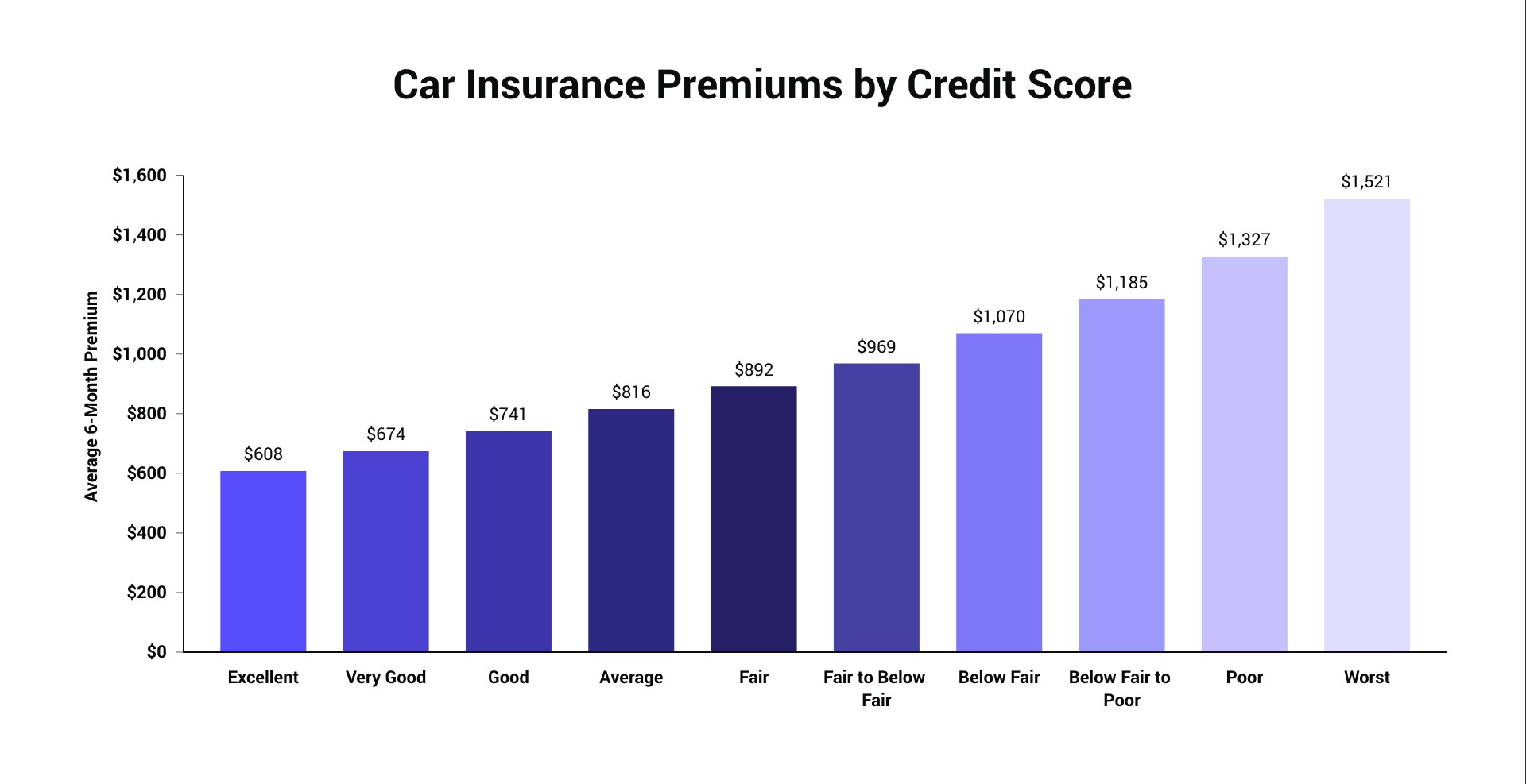

- Credit Score: In some states, insurance companies may use credit scores as a factor in determining premiums. A lower credit score can lead to higher insurance rates.

It’s important to note that the impact of each factor on SR22 insurance rates may vary depending on the insurance company’s policies and state regulations. This means that rates can vary significantly from one insurer to another.

Average Cost of SR22 Insurance per Month

The cost of SR22 insurance can vary significantly depending on various factors, including the severity of the violation, your driving record, your location, and the insurance company you choose. On average, SR22 insurance could cost you an additional $20 to $50 per month on top of your regular auto insurance premiums.

