Finance

How To Find Net Income With Dividends

Published: January 2, 2024

Learn how to calculate net income with dividends in the field of finance. Improve your financial analysis skills and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to find net income with dividends. Understanding the concept of net income and dividends is crucial for anyone interested in finance and investing. Net income, also known as net earnings or profit, is a key metric that indicates the profitability of a company or individual. Dividends, on the other hand, are the payments made by a company to its shareholders as a distribution of profits.

Knowing how to calculate net income and identify dividends is essential for investors, as it provides insights into a company’s financial health and its ability to generate profits. By analyzing these figures, investors can make informed decisions regarding where to invest their money.

This guide will walk you through the process of calculating net income and understanding dividends step by step. We will also provide you with a comprehensive formula to determine net income with dividends. Additionally, we will provide an example calculation to illustrate the concept and make it easier for you to grasp. By the end of this guide, you will have a solid understanding of how to find net income with dividends and how to leverage this knowledge in your financial decision-making process.

Whether you are a seasoned investor looking to fine-tune your investment strategy or a beginner wanting to gain a deeper understanding of finance, this guide is designed to equip you with the necessary knowledge and tools to analyze net income with dividends effectively. So, let’s dive in and explore this fascinating topic from beginning to end!

Understanding Net Income and Dividends

Before diving into the process of finding net income with dividends, it’s important to have a clear understanding of what net income and dividends actually mean in the world of finance.

Net income, also known as net profit or net earnings, is a key financial metric that reflects the total earnings of a company after deducting expenses, taxes, and other costs. It is essentially the amount of money left over after all the company’s operating expenses and taxes have been paid.

Net income is a crucial indicator of a company’s profitability. It allows investors and analysts to assess the financial health of a business and determine its ability to generate sustainable profits over time. A consistently positive net income is generally considered a positive sign and can attract investors and potentially lead to a higher stock price.

Dividends, on the other hand, are a portion of a company’s profits that are distributed to its shareholders. When a company generates excess profits, it can choose to allocate a portion of those profits to shareholders in the form of dividends. Dividends are usually paid to shareholders regularly, often on a quarterly or annual basis.

Dividends are an important aspect of investing, especially for income-focused investors who are seeking regular cash flow from their investments. Dividends can provide a steady stream of income and can be a key factor in a company’s attractiveness to investors.

Understanding how net income and dividends are connected is crucial. Net income is the starting point in determining whether a company has sufficient profits to pay out dividends. If a company has a positive net income, it has generated profits that it can potentially distribute to shareholders as dividends. However, it is important to note that not all companies pay dividends. Some companies, especially growth-oriented companies, may choose to reinvest their profits back into the business rather than paying dividends to shareholders.

Now that we have a solid understanding of net income and dividends, let’s move on to the next section, where we will explore how to calculate net income.

