Finance

How To Manage Cash Flow For Small Business

Published: November 24, 2023

Learn the best tips and strategies to effectively manage cash flow for your small business. Improve your finance management skills and ensure financial stability for your company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing cash flow is crucial for the success and sustainability of any small business. Cash flow refers to the movement of money in and out of a business, including revenue from sales, expenses, and investments. Effective cash flow management ensures that a business has enough cash on hand to cover its operational costs, pay employees, suppliers, and other obligations, and also have enough funds for growth and expansion.

However, many small businesses struggle with cash flow management due to factors such as late payments from clients, unexpected expenses, or seasonal fluctuations in revenue. Without proper cash flow management, a business can face financial problems, such as the inability to pay bills or suppliers, missed growth opportunities, or even bankruptcy.

In this article, we will explore the importance of cash flow management for small businesses and provide you with practical steps to effectively manage your cash flow. By implementing these strategies, you can optimize your financial position, ensure a healthy and consistent cash flow, and enhance the overall success of your business.

Importance of Cash Flow Management

Cash flow management is essential for small businesses for several reasons:

- Liquidity and Survival: Without proper cash flow management, even profitable businesses can run into financial trouble. Having a positive cash flow ensures that you have enough money to cover your day-to-day expenses, such as rent, utilities, and payroll. It also allows you to weather unexpected expenses and navigate through lean periods in revenue.

- Payment Obligations: Managing cash flow enables you to meet your financial obligations on time. This includes paying your suppliers, vendors, and lenders, thereby maintaining a good relationship with them. It also helps you avoid late payment penalties or damaged credit, which can negatively impact your business in the long run.

- Growth and Investment: Positive cash flow provides you with the funds necessary for growth and expansion. It enables you to invest in new equipment, hire additional staff, or launch new marketing campaigns. With a strong cash flow position, you can seize opportunities for business growth and stay competitive in the market.

- Managing Debt: Cash flow management allows you to effectively manage your debt obligations, such as loan repayments or credit card bills. By understanding your cash flow, you can allocate funds to ensure timely debt payments and avoid accruing unnecessary interest or penalties.

- Strategic Planning: Proper cash flow management provides you with valuable insights into the financial health of your business. It allows you to gauge the profitability of different products or services, identify areas where costs can be reduced, and make informed business decisions. By understanding your cash flow, you can plan for the future and set realistic goals for growth and profitability.

Overall, effective cash flow management is vital for the success and sustainability of your small business. It provides you with the financial stability and flexibility needed to navigate through both prosperous and challenging times, make strategic decisions, and achieve your long-term business objectives.

Understanding Cash Flow

Cash flow is the movement of money in and out of your business. It is important to understand the different components of cash flow to effectively manage your finances. There are three main categories of cash flow:

- Operating Cash Flow: This refers to the cash generated or consumed by your core business activities. It includes revenue from sales, payments received from customers, and operating expenses such as rent, utilities, and salaries. Positive operating cash flow indicates that your business is generating more cash than it is spending on its day-to-day operations.

- Investing Cash Flow: Investing cash flow tracks the cash inflows and outflows related to long-term investments in assets such as property, equipment, or marketable securities. Cash outflows include the purchase of these assets, while cash inflows include the sale of assets or returns on investments. Managing investing cash flow involves evaluating the potential return on investment and ensuring that it aligns with your business goals.

- Financing Cash Flow: Financing cash flow reflects the cash generated or consumed through activities like borrowing or repaying loans, issuing or repurchasing stock, or paying dividends. Borrowing money increases financing cash flow, while repaying debt decreases it. Issuing stock or receiving investments also increases financing cash flow, while paying dividends or buying back stock decreases it. Monitoring financing cash flow helps you assess your business’s capital structure and its ability to fund its operations.

To get a comprehensive view of your cash flow, you can create a cash flow statement, which captures the inflows and outflows in each of these categories. This statement provides an overview of your business’s cash position and highlights any cash flow issues that need attention.

