Finance

How To Check Chase Credit Score

Modified: March 6, 2024

Learn how to check your Chase credit score and stay on top of your finances. Gain insights into your creditworthiness with this helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to a comprehensive guide on how to check your credit score with Chase! In today’s world, where financial stability and creditworthiness play a pivotal role, monitoring your credit score has become more crucial than ever. Whether you’re planning to apply for a loan, a credit card, or even a rental property, having a good credit score is essential.

Chase Bank, one of the largest and most reputable financial institutions, provides its customers with various methods to conveniently access and monitor their credit scores. In this article, we will explore different ways to check your credit score using Chase’s tools and services.

But before we dive into the specifics, let’s take a moment to understand what a credit score is and why it is important.

Understanding Credit Scores

Your credit score is a three-digit number that serves as an indicator of your creditworthiness. It is calculated based on various factors such as your payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with a higher score indicating better creditworthiness.

A good credit score not only increases your chances of getting approved for loans and credit cards but also helps you secure better interest rates and more favorable terms. It is a reflection of your financial responsibility and trustworthiness in the eyes of lenders and financial institutions.

Now that we have a basic understanding of credit scores, let’s explore why it is important to regularly check your credit score.

Understanding Credit Scores

Your credit score is a vital component of your financial health. It not only reflects your creditworthiness but also affects your ability to secure loans, credit cards, and even rental agreements. Understanding how credit scores are calculated and what factors influence them can help you make informed financial decisions and improve your overall creditworthiness.

A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. The higher your score, the better your creditworthiness. The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation.

Several factors contribute to the calculation of your credit score, including:

- Payment History: Your history of making timely payments on credit accounts, including credit cards, loans, and mortgages.

- Credit Utilization: The percentage of your available credit that you are currently using. Keeping your credit utilization below 30% is generally recommended.

- Length of Credit History: The length of time you’ve been using credit. Longer credit histories generally indicate stability and reliability.

- Types of Credit: The different types of credit accounts you have, such as credit cards, loans, and mortgages.

- Recent Credit Inquiries: The number of times your credit report has been accessed by lenders or creditors in the past year.

Each of these factors carries a different weight in the calculation process. For example, payment history and credit utilization have a significant impact on your credit score, while recent credit inquiries have a relatively smaller effect.

It’s important to note that your credit score is not permanently fixed and can change over time. Regularly monitoring your credit score allows you to stay informed about any changes or discrepancies that may occur, such as identity theft or reporting errors.

Now that we have a grasp on what credit scores are and how they are calculated, let’s explore the importance of checking your credit score regularly.

Importance of Checking Your Credit Score

Checking your credit score regularly is a crucial step towards maintaining a healthy financial life. Here are a few key reasons why it’s important to stay on top of your credit score:

1. Awareness of your financial standing:

By checking your credit score regularly, you gain insight into your current financial health. You can see how lenders perceive you and whether there are any areas for improvement. This awareness allows you to make informed decisions regarding your finances and take appropriate actions to shape your creditworthiness.

2. Detecting and resolving errors:

Credit reporting errors can happen, and they can negatively impact your credit score. By monitoring your credit score, you can quickly identify any discrepancies, such as incorrect payment information or unrecognized accounts. Tackling these errors promptly can prevent lasting damage to your credit profile and save you from potential difficulties when applying for loans or credit cards.

3. Guarding against identity theft:

Identity theft is a significant concern in the digital age. Regularly checking your credit score allows you to detect any unauthorized activities or accounts opened under your name. Being proactive in monitoring your credit score can help you catch identity theft early on, minimizing the potential damage and giving you the opportunity to take necessary steps to mitigate the impact.

4. Setting financial goals:

Your credit score serves as a benchmark for your financial goals. Whether you’re aiming to improve your creditworthiness or qualify for better loan terms, monitoring your credit score can help you track your progress and motivate you to make financial decisions that positively impact your score. It provides clarity on what actions you need to take to achieve your desired financial milestones.

5. Responsibility and accountability:

Regular credit score check-ins promote financial responsibility and accountability. It encourages you to manage your credit responsibly, make timely payments, and keep your credit utilization in check. By keeping an eye on your credit score, you can stay motivated to maintain healthy financial habits and avoid harmful financial pitfalls.

Now that we understand the importance of checking your credit score, let’s explore the various methods provided by Chase to monitor your credit score easily and conveniently.

