Home>Finance>At What Value Are Accounts Receivable Reported On The Balance Sheet

Finance

At What Value Are Accounts Receivable Reported On The Balance Sheet

Modified: March 1, 2024

Discover how accounts receivable are reported on the balance sheet in finance and gain insights into their value.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accounts receivable is a vital component of a company’s financial records, and it plays a crucial role in assessing its financial health and performance. In simple terms, accounts receivable represents the money owed to a business by its customers for the sale of goods or services on credit. These outstanding payments form an essential part of a company’s assets and are recorded on the balance sheet.

In this article, we will delve into the topic of accounts receivable and explore how they are reported on the balance sheet. We will discuss the definition and explanation of accounts receivable, the process of recording them, and the factors that affect their value. Additionally, we will examine how accounts receivable are presented on the balance sheet to provide a comprehensive understanding of their significance in financial reporting.

Understanding how accounts receivable are valued and reported is crucial for both businesses and investors. For businesses, accounts receivable represent a substantial portion of their working capital and cash flow. Efficient management of accounts receivable is essential for maintaining a healthy cash flow and ensuring timely collection of outstanding payments. For investors, accounts receivable provide insights into a company’s sales, credit policies, and potential cash generation capabilities. Therefore, a clear understanding of how accounts receivable are recorded and presented on the balance sheet is essential for making informed financial decisions.

Now, let’s dive into the intricacies of accounts receivable and uncover how they are valued and reported on the balance sheet.

Definition and Explanation of Accounts Receivable

Accounts receivable, also known as trade receivables, refers to the money that a business is owed by its customers for goods sold or services rendered on credit. When a company sells its products or services on credit terms, it essentially extends a line of credit to its customers, allowing them to make payment at a later date. These unpaid invoices, or outstanding payments, are considered accounts receivable.

The concept of accounts receivable arises from the concept of credit sales. Businesses often offer credit to their customers as a way to encourage sales and build customer loyalty. By allowing their customers to pay at a later date, businesses can attract more buyers and facilitate larger transactions. In essence, accounts receivable reflect the trust that a company places in its customers to fulfill their payment obligations within the agreed-upon terms.

Accounts receivable can include a variety of transactions, such as the sale of goods, professional services, or the provision of ongoing subscriptions. Regardless of the nature of the transaction, when a business extends credit to a customer, an account receivable is created.

It’s important to note that accounts receivable are considered current assets on the balance sheet, as they are expected to be collected within a relatively short period, typically within one year. However, if the collection period extends beyond a year, the accounts receivable are classified as long-term assets.

Managing accounts receivable is a crucial aspect of financial management for businesses. It involves setting credit policies, monitoring payment terms, and actively pursuing the collection of outstanding debts. Effective management of accounts receivable ensures a healthy cash flow and minimizes the risk of bad debts.

In summary, accounts receivable represent the money owed to a business by its customers for credit sales. They reflect the trust extended to customers and form a significant part of a company’s assets. Managing accounts receivable is essential for maintaining a healthy cash flow and ensuring prompt collection of outstanding payments.

Recording of Accounts Receivable

Recording accounts receivable involves the systematic and accurate documentation of the amounts owed by customers for credit sales. This process is essential for proper financial record-keeping and helps businesses track outstanding payments, monitor credit policies, and assess their financial standing.

When a sale is made on credit, it is crucial to record the transaction accurately to ensure that the accounts receivable balance is updated. The recording process typically involves the following steps:

- Invoice Generation: When a business makes a sale on credit, an invoice is generated and sent to the customer. The invoice includes details such as the date of the sale, the quantity and description of the products or services, the agreed-upon price, and the payment terms.

- Updating the Sales Register: The details of the sale, including the customer’s name, invoice number, date, and amount, are recorded in the sales register. This register helps businesses track their sales and identify outstanding invoices.

- Recording in the Accounts Receivable Ledger: The information from the sales register is then transferred to the accounts receivable ledger. Each customer has a separate account in the ledger, which keeps a record of their outstanding balances. The ledger includes the invoice amount, the customer’s payment history, and any adjustments or credits applied.

- Posting to the General Ledger: The accounts receivable ledger is connected to the general ledger, which contains all the financial accounts of the business. The total accounts receivable balance is posted to the general ledger, increasing the accounts receivable account and maintaining the overall financial records.

It is essential to maintain accuracy and consistency in recording accounts receivable to ensure reliable financial statements. This helps businesses assess their cash flow, analyze customer payment patterns, and identify any potential issues with non-payment or overdue invoices.

In addition to the regular recording process, businesses should also pay attention to making necessary adjustments and allowances. This may include providing discounts for early payments or making provisions for doubtful debts (bad debts) based on the estimated amount that may not be collected. These adjustments help in presenting a more accurate picture of the value of accounts receivable and ensure compliance with accounting standards.

