Home>Finance>Deferred Income Tax: Definition, Purpose, And Examples

Finance

Deferred Income Tax: Definition, Purpose, And Examples

Published: November 9, 2023

Learn the definition, purpose, and examples of deferred income tax in finance. Understand its role in financial planning and accounting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Deferred Income Tax?

Deferred income tax refers to a liability that arises when a company’s taxable income is different from its reported financial income. In other words, it is the tax that a company owes to the government in the future because of temporary differences between its taxable income and financial income.

Key Takeaways

- Deferred income tax is a liability that arises when a company’s taxable income is different from its reported financial income.

- The purpose of deferred income tax is to ensure that a company’s financial statements accurately reflect the future tax consequences of its activities.

This liability is recorded on a company’s balance sheet and is the result of timing differences in recognizing revenue and expenses for accounting and tax purposes.

Purpose of Deferred Income Tax

The purpose of deferred income tax is to ensure that a company’s financial statements accurately reflect the future tax consequences of its activities. By recognizing both current and future tax liabilities or assets, companies can provide a more transparent view of their financial condition.

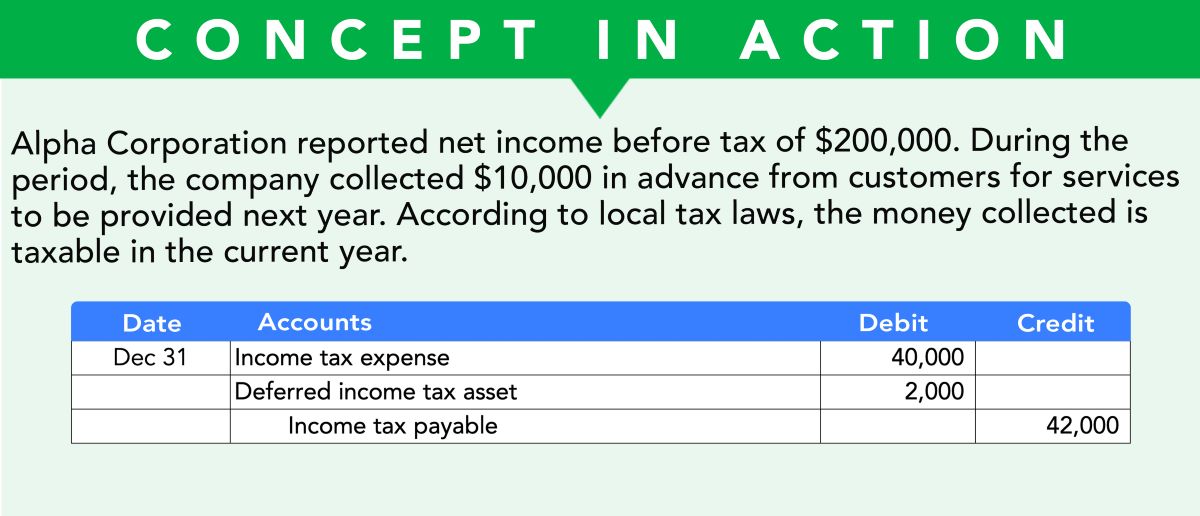

Examples of Deferred Income Tax

Let’s consider a few examples to illustrate how deferred income tax works:

- Depreciation: A company may use different depreciation methods for tax purposes and financial reporting. This creates a timing difference between the amount of depreciation expense recognized in the financial statements and the deductible depreciation for tax purposes. As a result, deferred income tax liabilities or assets may arise to account for the difference.

- Revenue Recognition: A company may recognize revenue for financial reporting purposes when it is earned, but for tax purposes, it may be recognized when cash is received. This timing difference can lead to deferred income tax liabilities or assets.

- Business Expenses: Expenses that are deductible for tax purposes immediately may be capitalized and amortized over time in the financial statements. This difference in timing creates deferred income tax liabilities or assets.

These examples demonstrate how temporary differences between accounting and tax rules can give rise to deferred income tax liabilities or assets.

Understanding deferred income tax is crucial for financial statement users, as it helps them evaluate a company’s financial position accurately and forecast its future tax obligations. By recognizing deferred income tax liabilities or assets, companies can provide a more comprehensive picture of their financial health.