Home>Finance>Why Is A Credit Check Required For Postpaid Service

Finance

Why Is A Credit Check Required For Postpaid Service

Modified: March 5, 2024

Find out why a credit check is necessary for postpaid service and how it impacts your finances. Learn more about the importance of credit in managing your postpaid accounts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When signing up for a postpaid service, such as a mobile phone plan or a monthly subscription service, it is common for service providers to require a credit check. You may wonder why this is necessary, especially if you have a good payment history and a stable income. Understanding the reasons behind credit checks for postpaid services can help you see why they are an essential part of the process.

Postpaid services allow consumers to use the service or product first and pay later. Unlike prepaid services where payment is made upfront, postpaid services offer the convenience of enjoying the service prior to settling the bill. This billing model creates a level of trust and risk for the service provider, as they are extending credit to the consumer with the expectation of being paid at a later date. To mitigate this risk, service providers typically request a credit check to assess the applicant’s creditworthiness.

A credit check involves evaluating an individual’s credit history and credit score to determine their ability to make timely payments. This assessment provides insight into their financial responsibility and helps service providers make informed decisions about whether or not to extend credit.

While credit checks may seem like an inconvenience for some, they play a crucial role in protecting service providers and ensuring the sustainability of postpaid services. This article explores the importance of credit checks for postpaid services, their benefits for service providers, and alternative options for individuals with less than perfect credit.

Understanding Postpaid Services

Before delving into the importance of credit checks for postpaid services, it is essential to have a clear understanding of what postpaid services entail. In simple terms, postpaid services are subscription-based plans where users are billed monthly for the services they have used. Common examples of postpaid services include mobile phone plans, internet services, cable TV subscriptions, and utility bills.

Unlike prepaid services, where users must pay in advance for a specific amount of usage, postpaid services allow users to utilize the service throughout the designated billing period and settle the bill at the end. This billing model grants users the flexibility and convenience of paying for the services after they have been utilized.

Postpaid services often come with various benefits, such as unlimited usage, discounted rates, and additional features that prepaid services may not offer. The creditworthiness of an individual plays a significant role in determining their eligibility for postpaid services. When applying for a postpaid plan, service providers evaluate an individual’s financial history and determine if they pose an acceptable level of risk.

It is important to note that postpaid services are contractual agreements between the user and the service provider. The user agrees to pay the designated amount, typically on a monthly basis, and adhere to the terms and conditions outlined by the service provider. By conducting a credit check, service providers aim to assess the individual’s ability to fulfill their contractual obligations and make timely payments.

With a solid understanding of postpaid services, we can now dive into the specific reasons why credit checks are imperative in this context. The next section explores the importance of credit checks and how they contribute to the overall functionality and stability of postpaid services.

Importance of Credit Checks

Credit checks are vital for postpaid service providers as they provide crucial insights into an individual’s financial stability and creditworthiness. Here are some key reasons why credit checks are important:

1. Assessing Creditworthiness: Credit checks allow service providers to evaluate an applicant’s credit history, including their payment patterns, outstanding debts, and credit utilization. This assessment helps determine whether the applicant has a history of making timely payments and managing their credit responsibly. A good credit history indicates a higher likelihood of paying bills on time, reducing the risk for the service provider.

2. Minimizing Financial Risk: By conducting credit checks, service providers can mitigate the risk of extending credit to individuals who may have a poor credit history or a high propensity for delinquency. This risk assessment helps protect the financial stability of the service provider and ensures that they are not exposed to excessive losses due to unpaid bills.

3. Setting Credit Limits: Based on the information obtained from credit checks, service providers can determine the appropriate credit limit for each applicant. This helps in maintaining a balance between offering a sufficient credit limit to meet the user’s needs while also ensuring responsible lending practices.

4. Preventing Fraudulent Activity: Credit checks help service providers identify potential fraudulent activities or suspicious behavior. This includes detecting instances of identity theft, where someone might attempt to use another person’s identity to obtain postpaid services without the intention of paying the bills. By verifying an applicant’s credit information, service providers can reduce the risk of fraudulent accounts being opened.

5. Establishing Trust and Security: For postpaid service providers, maintaining trust and security in their customer relationships is paramount. Conducting credit checks instills confidence in both the service provider and the customer. It ensures that individuals who are granted postpaid services have a proven track record of responsible financial behavior, reducing the risk of defaults and unpaid bills.

By considering these factors, it becomes clear why credit checks play a vital role in the selection and evaluation process of postpaid service providers. In the next section, we will explore how credit checks are conducted and the specific elements that service providers assess in an individual’s credit history.