It is also important to differentiate between cash flow and profit. While profit represents the excess of revenues over expenses, cash flow represents the actual movement of money. It is possible for a business to be profitable but have poor cash flow if it experiences delays in receiving payments from customers or has high operating expenses. Monitoring both profit and cash flow is crucial for a holistic understanding of your business’s financial health.

By understanding the different components of cash flow and how they relate to your business’s financial activities, you can make informed decisions to manage your cash flow effectively. This understanding will enable you to identify areas of improvement and take the necessary steps to optimize your cash flow and ensure the financial stability of your small business.

Steps to Manage Cash Flow

Managing cash flow requires proactive planning and consistent monitoring. By implementing the following steps, you can effectively manage your cash flow and improve the financial health of your small business:

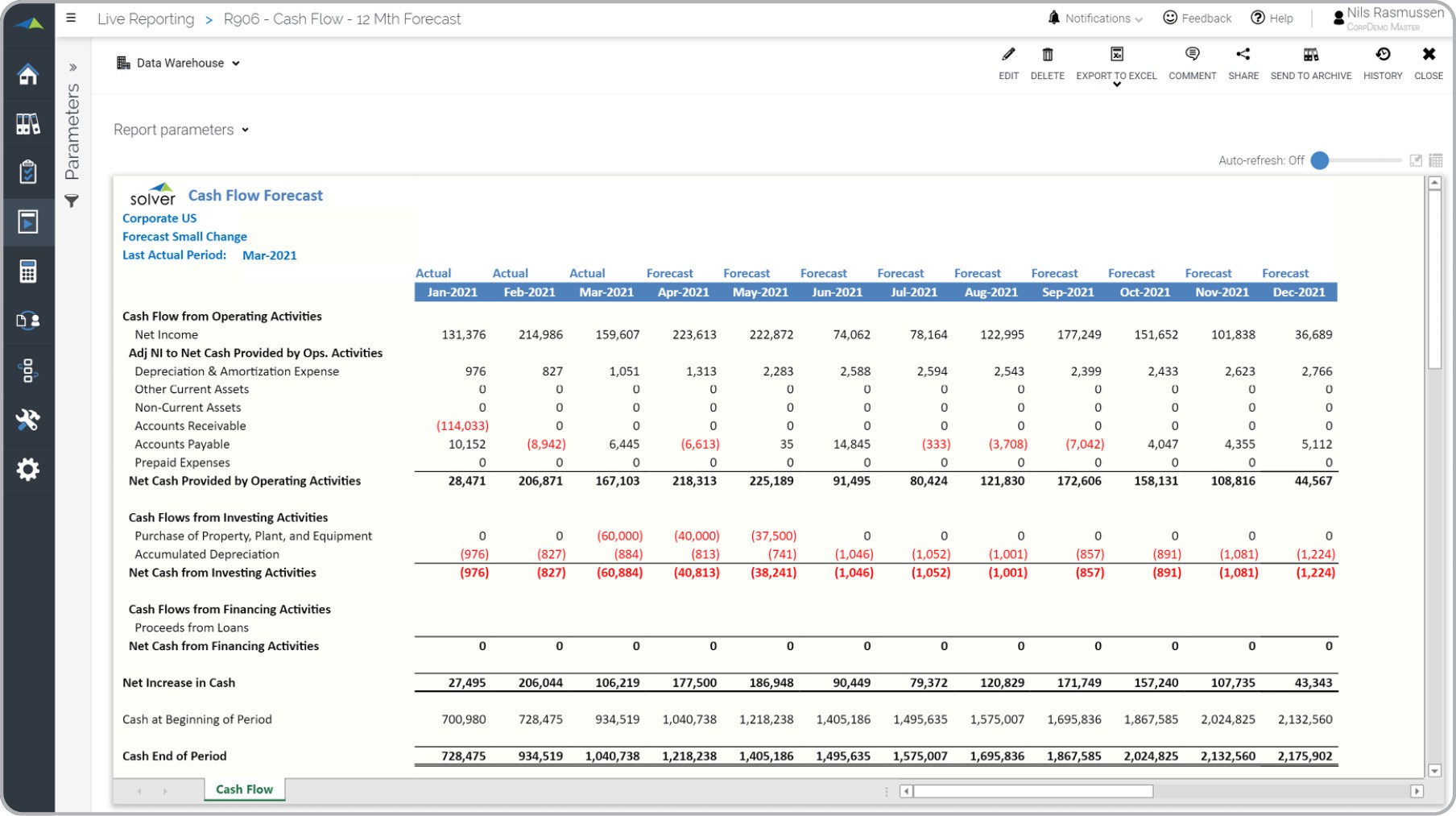

- Forecast Your Cash Flow: Start by creating a cash flow forecast or projection. Estimate your future cash inflows and outflows based on past data, industry trends, and any upcoming business initiatives or expenses. This will help you anticipate cash shortages or surpluses and make necessary adjustments in advance.

- Decrease Expenses: Review your expenses to identify areas where you can reduce costs without compromising the quality of your products or services. Consider negotiating better terms with suppliers, eliminating unnecessary expenses, or finding more cost-effective alternatives. Cutting down on expenses will help improve your cash flow.

- Increase Revenue: Look for opportunities to increase your sales and revenue. Explore new marketing strategies, offer promotions or discounts to attract more customers, or introduce new products or services. Increasing revenue will inject more cash into your business and positively impact your cash flow.

- Adjust Payment Terms: Review your payment terms with customers and suppliers. Consider implementing shorter payment terms for customers to ensure a steady stream of cash inflow. Negotiate longer payment terms with suppliers to provide more flexibility and improve your cash flow.

- Improve Inventory Management: Optimize your inventory management to avoid tying up excessive cash in inventory. Analyze sales trends, identify slow-moving or obsolete inventory, and adjust your purchasing decisions accordingly. Maintaining an optimal inventory level will free up cash and improve your cash flow.

