Home>Finance>How Are Policyowner Dividends Treated In Regards To Income Tax

Finance

How Are Policyowner Dividends Treated In Regards To Income Tax

Published: January 2, 2024

Learn how policyowner dividends are treated for income tax purposes in the field of finance. Gain insights and maximize your tax benefits today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Policyowner Dividends

- How Policyowner Dividends are Treated for Income Tax Purposes

- Tax Treatment of Policyowner Dividends for Different Types of Insurance Policies

- Reporting Policyowner Dividends on Income Tax Returns

- Deductibility of Premiums Paid for Policies that Pay Policyowner Dividends

- Conclusion

Introduction

In the world of insurance, policyowner dividends play a significant role in providing financial benefits to policyholders. These dividends are a unique feature offered by certain types of insurance policies, such as participating life insurance policies or certain types of property and casualty policies.

But what exactly are policyowner dividends, and how are they treated for income tax purposes? This article will guide you through the ins and outs of policyowner dividends and help you understand how they impact your tax liability.

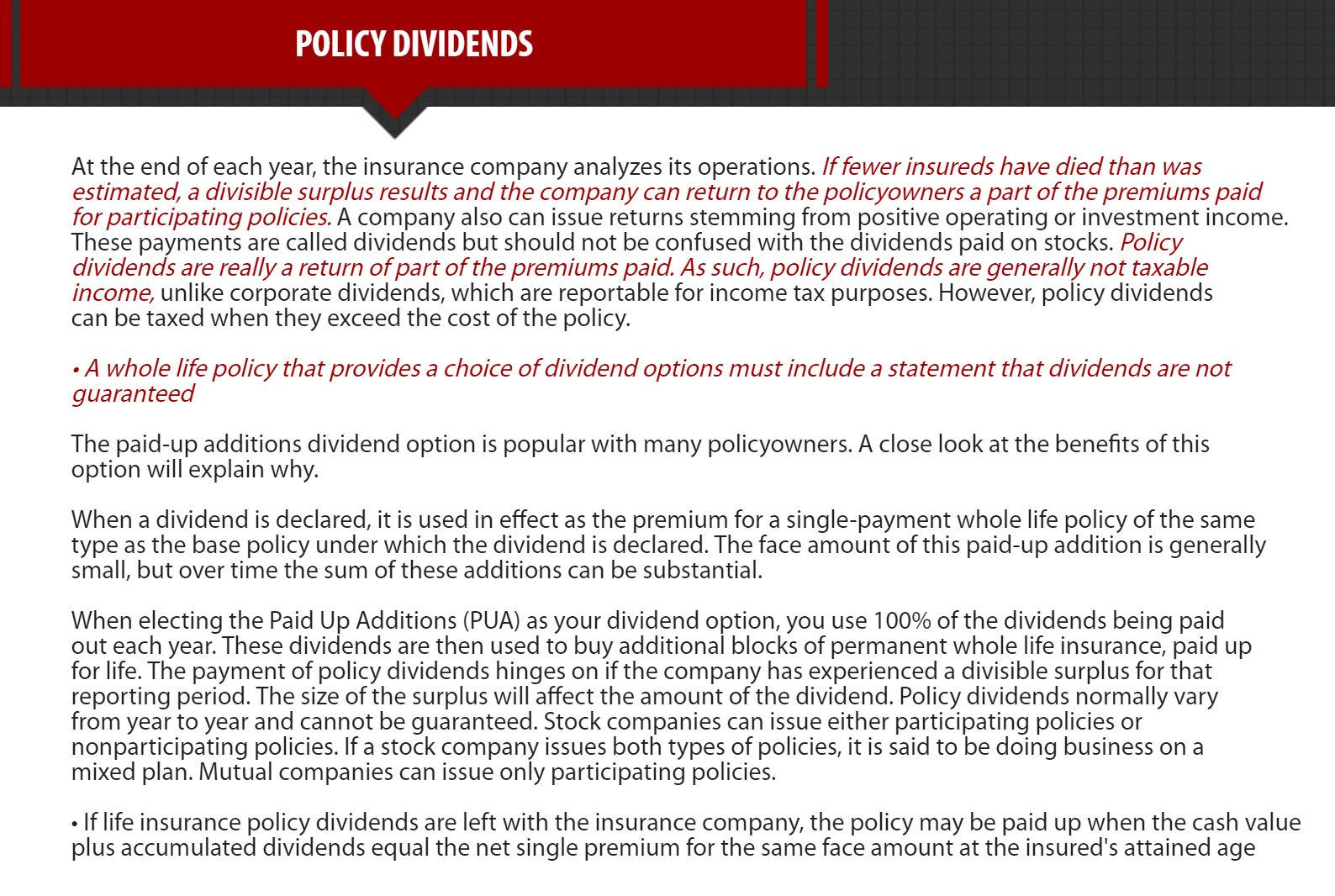

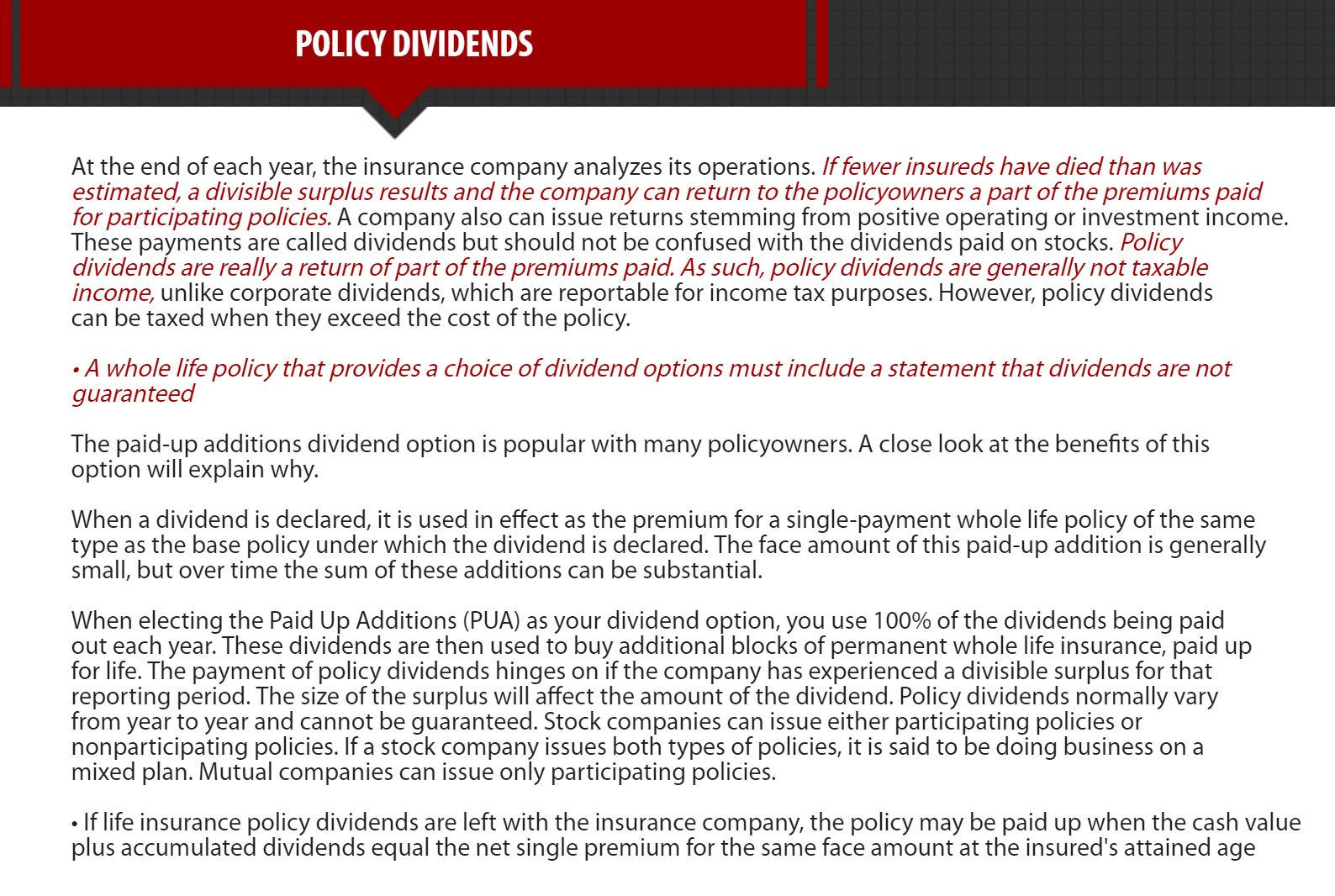

Policyowner dividends, also known as policy dividends, are typically payments made by insurance companies to the policyholders of participating insurance policies. These dividends are derived from the profits earned by the insurance company from its operations and investments.

It’s important to note that not all insurance policies offer policyowner dividends. Generally, participating policies, such as participating whole life insurance or certain types of property and casualty policies, are the ones that provide this additional financial benefit to policyholders.