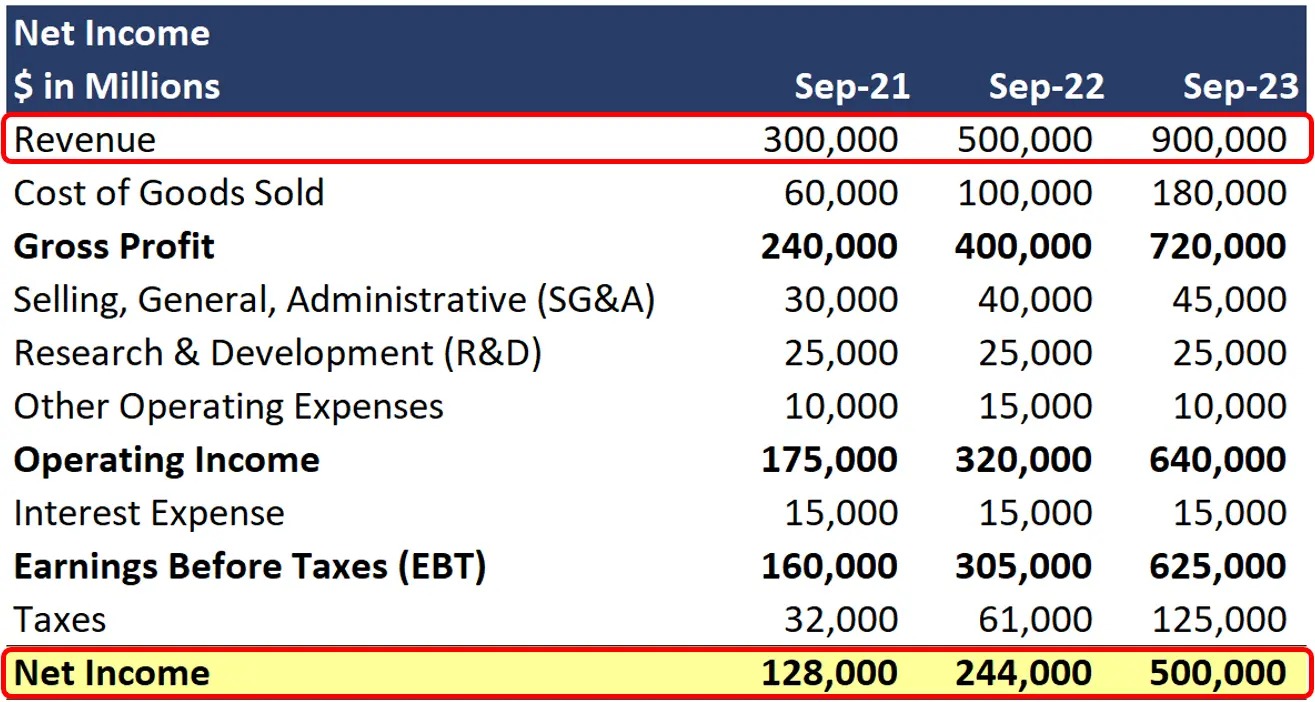

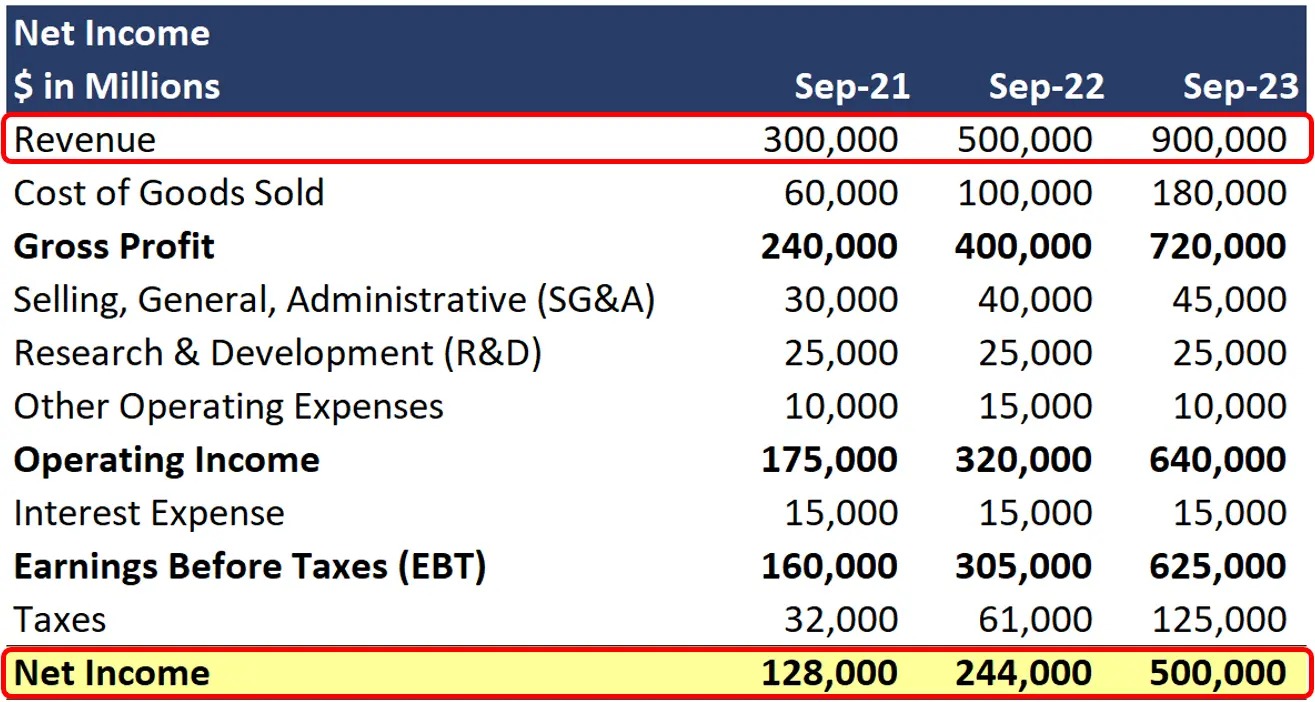

Calculating Net Income

Calculating net income involves determining the total earnings of a company after deducting all expenses, taxes, and other costs. This calculation provides valuable insights into a company’s profitability and financial performance.

To calculate net income, you will need the following information:

- Revenue: This is the total amount of money generated from the sales of goods or services.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing or delivering the goods or services sold.

- Operating Expenses: These are the various expenses incurred in the day-to-day operations of the business, such as salaries, rent, utilities, and marketing costs.

- Interest and Taxes: This includes any interest payments on loans or debt and the applicable taxes levied on the company’s profits.

The formula to calculate net income is as follows:

Net Income = Revenue – COGS – Operating Expenses – Interest and Taxes

Let’s illustrate the calculation with a simple example:

ABC Company generated $1,000,000 in revenue. The cost of goods sold was $500,000, and the operating expenses totaled $200,000. The company paid $50,000 in interest and $100,000 in taxes.

Using the formula mentioned earlier, we can calculate the net income:

Net Income = $1,000,000 – $500,000 – $200,000 – $50,000 – $100,000

Net Income = $1,000,000 – $850,000

Net Income = $150,000

In this example, ABC Company has a net income of $150,000. This means that after deducting all the expenses, taxes, and interest payments, the company generated a profit of $150,000.

Calculating net income is essential for assessing a company’s financial performance and profitability. It provides valuable insights into the company’s ability to generate profits and can help investors make informed decisions regarding their investments.

Now that we have covered how to calculate net income, let’s explore the next section, which focuses on identifying dividends.

Identifying Dividends

Dividends are an important aspect of investing, as they represent a portion of a company’s profits that are distributed to its shareholders. Identifying dividends is crucial for investors who rely on dividend income as part of their investment strategy.

There are several ways to identify dividends:

- Company Announcements: Companies typically announce the declaration and payment of dividends through press releases, official statements, or quarterly earnings reports. These announcements provide details about the dividend amount, record date, and payment date.

- Financial Websites: Financial websites, such as Yahoo Finance and Bloomberg, provide comprehensive information on dividend payments. These websites often have dedicated sections that list the upcoming and historical dividend payments for individual companies.

- Stock Exchanges: Stock exchanges also provide information on dividend payments. You can check the dividend history of a particular stock by looking up its ticker symbol on the exchange’s website or through specialized financial data providers.

- Annual Reports: Companies disclose their dividend policies and payment history in their annual reports. These reports provide a wealth of information about a company’s financial performance and can be accessed through the company’s investor relations website or regulatory filings.

It’s important to note that not all companies pay dividends. Some companies, especially startups or growth-oriented companies, may choose to retain their profits to reinvest in the business rather than distributing them as dividends. These companies may offer capital appreciation potential but may not provide regular dividend income.

When identifying dividends, it’s also crucial to understand the different types of dividends that companies may offer:

- Cash Dividends: These are the most common type of dividends where shareholders receive cash payments.

- Stock Dividends: Instead of cash, companies may distribute additional shares of stock to shareholders as dividends.

- Dividend Reinvestment Plans (DRIPs): Some companies offer DRIPs, which allow shareholders to automatically reinvest their cash dividends to purchase additional shares of the company’s stock.

- Special Dividends: Occasionally, companies may issue special dividends, which are one-time payments to shareholders outside of the regular dividend schedule.

By identifying dividends and understanding their types, investors can assess the potential for regular income from their investments. Regular dividend payments can provide a stable and predictable source of cash flow, making them attractive to certain types of investors.