It’s important to note that SR22 insurance itself is not expensive. It is typically the high-risk factors that lead to increased premiums. If you have a clean driving record and no prior violations, your SR22 insurance rates may be on the lower end of the spectrum. However, if you have a history of DUIs or multiple at-fault accidents, your rates could be significantly higher.

The type of coverage you choose will also impact the cost of SR22 insurance. Opting for higher coverage limits will result in higher premiums. Additionally, the duration that you are required to maintain SR22 insurance can also affect the overall cost. The longer the SR22 filing period, the more you will have to pay for insurance.

It’s important to compare quotes from different insurance companies to get the best rates. Each insurer has its own way of assessing risk, and the rates can vary significantly. Additionally, taking steps to improve your driving record, such as attending defensive driving courses or maintaining a clean record, can also help lower your SR22 insurance premiums.

Remember, SR22 insurance is typically required for a minimum of three years, but the duration can vary depending on the severity of the violation and state regulations. Be sure to comply with all requirements to maintain continuous coverage and avoid any further violations that could prolong the SR22 filing period.

Ways to Lower SR22 Insurance Premiums

While SR22 insurance premiums are generally higher due to being considered a high-risk driver, there are several ways you can potentially lower your SR22 insurance premiums. Here are some strategies to consider:

- Improve Your Driving Record: Maintaining a clean driving record is crucial in reducing your insurance rates. Avoid speeding tickets, accidents, and any other traffic violations that could negatively impact your driving history.

- Take Defensive Driving Courses: Completing a defensive driving course can not only enhance your driving skills but may also qualify you for discounts on your SR22 insurance. Check with your insurance company to see if they offer any discounts for completing approved defensive driving courses.

- Shop Around and Compare Quotes: It’s essential to shop around and compare quotes from different insurance companies. Each insurer has its own way of assessing risk and may offer different rates for SR22 insurance. Take the time to research and gather multiple quotes to find the most affordable option.

- Bundle Your Insurance Policies: If you have other insurance policies, such as home or renters insurance, consider bundling them with your SR22 insurance. Many insurers offer discounts for bundling multiple policies, which can help lower your overall premiums.

- Increase Deductibles: Opting for a higher deductible means you’ll have to pay more out of pocket in the event of a claim. However, it can also reduce your SR22 insurance premiums. Before increasing your deductibles, make sure you can comfortably afford the higher out-of-pocket expenses.

- Improve Your Credit Score: Some insurance companies consider credit scores when calculating premiums. Improving your credit score can make you eligible for lower SR22 insurance rates. Make sure to pay your bills on time, keep credit card balances low, and fix any errors on your credit report.

- Maintain Continuous Coverage: It’s crucial to maintain continuous insurance coverage without any lapses. Any gaps or cancellations in coverage can result in higher premiums when it comes to SR22 insurance. Pay your premiums on time and stay up to date with your policy to avoid any issues.

Keep in mind that not all strategies may be applicable or have the same effect for everyone. Insurance rates can vary based on individual circumstances and the policies of different insurance companies. It’s important to consult with your insurance agent and discuss possible options for lowering your SR22 insurance premiums.

Conclusion

SR22 insurance is a necessary requirement for individuals who have been involved in serious driving violations. While it may result in higher insurance premiums, there are ways to potentially lower your SR22 insurance costs. Factors like your driving record, location, age, and vehicle type can impact your rates. It’s important to shop around and compare quotes from different insurance companies to find the best rates for your situation.

To reduce your SR22 insurance premiums, focus on improving your driving record, taking defensive driving courses, and maintaining continuous coverage. Additionally, bundling your insurance policies, increasing deductibles, and working to improve your credit score can also help lower your rates. Keep in mind that each insurance company has its own assessment of risk, so it’s crucial to research and explore different options.

Remember, SR22 insurance is typically required for a minimum of three years, but this can vary depending on the state and severity of the violation. Complying with all requirements and maintaining continuous coverage is essential to avoid any additional penalties or prolonging the SR22 filing period.

While SR22 insurance may initially seem daunting, it’s important to remember that it is a temporary requirement to demonstrate responsible behavior on the road. By taking the necessary steps to improve your driving record and exploring ways to reduce your SR22 insurance premiums, you can successfully fulfill the requirements and work towards reinstating your driving privileges.

If you have any specific questions or concerns about SR22 insurance, it is advisable to consult with your insurance agent or a certified professional who can provide you with accurate and personalized advice based on your unique circumstances.