Finance

How To Check Credit Score With ITIN Number

Published: October 22, 2023

Learn how to check your credit score with an ITIN number and take control of your finances. Get valuable insights and start building a strong financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an ITIN Number?

- Importance of Checking Credit Score

- Can You Check Credit Score with an ITIN Number?

- How to Check Credit Score with ITIN Number

- Option 1: Free Annual Credit Report

- Option 2: Credit Monitoring Services

- Option 3: Credit Score Apps and Websites

- Option 4: Credit Counseling Agencies

- Option 5: Consult with a Financial Advisor

- Conclusion

Introduction

Welcome to this comprehensive guide on how to check your credit score with an ITIN number. Understanding your credit score is crucial for managing your finances, whether you’re applying for a loan, renting an apartment, or even applying for a job. Your credit score reflects your creditworthiness and is an important factor that lenders consider when making lending decisions.

For those individuals who don’t have a Social Security number (SSN), obtaining credit and checking their credit score can be challenging. However, there’s good news for non-U.S. citizens or residents who are employed or have income in the United States: you can obtain an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS). An ITIN serves as a unique identification number for tax purposes and can also be used for certain financial transactions.

In this guide, we’ll explore the importance of checking your credit score, and more specifically, whether you can check your credit score with an ITIN number. We’ll also discuss various options that you can consider to check your credit score using your ITIN number. Let’s dive in!

What is an ITIN Number?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security Number (SSN) but need to fulfill their tax obligations in the United States. The ITIN is a nine-digit number that begins with the number 9 and is formatted like a Social Security number (XXX-XX-XXXX).

The primary purpose of an ITIN is to ensure that individuals who are required to pay taxes, such as non-U.S. citizens or residents, can still comply with U.S. tax laws. It is commonly used by non-resident aliens, foreign investors, dependents or spouses of U.S. citizens or residents, and individuals who are not eligible for an SSN but have income in the United States.

It is important to note that an ITIN is not a form of identification, and it does not provide work authorization or eligibility for Social Security benefits. Its sole purpose is for tax reporting purposes.

To apply for an ITIN, individuals need to complete Form W-7, which is the application for an Individual Taxpayer Identification Number. This form requires individuals to provide specific documentation to verify their identity and foreign status. Examples of acceptable documentation include passports, birth certificates, and national identification cards issued by the individual’s country of citizenship.

Once individuals have obtained an ITIN, they can use it to file their tax returns, claim tax treaty benefits, open a bank account, and meet other tax-related obligations. In recent years, the IRS has also allowed ITIN holders to use their ITIN to establish credit history and potentially check their credit score.

Importance of Checking Credit Score

Checking your credit score on a regular basis is essential for maintaining healthy financial well-being. Your credit score is a numerical representation of your creditworthiness, which lenders use to assess your creditworthiness and determine whether to approve you for loans, credit cards, or other financial products.

Here are some key reasons why checking your credit score is important:

- Access to Better Financial Opportunities: A good credit score opens doors to better financial opportunities, such as lower interest rates on loans and credit cards. Lenders are more likely to offer you favorable terms and conditions when they see a high credit score, which can ultimately save you money.

- Ability to Monitor for Errors or Fraud: Regularly checking your credit score allows you to identify any errors or fraudulent activity on your credit report. Inaccurate information can harm your credit score, so monitoring it helps you catch and correct any mistakes in a timely manner.

- Improvement of Credit Health: By keeping track of your credit score, you can easily track improvements or declines in your financial behavior. This allows you to make necessary changes to enhance your credit health and take steps towards building a solid credit history.

- Preparation for Financial Goals: Whether you’re planning to buy a house, lease a car, or start a business, knowing your credit score in advance helps you gauge your eligibility for loans or leases. It allows you to take the necessary steps to strengthen your credit score if needed, increasing your chances of achieving your financial goals.

- Understanding Your Financial Standing: Your credit score reflects your overall financial standing and how well you manage your debts. By regularly checking your credit score, you gain a better understanding of your financial situation and can take proactive steps to improve it.

Remember, a high credit score demonstrates responsible financial behavior and opens up a world of opportunities. By regularly monitoring your credit score, you can take control of your financial future and make informed decisions about your credit and overall financial well-being.

Can You Check Credit Score with an ITIN Number?