- Establish Emergency Funds: Set aside a portion of your cash flow as emergency funds. This safety net will help you navigate unforeseen expenses or periods of low revenue without disrupting your business operations or facing cash flow shortages.

- Monitor and Review Cash Flow: Regularly monitor and review your cash flow statement to identify any discrepancies or areas of concern. Keep a close eye on key performance indicators (KPIs) such as cash conversion cycle, days sales outstanding (DSO), and accounts payable turnover. This will enable you to identify potential cash flow issues and take corrective actions promptly.

By implementing these steps and adopting a proactive approach to cash flow management, you can optimize your small business’s financial position, ensure a healthy cash flow, and withstand any challenges that may arise.

Forecast Your Cash Flow

Forecasting your cash flow is a crucial step in effectively managing your small business’s finances. By estimating your future cash inflows and outflows, you can anticipate any potential cash shortages or surpluses and make informed decisions to optimize your cash flow. Here are some key steps to follow when forecasting your cash flow:

- Collect Past Data: Gather historical financial data, including cash flow statements, sales records, and payment histories. This information will serve as a foundation for understanding your current cash flow patterns and projecting future trends.

- Identify Revenue Sources: Determine the various sources of revenue for your business, such as product sales, service fees, or investments. Consider seasonal variations and industry trends to estimate the expected revenue for each period.

- Estimate Cash Inflows: Based on your revenue sources, estimate the timing and amount of cash that will be coming into your business. Consider factors like payment terms, collection periods, and any anticipated changes in customer behavior.

- Analyze Expenses: Review your expense categories, including rent, utilities, inventory costs, salaries, and other operating expenses. Identify any fixed or variable costs and project them for each period. Consider any upcoming expenses, such as equipment purchases or marketing campaigns.

- Estimate Cash Outflows: Based on your expense analysis, project the timing and amount of cash that will be going out of your business. Take into account the payment terms with suppliers, loan repayments, taxes, and other financial obligations.

