Finance

What Is Loans Receivable?

Modified: March 1, 2024

Learn about loans receivable in finance, including its definition, importance, and how it impacts a company's financial position. Understand the role of loans receivable in managing cash flow and liquidity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Loans receivable are a fundamental aspect of the financial industry, playing a pivotal role in the operations of banks, credit unions, and other lending institutions. These financial instruments represent the amounts owed to a lender by borrowers, and they are a key component of a lender’s assets. Understanding loans receivable is essential for comprehending the intricacies of financial management and the potential risks and rewards associated with lending activities.

In this article, we will delve into the definition of loans receivable, explore the various types of loans receivable, examine how they are recorded on a company’s balance sheet, and discuss their importance in the realm of finance. Additionally, we will shed light on the risks associated with loans receivable, providing a comprehensive overview of this critical financial concept.

Whether you are a finance professional, a business owner, or an individual seeking to expand your knowledge of financial matters, gaining insights into loans receivable can empower you to make informed decisions and navigate the complex landscape of borrowing and lending.

Definition of Loans Receivable

Loans receivable, also known as notes receivable, refer to the amounts of money owed to a lender by borrowers. These loans are typically extended for a specific period and carry an interest rate, generating income for the lender. From the lender’s perspective, loans receivable are considered assets, as they represent the right to receive payment from the borrowers in the future.

When a lender disburses funds to a borrower, a legal agreement is established, outlining the terms and conditions of the loan, including the repayment schedule, interest rate, and any collateral provided by the borrower. This agreement serves as evidence of the borrower’s obligation to repay the borrowed amount along with the accrued interest.

Loans receivable can take various forms, such as commercial loans, consumer loans, mortgage loans, and other types of financing provided by financial institutions. These loans can be secured, where the borrower pledges collateral to secure the loan, or unsecured, relying solely on the borrower’s creditworthiness and promise to repay.

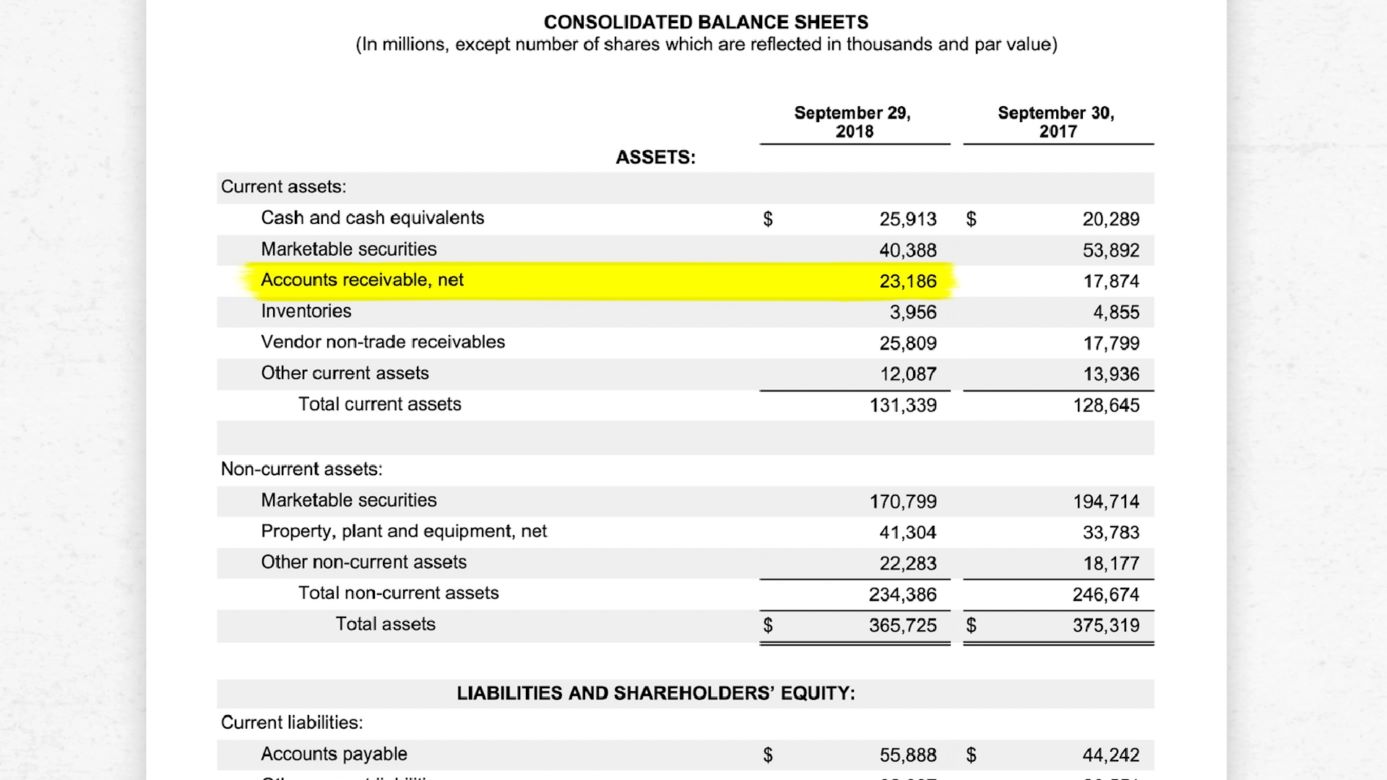

From a financial reporting standpoint, loans receivable are recorded as assets on the lender’s balance sheet, reflecting the expected future cash flows from the borrowers. The valuation of these assets takes into account factors such as the creditworthiness of the borrowers, the presence of collateral, and the prevailing interest rates.