Yes, you can check your credit score even if you have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN). In recent years, there have been efforts to include ITIN holders in the credit reporting system, allowing them to establish credit history and access their credit scores.

While not all credit reporting agencies may include ITIN holders in their systems, there are options available that specifically cater to individuals with ITINs. These alternative credit reporting agencies recognize the value of ITINs for non-U.S. citizens or residents who contribute to the U.S. economy.

These specialized credit reporting agencies use alternative data sources, such as utility bills, rental payments, and other financial information, to generate credit scores for individuals with ITINs. By considering this alternative data, they provide a comprehensive and accurate assessment of creditworthiness for those without traditional credit histories.

It’s important to note that ITIN credit scores may differ from traditional credit scores based on SSNs. However, they still serve as a valuable tool for managing and understanding your credit health. These scores enable ITIN holders to monitor their creditworthiness and make informed financial decisions.

Furthermore, many financial institutions and lenders are becoming more inclusive and recognizing the importance of considering ITIN credit scores when evaluating loan applications or other financial services. This opens up opportunities for ITIN holders to access credit and other financial products on more favorable terms.

So, if you have an ITIN, rest assured that you have the ability to check your credit score. By monitoring and understanding your score, you can take the necessary steps to build credit history, improve your creditworthiness, and achieve your financial goals.

How to Check Credit Score with ITIN Number

Checking your credit score with an Individual Taxpayer Identification Number (ITIN) is a relatively straightforward process. While traditional credit reporting agencies may not include ITIN holders in their systems, there are alternative methods and options available.

Here are several ways to check your credit score using your ITIN number:

Option 1: Free Annual Credit Report

Under federal law, you are entitled to receive a free annual credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. These reports do not require a Social Security Number and can be obtained by providing your ITIN.

By reviewing your credit reports, you can get a comprehensive view of your credit history and identify any discrepancies or inaccuracies. However, please note that the free credit report does not include your credit score.

Option 2: Credit Monitoring Services

There are credit monitoring services available that cater specifically to individuals with ITINs. These services might require a subscription or fee, but they provide access to your credit score and detailed credit information.

By signing up for a credit monitoring service, you’ll receive alerts about any changes to your credit file and have ongoing access to your credit score. This can help you keep a close eye on your credit health and make informed financial decisions.

