Home>Finance>How Often Do Insurance Companies Check Driving Records

Finance

How Often Do Insurance Companies Check Driving Records

Published: November 22, 2023

Find out how often insurance companies check driving records and the impact it can have on your finances. Stay informed and save money on your car insurance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Driving Records

- Importance of Driving Records for Insurance Companies

- Frequency of Checking Driving Records

- Factors that Affect the Frequency of Checking

- Common Methods Insurance Companies Use to Check Driving Records

- Consequences of Poor Driving Records on Insurance Premiums

- Tips for Maintaining a Clean Driving Record

- Conclusion

Introduction

Welcome to the world of insurance, where your driving record can have a significant impact on your premiums. Insurance companies rely on a variety of factors to determine the cost of your coverage, and one of the most important factors is your driving record. In this article, we will explore the frequency with which insurance companies check driving records and why it is crucial for them to do so.

Driving records are a comprehensive record of an individual’s driving history. They include information such as traffic violations, accidents, and any other incidents that may have occurred while operating a motor vehicle. Insurance companies consider this information as it provides valuable insights into an individual’s driving behavior and level of risk on the road.

For insurance companies, assessing the risk associated with an individual’s driving record is vital when determining insurance premiums. Drivers with a history of traffic violations or accidents are considered higher risk and are more likely to be involved in future incidents. Therefore, insurance companies need to regularly check driving records to ensure accurate pricing and minimize potential losses.

The frequency at which insurance companies check driving records can vary. Some companies may check driving records annually, while others may do it more frequently, such as every six months or even quarterly. The decision on the frequency of checks depends on several factors that we will discuss in detail later in this article.

It is important to understand that insurance companies have a responsibility to protect their policyholders and manage risks effectively. By regularly reviewing driving records, they can accurately assess the level of risk and adjust insurance premiums accordingly. This ensures that low-risk drivers are not subsidizing high-risk drivers and promotes fairness in the insurance industry.

In the next sections, we will dive deeper into the importance of driving records for insurance companies, the factors that influence the frequency of checking driving records, the common methods used by insurance companies to check driving records, and the consequences of poor driving records on insurance premiums. We will also provide some helpful tips on how to maintain a clean driving record. So, let’s get started!

Understanding Driving Records

A driving record is a documented history of an individual’s driving activities. It contains information on traffic violations, accidents, license suspensions, and any other incidents involving the driver and their interactions with the law while operating a motor vehicle. These records are maintained by the Department of Motor Vehicles (DMV) or a similar governmental agency in each state or jurisdiction.

Driving records serve as a comprehensive summary of an individual’s driving behavior and can provide valuable insights into their level of risk on the road. Insurance companies use these records to assess the likelihood of an individual being involved in accidents or traffic violations in the future.

The information found on a driving record typically includes the following:

- License status and expiration date

- Traffic violations such as speeding tickets, red light violations, and DUI offenses

- Accidents and collisions, including fault determination

- License suspensions or revocations

- Points assessed against the driver’s license for infractions

- Driver’s personal information, such as name, date of birth, and address

It is important to note that driving records are public records, meaning they can be accessed by insurance companies, potential employers, and law enforcement agencies. Insurance companies utilize these records to evaluate the level of risk associated with an individual and determine appropriate insurance premiums.

Driving records are typically maintained for a specific period, depending on state regulations. In many cases, minor infractions and violations will remain on a driving record for a certain number of years, while more serious offenses may have a longer-lasting impact.

As a driver, it is essential to review your driving record occasionally to ensure its accuracy. Mistakes or incorrect information on your driving record could affect your ability to obtain insurance coverage or result in higher premiums. If you notice any discrepancies, it is recommended to contact your local DMV or relevant authority to have the errors corrected.

Now that we have a better understanding of what driving records entail, let us explore why insurance companies place such importance on reviewing these records regularly.

Importance of Driving Records for Insurance Companies

Driving records play a crucial role in the insurance industry as they provide valuable insights into an individual’s driving behavior and level of risk on the road. Insurance companies rely on these records to assess the likelihood of an individual being involved in accidents or traffic violations in the future. Here are the key reasons why driving records are of utmost importance:

1. Risk Assessment: Insurance companies use driving records to assess the risk associated with insuring a particular individual. By reviewing a driver’s history of traffic violations, accidents, and other incidents, insurers can make informed decisions about the likelihood of future claims. Drivers with a clean driving record are generally seen as lower risk compared to those with a history of violations or accidents, and as a result, they may receive lower insurance premiums.