Policyowner dividends can be thought of as a portion of the surplus profits generated by the insurance company, which is distributed back to policyholders. The amount of the dividend payment is typically determined by several factors, including the performance of the insurance company, the type of policy owned, and the contributions made by the policyholder.

One key aspect to understand about policyowner dividends is that they are not guaranteed. Unlike the insurance coverage itself, which is contractual and guaranteed by the insurer, policyowner dividends are declared at the discretion of the insurance company based on its financial performance.

Now that we have a basic understanding of what policyowner dividends are, let’s delve into how they are treated for income tax purposes in various scenarios.

Definition of Policyowner Dividends

Policyowner dividends are an additional financial benefit provided to the owners of participating insurance policies. These dividends represent a portion of the profits earned by the insurance company, which is distributed back to the policyholders. Unlike the guaranteed benefits of the insurance policy itself, policyowner dividends are not guaranteed and are declared at the discretion of the insurance company.

Policyowner dividends can be understood as a form of profit-sharing between the insurance company and the policyholders. The dividends are derived from the surplus profits generated by the insurance company, which is the excess of premiums received over the company’s operating costs, claims, and reserves.

These dividends are typically paid out annually, although some policies may have a different dividend frequency. The amount of the policyowner dividend payment is determined by various factors, including the financial performance of the insurance company, the investment returns generated, and the experience of the policyholder’s group or class.

It’s important to note that policyowner dividends are different from interest payments or returns on investments. While dividends are derived from the profits of the insurance company, interest payments are related to the investment returns earned on the policyholder’s premium payments.