Overall, recording accounts receivable involves generating invoices, updating sales registers, maintaining accounts receivable ledgers, and posting to the general ledger. This systematic process ensures proper financial record-keeping and facilitates effective management of outstanding payments.

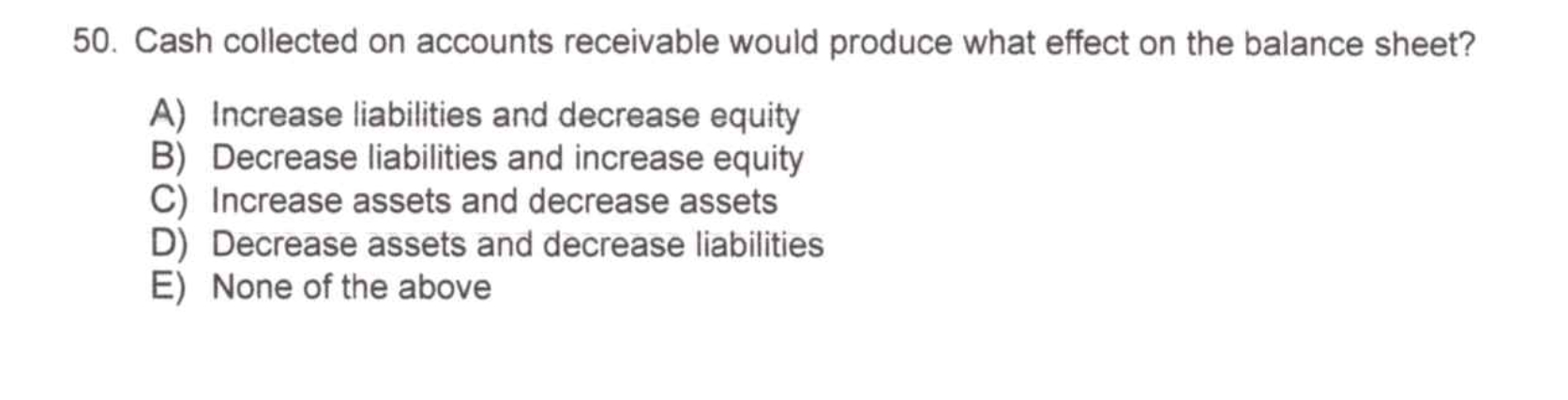

Valuing Accounts Receivable

Valuing accounts receivable involves determining the amount at which they are reported on the balance sheet. Accurate valuation is crucial as it reflects the expected realizable value of the outstanding payments and provides insights into a company’s financial position.

The most common method of valuing accounts receivable is the net realizable value (NRV) approach. The net realizable value represents the estimated amount that a company expects to collect from its customers after considering potential bad debts or uncollectible amounts. It takes into account the historical collection experience, creditworthiness of customers, and any specific circumstances that might impact the collectability of the outstanding payments.

To calculate the net realizable value, businesses generally follow these steps:

- Total Accounts Receivable: The starting point is the total amount of accounts receivable recorded in the accounts receivable ledger.

- Allowance for Doubtful Debts: An allowance for doubtful debts is created based on an estimate of the uncollectible portion. This estimation is typically based on historical collection experience, industry norms, economic factors, and individual assessment of customers’ creditworthiness. The allowance for doubtful debts is then deducted from the total accounts receivable.

- Net Realizable Value: The net realizable value is the resulting balance after subtracting the allowance for doubtful debts from the total accounts receivable. It represents the expected amount that the company anticipates collecting from its customers.

Valuing accounts receivable is critical for providing a realistic representation of a company’s financial position. A conservative approach should be adopted when estimating the allowance for doubtful debts to ensure that the net realizable value accurately reflects the collectability of the outstanding amounts.

In certain situations, accounts receivable may be valued at their face value or gross amount without deducing any allowance for doubtful debts. This is typically done when the likelihood of uncollectibility is remote, and there is a high level of certainty that all outstanding payments will be collected in full.

It’s worth noting that the valuation of accounts receivable directly impacts the reported net income. A decrease in the net realizable value will result in an increase in the bad debt expense, reducing the net income. Conversely, an increase in the net realizable value will have the opposite effect on the net income.

Overall, valuing accounts receivable involves estimating the net realizable value by deducting the allowance for doubtful debts from the total accounts receivable. This valuation provides a more accurate representation of the collectability of outstanding payments and contributes to the assessment of a company’s financial standing.