2. Pricing Accuracy: Accurate pricing is essential for insurance companies to remain profitable and financially stable. By regularly checking driving records, insurers can adjust premiums based on the level of risk associated with an individual. If a driver’s record indicates a higher likelihood of future accidents or violations, their premiums may increase to reflect the increased risk they pose.

3. Fraud Detection: Driving records also help insurance companies detect potential fraudulent claims. Individuals with a history of frequent accidents or traffic violations may raise red flags for insurers. By closely scrutinizing their driving records, insurers can identify patterns of suspicious behavior and take appropriate measures to prevent fraudulent claims.

4. Maintaining Fairness: Regularly checking driving records helps insurance companies ensure fairness within their customer base. By accurately assessing an individual’s risk level, insurers can ensure that low-risk drivers are not subsidizing high-risk drivers. This promotes equity in insurance pricing and allows insurers to provide competitive rates to responsible drivers.

Insurance companies typically have access to various resources, such as driving record databases and reports from the Department of Motor Vehicles (DMV), to obtain up-to-date information on a driver’s history. These records are carefully analyzed to determine the appropriate premiums for each policyholder and to manage risk effectively.

In the next section, we will delve into the frequency with which insurance companies check driving records and the factors that influence this frequency.

Frequency of Checking Driving Records

The frequency at which insurance companies check driving records can vary depending on a variety of factors. While some insurance companies may conduct checks annually, others may do so more frequently, such as every six months or even quarterly. The decision on how often to check driving records is influenced by several key factors:

1. Individual Insurance Company Policies: Each insurance company has its own policies and practices regarding the frequency of checking driving records. Some companies prioritize regular checks to ensure accurate pricing and risk assessment, while others may opt for less frequent checks. It is important to note that insurance companies are required to comply with state regulations regarding record checking intervals.

2. State Regulations: State regulations can play a role in determining the frequency of driving record checks. Some states may have specific guidelines that require insurance companies to check driving records at regular intervals to maintain compliance with insurance laws and regulations.

3. Risk Factors: Insurance companies may conduct more frequent driving record checks for individuals who exhibit higher-risk behaviors or have a history of traffic violations or accidents. These individuals pose a greater risk to the insurer, and more frequent checks enable the company to adjust premiums accordingly.

4. Policy Renewal Periods: Insurance companies often check driving records when policyholders renew their insurance coverage. This ensures that any recent changes or incidents are taken into account when determining premiums for the next policy term.

5. Significant Life Events: Certain significant life events, such as moving to a new state, purchasing a new vehicle, or adding a new driver to a policy, may trigger a driving record check by the insurance company. These events can impact insurance premiums, and the check helps the insurer assess the new risk factors associated with the changes.

It is worth noting that insurance companies are not constantly monitoring driving records in real-time. Rather, they typically conduct periodic checks as outlined by their policies and state regulations. During these checks, insurance companies obtain updated information on a driver’s history, allowing them to adjust premiums and assess risk accurately.

Regular driving record checks serve as a mechanism for insurance companies to stay up to date with an individual’s driving behavior and ensure that their premiums are reflective of their level of risk on the road. By doing so, insurance companies can maintain fairness among policyholders and manage risks effectively.

In the next section, we will explore the common methods that insurance companies use to check driving records.

Factors that Affect the Frequency of Checking

The frequency at which insurance companies check driving records can vary based on several key factors. These factors influence the decision to check driving records more or less frequently for individual policyholders. Understanding these factors can provide insight into why some individuals may undergo more frequent checks than others. Here are the factors that affect the frequency of checking driving records:

1. Driving History: The driving history of an individual is a significant factor that can impact the frequency of driving record checks. Insurance companies are more likely to conduct frequent checks for policyholders with a history of traffic violations, accidents, or other incidents. These individuals tend to be categorized as higher-risk drivers, and insurers need to closely monitor their driving records to assess the ongoing level of risk.

2. Age and Experience: Younger and less experienced drivers are often subject to more frequent driving record checks. Insurance companies recognize that new drivers may be more prone to accidents and violations due to their lack of experience on the road. As these drivers gain more experience and develop a safer driving record, the frequency of record checks may reduce over time.

3. Policy Type: The type of insurance policy can also impact the frequency of driving record checks. High-risk policies, such as those for sports car owners or drivers with a history of DUI offenses, may undergo more frequent checks. These policies carry a higher level of risk, and insurers need to closely monitor the driving behavior and history of these policyholders to assess ongoing risk accurately.