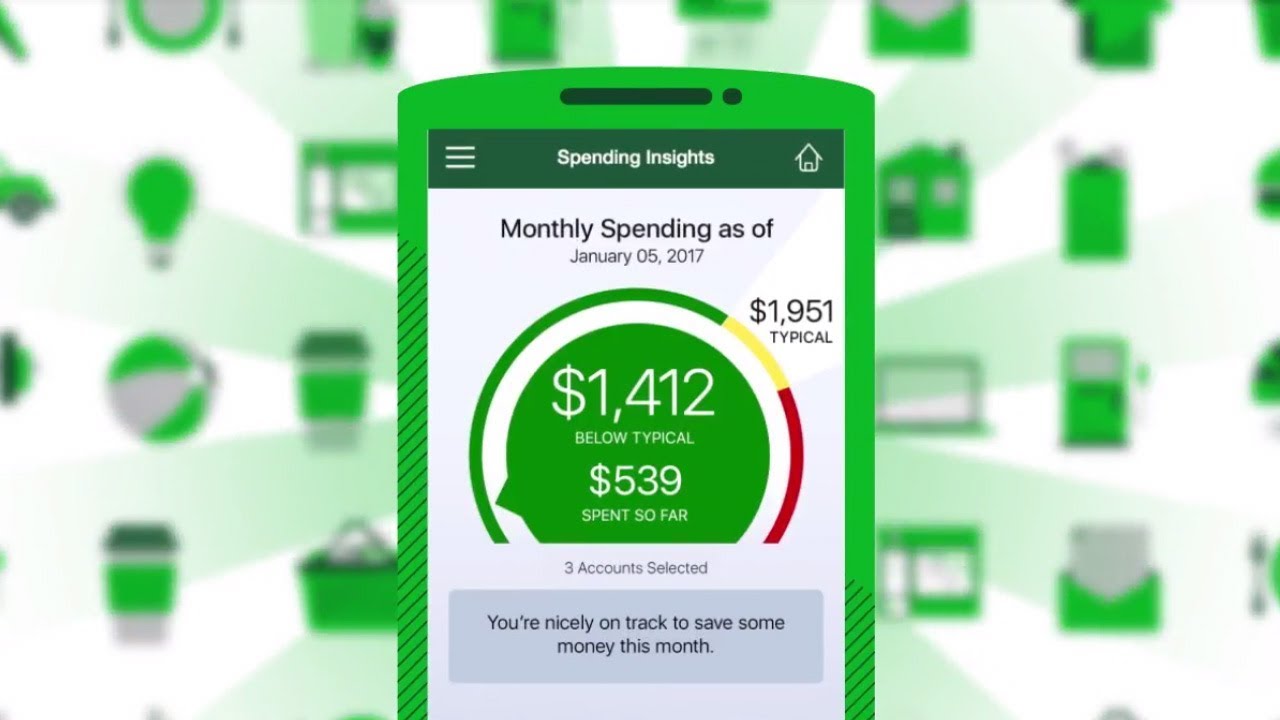

Option 3: Credit Score Apps and Websites

There are various credit score apps and websites that allow you to check your credit score using your ITIN. These platforms provide a user-friendly interface that displays your credit score and offers insights into your credit history and factors affecting your score.

Some credit score apps and websites even provide personalized tips and recommendations to help you improve your creditworthiness and maintain a healthy credit profile.

Option 4: Credit Counseling Agencies

Credit counseling agencies can provide guidance and assistance in checking your credit score with an ITIN. These agencies specialize in helping individuals with credit-related matters and can access your credit information using your ITIN.

Working with a credit counseling agency can be beneficial as they can provide guidance on how to improve your credit score, manage your debts, and build a solid credit history.

Option 5: Consult with a Financial Advisor

A financial advisor experienced in assisting individuals with ITINs can guide you on how to check your credit score and provide insights tailored to your specific financial situation.

They can help you understand the different options available and recommend the best method for obtaining your credit score using your ITIN.

Remember, by regularly checking your credit score with your ITIN, you can stay informed about your creditworthiness, identify areas for improvement, and make informed financial decisions.

Option 1: Free Annual Credit Report

One of the options available to check your credit score with an Individual Taxpayer Identification Number (ITIN) is to request a free annual credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion.

Here’s how you can obtain your free annual credit report:

- Visit AnnualCreditReport.com: This is the only authorized website to access your free annual credit report. Be cautious of other websites that may charge a fee or require subscriptions.

- Submit Your Information: Provide your personal information, including your ITIN, name, address, and date of birth. This helps confirm your identity and ensures you receive the correct credit report.

- Select the Credit Reporting Agencies: Choose which credit reporting agencies you want to request the credit report from. You have the option to request reports from all three agencies at once or stagger them throughout the year.

- Complete Security Verification: The website may ask you to complete security verification, such as answering personal questions related to your credit file. This step ensures that only you can access your credit report.

- Review Your Credit Report: Once the request is processed, you will be able to view and download your credit report from each selected agency. Take the time to carefully review the report for any errors, discrepancies, or unauthorized accounts.

It’s important to note that while your free annual credit report provides detailed information about your credit history, it does not include your credit score. However, reviewing your credit report allows you to identify any issues that may be impacting your creditworthiness.

If you come across any errors or discrepancies on your credit report, you can file a dispute with the credit reporting agencies to have the inaccuracies corrected. This can help improve your credit score and ensure the accuracy of your credit information.

Remember, you are entitled to receive one free credit report from each agency every 12 months. By taking advantage of this option, you can stay informed about your credit standing and make informed financial decisions based on your credit report information.

Option 2: Credit Monitoring Services

Another option to check your credit score with an Individual Taxpayer Identification Number (ITIN) is to utilize credit monitoring services. These services cater specifically to individuals who may not have a traditional Social Security Number but still want to access their credit information.

Here’s how credit monitoring services can help you check your credit score:

- Research and Choose a Credit Monitoring Service: There are several credit monitoring services available in the market. Research and select a reputable service that offers credit reporting for individuals with ITINs.

- Sign Up and Provide Your ITIN: Register for the credit monitoring service by providing your personal information, including your ITIN. This information is necessary for the service provider to access and monitor your credit information.

