Home>Finance>Domestic Production Activities Deduction Definition

Finance

Domestic Production Activities Deduction Definition

Published: November 13, 2023

Learn the definition and benefits of the Domestic Production Activities Deduction in finance, and how it can optimize your tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Benefits of the Domestic Production Activities Deduction

When it comes to maximizing your financial opportunities, understanding the intricacies of tax laws is key. One area that can provide significant advantages for businesses in the United States is the Domestic Production Activities Deduction (DPAD). In this article, we will explore the definition of DPAD and how it can benefit your organization.

Key Takeaways:

- The Domestic Production Activities Deduction (DPAD) is a tax incentive provided to eligible businesses engaged in domestic production activities.

- DPAD allows eligible businesses to deduct a percentage of their qualified production income, reducing their overall tax liability.

What is the Domestic Production Activities Deduction?

The Domestic Production Activities Deduction, commonly referred to as DPAD, is a tax deduction designed to incentivize and encourage domestic production activities within the United States. It was introduced as part of the American Jobs Creation Act of 2004 and has since provided substantial benefits to eligible businesses across various industries.

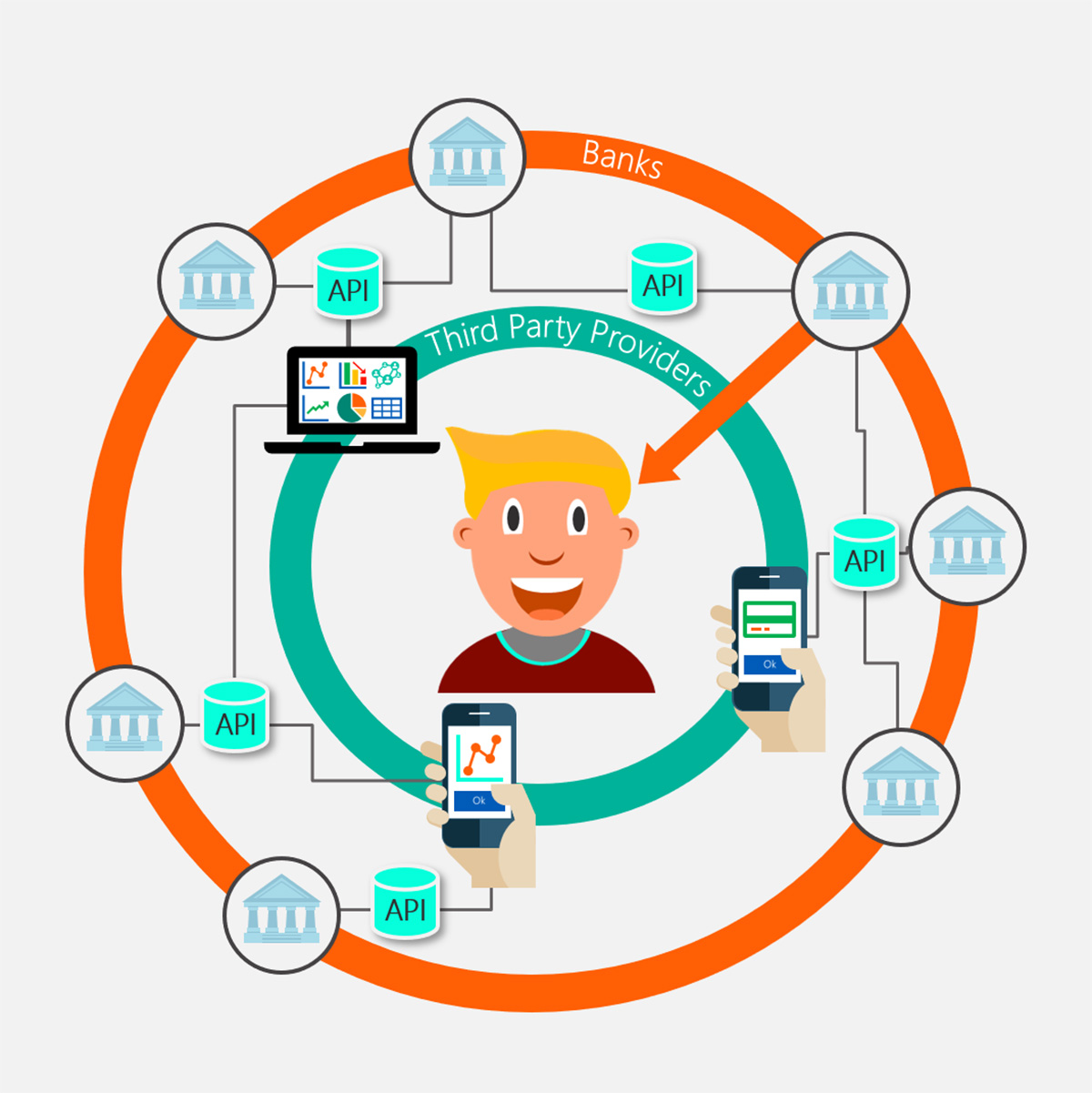

DPAD is available to businesses that engage in qualified production activities, such as manufacturing, construction, engineering, and even software development. By meeting the necessary criteria, businesses can claim a percentage deduction on their qualified production income, effectively reducing their overall tax liability.

How Does DPAD Benefit Your Business?

1. Tax Savings: The primary advantage of DPAD is the potential tax savings it offers to eligible businesses. By reducing your tax liability, DPAD can free up additional funds that can be reinvested into your business growth or used for other strategic purposes.

2. Promote Domestic Production: DPAD serves as a catalyst for promoting and supporting domestic production activities. By incentivizing businesses to engage in manufacturing, construction, and other related activities within the United States, DPAD contributes to the growth of the national economy and job creation.

How Can You Qualify for DPAD?

To qualify for DPAD, your business must meet specific criteria as defined by the Internal Revenue Service (IRS). These criteria include:

- Engagement in qualified production activities: Your business must be involved in manufacturing, construction, engineering, software development, or other qualifying activities.

- Domestic production: The qualifying activities must occur within the United States.

- W-2 wages and qualified production property: Your business must have sufficient W-2 wages and/or have invested in qualified production property.

- Proper documentation: It is essential to keep accurate records and documentation to support your eligibility for DPAD. This includes maintaining records of your qualified production activities and related expenses.

Conclusion

The Domestic Production Activities Deduction (DPAD) can be a powerful tool for eligible businesses looking to reduce their tax liability and promote domestic production. By understanding the definition of DPAD, the potential benefits, and the qualification criteria, you can leverage this tax incentive to unlock new financial opportunities for your organization. Consult with a tax professional to determine if your business qualifies for DPAD and to explore how you can strategically incorporate it into your overall financial planning.