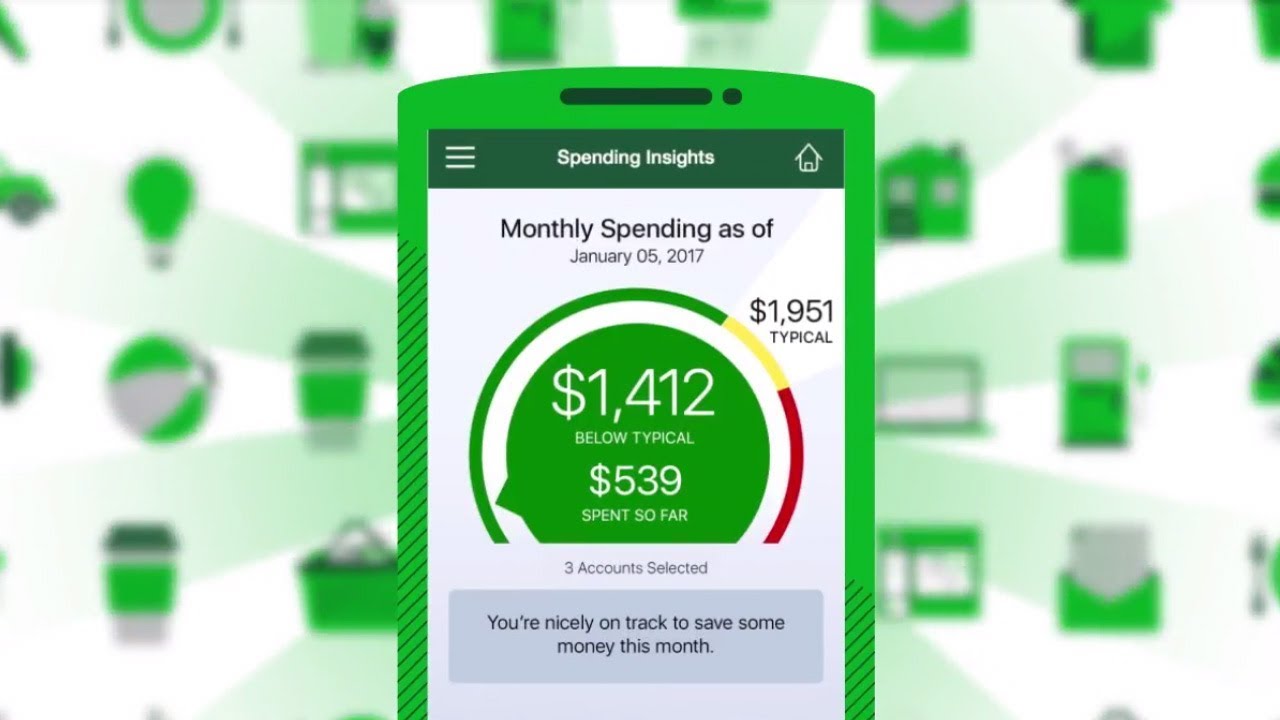

Method 1: Chase Credit Journey

Chase Credit Journey is an online tool provided by Chase that allows you to check and monitor your credit score easily. Here’s how you can access your credit score through Chase Credit Journey:

- First, log in to your Chase online banking account.

- Once logged in, navigate to the “Credit Journey” section, which is usually located under the “Accounts” or “Tools” tab.

- Click on the “Credit Journey” link to access the service.

- Follow the prompts to set up your account if it’s your first time using Chase Credit Journey.

- Once you’ve set up your account, you can view your credit score, as well as key factors affecting it, such as payment history, credit utilization, and more.

Chase Credit Journey also provides other useful features, such as personalized credit insights, credit score simulators, and credit monitoring alerts. These additional tools can help you better understand your credit profile and take proactive steps to improve your creditworthiness.

It’s worth noting that Chase Credit Journey provides you with a VantageScore 3.0, which is a credit scoring model developed by the three major credit bureaus: Equifax, Experian, and TransUnion. While VantageScore is widely accepted, some lenders may still use the FICO scoring model. Therefore, it’s advisable to regularly check your credit score using both Chase Credit Journey and FICO scores to get a complete picture of your creditworthiness.

Now that you know how to access your credit score through Chase Credit Journey, let’s explore another method: using the Chase Mobile App to check your credit score on the go.

