Home>Finance>How To Request Credit Limit Increase Navy Federal

Finance

How To Request Credit Limit Increase Navy Federal

Modified: March 5, 2024

Learn how to request a credit limit increase with Navy Federal. Improve your finances with step-by-step instructions and tips to increase your credit limit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Eligibility requirements for credit limit increase

- Steps to request a credit limit increase with Navy Federal

- Documentation needed for credit limit increase request

- Tips for a successful credit limit increase request

- Factors that may impact credit limit increase approval

- Pros and cons of requesting a credit limit increase

- Frequently asked questions about requesting a credit limit increase with Navy Federal

- Conclusion

Introduction

When it comes to managing your credit, having a higher credit limit can provide you with flexibility and financial peace of mind. Whether you’re planning a major purchase or want to improve your credit utilization ratio, requesting a credit limit increase can be a smart move. If you have an account with Navy Federal, one of the largest credit unions in the United States, you may be wondering how to go about requesting a credit limit increase.

In this article, we will guide you through the process of requesting a credit limit increase with Navy Federal. We will cover the eligibility requirements, the necessary documentation, and provide tips for a successful request. Additionally, we will discuss the factors that may impact the approval of your credit limit increase and highlight the pros and cons of this decision. By the end of this article, you’ll have a clear understanding of how to navigate the credit limit increase process with Navy Federal.

Before we delve into the details, let’s briefly discuss why requesting a credit limit increase can be beneficial. A credit limit increase can boost your available credit, which in turn can improve your credit utilization ratio. This ratio is an important factor in determining your credit score, as it reflects the amount of credit you are using compared to the total credit available to you. By having a higher credit limit, you can lower your credit utilization ratio, potentially leading to a higher credit score.

A credit limit increase can also provide you with increased purchasing power. It gives you the ability to make larger purchases or handle unexpected expenses without maxing out your available credit. Additionally, a higher credit limit can demonstrate to lenders that you are a responsible borrower, which can positively impact your creditworthiness in the long run.

Now that we understand the potential benefits of a credit limit increase, let’s explore the eligibility requirements for requesting one with Navy Federal.

Eligibility requirements for credit limit increase

In order to request a credit limit increase with Navy Federal, you must meet certain eligibility requirements. These requirements are in place to ensure that you have a stable financial standing and are responsible in managing your credit. Here are the key eligibility criteria to keep in mind:

- You must have an existing credit card or line of credit with Navy Federal. Navy Federal typically does not consider credit limit increase requests for new accounts.

- You should have a good payment history with Navy Federal. This means making timely payments on your existing credit card or line of credit for a certain period of time. Generally, having a minimum of six months to a year of on-time payments is recommended.

- Your income and employment stability will be evaluated. Navy Federal wants to ensure that you have a steady source of income that can support a higher credit limit. Providing accurate and up-to-date income information is essential.

- Your credit utilization ratio should be low. Navy Federal will review your current credit usage to determine if you have been using your available credit responsibly. A lower credit utilization ratio demonstrates better financial management.

- You should not have any recent negative credit entries. This includes late payments, collection accounts, or bankruptcies. Having a clean credit history will increase your chances of being approved for a credit limit increase.

- Your account should be in good standing. This means that you should not have any outstanding balances or delinquent accounts with Navy Federal.

It’s important to note that meeting these eligibility requirements does not guarantee approval of your credit limit increase request. Navy Federal will evaluate each application on a case-by-case basis and may consider other factors such as your overall creditworthiness and the current economic climate.

Now that we understand the eligibility requirements, let’s move on to the steps involved in requesting a credit limit increase with Navy Federal.

Steps to request a credit limit increase with Navy Federal

If you meet the eligibility requirements and are interested in requesting a credit limit increase with Navy Federal, follow these steps to navigate the process:

- Review your account: Before making a request, take a careful look at your current account status. Ensure that you have met the eligibility requirements and have a good payment history with Navy Federal.

- Gather necessary information: Collect all the relevant information and documentation that you will need to support your credit limit increase request. This may include proof of income, recent pay stubs, and any other documents that demonstrate your financial stability.

- Log in to your Navy Federal online account: Access your Navy Federal online banking account using your username and password.

- Navigate to the credit limit increase request section: Once logged in, locate the section or tab that allows you to request a credit limit increase. The location of this option may vary depending on the layout of your online banking portal.