Understanding the definition of loans receivable is crucial for both lenders and borrowers, as it forms the foundation for the entire lending process and influences the financial health of the parties involved.

Types of Loans Receivable

Loans receivable encompass a diverse array of financial instruments tailored to meet the varied needs of borrowers and lenders. Understanding the different types of loans receivable is essential for navigating the complex landscape of lending and comprehending the specific characteristics and risks associated with each category.

1. Commercial Loans: These loans are extended to businesses to support their operational needs, expansion plans, or capital expenditures. Commercial loans can be short-term or long-term, and they are often secured by business assets or personal guarantees from the business owners.

2. Consumer Loans: Consumer loans are designed to meet the personal financial requirements of individuals. This category includes auto loans, personal loans, and credit card loans. Consumer loans can be either secured or unsecured, with the terms and interest rates varying based on the borrower’s credit history and financial standing.

3. Mortgage Loans: Mortgage loans are specifically used to finance the purchase of real estate properties. They are secured by the underlying property, providing the lender with a legal claim to the property in case of default. Mortgage loans can be fixed-rate or adjustable-rate, offering different repayment structures to borrowers.

4. Installment Loans: Installment loans involve fixed, regular payments over a predetermined period. These loans are commonly used for large purchases such as furniture, appliances, or home improvements. The terms of installment loans specify the repayment schedule and the total amount of interest to be paid over the loan’s duration.

5. Revolving Credit Facilities: This type of loan allows borrowers to access funds up to a predetermined credit limit. Credit cards and lines of credit are common examples of revolving credit facilities. Borrowers can use and repay the funds multiple times, with interest charged on the outstanding balance.

Each type of loan receivable serves distinct purposes and comes with its own set of risks and rewards. Lenders carefully assess the creditworthiness of the borrowers and the underlying collateral, if any, to determine the terms and conditions for extending these loans.

How Loans Receivable Are Recorded

Recording loans receivable involves a structured process that reflects the financial impact of lending activities on a company’s balance sheet and income statement. The accurate and transparent recording of loans receivable is crucial for financial reporting and analysis, providing stakeholders with insights into the company’s assets, liabilities, and overall financial health.

When a lender extends a loan to a borrower, the transaction triggers several accounting entries to appropriately capture the loan on the lender’s books. The initial recording of a loan receivable involves the following steps:

- Recognition: The loan amount is recognized as an asset on the lender’s balance sheet, reflecting the present value of the future cash flows expected from the borrower, including both the principal amount and the accrued interest.

- Interest Income: As the loan accrues interest over time, the interest income is recognized on the income statement, contributing to the lender’s revenue. The interest income is calculated based on the outstanding loan balance and the applicable interest rate.

- Amortization of Fees and Costs: If the loan involves origination fees, closing costs, or other expenses, these costs are amortized over the loan’s term and reflected in the lender’s financial statements as a reduction of the loan’s carrying amount.

- Provision for Credit Losses: Lenders are required to estimate and set aside provisions for potential credit losses related to loans receivable. This provision is a prudent measure to account for the possibility of borrowers defaulting on their loan obligations.

Additionally, the accounting treatment of loans receivable entails ongoing monitoring and evaluation of the loan portfolio, including assessing the collectability of the loans, recognizing impairment losses, and disclosing relevant information in the financial statements and accompanying notes.

It is important to note that the specific accounting standards and regulatory requirements governing the recording of loans receivable may vary based on the jurisdiction and the nature of the lending institution. Compliance with these standards ensures transparency and accuracy in financial reporting, fostering trust and confidence among investors, regulators, and other stakeholders.

By meticulously recording loans receivable and adhering to accounting principles, lenders can effectively communicate the value and risks associated with their loan portfolios, enabling informed decision-making and robust financial analysis.

Importance of Loans Receivable

Loans receivable hold significant importance within the financial landscape, serving as a cornerstone of lending activities and playing a pivotal role in the operations of financial institutions. The following points underscore the importance of loans receivable:

- Revenue Generation: Loans receivable are a primary source of revenue for lenders, as the interest income derived from these loans contributes to their overall earnings. By extending loans to creditworthy borrowers, lenders can generate a steady stream of interest income, thereby enhancing their financial performance.

- Facilitating Economic Growth: Loans receivable enable individuals and businesses to access the capital needed for various purposes, including starting a business, purchasing a home, or funding expansion initiatives. By providing financial resources, lenders support economic growth and entrepreneurship, contributing to overall prosperity.