Assessing Creditworthiness

When conducting a credit check for postpaid services, service providers assess an individual’s creditworthiness to determine their suitability for extending credit. This assessment involves analyzing various aspects of an individual’s credit history and financial background. Here are some key factors that service providers typically consider when assessing creditworthiness:

1. Credit Score: A credit score is a numerical representation of an individual’s creditworthiness. It is based on their credit history, payment patterns, outstanding debts, and other financial information. Service providers evaluate an applicant’s credit score to gauge their level of financial responsibility. A higher credit score indicates a lower risk for the service provider and increases the likelihood of approval for postpaid services.

2. Payment History: Service providers review an individual’s payment history to ascertain if they have a consistent record of making timely payments. Late payments, defaults, and delinquencies may raise concerns about an individual’s ability to fulfill their financial obligations and may result in a lower creditworthiness assessment.

3. Credit Utilization Ratio: The credit utilization ratio represents the proportion of an individual’s available credit that they have utilized. High credit utilization can indicate a dependence on credit and potential financial strain, which may impact creditworthiness. Service providers typically look for applicants with a manageable credit utilization ratio.

4. Outstanding Debts: The amount of outstanding debts an individual carries can influence creditworthiness. High levels of existing debt may indicate a higher risk for service providers, as it might impact an individual’s ability to pay their postpaid service bills consistently.

5. Length of Credit History: The length of an individual’s credit history is often a consideration in creditworthiness assessments. A longer credit history provides a more extensive record of financial behavior, allowing service providers to gain insights into an applicant’s long-term financial habits.

6. Public Records and Collections: Service providers also check for any public records or outstanding collections associated with an applicant. Bankruptcies, liens, and judgments may negatively impact creditworthiness and could result in a denial of postpaid services.

By evaluating these factors, service providers can form a comprehensive picture of an individual’s creditworthiness. This assessment helps them make informed decisions about extending credit for postpaid services. In the following sections, we will explore the benefits that credit checks offer for postpaid service providers and the potential risks they help mitigate.

Benefits of Credit Checks for Postpaid Service Providers

Credit checks provide several key benefits for postpaid service providers. These checks allow providers to make informed decisions about extending credit to individuals and help ensure the profitability and sustainability of their business. Here are some significant advantages of credit checks:

1. Minimizing Financial Risk: By assessing an individual’s creditworthiness, service providers can minimize the risk of extending credit to customers who are unable or unlikely to pay their bills. This helps protect the financial stability of the provider by reducing the occurrence of payment defaults and unpaid balances.

2. Predicting Payment Behavior: Credit checks provide insights into an individual’s payment history and credit management. This information helps service providers predict an applicant’s future payment behavior. By evaluating an individual’s financial responsibility, providers can identify those who are likely to make timely payments, reducing the risk of delinquency and default.

3. Tailoring Credit Offers: Credit checks aid service providers in tailoring credit offers to individuals based on their creditworthiness. Applicants with strong credit histories may be eligible for higher credit limits or more competitive pricing on their postpaid services, while those with lower credit scores may receive lower credit limits or specific payment terms to manage risk.

4. Improving Customer Retention: Conducting credit checks helps ensure that service providers are extending postpaid services to individuals who are financially stable. This reduces the likelihood of customers defaulting on payments or experiencing financial difficulties that may lead to service termination. By maintaining a customer base of financially responsible individuals, service providers can improve customer retention and satisfaction.

5. Offering Better Terms and Rewards: Creditworthy customers may qualify for better terms and rewards, such as lower interest rates, discounted rates on additional services, or access to exclusive promotions or perks. By recognizing and rewarding creditworthy customers, service providers can foster customer loyalty and encourage responsible financial behavior.

6. Enhancing Fraud Prevention: Credit checks are an effective tool in detecting and preventing fraudulent activity. By verifying an applicant’s credit history and information, service providers can identify potential cases of identity theft or individuals attempting to obtain postpaid services fraudulently. This protection helps safeguard the provider’s financial interests and enhances overall security.

Overall, credit checks provide postpaid service providers with a valuable risk assessment tool that allows them to make well-informed decisions about extending credit. By minimizing financial risk, predicting payment behavior, tailoring credit offers, improving customer retention, offering better terms and rewards, and enhancing fraud prevention measures, service providers can optimize their operations and provide a secure and reliable postpaid service experience.