- Fill out the credit limit increase request form: Follow the prompts and provide the requested information accurately. This may include details such as your current credit limit, requested credit limit increase amount, and your income information.

- Provide supporting documentation: As part of the request process, you may be required to upload or submit the necessary documentation to support your credit limit increase request. Make sure to provide clear and accurate information to expedite the review process.

- Submit the request: Once you have completed the request form and provided all the necessary documentation, review your information to ensure its accuracy. Then, submit your credit limit increase request to Navy Federal for review.

- Wait for a response: After submitting your request, you will need to wait for a decision from Navy Federal. The processing time can vary, but you can typically expect a response within a few business days. Navy Federal will notify you via email, mail, or through your online banking account.

- Monitor your account: While waiting for a response, continue to monitor your Navy Federal account. Keep track of any updates or notifications regarding your credit limit increase request.

It’s important to note that the above steps are a general guideline and the specific process may vary slightly. Navy Federal may have its own unique platform and requirements for requesting a credit limit increase. It’s always a good idea to refer to their official website, contact their customer service, or review any guidelines provided by Navy Federal to ensure you have the most up-to-date and accurate information.

Now that you are aware of the steps involved in requesting a credit limit increase with Navy Federal, let’s move on to the documentation you may need to support your request.

Documentation needed for credit limit increase request

When submitting a credit limit increase request with Navy Federal, it’s important to provide the necessary documentation to support your application. This documentation helps Navy Federal assess your financial stability and make an informed decision regarding your credit limit increase. Here are some common documents you may need to include:

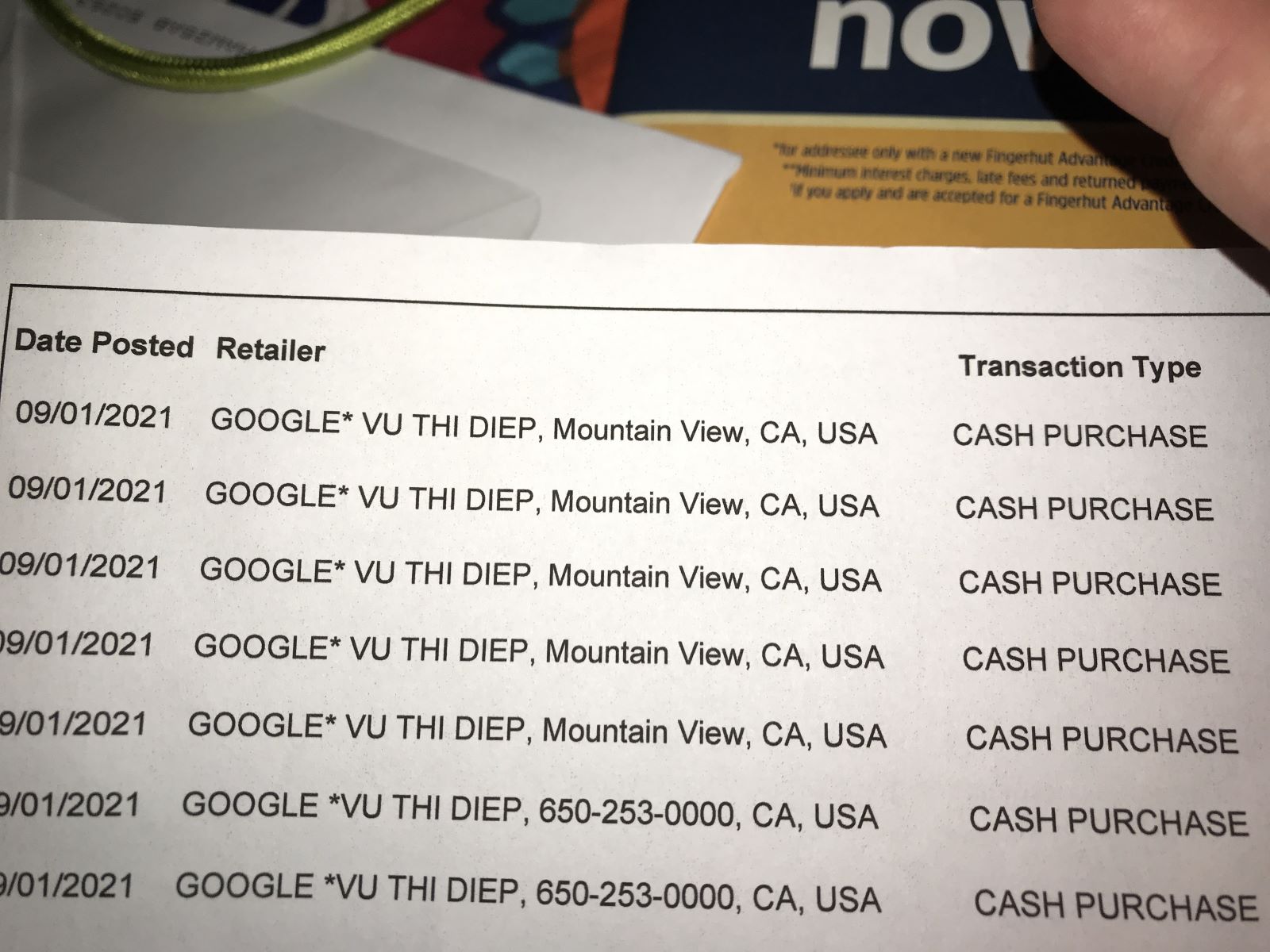

- Proof of income: Navy Federal may request documentation that verifies your income. This can include recent pay stubs, income tax returns, or bank statements that show regular deposits. Providing accurate and up-to-date income information helps demonstrate your ability to manage a higher credit limit.

- Employment verification: Navy Federal may require proof of your employment status and stability. This can be a letter from your employer, stating your job title, length of employment, and monthly or annual income. If you are self-employed, you may need to provide additional documentation, such as business tax returns or financial statements.

- Identification documents: As with any credit application, Navy Federal may require proof of your identity. This typically includes a copy of a valid government-issued photo ID, such as a driver’s license or passport.

- Recent credit report: It can be helpful to provide a copy of your recent credit report to Navy Federal. This shows your overall credit history, outstanding accounts, and any recent credit inquiries. Though Navy Federal may already have access to this information, submitting your credit report can provide further context to support your credit limit increase request.

- Other financial documents: Depending on your specific situation, Navy Federal may request additional financial documents. This can include bank statements, investment account statements, and statements from any outstanding loans or mortgages. These documents provide a comprehensive view of your financial health and can bolster your credit limit increase request.

When submitting these documents, it’s important to ensure their accuracy and legibility. Double-check that the information provided matches the details you entered in your credit limit increase request form. Submitting incomplete or inaccurate documentation may delay the processing of your request.

Keep in mind that the specific documentation requirements may vary based on your individual circumstances, Navy Federal’s policies, and the type of credit limit increase request you are making. It’s always a good idea to consult Navy Federal’s official website, reach out to their customer service, or refer to any guidelines provided by Navy Federal to ensure you have the most up-to-date and accurate information.

Now that you know the documentation needed for a credit limit increase request, let’s move on to some tips for a successful request.

Tips for a successful credit limit increase request

When requesting a credit limit increase with Navy Federal, there are a few tips you can follow to increase your chances of a successful outcome. These tips can help you make a strong case for a higher credit limit and demonstrate your creditworthiness. Consider the following tips:

- Monitor your credit score: Before making a credit limit increase request, review your credit score and credit history. A higher credit score can increase your chances of approval. If there are any errors on your credit report, dispute them and have them resolved before submitting your request.

- Pay your bills on time: A consistent record of on-time payments shows your responsibility as a borrower. Make sure to pay your Navy Federal credit card or line of credit on time to strengthen your case for a credit limit increase.

- Reduce your credit utilization ratio: Lowering the percentage of credit you are using compared to the total available credit demonstrates responsible credit management. Before requesting a credit limit increase, pay down any outstanding balances to reduce your credit utilization ratio.

- Build a positive payment history: If you’re new to Navy Federal, establishing a good payment history by consistently making on-time payments for several months can improve your chances of a credit limit increase. This demonstrates your financial responsibility and reliability as a borrower.

- Keep your income information up to date: Ensure that your income information is accurate and updated in your Navy Federal account. A higher income can indicate your ability to handle a higher credit limit.

- Avoid applying for multiple credit limit increases simultaneously: Submitting multiple requests for credit limit increases within a short period may raise concerns about your financial stability. It’s best to focus on one request at a time and give it a reasonable amount of time before submitting another.

- Be realistic in your requested credit limit increase amount: While it’s tempting to request a significant increase, it’s essential to be realistic. Request an amount that aligns with your income, credit history, and spending habits. A reasonable increase is more likely to be approved.