Policyowner dividends can be received in different forms, depending on the insurance policy and the preferences of the policyholder. Common options include receiving the dividends in cash, using them to offset future premiums, purchasing additional coverage, or accumulating them with the insurer to earn interest.

Participating life insurance policies, such as whole life insurance or universal life insurance, are the most common types of policies that offer policyowner dividends. However, some property and casualty insurance policies, such as certain types of mutual insurance policies, may also provide policyowner dividends.

It’s important for policyholders to understand that policyowner dividends are not considered a return of premium, but rather a distribution of profits. As such, they may have implications for income tax purposes, which we will explore in the following sections.

How Policyowner Dividends are Treated for Income Tax Purposes

Policyowner dividends, being a form of additional financial benefit received by policyholders, have specific implications for income tax purposes. The tax treatment of policyowner dividends depends on several factors, such as the type of insurance policy, the nature of the dividends, and the purpose for which they are used.

Generally, policyowner dividends are treated as a return of premium and are not taxable. This means that if you receive dividends from your insurance policy and use them to offset future premiums or accumulate them with the insurer, you will not be required to report them as taxable income.

However, there are some exceptions to this rule. If you choose to receive policyowner dividends in cash rather than using them to offset premiums, the cash dividends may be subject to income tax. In this case, the dividends would be treated as taxable income in the year they are received.

It’s important to note that even if policyowner dividends are subject to income tax, they may still be eligible for certain tax preferences or exclusions. For example, if they qualify as a return of previously taxed premiums, they may be exempt from taxation.