- Consider Non-Operating Items: Include any non-operating items that may impact your cash flow, such as investments, loan proceeds, or one-time cash infusions or outflows.

- Review and Revise: Regularly review and update your cash flow forecast as new information becomes available. Make adjustments based on actual cash flow data, changes in market conditions, or any unforeseen events that may affect your cash flow.

By forecasting your cash flow, you will have a clearer understanding of your business’s financial position and can make proactive decisions to mitigate potential cash flow problems. This will enable you to allocate resources effectively, anticipate funding needs, and ensure the ongoing stability and growth of your small business.

Decrease Expenses

Reducing expenses is a key strategy to improve your small business’s cash flow. By identifying areas where you can cut costs without sacrificing quality, you can free up more cash to cover essential expenses and invest in growth opportunities. Here are some effective ways to decrease expenses:

- Review Overhead Costs: Take a close look at your monthly overhead costs, such as rent, utilities, insurance, and office supplies. Consider negotiating lower rates with service providers, exploring energy-saving measures, or downsizing your office space if it is excessive.

- Trim Operational Expenses: Analyze your day-to-day operational expenses and identify areas where you can reduce costs. Look for cost-saving alternatives or negotiate better terms with vendors and suppliers. Consider consolidating orders to take advantage of volume discounts.

- Optimize Inventory Management: Excess inventory ties up valuable cash. Review your inventory levels and identify slow-moving or obsolete items. Develop a streamlined inventory management system to avoid overstocking and minimize waste. Consider implementing just-in-time inventory practices to reduce carrying costs.

- Reduce Marketing Expenses: Explore cost-effective marketing strategies that offer a high return on investment. Focus on targeted digital marketing campaigns, utilize social media platforms, and leverage customer referrals. Monitor the performance of your marketing efforts and optimize your spending based on their effectiveness.

- Control Employee Costs: Labor costs can significantly impact your cash flow. Evaluate whether you have the right number of employees and consider alternatives such as outsourcing or automation. Implement cost-saving measures like flexible work schedules, remote work options, or cross-training employees to handle multiple tasks.

- Negotiate with Suppliers: Regularly review your contracts and payment terms with suppliers. Negotiate better prices or discounts for bulk purchases. Explore alternative suppliers to ensure you are getting the best value for your money. Building strong relationships with suppliers can help you secure better deals and improve your cash flow.

- Track and Analyze Expenses: Maintain a detailed record of your expenses and regularly analyze them for opportunities to cut costs. Categorize expenses and identify areas where spending can be reduced. Use expense tracking software or apps to streamline this process and gain valuable insights into your spending patterns.

By implementing these strategies to decrease expenses, you can efficiently manage your cash flow and increase the financial stability of your small business. Regularly review your expenses and seek opportunities for cost savings to optimize your cash flow and ensure long-term success.

Increase Revenue

Increasing revenue is a vital step in managing your cash flow and ensuring the financial growth of your small business. By implementing strategies to boost sales and attract new customers, you can generate more cash inflow and improve your cash flow position. Here are some effective ways to increase revenue:

- Identify Target Markets: Understand your target audience and tailor your products or services to meet their needs. Conduct market research to identify untapped opportunities and develop targeted marketing campaigns to reach potential customers.

- Expand Product or Service Offerings: Consider expanding your product or service offerings to cater to a wider range of customer preferences. Introduce complementary products or explore new markets to diversify your revenue streams.

- Price Strategically: Analyze the market and adjust your pricing strategy accordingly. Consider offering bundled packages, discounts for bulk purchases, or loyalty programs to incentivize customers to spend more.

- Improve Customer Experience: Enhancing the customer experience can lead to repeat business and positive word-of-mouth referrals. Provide exceptional customer service, personalize interactions, and actively seek feedback to continually improve and retain customers.