- Set Up Account and Profile: Once registered, you will need to set up your account and profile on the credit monitoring platform. This typically involves creating a username, password, and answering security questions to protect your personal information.

- Access Your Credit Score and Reports: After setting up your account, you will gain access to your credit score and credit reports. The monitoring service will provide a detailed overview of your credit history, accounts, payment history, and other relevant factors that contribute to your creditworthiness.

- Receive Monitoring Alerts: Credit monitoring services also offer real-time monitoring of your credit file. They will notify you of any changes, such as new accounts opened in your name, credit inquiries, or late payments. This helps you detect potential identity theft or credit-related issues early on.

- Utilize Additional Features: Many credit monitoring services offer additional features to help you manage and improve your credit score. These can include credit score simulators, personalized recommendations, and credit education resources.

It’s important to review the terms and conditions, as well as the cost associated with the credit monitoring service. Some providers offer free basic services, while others may require a subscription fee for more comprehensive monitoring features.

By utilizing a credit monitoring service designed for ITIN holders, you can regularly check your credit score, receive ongoing credit monitoring, and stay informed about any changes or updates to your credit file. This empowers you to take control of your financial health and make informed decisions based on your credit information.

Option 3: Credit Score Apps and Websites

If you have an Individual Taxpayer Identification Number (ITIN), you can also check your credit score using credit score apps and websites specifically designed for individuals without a traditional Social Security Number. These platforms provide an accessible and user-friendly way to access your credit information and monitor your credit score.

Here’s how you can use credit score apps and websites to check your credit score:

- Research and Choose a Credit Score App or Website: Look for reputable credit score apps and websites that cater to individuals with ITINs. Ensure that the platform you choose provides accurate and reliable credit information.

- Download the App or Visit the Website: Once you have identified a suitable credit score app or website, download the app or visit the website through your preferred internet browser.

- Create an Account: Register for an account on the app or website by providing the required information, including your ITIN, name, address, and other personal details. This enables the platform to access and retrieve your credit information.

- Verify Your Identity: Many credit score apps and websites have security measures in place to protect your information. You may be asked to provide additional verification, such as answering personal questions or submitting identification documents.

- Access Your Credit Score: Once your account is set up and your identity is verified, you can access your credit score and credit report through the app or website. The platform will display your credit score along with relevant details about your credit history, accounts, and payment history.

- Utilize Additional Features: Credit score apps and websites often offer additional features to help you better understand and manage your credit. These features may include credit score simulators, personalized recommendations for improving your credit, and educational resources.

It’s important to choose a reputable credit score app or website that values the privacy and security of your information. Research user reviews and verify the platform’s legitimacy before providing sensitive personal details.

With credit score apps and websites, checking your credit score and monitoring your credit becomes convenient and accessible. You can stay informed about your credit health, identify areas for improvement, and make informed financial decisions based on your credit information.

Option 4: Credit Counseling Agencies

If you have an Individual Taxpayer Identification Number (ITIN) and need assistance in checking your credit score, credit counseling agencies can provide expert guidance and support. These agencies specialize in helping individuals with credit-related matters and can offer valuable insights into your credit situation.

Here’s how credit counseling agencies can assist you in checking your credit score:

- Research and Choose a Reputable Credit Counseling Agency: Look for credit counseling agencies that have experience working with individuals with ITINs. Research their services, reviews, and credentials to ensure they are trustworthy and capable of providing the assistance you need.

- Contact the Credit Counseling Agency: Reach out to the chosen credit counseling agency to schedule an appointment or consultation. Many agencies offer free initial consultations to assess your situation and determine the best course of action.

- Provide Your ITIN and Relevant Information: During your consultation with the credit counseling agency, provide them with your ITIN and any other relevant information they require to access your credit information. This allows them to assess your creditworthiness and provide accurate advice.

- Review Your Credit Report: Credit counseling agencies have access to credit reports and can help you review your credit history, accounts, and payment details. They can identify any discrepancies, errors, or areas of improvement.

- Understand Your Credit Score and Factors: The credit counseling agency will explain your credit score and the factors that influence it. They can help you understand how certain financial behaviors impact your creditworthiness and provide guidance on improving your credit score.