Potential Risks and Fraud Prevention

While credit checks play a crucial role in mitigating financial risks for postpaid service providers, it is important to acknowledge that there are still potential risks involved. Understanding these risks and implementing effective fraud prevention measures is essential for maintaining the integrity of the postpaid service system. Here are some potential risks and the corresponding measures to address them:

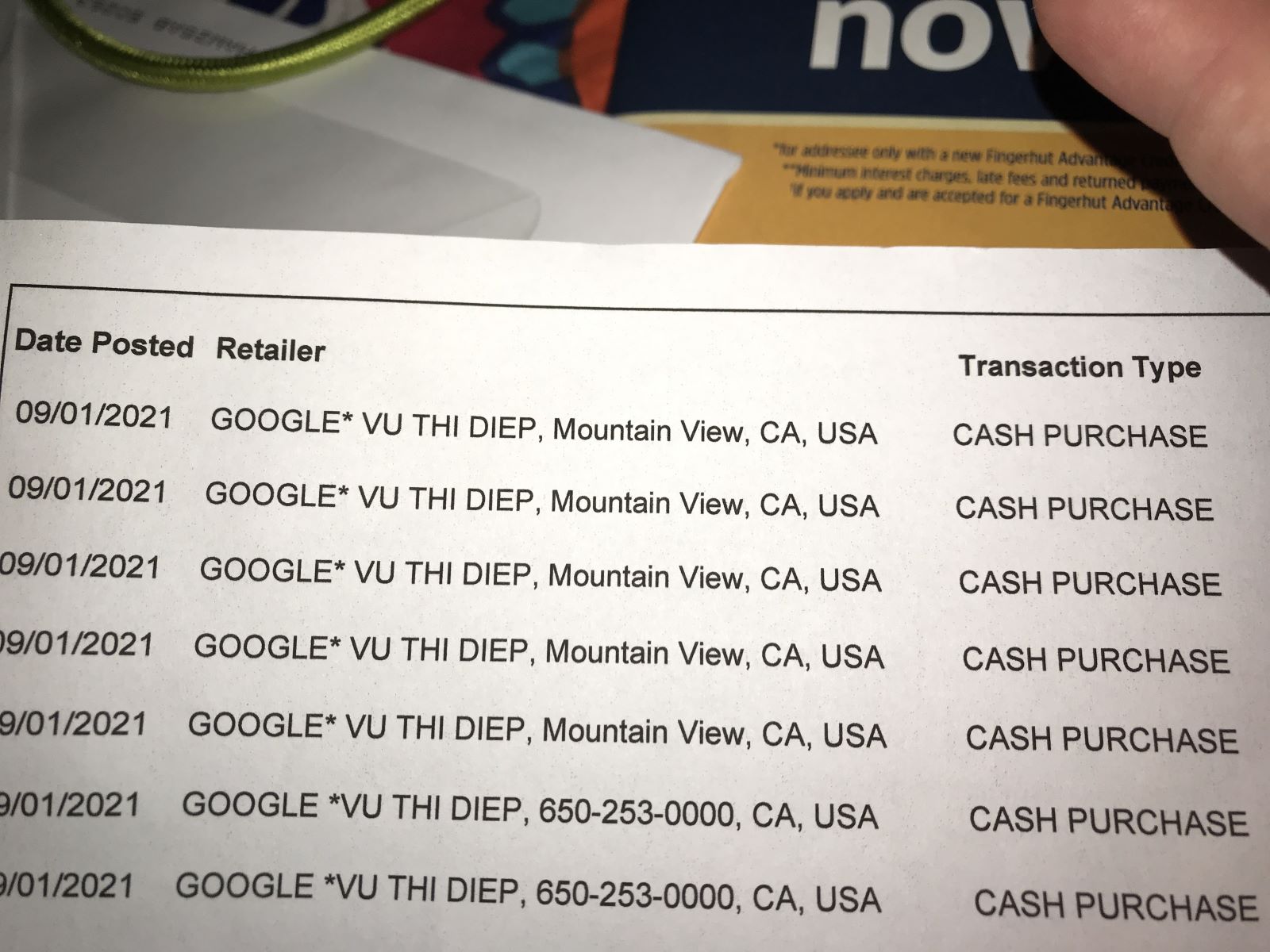

1. Identity Theft: One significant risk is the possibility of identity theft, where an unauthorized individual uses someone else’s personal information to open postpaid service accounts. To combat this risk, service providers implement rigorous identity verification processes during the credit check stage. This may include verifying personal information, cross-referencing with official documents, and utilizing fraud detection tools to ensure that the applicant is who they claim to be.

2. Fraudulent Applications: Fraudulent applications can occur when individuals knowingly provide false or misleading information during the credit check process. Service providers combat this risk by conducting thorough checks of the applicant’s credit history, employment verification, and income documentation. Maintaining strict verification procedures helps identify and reject fraudulent applications.