- Invest in Marketing: Allocate resources to effective marketing strategies to increase your brand visibility and attract new customers. Utilize digital marketing channels, social media platforms, and targeted advertising campaigns. Track the results of your marketing efforts to optimize your spending and focus on the most successful channels.

- Upsell and Cross-sell: Identify opportunities to upsell or cross-sell to your existing customer base. Recommend complementary products or services that enhance their current purchase, increasing their overall spend with your business.

- Explore New Sales Channels: Expand your sales channels by exploring online platforms, setting up an e-commerce store, or partnering with other businesses. This can help you reach a wider audience and increase your revenue potential.

- Build Customer Loyalty: Develop loyalty programs or rewards systems to encourage repeat purchases and turn customers into brand advocates. Offer incentives, exclusive discounts, or special promotions for loyal customers to foster long-term relationships.

By strategically increasing your revenue, you can improve your cash flow and strengthen the financial position of your small business. Continuously assess market opportunities, optimize your product offerings, and invest in effective marketing strategies to attract new customers and grow your revenue streams.

Adjust Payment Terms

Adjusting payment terms can have a significant impact on your cash flow and improve the financial stability of your small business. By optimizing when and how you receive payments from customers and when you make payments to suppliers, you can better manage your cash flow. Here are some strategies to consider:

- Invoice Promptly and Clearly: Send out invoices as soon as possible after delivering your products or services. Ensure that your invoices are clear, accurate, and include all necessary details, such as payment terms and banking information. This will help speed up the payment process.

- Offer Early Payment Incentives: Encourage customers to pay early by offering incentives, such as discounts or extended warranties. This motivates them to settle their invoices sooner, improving your cash flow and potentially building customer loyalty.

- Negotiate Payment Terms: Review your payment terms with customers and identify opportunities to negotiate shorter payment cycles. Consider offering multiple payment options and flexible terms that accommodate your customers’ preferences and financial capabilities.

- Implement Late Payment Penalties: To discourage late payments, establish clear penalties for overdue invoices. Communicate these penalties to your customers and enforce them consistently. This encourages timely payments and reduces cash flow disruptions caused by delayed payments.

- Utilize Payment Gateways or Online Platforms: Implement online payment gateways or digital platforms that streamline your payment processes. This makes it easier and faster for customers to pay, resulting in quicker cash inflows and improved cash flow management.

- Negotiate Payment Terms with Suppliers: Evaluate your payment terms with suppliers and negotiate more favorable terms. Consider extending payment periods or negotiating discounts for early payment. This allows you to preserve cash for longer periods and improve your cash flow position.

- Explore Financing Options: If your cash flow is consistently affected by late payments, consider exploring financing options such as invoice factoring or using a line of credit to bridge the gap. This allows you to access funds when needed and maintain smooth operations.

- Regularly Monitor Receivables: Keep a close eye on your accounts receivable and follow up on any overdue payments. Implement a system to track outstanding invoices and send payment reminders to customers. This ensures that you are proactively managing your cash flow and minimizing the impact of late payments.

By adjusting payment terms, you can optimize your cash flow by accelerating cash inflows and strategically managing your payment obligations. Regularly review and assess your payment processes and terms to ensure they align with your business goals and improve your overall financial stability.

Improve Inventory Management

Effective inventory management is crucial for optimizing your cash flow and improving the financial health of your small business. Properly managing your inventory levels ensures that you have the right amount of stock on hand to meet customer demand while minimizing excess inventory costs. Here are some strategies to improve your inventory management:

- Regularly Analyze Sales Trends: Review your sales data to identify patterns and trends in customer demand. This information will help you make more accurate inventory projections and avoid overstocking or understocking.

- Implement Just-in-Time (JIT) Inventory: Adopt a just-in-time inventory system to minimize holding costs. With JIT, you only order inventory as needed, reducing the amount of working capital tied up in inventory. This approach can improve cash flow and reduce the risk of holding obsolete or slow-moving inventory.