The tax treatment of policyowner dividends also varies depending on the type of insurance policy. For participating life insurance policies, the dividends are generally not subject to income tax if they are used to pay premiums or accumulate with the insurance company. However, if you decide to withdraw the dividends or surrender the policy, the cash value accumulated from the dividends may be subject to taxation.

On the other hand, policyowner dividends received from property and casualty insurance policies are typically treated as a reduction of future premiums and are not subject to income tax. However, if the dividends exceed the total amount of premiums paid, the excess may be considered taxable income.

To ensure proper reporting and compliance with tax regulations, it’s essential to keep accurate records of policyowner dividends received and any related tax transactions. Consult with a tax professional or review the specific tax guidelines provided by your country’s tax authority to understand the rules and requirements that apply in your jurisdiction.

Overall, the treatment of policyowner dividends for income tax purposes depends on various factors, including the type of insurance policy, the nature of the dividends, and how they are utilized. Understanding these tax implications will help you make informed decisions and ensure compliance with your tax obligations.

Tax Treatment of Policyowner Dividends for Different Types of Insurance Policies

The tax treatment of policyowner dividends can vary depending on the type of insurance policy you hold. Here, we will explore the tax implications for different insurance policy categories:

Participating Life Insurance Policies:

In the case of participating life insurance policies, such as whole life insurance or universal life insurance, policyowner dividends are typically not subject to income tax if they are used to pay premiums or accumulate with the insurance company. These dividends are considered a return of premium and are generally not taxable. However, if you decide to withdraw the dividends as cash or surrender the policy, the cash value accumulated from the dividends may be subject to taxation.

Property and Casualty Insurance Policies:

Policyowner dividends received from property and casualty insurance policies, such as certain types of mutual insurance policies, are generally treated as a reduction of future premiums and are not subject to income tax. In other words, if you receive a dividend from your property or casualty insurance policy, it will be applied to reduce your future premium payments. However, if the dividend exceeds the total amount of premiums paid, the excess may be considered taxable income.

Non-Participating Policies:

Non-participating policies, which do not offer policyowner dividends, typically do not have any tax implications related to dividends. Since no dividends are paid out in these types of policies, there is no need to consider tax treatment specifically for dividends.

Group Insurance Policies:

Policyowner dividends received from group insurance policies, commonly provided by employers, may have different tax implications. In some cases, the dividends may be considered taxable income if they are received in cash or if they exceed the total premiums paid by the employer. However, if the dividends are used to reduce future premium payments or accumulate with the insurer, they may not be subject to income tax.

It’s important to note that the tax treatment of policyowner dividends can vary depending on the specific regulations in your country or jurisdiction. Therefore, it’s recommended to consult with a tax professional or review the tax guidelines provided by your country’s tax authority for precise and up-to-date information regarding the tax treatment of policyowner dividends in your region.

Understanding the tax implications associated with policyowner dividends for different types of insurance policies is crucial for making informed decisions and ensuring compliance with your tax obligations.

Reporting Policyowner Dividends on Income Tax Returns

When it comes to reporting policyowner dividends on your income tax returns, the specific requirements can vary depending on the regulations in your country or jurisdiction. However, there are general guidelines to keep in mind.

If you receive policyowner dividends that are considered taxable income, either because you opted to receive them in cash or they exceed the total premiums paid, you will typically need to report them on your income tax return.

In most cases, policyowner dividends will be reported on a specific section of your income tax return form that accounts for miscellaneous income or other types of taxable income. You will need to provide the total amount of policyowner dividends received during the tax year.

It’s important to keep accurate records of the policyowner dividends you receive, as well as any supporting documentation provided by the insurance company. This includes statements or forms that detail the amount and nature of the dividend payments.

In addition to reporting the policyowner dividends received as taxable income, you may also be eligible for certain tax preferences or exclusions, depending on your circumstances. For example, if the policyowner dividends qualify as a return of previously taxed premiums, they may be exempt from taxation or subject to reduced tax rates.

To ensure proper compliance with tax regulations, it’s recommended to consult with a tax professional or review the specific tax guidelines provided by your country’s tax authority. They can provide you with accurate and up-to-date information on how to report policyowner dividends on your income tax return.