Now that we have a clear understanding of how to identify dividends, let’s move on to the next section, where we will explore the formula to calculate net income with dividends.

Net Income with Dividends Formula

The net income with dividends formula allows us to determine the total net income of a company after accounting for the dividends issued to shareholders. This formula takes into consideration both the net income and the dividends paid out by the company.

The formula to calculate net income with dividends is as follows:

Net Income with Dividends = Net Income – Dividends

This formula subtracts the total dividends paid to shareholders from the net income. By doing so, we can determine the final net income figure that accounts for the distribution of profits to shareholders.

It’s important to note that the dividends used in this formula should only include the dividends paid during the specific period for which the net income is being calculated. Dividends from previous periods should not be included in the calculation.

Let’s illustrate the use of this formula with an example:

XYZ Company has a net income of $500,000 for the year. During the same period, the company paid $100,000 in dividends to its shareholders. To determine the net income with dividends, we can use the formula:

Net Income with Dividends = $500,000 – $100,000

Net Income with Dividends = $400,000

In this example, the net income with dividends for XYZ Company is $400,000. This figure reflects the company’s profit after accounting for the dividends paid to shareholders.

Calculating the net income with dividends provides a more comprehensive view of a company’s financial performance. It takes into account both the profitability of the company and the distribution of profits to shareholders. Investors can use this figure to evaluate the overall financial strength and attractiveness of the company as an investment opportunity.

Now that we have covered the net income with dividends formula, let’s proceed to the next section, where we will provide an example calculation to bring everything together.

Example Calculation

To better understand how to find net income with dividends, let’s walk through an example calculation. We will use fictional numbers for illustration purposes.

ABC Corporation has a net income of $1,500,000 for the year. During the same period, the company paid $300,000 in dividends to its shareholders.

To calculate the net income with dividends, we can use the formula:

Net Income with Dividends = Net Income – Dividends

Net Income with Dividends = $1,500,000 – $300,000

Net Income with Dividends = $1,200,000

In this example, the net income with dividends for ABC Corporation is $1,200,000. This figure represents the company’s profit after deducting the dividends paid to shareholders.

By considering the net income with dividends, investors can assess not only the profitability of the company but also the impact of dividend distributions on its financial performance. This information can be valuable in evaluating the financial stability and attractiveness of the company as an investment.

It’s important to note that the net income with dividends can vary from period to period, depending on the company’s profitability and dividend payment decisions. Therefore, it is essential to analyze this figure alongside other financial indicators and consider the overall financial health of the company.

Now that we have completed the example calculation, it’s time to wrap up our guide on finding net income with dividends.

Conclusion

Congratulations! You now have a comprehensive understanding of how to find net income with dividends. Net income is a crucial metric that reflects a company’s profitability after deducting expenses, taxes, and other costs. Dividends, on the other hand, are the distribution of profits to shareholders. By taking into account the impact of dividends on net income, investors can gauge the financial health and attractiveness of a company as an investment.

Throughout this guide, we explored the process of calculating net income by considering revenue, cost of goods sold, operating expenses, interest, and taxes. We also discussed how to identify dividends through company announcements, financial websites, stock exchanges, and annual reports. Understanding the different types of dividends, such as cash dividends, stock dividends, dividend reinvestment plans, and special dividends, is crucial in assessing the potential for regular income from investments.

Lastly, we introduced the net income with dividends formula, which subtracts the dividends paid to shareholders from the net income. This provides a more comprehensive view of a company’s financial performance. We illustrated the calculation through an example to solidify your understanding of the concept.

As an investor, the ability to analyze net income with dividends is an invaluable skill. It allows you to make informed decisions about where to allocate your investments based on a company’s profitability, potential for dividend income, and overall financial stability.

Remember to remain vigilant and conduct thorough research on the financial health of a company before making any investment decisions. It’s crucial to consider net income, dividends, and other financial indicators in the context of the market, industry trends, and your investment goals.

Now armed with this knowledge, go forth and apply these concepts in your investment journey. Whether you are a seasoned investor or just starting out, the ability to find net income with dividends will enable you to make more informed decisions and navigate the world of finance with confidence.

Happy investing!