- Asset Diversification: For financial institutions, loans receivable represent a diversified asset class, allowing them to spread risk across a broad spectrum of borrowers and industries. This diversification helps mitigate the impact of economic downturns or sector-specific challenges, bolstering the stability of the institution’s asset portfolio.

- Interest Rate Management: Lenders can strategically manage their loan portfolios to align with prevailing interest rate environments, thereby optimizing their interest income and managing interest rate risk. By offering a mix of fixed-rate and adjustable-rate loans, lenders can adapt to changing market conditions and customer preferences.

- Customer Relationships: Extending loans to customers fosters long-term relationships and enhances customer loyalty. By providing tailored financing solutions and supporting the financial needs of individuals and businesses, lenders can strengthen their customer base and position themselves as trusted financial partners.

Furthermore, loans receivable contribute to the overall liquidity and solvency of lending institutions, providing a foundation for sustainable growth and stability. The prudent management of loans receivable, including robust underwriting standards, risk assessment, and portfolio monitoring, is essential for mitigating credit risk and ensuring the long-term viability of the lending institution.

By recognizing the importance of loans receivable and embracing sound lending practices, financial institutions can fulfill their role as key enablers of economic activity while prudently managing the associated risks and opportunities.

Risks Associated with Loans Receivable

While loans receivable are integral to the functioning of financial institutions and the broader economy, they are accompanied by inherent risks that warrant careful consideration and proactive risk management. Understanding and mitigating these risks is essential for maintaining the stability and resilience of lending institutions. The following are key risks associated with loans receivable:

- Credit Risk: One of the primary risks associated with loans receivable is credit risk, which arises from the potential for borrowers to default on their loan obligations. Lenders face the risk of non-payment or delayed payment by borrowers, impacting the expected cash flows and the overall financial performance of the institution.

- Interest Rate Risk: Loans receivable expose lenders to interest rate risk, especially in the case of variable or adjustable-rate loans. Fluctuations in interest rates can affect the income generated from these loans and may lead to mismatches between the cost of funds and the interest income, impacting the institution’s profitability.

- Liquidity Risk: Lenders may encounter liquidity risk related to loans receivable, particularly in scenarios where a significant portion of the loan portfolio becomes non-performing or when unexpected withdrawal requests from depositors outpace the available funds. This can strain the institution’s liquidity position and its ability to meet its obligations.

- Regulatory and Compliance Risk: The lending activities associated with loans receivable are subject to regulatory oversight and compliance requirements. Non-compliance with applicable laws and regulations can expose lenders to legal and reputational risks, potentially leading to penalties and loss of trust among stakeholders.

- Concentration Risk: Concentration risk arises when a large portion of the loan portfolio is exposed to specific industries, geographic regions, or types of borrowers. Economic downturns or adverse developments in concentrated sectors can significantly impact the performance of the loan portfolio and the overall financial health of the institution.

Effectively managing these risks requires robust risk assessment, prudent underwriting standards, ongoing monitoring of the loan portfolio, and the implementation of risk mitigation strategies. Lending institutions employ various risk management tools and practices, including credit analysis, stress testing, loan loss provisioning, and the use of derivatives to hedge against interest rate fluctuations.

Furthermore, fostering a risk-aware culture within the organization and maintaining open communication with regulators and stakeholders are essential components of effective risk management in the context of loans receivable. By proactively identifying, assessing, and mitigating these risks, lenders can safeguard their financial stability and uphold their role as responsible stewards of capital and credit.

Conclusion

Loans receivable form the cornerstone of lending activities, playing a vital role in the functioning of financial institutions and the broader economy. As assets on a lender’s balance sheet, loans receivable represent the amounts owed by borrowers and serve as a source of interest income, revenue generation, and economic growth. The diverse types of loans receivable, including commercial loans, consumer loans, mortgage loans, and revolving credit facilities, cater to the varied financial needs of individuals and businesses, contributing to the expansion and development of economic activities.

However, the importance of loans receivable is accompanied by inherent risks, including credit risk, interest rate risk, liquidity risk, regulatory and compliance risk, and concentration risk. Prudent risk management practices, robust underwriting standards, and ongoing portfolio monitoring are crucial for mitigating these risks and safeguarding the stability and resilience of lending institutions.

Effective recording and reporting of loans receivable, in compliance with accounting standards and regulatory requirements, provide transparency and insights into the financial health of lenders, fostering trust and confidence among stakeholders. Furthermore, the strategic management of loans receivable, encompassing customer relationships, asset diversification, and interest rate management, contributes to the long-term viability and sustainability of lending institutions.

In conclusion, loans receivable are not only financial assets but also catalysts for economic progress and prosperity. By embracing sound lending practices, prudent risk management, and a commitment to regulatory compliance, lenders can navigate the complexities of loans receivable while fulfilling their pivotal role in facilitating access to capital and fostering financial well-being for individuals and businesses alike.