Factors Affecting the Value of Accounts Receivable

The value of accounts receivable is influenced by several factors that can impact their collectability and subsequent valuation. These factors can vary across industries and individual businesses but generally include the following:

- Credit Policies and Terms: The credit policies and terms set by a business play a crucial role in determining the collectability of accounts receivable. Businesses that have strict credit evaluation processes, clear payment terms, and proactive collections practices tend to have lower instances of bad debts and a higher value of accounts receivable.

- Customer Creditworthiness: The creditworthiness of customers significantly impacts the collectability of accounts receivable. Businesses that sell to customers with a solid credit history and a good track record of making timely payments are more likely to have a higher value of accounts receivable. On the other hand, customers with a poor credit history or a high risk of defaulting on payments may increase the probability of bad debts.

- Economic Conditions: The overall economic conditions, both at the macro and micro levels, can influence the value of accounts receivable. During an economic downturn, businesses may experience higher instances of non-payment or delayed payments, leading to a decrease in the value of accounts receivable. Conversely, in a robust economy, with higher consumer spending and better financial stability, businesses may see a lower risk of bad debts and a higher value of accounts receivable.

- Industry Factors: Industry-specific factors can impact the value of accounts receivable. For example, businesses operating in industries with longer payment cycles, such as construction or manufacturing, may have a higher value of accounts receivable due to extended credit terms. On the other hand, businesses in industries with shorter payment cycles, such as retail or e-commerce, may have a lower value of accounts receivable due to shorter credit terms or immediate payment requirements.

- Collection Practices: The effectiveness of a business’s collection practices can significantly influence the value of accounts receivable. Businesses that have robust collections processes, including regular follow-ups, reminders, and efficient dispute resolution mechanisms, are more likely to collect outstanding payments in a timely manner, resulting in a higher value of accounts receivable.

It is critical for businesses to monitor and evaluate these factors to assess the creditworthiness of their customers, manage their credit policies and terms, and make informed decisions regarding the value of accounts receivable. By actively managing these factors, businesses can enhance their cash flow, minimize the risk of bad debts, and maintain a healthy financial position.

In summary, the value of accounts receivable is influenced by factors such as credit policies and terms, customer creditworthiness, economic conditions, industry factors, and collection practices. Understanding and managing these factors are pivotal for businesses in determining the collectability and subsequent valuation of their accounts receivable and for maintaining a strong financial position.