- Communicate any changes in your financial situation: If you have experienced positive changes in your financial situation, such as a salary increase or a significant decrease in debt, it may be beneficial to include that information in your credit limit increase request. This can showcase your improved financial position and boost your chances of approval.

By following these tips, you can present a strong case for a credit limit increase and demonstrate your creditworthiness to Navy Federal. However, it’s important to remember that credit limit increase approval is not guaranteed, and Navy Federal evaluates each request based on individual circumstances.

Now that you’re equipped with these tips, let’s explore the factors that may impact the approval of your credit limit increase request.

Factors that may impact credit limit increase approval

When requesting a credit limit increase with Navy Federal, several factors come into play that can influence the approval decision. Understanding these factors can help you prepare a stronger case and increase your chances of a successful credit limit increase. Here are some key factors that Navy Federal may consider:

- Payment history: Navy Federal will review your payment history to assess your financial responsibility. Consistently making on-time payments and having a positive payment history demonstrates your ability to manage credit effectively.

- Credit utilization ratio: Your credit utilization ratio, which is the percentage of your available credit you are currently using, is an important factor in credit limit increase decisions. Maintaining a low utilization ratio indicates responsible credit management and may increase the likelihood of approval.

- Creditworthiness: Navy Federal will assess your overall creditworthiness, taking into account factors such as your credit score, credit history, and any other outstanding debts. A higher credit score and a positive credit history can positively influence the approval decision.

- Income and employment stability: Your income level and employment stability are crucial factors in determining your ability to handle a higher credit limit. Navy Federal will evaluate your income information and may request documentation to verify your financial stability.

- Account standing: The status of your existing Navy Federal account will be considered. If you have any delinquent accounts or outstanding balances, it may negatively impact your credit limit increase request. Maintaining a good standing with Navy Federal is important for approval.

- Economic factors: The current economic climate and lender policies can also influence credit limit increase decisions. During periods of economic uncertainty or tighter credit requirements, lenders may be more cautious in approving credit limit increases.

- Requested credit limit increase amount: The amount you request for a credit limit increase can also impact the approval decision. Requesting a reasonable increase that aligns with your income and creditworthiness is more likely to be approved.

- Overall credit profile: Navy Federal will consider your entire credit profile and assess the risk associated with granting a credit limit increase. They will evaluate your existing debt, credit age, and any negative or positive changes that may have occurred since opening your account.

It’s important to note that these factors are not mutually exclusive, and Navy Federal will consider a combination of these factors when evaluating your credit limit increase request. It is also worth mentioning that Navy Federal’s specific internal policies, guidelines, and discretion play a role in the approval decision.

Now that you understand the factors that may impact your credit limit increase approval, let’s move on to examining the pros and cons of requesting a credit limit increase.

Pros and cons of requesting a credit limit increase

Requesting a credit limit increase with Navy Federal can have both advantages and potential drawbacks. Understanding the pros and cons can help you make an informed decision that aligns with your financial goals and circumstances. Here are some of the key pros and cons to consider:

Pros:

- Increased purchasing power: One of the main advantages of a credit limit increase is the ability to make larger purchases or handle unexpected expenses without maxing out your available credit. This can provide you with financial flexibility and peace of mind.

- Improved credit utilization ratio: A higher credit limit can positively impact your credit utilization ratio, which is the percentage of your available credit that you are currently utilizing. A lower utilization ratio can help improve your credit score and demonstrate responsible credit management.

- Showcase financial responsibility: Requesting and receiving a credit limit increase can demonstrate to lenders that you are a responsible borrower. It shows that you can handle a higher credit limit and use credit responsibly, which may positively impact your creditworthiness in the long term.

- Demonstrate stability: A credit limit increase can indicate to lenders that you have stable income and employment. This can be beneficial when applying for other loans or credit in the future, as it adds to your overall financial credibility.

- Flexibility for emergencies or opportunities: Having a higher credit limit can provide you with a financial safety net in case of emergencies or unexpected opportunities. It can allow you to handle unexpected expenses or take advantage of time-sensitive deals or investments.

Cons:

- Increased temptation to overspend: With a higher credit limit, there is a risk of falling into the trap of overspending and accumulating more debt. It’s important to exercise discipline and only use the increased credit limit when necessary and within your means to repay.