3. Non-Payment and Delinquency: Despite credit checks, there is always a risk of customers defaulting on payments or becoming delinquent. To minimize this risk, service providers may implement payment reminders, offer flexible payment plans, or require automatic payments. Regular communication with customers regarding outstanding balances and the consequences of non-payment can also help reduce this risk.

4. External Factors: Economic downturns, unforeseen circumstances, or changes in an individual’s financial situation can impact their ability to make timely payments. Service providers need to be prepared for these external factors by offering assistance programs, hardship options, or the ability to temporarily suspend or modify services. This flexibility can help maintain a positive relationship with customers and mitigate risks associated with financial hardships.

5. Continuing Fraud Monitoring: Postpaid service providers must continually monitor customer accounts and credit activities to identify any suspicious or fraudulent behavior. Advanced fraud detection systems can help identify patterns or anomalies that may indicate fraudulent activity. Regular audits and staff training on fraud prevention measures are also essential to maintaining a secure system.

By recognizing these potential risks and implementing effective fraud prevention measures, postpaid service providers can safeguard their operations, protect their financial stability, and maintain trust with their customers. It is an ongoing process that requires constant vigilance and adaptation to emerging risks and technologies.

Alternative Options for Individuals with Bad Credit

For individuals with bad credit or a limited credit history, the requirement of a credit check for postpaid services can pose challenges. However, there are still alternative options available that can help individuals access the services they need. Here are some alternatives for individuals with bad credit:

1. Prepaid Services: Prepaid services are a viable option for individuals with bad credit, as they do not require a credit check or a contract. With prepaid services, users pay in advance for a set amount of usage, eliminating the need for creditworthiness assessment. While prepaid services may have certain limitations, such as limited features or higher costs per usage, they provide a reliable and convenient way to access essential services.

2. Secured Postpaid Services: Some service providers offer secured postpaid services, where individuals provide a security deposit or collateral to secure the credit. This deposit acts as a guarantee, allowing individuals with bad credit to access postpaid services. Over time, as the individual demonstrates responsible payment behavior, they may be eligible for unsecured postpaid services.

3. Co-Signer or Authorized User: Another option is to have a co-signer or an authorized user with good credit apply for the postpaid service on behalf of the individual with bad credit. This arrangement uses the creditworthiness of the co-signer or authorized user to qualify for the service, while still allowing the individual with bad credit to use and manage the service.

4. Credit Building Programs: Engaging in credit building programs, such as secured credit cards or credit builder loans, can help individuals improve their credit score over time. By responsibly managing these credit-building tools, individuals can gradually rebuild their credit and become eligible for postpaid services that require a credit check.

5. Exploring Alternative Service Providers: It may be worth considering alternative service providers that have more lenient credit requirements or specialized plans for individuals with bad credit. These providers may offer postpaid services with reduced credit checks or flexible payment options tailored to individuals with lower credit scores.

6. Improving Credit Health: Ultimately, the best long-term solution is to work on improving credit health. This includes paying bills on time, reducing outstanding debts, monitoring credit reports for any errors or fraudulent activity, and utilizing credit responsibly. By taking steps to rebuild credit, individuals can enhance their chances of qualifying for mainstream postpaid services in the future.

While individuals with bad credit may face some initial limitations, it is important to remember that there are still options available. By exploring alternative service providers, considering prepaid or secured services, utilizing co-signers or authorized users, participating in credit building programs, and focusing on improving credit health, individuals can gradually access the postpaid services they need and work towards rebuilding their credit.

Conclusion

In conclusion, credit checks are a critical component of the postpaid service process. They enable service providers to assess an individual’s creditworthiness and make informed decisions about extending credit. By evaluating an individual’s credit history, payment patterns, and financial stability, service providers can minimize financial risks, predict payment behavior, and tailor credit offers to suit the individual’s circumstances.

Credit checks not only protect the financial interests of service providers but also contribute to the overall stability and sustainability of postpaid services. They help prevent fraudulent activity, establish trust and security, and foster responsible financial behavior among customers. Moreover, credit checks allow service providers to offer better terms, rewards, and benefits to creditworthy customers, enhancing customer satisfaction and retention.

For individuals with bad credit, alternative options such as prepaid services, secured postpaid services, co-signers, credit building programs, and exploring alternative service providers can still provide access to the services they need. Additionally, focusing on improving credit health can open up opportunities for individuals to qualify for mainstream postpaid services in the future and rebuild their credit.

Overall, credit checks are a necessary and valuable tool in the postpaid service industry. They help balance the risk and trust between service providers and customers, ensuring fair and responsible access to postpaid services. By understanding the reasons behind credit checks and the benefits they provide, individuals and service providers can navigate the postpaid service landscape with confidence and security.