4. Claims History: Individuals with a history of filing insurance claims may undergo more frequent driving record checks. Insurance companies want to assess the ongoing risk associated with policyholders who have had recent claims, as this may indicate a higher likelihood of future claims. By monitoring driving records, insurers can adjust premiums based on the level of risk associated with individuals who have a history of claims.

5. Significant Life Events: Certain life events can trigger more frequent driving record checks. Events such as moving to a new state, purchasing a new vehicle, or adding a new driver to a policy can prompt insurance companies to conduct checks to assess the new risk factors associated with these changes. These checks ensure that insurance premiums accurately reflect the updated circumstances of the policyholder.

6. State Regulations: State regulations can also impact the frequency of driving record checks. Some states have specific guidelines that require insurance companies to check driving records at regular intervals to maintain compliance with insurance laws and regulations.

It is important to note that the frequency of driving record checks may vary between insurance companies. Each insurance company has its own policies and practices regarding how frequently they check driving records. These policies should comply with state regulations and are designed to accurately assess risk and determine appropriate insurance premiums.

Now that we understand the factors that influence the frequency of checking driving records, let’s explore the common methods insurance companies use to check these records in the next section.

Common Methods Insurance Companies Use to Check Driving Records

Insurance companies employ various methods to check driving records and gather the necessary information to assess the risk associated with individual policyholders. These methods ensure that insurers have accurate and up-to-date data on a driver’s history. Here are some common methods used by insurance companies to check driving records:

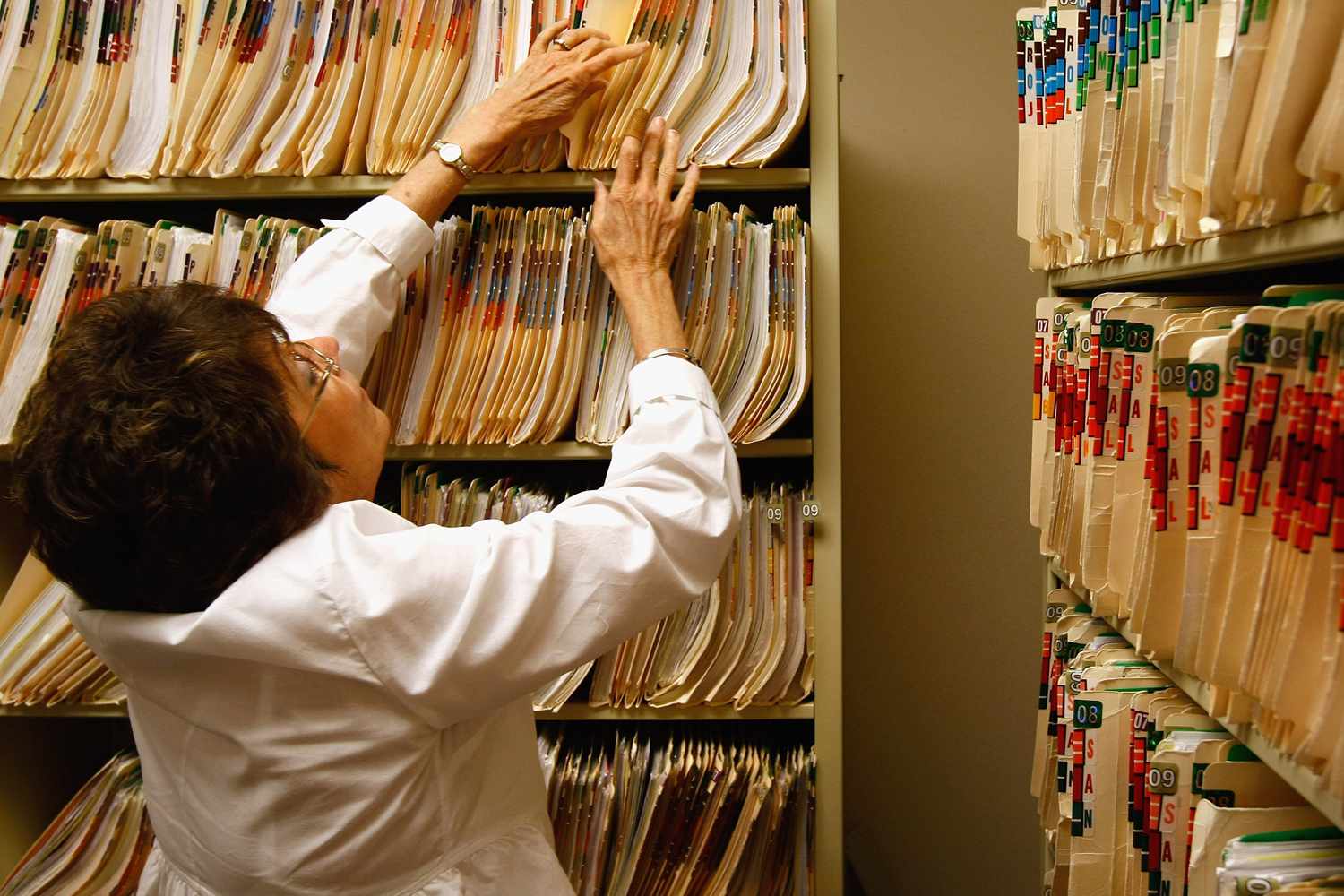

1. Department of Motor Vehicles (DMV) Records: Insurance companies often rely on DMV records to obtain driving history information. They have access to DMV databases, which provide comprehensive records of an individual’s driving history, including traffic violations, accidents, license suspensions, and other relevant data. Insurance companies can request these records to assess an individual’s risk profile.

2. Online Driving Record Checks: Insurance companies may also utilize online portals or services to obtain driving record information. These online platforms allow insurers to access driving records quickly and efficiently. Through these services, insurers can obtain driving history information such as violations, accidents, and license status in a convenient manner.

3. Driving Record Reports from Insurance Bureau: There are specialized insurance bureaus that provide driving record reports to insurance companies. These bureaus compile driving record information and generate reports that include details such as traffic violations, accidents, and license status. Insurers can request these reports to assess an individual’s driving behavior history and determine appropriate premiums.

4. Self-Reporting by Policyholders: Insurance companies often rely on policyholders to self-report any changes or incidents that may impact their driving record. Policyholders are typically required to disclose any new violations, accidents, or license suspensions when renewing or applying for insurance coverage. Insurers may then verify this information by checking the driving record directly or through other methods mentioned above.

5. Third-Party Reporting Services: Insurance companies may also utilize third-party reporting services to obtain driving record information. These services specialize in collecting driving history data and provide reports to insurers. They gather information from various sources, including DMV records, court records, and public safety databases, to create comprehensive reports that insurers can use to assess risk.

It is important to note that insurance companies have legal access to driving record information, in accordance with privacy laws and regulations. They use the collected data solely for the purpose of determining insurance premiums and assessing risk. Policyholders’ driving records are treated confidentially and are only shared with authorized entities involved in the insurance process.

By using these common methods to check driving records, insurance companies can gather accurate driving history information and assess the risk associated with individual policyholders. This allows them to adjust premiums accordingly and maintain fairness in the insurance industry.

In the next section, we will discuss the consequences of poor driving records on insurance premiums.

Consequences of Poor Driving Records on Insurance Premiums

A poor driving record can have significant consequences on insurance premiums. Insurance companies consider driving records as a vital factor when determining coverage costs. Drivers with a history of traffic violations, accidents, or other incidents may face higher premiums due to the increased level of risk they pose. Here are the key consequences of having a poor driving record on insurance premiums:

1. Increased Premiums: Insurance companies view drivers with poor records as higher risk, which often results in higher insurance premiums. Policyholders who have a history of traffic violations or accidents are more likely to file claims in the future, leading insurers to charge higher premiums to offset the increased risk of payouts.

2. Policy Exclusions: In some cases, insurance companies may choose to exclude coverage for specific incidents or drivers with poor driving records. For example, a policyholder with multiple DUI offenses may be excluded from coverage for any alcohol-related incidents. These exclusions serve as a way for insurers to mitigate potential losses associated with high-risk behaviors.

3. Difficulties in Obtaining Coverage: Poor driving records can make it challenging for individuals to find insurance coverage. Some insurance companies may view drivers with a history of numerous violations or accidents as too high-risk to insure. This can result in limited options and higher costs if coverage is obtained from specialized or high-risk insurance carriers.

4. Loss of Discounts: Many insurance companies offer discounts to drivers with clean records or a history of responsible driving. These discounts can significantly reduce insurance premiums. However, a poor driving record may lead to the loss of these discounts, resulting in higher overall premiums.