- Hard inquiry on your credit report: When requesting a credit limit increase, Navy Federal may perform a hard inquiry on your credit report. While this may have a minimal impact, multiple hard inquiries within a short period can temporarily lower your credit score.

- Potential for high-interest charges: If you carry a balance on your credit card and utilize your higher credit limit, you may end up paying more in interest charges over time. It’s important to manage your credit responsibly and pay off your balances in full to avoid accruing unnecessary interest.

- Potential impact on future credit applications: While a credit limit increase can have positive implications, it’s important to consider the potential impact on future credit applications. Lenders may view a higher credit limit as a potential risk, which could affect their decision when assessing your creditworthiness for other loans or credit in the future.

It’s crucial to weigh these pros and cons based on your individual financial situation and goals. If you decide that requesting a credit limit increase aligns with your needs, it’s time to address some frequently asked questions about the process with Navy Federal.

Frequently asked questions about requesting a credit limit increase with Navy Federal

When it comes to requesting a credit limit increase with Navy Federal, you may have some questions in mind. To provide clarity, here are answers to some frequently asked questions:

- How often can I request a credit limit increase with Navy Federal?

- Will requesting a credit limit increase affect my credit score?

- How long does it take to receive a decision on a credit limit increase request?

- Is there a specific credit score requirement to be eligible for a credit limit increase?

- Is my credit limit increase request guaranteed to be approved?

- If my credit limit increase request is denied, can I reapply in the future?

- Will a credit limit increase affect my ability to obtain other loans or credit in the future?

The frequency of credit limit increase requests may vary, but it’s generally recommended to wait at least six months between requests. It’s important to demonstrate responsible credit management and give yourself time to build a positive payment history.

When you request a credit limit increase, Navy Federal may perform a hard inquiry on your credit report. While this may have a minimal impact on your credit score, multiple hard inquiries within a short period can temporarily lower your score. However, the potential long-term benefits of a higher credit limit can outweigh the temporary impact.

The processing time for a credit limit increase request with Navy Federal can vary. While some requests are processed within a few business days, others may take longer. It’s advisable to monitor your account and be patient while waiting for a response.

Navy Federal does not disclose specific credit score requirements for credit limit increase requests. While a higher credit score may increase your chances of approval, many other factors, such as payment history and income, are also considered.

Approval for a credit limit increase is not guaranteed, as it depends on various factors, including your creditworthiness and Navy Federal’s evaluation of your financial stability. However, meeting the eligibility requirements, maintaining good payment history, and demonstrating responsible credit management can increase your chances of approval.

If your credit limit increase request is denied, you can still reapply in the future. It’s important to assess the reasons for the denial and take steps to improve those aspects of your credit profile, such as paying bills on time and reducing your credit utilization ratio, before submitting another request.

A credit limit increase may impact how other lenders view your creditworthiness, as it increases your overall available credit. Some lenders may see this as a potential risk, while others may view it positively. It’s important to manage your credit responsibly and consider the potential impact on future loans or credit applications.

These answers provide general guidelines, but it’s always a good idea to refer to Navy Federal’s official website or contact their customer service directly for the most accurate and up-to-date information regarding credit limit increases.

Now that you are well-informed about requesting a credit limit increase with Navy Federal, it’s time to wrap up this article.

Conclusion

Requesting a credit limit increase with Navy Federal can be a strategic move to enhance your financial flexibility and demonstrate responsible credit management. By following the steps outlined in this article and understanding the eligibility requirements, documentation needed, and factors that may impact approval, you can confidently navigate the process.

Increasing your credit limit with Navy Federal can offer several advantages. It can provide increased purchasing power, improve your credit utilization ratio, showcase your financial responsibility, and offer flexibility for emergencies or opportunities. However, it’s important to be mindful of the potential drawbacks, such as the temptation to overspend and the impact on future credit applications.

Remember to monitor your credit score, maintain a positive payment history, and manage your credit responsibly. These practices can increase your chances of a successful credit limit increase and contribute to your overall financial well-being.

If you have any specific questions regarding the credit limit increase process with Navy Federal, it’s advisable to refer to their official website or contact their customer service for personalized guidance and up-to-date information.

By understanding the process and considering the pros and cons, you can make an informed decision about whether requesting a credit limit increase with Navy Federal is the right choice for you.+

In the end, managing your credit wisely and using a higher credit limit responsibly can open up opportunities for financial growth and stability.