Method 2: Chase Mobile App

If you prefer checking your credit score on your mobile device, the Chase Mobile App provides a convenient solution. Here’s how you can access your credit score through the Chase Mobile App:

- Download and install the Chase Mobile App from the App Store or Google Play Store, depending on your device.

- Open the app and log in to your Chase account using your username and password.

- Once logged in, navigate to the “Accounts” or “More” tab.

- Look for the “Credit Journey” or “Credit Score” option and tap on it.

- Follow any additional prompts or security measures to access your credit score.

- Your credit score will be displayed, along with any relevant details or factors affecting it.

The Chase Mobile App offers the same features as the online Credit Journey, including credit insights, simulators, and monitoring alerts. It provides a user-friendly and accessible way to keep track of your credit score, whether you’re at home or on the go.

Remember, just like with Chase Credit Journey, the credit score provided through the Chase Mobile App is based on the VantageScore 3.0 model. While this score is widely used and accepted, it’s important to remember that some lenders may still rely on the FICO scoring model. As a result, it is recommended to regularly check your credit score using both Chase’s VantageScore 3.0 and FICO scores to have a comprehensive view of your creditworthiness.

Now that you know how to access your credit score using the Chase Mobile App, let’s explore another method: checking your credit score through Chase’s Online Banking platform.

Method 3: Chase Online Banking

If you prefer to access your credit score through Chase’s Online Banking platform on your computer or laptop, here’s how you can do it:

- Visit the Chase website and log in to your online banking account using your username and password.

- Once logged in, navigate to the “Accounts Summary” or “Dashboard” page.

- Look for the “Credit Journey” or “Credit Score” section, usually located under the “Tools” or “Account Information” tab.

- Click on the “Credit Journey” or “Credit Score” link to access your credit score.

- If it’s your first time using the service, you may need to follow the prompts to set up your account.

- Once you have access to your credit score, you can view it along with detailed information about the factors affecting your score.

Chase Online Banking offers the same features and benefits as the Chase Credit Journey and Mobile App. You can gain valuable insights into your credit profile, monitor changes in your credit score, and receive alerts about significant events that may impact your creditworthiness.

Just like the other methods, it’s important to note that the credit score provided through Chase Online Banking is based on the VantageScore 3.0 model. While this score is widely used and accepted, it’s good practice to regularly check your credit score using both Chase’s VantageScore 3.0 and FICO scores to get a more comprehensive understanding of your creditworthiness.

Now that you know how to access your credit score through Chase’s Online Banking platform, let’s explore another avenue: requesting your credit report directly.

Method 4: Requesting Your Credit Report

In addition to checking your credit score through Chase’s tools and services, it’s important to review your complete credit report periodically. Your credit report provides a detailed record of your credit history and is used by lenders to assess your creditworthiness. Here’s how you can request your credit report:

- Visit AnnualCreditReport.com, which is the official website authorized by the U.S. government to provide free credit reports.

- Click on the “Request your free credit reports” button.

- Fill out the required information, including your name, address, date of birth, and social security number.

- Choose which credit reporting agencies you want to request your report from. The three major credit bureaus are Equifax, Experian, and TransUnion.

- Submit your request and verify your identity through the provided verification process.

- Once your identity is confirmed, you will be able to access and download your credit reports from each of the credit bureaus.

Reviewing your credit report allows you to check for any inaccuracies, such as incorrect personal information or fraudulent activities. It also helps you detect any potential issues that may be affecting your creditworthiness, such as missed payments or high credit utilization.

By requesting your credit report from each of the major credit bureaus at least once a year, you can identify any errors and take steps to correct them. Furthermore, monitoring your credit report regularly enables you to detect any signs of identity theft and take immediate action to mitigate the impact.

While your credit report does not provide you with a credit score, it is an important component in assessing your financial health. By combining your credit score from Chase’s tools with the detailed information in your credit report, you can gain a comprehensive understanding of your creditworthiness and take the necessary actions to improve it.

Now that we have discussed the methods of checking your credit score and obtaining your credit report, let’s delve into the benefits of regularly monitoring your credit score.

Benefits of Regularly Checking Your Credit Score

Regularly checking your credit score is essential for staying on top of your financial health. Here are several benefits of monitoring your credit score on a consistent basis:

1. Early detection of errors or discrepancies:

By checking your credit score regularly, you can quickly identify any errors or discrepancies on your credit report. Whether it’s an incorrect payment record or a fraudulent account, catching these issues early allows you to take prompt action to correct them and prevent further damage to your creditworthiness.