5. Difficulty Switching Insurers: Switching insurers with a poor driving record can be challenging. Insurance companies often consider driving history during the underwriting process, and a negative record may lead to higher quotes or limited options when seeking coverage from a new provider.

6. Impact on Future Insurability: A poor driving record can have long-term consequences on future insurability. Insurers may review an individual’s driving history for several years, especially for major violations or accidents. Poor records can make it more difficult to obtain affordable coverage in the future, as insurers may see the individual as a higher risk for claims.

It is important to note that the specific consequences of a poor driving record can vary depending on individual circumstances and insurance company policies. However, maintaining a clean driving record and practicing safe driving habits can help mitigate these consequences and potentially lower insurance premiums over time.

In the next section, we will provide some helpful tips for maintaining a clean driving record and keeping insurance premiums affordable.

Tips for Maintaining a Clean Driving Record

A clean driving record not only ensures safer roads but can also help keep your insurance premiums affordable. Here are some valuable tips to help you maintain a clean driving record:

1. Obey Traffic Laws: Follow all traffic laws, including speed limits, traffic signals, and road signs. Stay aware of changing road conditions and adjust your driving accordingly to avoid violations.

2. Practice Defensive Driving: Be proactive on the road by anticipating potential hazards and avoiding dangerous situations. Maintain a safe distance from other vehicles, use your mirrors and signals effectively, and always be aware of your surroundings.

3. Avoid Distractions: Keep your focus on the road by avoiding distractions such as using your phone, eating, or grooming while driving. These distractions can significantly increase the risk of accidents and violations.

4. Don’t Drink and Drive: Never operate a vehicle under the influence of alcohol or drugs. Driving impaired not only puts lives at risk but also carries severe legal consequences and can lead to a significant increase in insurance premiums.

5. Take Defensive Driving Courses: Consider enrolling in defensive driving courses. These courses can help improve your driving skills, provide valuable knowledge on safe driving techniques, and may even offer insurance premium discounts upon completion.

6. Regular Vehicle Maintenance: Keep your vehicle in good working condition by following the manufacturer’s recommended maintenance schedule. Regular maintenance and inspections can help prevent breakdowns and accidents resulting from mechanical failures.

7. Be Mindful of Weather Conditions: Adjust your driving habits based on weather conditions. Reduce your speed, increase following distances, and use appropriate signals when driving in adverse weather such as rain, snow, or fog.

8. Remain Calm and Patient: Avoid aggressive driving behaviors such as speeding, tailgating, or excessive honking. Practice patience and respect other drivers on the road, even in frustrating situations.

9. Regularly Check Your Driving Record: Periodically review your driving record to ensure its accuracy. If you notice any errors or discrepancies, contact the Department of Motor Vehicles or relevant authority to have them corrected.

10. Avoid Unnecessary Risks: Avoid taking unnecessary risks on the road, such as engaging in street racing or participating in dangerous driving behaviors. These actions not only endanger lives but can also lead to severe consequences, including license suspensions and increased insurance premiums.

Remember, maintaining a clean driving record is an ongoing effort that requires discipline and responsible driving habits. By following these tips, you can reduce the risk of accidents and violations, and ultimately, keep your insurance premiums affordable.

Now that we’ve covered tips for maintaining a clean driving record, let’s conclude the article.

Conclusion

Your driving record plays a crucial role in determining your insurance premiums and the level of risk you present to insurance companies. Insurance companies regularly check driving records to assess the likelihood of accidents, violations, and claims. Factors such as driving history, age, and policy type can influence the frequency of these checks.

Insurance companies use various methods, including DMV records, online checks, and third-party reporting services, to gather accurate driving history information. Poor driving records can lead to increased premiums, policy exclusions, and difficulties when seeking coverage. However, maintaining a clean driving record is achievable by following important tips:

Obey traffic laws, practice defensive driving, avoid distractions, never drink and drive, and consider taking defensive driving courses. Regular vehicle maintenance, being mindful of weather conditions, practicing patience, and avoiding unnecessary risks are also important. Regularly checking your driving record ensures its accuracy and allows you to address any errors promptly.

A clean driving record not only helps keep the roads safer but can also lead to more affordable insurance premiums. Remember that responsible driving habits should be maintained consistently to benefit from a clean record.

So, be mindful of your driving behavior, stay up-to-date with traffic laws, and strive to maintain a clean driving record. By doing so, you can enjoy the benefits of lower insurance premiums, better coverage options, and peace of mind knowing that you are a responsible and safe driver.

Safe travels!