- Establish Effective Reordering Systems: Set up reliable systems to monitor inventory levels and automate reordering processes. This ensures that you are restocking products in a timely manner, preventing stockouts and ensuring you have sufficient inventory to fulfill customer orders.

- Optimize Supplier Relationships: Develop strong relationships with your suppliers to facilitate smoother inventory management. Communicate regularly and negotiate favorable terms, such as flexible payment terms or bulk discounts, to improve your cash flow and reduce costs.

- Utilize Demand Forecasting: Utilize forecasting techniques to project future demand for your products. Consider factors such as seasonal fluctuations, market trends, and upcoming promotions or events. Accurate demand forecasting enables you to optimize inventory levels and avoid excess stock.

- Implement SKU Rationalization: Regularly assess your product offerings and identify underperforming or low-margin SKUs (Stock Keeping Units). Eliminate or replace these SKUs to focus on more profitable products and reduce inventory holding costs.

- Streamline Order Fulfillment Processes: Review and optimize your order fulfillment processes to minimize errors and delays. Efficient operations ensure timely delivery of products to customers, reducing order cancellations or returns that can tie up cash and impact cash flow.

- Utilize Technology and Inventory Management Systems: Implement inventory management software or systems that provide real-time visibility into your inventory levels, sales data, and order history. Such tools enable you to make data-driven decisions and streamline inventory management processes.

By improving your inventory management practices, you can free up valuable cash flow, reduce holding costs, and ensure that you have the right products available to meet customer demand. Regularly analyze your inventory data, streamline processes, and utilize technology to optimize your inventory management and positively impact your cash flow.

Establish Emergency Funds

Establishing emergency funds is a vital step in managing your small business’s cash flow and safeguarding its financial stability. These funds act as a safety net during unexpected events or challenging times, allowing you to navigate through financial uncertainties without severely impacting your operations. Here’s how to establish and manage emergency funds:

- Set Clear Savings Goals: Determine how much you need to save in order to establish an adequate emergency fund. This should be based on factors such as your business’s size, industry, and potential risks. Aim to save enough to cover several months’ worth of fixed expenses.

- Make Regular Contributions: Treat your emergency fund as a priority expense and allocate funds to it on a regular basis. Set up automatic transfers from your business’s operating account to the emergency fund to ensure consistency and discipline.

- Separate Emergency Funds from Operating Funds: Keep your emergency funds in a separate business account, distinct from your day-to-day operating funds. This separation will help you resist the temptation to dip into the emergency funds for non-essential expenses.

- Plan for Different Scenarios: Consider possible scenarios that could impact your business’s cash flow, such as economic downturns, industry disruptions, or unexpected expenses. Develop contingency plans to mitigate these risks and determine how much you need to allocate to your emergency fund to address each scenario.

- Replenish the Fund: If you have to use your emergency funds, make it a priority to replenish them as soon as possible. Adjust your cash flow forecast and allocate funds specifically for rebuilding the emergency fund until it reaches the desired level again.

- Evaluate Insurance Coverage: Assess your business insurance policies to ensure that you have adequate coverage for potential risks. This can include property insurance, liability insurance, and business interruption insurance. Proper insurance coverage can provide additional financial protection during emergencies.

- Regularly Review and Update: Revisit your emergency fund goals and strategies periodically to ensure they remain relevant and aligned with your business’s evolving needs. Update the fund as your business grows or encounters new risks.

- Stay Disciplined: Resist the temptation to dip into your emergency funds for non-emergency purposes. Maintain the discipline to only use the funds when truly necessary to protect your business’s financial stability.

By establishing and maintaining emergency funds, you are better prepared to handle unexpected financial challenges and cash flow disruptions. These funds provide you with peace of mind, allowing you to focus on running your business and navigating through difficult times with greater confidence and resilience.