2. Protection against identity theft:

Monitoring your credit score enables you to detect any unauthorized activities or accounts that may indicate identity theft. Identifying and addressing these issues promptly can help minimize potential financial harm and protect your identity.

3. Awareness of your creditworthiness:

Regularly checking your credit score provides insight into your creditworthiness and how lenders perceive you. It helps you understand where you stand financially and what areas you may need to improve on to strengthen your credit profile.

4. Opportunity to identify areas for improvement:

By monitoring your credit score, you can identify specific factors that may be negatively affecting your creditworthiness. Whether it’s a high credit utilization ratio or late payments, recognizing these areas for improvement allows you to take steps to address them and enhance your credit score over time.

5. Preparedness for major financial decisions:

When you regularly check your credit score, you are better positioned to make informed financial decisions. Whether you’re considering applying for a mortgage, car loan, or credit card, having a good understanding of your creditworthiness allows you to have realistic expectations and negotiate better terms.

6. Motivation to maintain good financial habits:

Monitoring your credit score serves as a reminder to practice healthy financial habits. When you see the positive impact of responsible credit management on your credit score, it can motivate you to continue making timely payments, reducing debt, and maintaining a good credit utilization ratio.

Regularly checking your credit score ensures that you are aware of any changes, proactive in protecting your credit, and actively working towards improving your financial standing. By staying on top of your credit score, you can take control of your financial future and make informed decisions that positively impact your creditworthiness.

Now, let’s explore some tips for improving your credit score and maintaining a healthy financial profile.

Tips for Improving Your Credit Score

If you want to improve your credit score and enhance your creditworthiness, there are several steps you can take. Here are some helpful tips to get you started:

1. Pay your bills on time:

Consistently making on-time payments is one of the most important factors in building good credit. Set up automatic payments or reminders to ensure you never miss a payment.

2. Reduce your credit card balances:

Keep your credit card utilization ratio below 30% by paying down your balances. This shows lenders that you are responsible in managing your credit and can positively impact your credit score.

3. Avoid applying for too much new credit:

Applying for multiple credit cards or loans within a short period of time can negatively affect your credit score. Only apply for new credit when necessary and be mindful of how it may impact your overall creditworthiness.

4. Maintain a mix of different types of credit:

Having a mix of credit accounts, such as credit cards, loans, and mortgages, shows lenders that you can handle different types of credit responsibly. However, only take on credit that you can manage comfortably.

5. Regularly review your credit report:

Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at least once a year to ensure the information is accurate. Dispute any errors or fraudulent accounts promptly to protect your credit.

6. Keep old accounts open:

Length of credit history is an important factor in calculating your credit score. Instead of closing old accounts, keep them open and occasionally use them to maintain a positive credit history.

7. Be patient and consistent:

Improving your credit score takes time and small, consistent steps. Be patient and continue practicing good credit habits to see long-term improvement in your creditworthiness.

By implementing these tips and maintaining good financial habits, you can improve your credit score over time. Remember that building good credit is a journey, and it requires discipline and responsible credit management.

Now that we have covered tips for improving your credit score, let’s wrap up this guide.

Conclusion

Monitoring your credit score is a crucial part of maintaining a healthy financial life. With Chase’s tools and services, such as Chase Credit Journey, the Chase Mobile App, and Online Banking, checking your credit score has never been easier or more convenient.

Regularly checking your credit score provides numerous benefits, including early detection of errors or discrepancies, protection against identity theft, awareness of your creditworthiness, and the opportunity to identify areas for improvement. It also prepares you for major financial decisions and motivates you to maintain good financial habits.

In addition to checking your credit score, requesting your free credit report annually from AnnualCreditReport.com allows you to review your complete credit history and identify any inaccuracies or signs of identity theft.

To improve your credit score, focus on making on-time payments, reducing credit card balances, avoiding excessive new credit applications, maintaining a mix of credit types, and regularly reviewing your credit report for accuracy. These steps, combined with patience and consistency, can help you enhance your creditworthiness over time.

Remember, building good credit is a journey that requires responsible credit management. By being proactive and staying informed about your credit score, you can take control of your financial future and make well-informed decisions.

So, whether you choose to access your credit score through Chase Credit Journey, the Chase Mobile App, Online Banking, or by requesting your credit report, take the first step in monitoring and improving your credit score today!