Finally, it’s crucial to note that tax regulations and requirements can change over time. Therefore, staying informed about any updates or changes to the tax laws in your jurisdiction is essential for accurately reporting policyowner dividends on your income tax return.

By understanding the reporting requirements and seeking professional advice if needed, you can ensure that you correctly report your policyowner dividends and fulfill your tax obligations.

Deductibility of Premiums Paid for Policies that Pay Policyowner Dividends

When it comes to the deductibility of premiums paid for insurance policies that pay policyowner dividends, the rules can vary based on the purpose and nature of the insurance policy. Here, we will explore the general guidelines regarding the deductibility of premiums for policies that offer policyowner dividends.

For personal insurance policies, such as participating life insurance policies, premiums paid are typically not deductible for income tax purposes. This means that if you hold a participating life insurance policy that pays policyowner dividends, you usually cannot deduct the premiums paid from your taxable income.

The rationale behind this is that personal insurance policies are generally considered personal expenses rather than business expenses. As a result, the premiums paid for these policies are not eligible for a tax deduction.

However, there are certain exceptions to this rule. If the insurance policy has a significant investment component, such as a cash value or savings component, a portion of the premiums may be eligible for deduction if certain criteria are met. In some jurisdictions, the premiums paid for policies with an investment component may be partially deductible to the extent that they represent an investment in the policy’s cash value or savings element.

On the other hand, for businesses or self-employed individuals who purchase insurance policies that pay policyowner dividends, the premiums may be deductible as a business expense. This is because insurance premiums paid by businesses are generally considered ordinary and necessary expenses for the operation of the business. As a result, these premiums may be deductible from taxable income.

It’s important to note that the deductibility of insurance premiums can also depend on the specific purpose of the policy. For example, if the insurance policy provides coverage for business-related risks, such as property and casualty insurance for a business property, the premiums paid may be deductible as a business expense.

Ultimately, the deductibility of premiums paid for insurance policies that pay policyowner dividends is influenced by factors such as the nature of the policy, the purpose for which it is held (personal or business), and the specific tax regulations in your country or jurisdiction. It’s always advisable to consult with a tax professional or review the guidelines provided by your country’s tax authority to determine the deductibility of premiums in your particular situation.

Understanding the deductibility rules for premiums paid for policies that offer policyowner dividends can help you effectively manage your tax obligations and make informed decisions regarding your insurance coverage.

Conclusion

Policyowner dividends can provide policyholders with significant financial benefits, but it is crucial to understand their implications for income tax purposes. The tax treatment of policyowner dividends may vary depending on the type of insurance policy, the nature of the dividends, and how they are used.

In general, policyowner dividends are considered a return of premium and are not taxable if they are used to pay premiums or accumulate with the insurance company. However, if policyowner dividends are received in cash or exceed the total amount of premiums paid, they may be subject to income tax.

The tax treatment of policyowner dividends differs for different types of insurance policies. Participating life insurance policies generally do not tax dividends if they are used to pay premiums or accumulate with the insurer. On the other hand, property and casualty insurance policies treat dividends as a reduction of future premiums and are usually not taxable unless they exceed the total premiums paid.

It is important to report any taxable policyowner dividends accurately on your income tax returns. Consult with a tax professional or refer to the guidelines provided by your country’s tax authority to ensure proper compliance with tax regulations.

Additionally, the deductibility of premiums paid for policies that pay policyowner dividends depends on factors such as the type of policy and the purpose for which it is held. Generally, personal insurance policies do not allow for the deduction of premiums, while premiums paid by businesses or self-employed individuals may be deductible as a business expense.

Understanding the tax implications associated with policyowner dividends is crucial for making informed decisions and properly managing your tax obligations. Stay updated with any changes in tax laws and consult with a tax professional to ensure accurate reporting and compliance.

By having a clear understanding of how policyowner dividends are treated for income tax purposes and the deductibility of premiums, you can navigate the complexities of insurance taxation and make the most of the financial benefits provided by your insurance policies.