Monitor and Review Cash Flow

Monitoring and regularly reviewing your cash flow is essential for effective cash flow management. By continuously tracking your cash inflows and outflows, analyzing trends, and making necessary adjustments, you can maintain a healthy cash flow and ensure the financial success of your small business. Here are key steps to monitor and review your cash flow:

- Maintain Accurate Financial Records: Keep detailed and up-to-date records of all financial transactions, including sales, expenses, payments, and receipts. Use accounting software or tools to streamline this process and ensure accuracy.

- Create and Analyze Cash Flow Statements: Regularly generate cash flow statements to provide a snapshot of your cash flow, including cash inflows and outflows over a specific period. Use these statements to track your performance, identify trends, and assess the financial health of your business.

- Identify Key Performance Indicators (KPIs): Determine relevant KPIs for your business to measure and monitor your cash flow. Key indicators may include cash conversion cycle, days sales outstanding (DSO), accounts payable turnover, or gross margin. Tracking these KPIs helps you identify potential issues and make informed decisions.

- Compare Actuals vs. Forecasts: Regularly compare your actual cash flow data with your forecasted projections. Analyzing the variances will highlight areas where you may need to make adjustments or take corrective actions to align your cash flow with your projections.

- Conduct Regular Cash Flow Reviews: Set a schedule to review your cash flow statements and financial records on a weekly, monthly, or quarterly basis. Use these reviews as an opportunity to identify areas of improvement, uncover cash flow bottlenecks, and make strategic decisions to optimize your cash flow.

- Seek Professional Advice: Consider consulting with a finance professional or accountant to help you interpret your cash flow statements and provide valuable insights. They can offer guidance on cash flow management techniques and help you navigate any financial challenges.

- Anticipate and Plan for Seasonal Fluctuations: If your business experiences seasonal variations in cash flow, anticipate these fluctuations in advance. Adjust your cash flow forecasts and plan for the lean periods by building up cash reserves or implementing cost-saving measures.

- Regularly Update Your Cash Flow Forecast: Adjust your cash flow forecast as new information becomes available. Incorporate changes in market conditions, customer behavior, or business initiatives to ensure your forecasts remain accurate and realistic.

- Implement Continuous Improvement Measures: Continually assess and refine your cash flow management strategies. Identify areas for improvement, seek feedback from your team or advisors, and implement changes to optimize your cash flow on an ongoing basis.

By diligently monitoring and reviewing your cash flow, you can maintain a clear understanding of your business’s financial position, identify potential issues or opportunities, and make informed decisions to improve your cash flow management. Regular monitoring ensures that you stay proactive and agile in adapting to changing market dynamics and maintaining a healthy cash flow for the long-term success of your small business.

Conclusion

Managing cash flow is a critical aspect of running a successful small business. It allows you to maintain financial stability, meet payment obligations, and seize growth opportunities. By implementing the steps outlined in this article, you can optimize your cash flow and enhance the overall financial health of your business.

First, forecasting your cash flow enables you to anticipate potential cash shortages or surpluses, allowing you to make informed decisions and take necessary actions in advance. Decreasing expenses helps you cut costs without compromising the quality of your products or services, freeing up valuable cash for other business needs.

Increasing revenue through targeted marketing strategies and expanding your product offerings boosts your cash inflows, improving your cash flow position. Adjusting payment terms with both customers and suppliers can have a significant impact on your cash flow by speeding up payment collections and optimizing payment obligations.

Improving inventory management ensures that you have the right amount of stock at the right time, reducing holding costs and avoiding excess inventory. Establishing emergency funds provides a safety net during unexpected events or downturns, protecting your business’s financial stability.

Lastly, continuous monitoring and reviewing of your cash flow allows you to stay proactive, gain insights into your financial performance, and make necessary adjustments to optimize your cash flow management strategies.

Remember, effective cash flow management is a dynamic process that requires regular attention and adaptation to changing circumstances. By implementing these strategies and maintaining a disciplined approach to cash flow management, you can navigate financial challenges, seize growth opportunities, and ensure the long-term success of your small business.