- Receive Personalized Recommendations: Based on your credit report and financial situation, credit counseling agencies can offer personalized recommendations for enhancing your credit health. They may suggest strategies for paying off debts, improving payment history, or establishing positive credit habits.

Working with a credit counseling agency provides you with expert guidance, allowing you to make informed decisions to improve your credit score. The agency can also assist you in developing a personalized plan to achieve your financial goals and address any credit-related challenges you may be facing.

Remember to choose a reputable credit counseling agency that has a track record of helping individuals with ITINs. With their support, you can navigate the complexities of credit and work towards building a healthier credit profile.

Option 5: Consult with a Financial Advisor

If you have an Individual Taxpayer Identification Number (ITIN) and are seeking guidance on how to check your credit score, consulting with a financial advisor can provide valuable insights and personalized assistance. A financial advisor experienced in working with individuals with ITINs can offer expert advice and help you navigate the process of checking your credit score.

Here’s how consulting with a financial advisor can help you check your credit score:

- Research and Choose a Qualified Financial Advisor: Look for financial advisors who specialize in working with individuals with ITINs or non-U.S. citizens. Verify their credentials, experience, and track record to ensure they are knowledgeable and reputable.

- Schedule a Consultation: Contact the chosen financial advisor to schedule a consultation. During the consultation, discuss your situation, goals, and desire to check your credit score.

- Provide Relevant Documentation: Provide your ITIN and any other relevant documentation requested by the financial advisor. This may include personal identification, financial statements, or other supporting documents.

- Assess Your Credit Situation: The financial advisor will analyze your credit situation, review your credit history, and explore potential obstacles or opportunities. They will assess your creditworthiness and help you understand your current credit score and factors influencing it.

- Receive Personalized Guidance: Based on their analysis, the financial advisor will provide personalized guidance tailored to your specific financial situation. They can suggest strategies to improve your credit score, build credit history, and manage your overall financial health.

- Review Monitoring Options: The financial advisor can discuss various credit monitoring options suitable for your needs. They can recommend credit monitoring services or apps specifically designed for individuals without Social Security Numbers (SSNs).

- Continued Support: By consulting with a financial advisor, you benefit from ongoing support and expertise. They can assist with monitoring your credit score, updating your financial strategy, and helping you achieve your long-term financial goals.

Working with a financial advisor ensures that you receive personalized advice and guidance based on your unique circumstances. They can help you navigate the complexities of checking your credit score with an ITIN and provide strategies to establish and improve your creditworthiness.

Remember to choose a financial advisor who understands the unique challenges faced by individuals with ITINs and has a deep understanding of credit and financial planning. With their expert support, you can make informed decisions and take control of your financial future.

Conclusion

Checking your credit score is an important step in managing your financial health, even if you have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN). Fortunately, there are options available that allow individuals with ITINs to access their credit scores and monitor their creditworthiness.

In this guide, we have explored various options for checking your credit score with an ITIN:

- Option 1: Free Annual Credit Report – You can request a free annual credit report from each of the three major credit reporting agencies.

- Option 2: Credit Monitoring Services – Credit monitoring services cater specifically to individuals with ITINs and provide ongoing access to credit scores and credit monitoring features.

- Option 3: Credit Score Apps and Websites – These platforms are designed to cater to individuals without SSNs, offering user-friendly interfaces to check credit scores and access credit information.

- Option 4: Credit Counseling Agencies – Credit counseling agencies specialize in assisting individuals with ITINs, providing guidance on checking credit scores and developing strategies to improve credit health.

- Option 5: Consult with a Financial Advisor – Consulting with a financial advisor experienced in working with ITIN holders can provide personalized guidance and assistance in checking credit scores.

Remember, regularly checking your credit score with your ITIN allows you to stay informed about your creditworthiness, identify areas for improvement, and make informed financial decisions. It is essential to choose reputable services, apps, or professionals to ensure the accuracy and security of your credit information.

By taking advantage of the available options and actively monitoring your credit, you can work towards building a strong credit history, improving your credit score, and achieving your financial goals. Whether you are applying for a loan, seeking better interest rates, or aiming to improve your overall financial well-being, understanding and managing your credit is key.

Keep in mind that establishing and maintaining good credit takes time and responsible financial behavior. Use the information and resources provided in this guide to empower yourself and take control of your financial future.