Presentation of Accounts Receivable on the Balance Sheet

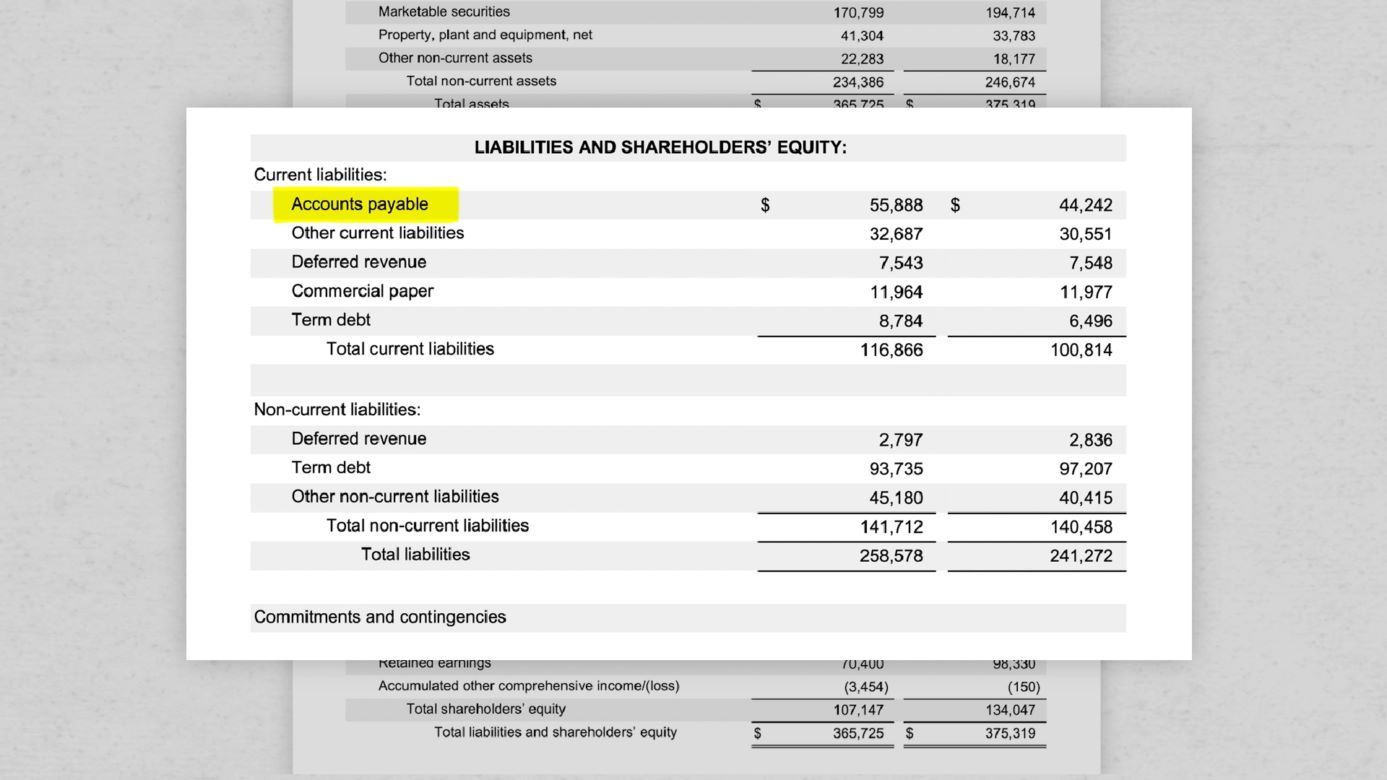

When it comes to presenting accounts receivable on the balance sheet, they are usually categorized as a current asset since they are expected to be collected within a year. The balance sheet provides a snapshot of a company’s financial position at a given point in time, and accounts receivable play a significant role in assessing its liquidity and overall financial health.

Typically, accounts receivable are presented in the asset section of the balance sheet, following cash and equivalents. They are listed separately from other current assets such as inventory or prepaid expenses. Some companies may further divide accounts receivable into current and non-current portions if a portion is not expected to be collected within the next year. This distinction allows for a more accurate representation of the timing of expected cash inflows.

Underneath the accounts receivable line item, additional information may be provided to enhance the transparency and clarity of the balance sheet. This includes disclosing the total amount of accounts receivable, any allowances for doubtful debts, or any restrictions on the collection or use of certain receivables.

Furthermore, it is common to disclose the aging schedule of accounts receivable, which groups outstanding invoices based on their age, usually in 30-day increments. This allows readers of the financial statements to gauge the timeliness of customer payments and assess the collectability of the receivables. Aging schedules can provide insights into any potential issues with slow-paying or delinquent customers, enabling businesses to take appropriate collection actions.

The presentation of accounts receivable on the balance sheet is crucial for financial statement users, including investors, lenders, and analysts, as it represents the extent of a company’s outstanding credit sales and its potential cash flow from customer payments. It allows stakeholders to evaluate the efficiency of a company’s credit policies, assess the risk of bad debts, and make informed decisions concerning creditworthiness and liquidity.

It is worth noting that the presentation of accounts receivable may vary across different accounting standards and practices. However, the underlying principle remains the same – to provide transparency and meaningful information about a company’s outstanding customer payments and their impact on its financial position.

In summary, accounts receivable are typically presented as a current asset on the balance sheet, following cash and equivalents. They may be further categorized into current and non-current portions if necessary. Additional information such as allowances for doubtful debts and aging schedules may be disclosed to provide further insights into the collectability and timing of customer payments.

Conclusion

Accounts receivable are a vital component of a company’s financial records, representing the amounts owed by customers for credit sales. Understanding how accounts receivable are valued and reported on the balance sheet is crucial for businesses, investors, and other stakeholders.

In this article, we explored the definition and explanation of accounts receivable, highlighting their significance as a current asset on the balance sheet. We discussed the recording process, which involves generating invoices, updating sales registers, maintaining accounts receivable ledgers, and posting to the general ledger.

We also delved into the valuation of accounts receivable, emphasizing the net realizable value approach, which considers the expected collectability of outstanding payments. Factors such as credit policies, customer creditworthiness, economic conditions, industry dynamics, and collection practices influence the value of accounts receivable.

Furthermore, we examined the presentation of accounts receivable on the balance sheet, emphasizing their categorization as a current asset and the disclosure of additional information such as allowances for doubtful debts and aging schedules. The balance sheet presentation helps stakeholders assess a company’s liquidity, creditworthiness, and overall financial health.

Having a clear understanding of accounts receivable and their reporting on the balance sheet is essential for effective financial management. It enables businesses to monitor their cash flow, manage credit policies, and pursue timely collections. For investors and other stakeholders, it provides insights into a company’s sales, creditworthiness, and potential cash generation capabilities.

In conclusion, accounts receivable are a critical aspect of financial management and reporting. Businesses should implement sound credit policies, maintain accurate and timely records, and actively manage their accounts receivable to ensure a healthy cash flow and minimize the risk of bad debts. By doing so, businesses can optimize their financial position and provide stakeholders with the information they need to make informed decisions.