Finance

What Does Futures Contracts Affect?

Published: December 23, 2023

Discover how futures contracts can impact the world of finance and influence various markets. Explore the key factors affected by these contracts and their significance in shaping the financial landscape.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of finance, futures contracts play a vital role in shaping various aspects of the market. A futures contract is a legally binding agreement to buy or sell a specific underlying asset at a predetermined price and date in the future. These contracts are commonly used in the commodities, stock, and currency markets.

Unlike other financial instruments, futures contracts have a unique characteristic that sets them apart – they have a significant impact on various factors within the financial markets. Understanding the key influencers of futures contracts is essential for investors, traders, and financial institutions to make informed decisions and manage risks effectively.

From market prices to investor behavior, supply and demand dynamics to volatility, futures contracts have a profound effect on the overall functioning and behavior of the financial markets. By analyzing these factors, we can gain valuable insights into the implications of futures contracts and how they influence the broader economy as a whole.

In this article, we will delve deeper into the factors that are influenced by futures contracts, exploring their significance and unraveling the interplay between futures contracts and the financial landscape. By gaining a comprehensive understanding of these factors, investors can navigate the markets more confidently and seize profitable opportunities.

Definition of Futures Contracts

Before we dive into the factors influenced by futures contracts, let’s first establish a clear understanding of what a futures contract actually is. A futures contract is a standardized agreement between two parties to buy or sell a specific asset at a future date, at a predetermined price known as the futures price. The underlying asset can be commodities like oil, gold, or wheat, financial instruments such as stocks or bonds, or even currencies.

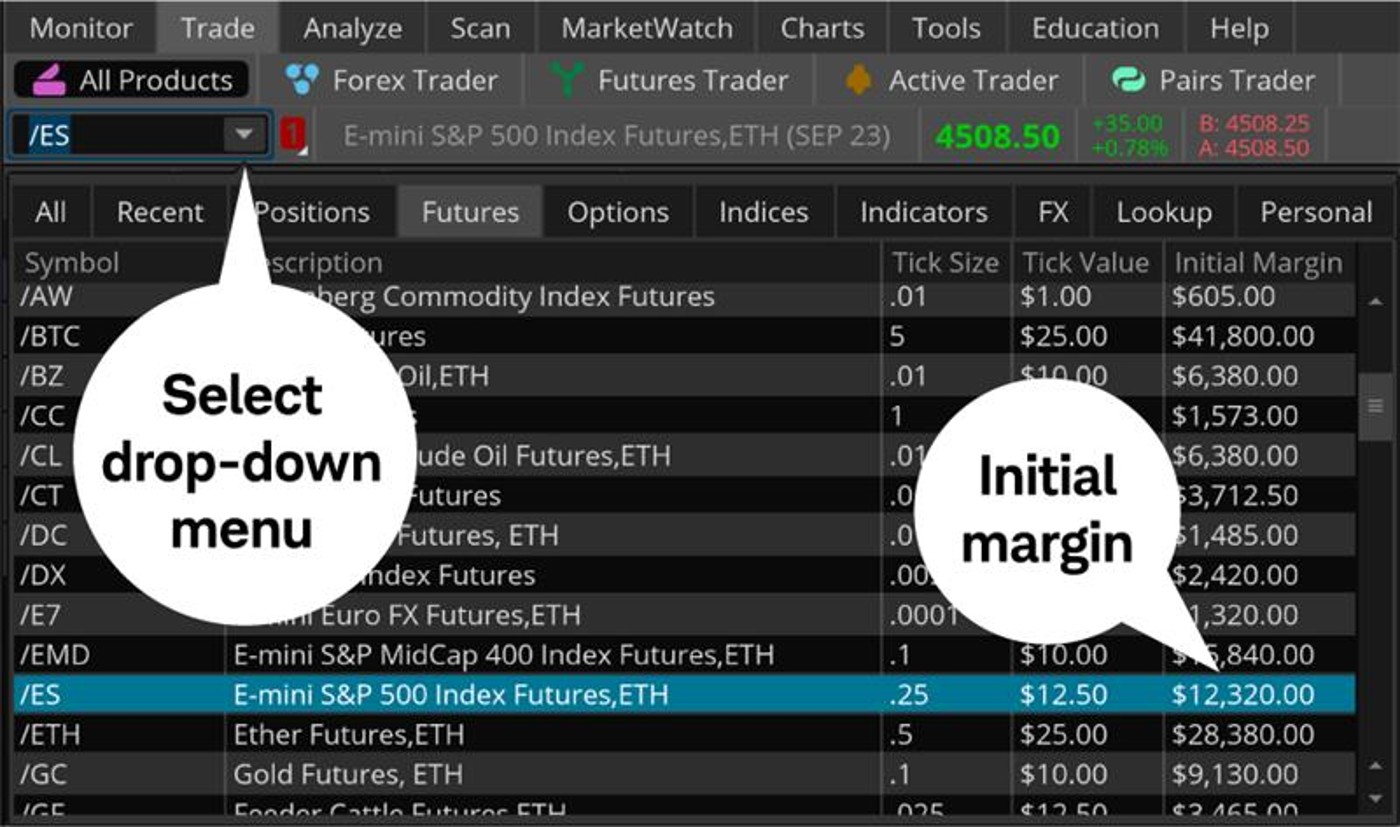

One key feature of futures contracts is that they are traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). These exchanges act as intermediaries to ensure the smooth functioning and integrity of the futures market.

Unlike options contracts, which give the holder the right to buy or sell an asset but not the obligation, futures contracts are binding agreements that require the parties to fulfill their contractual obligations. This means that both the buyer and the seller must adhere to the terms of the contract and either take or deliver the underlying asset at the specified date and price.

The standardized nature of futures contracts ensures transparency and liquidity in the market. Each contract specifies the quantity and quality of the underlying asset, as well as the delivery date and location. This standardization allows for seamless trading and price discovery.

It’s important to note that most futures contracts are settled in cash rather than physical delivery. This means that instead of exchanging the actual asset, the parties settle the contract by paying or receiving the difference between the futures price and the market price at the time of settlement.

Overall, futures contracts provide market participants with a means to hedge against price fluctuations, speculate on future price movements, and gain exposure to various asset classes. Now let’s explore the factors that are influenced by these contracts and how they impact the financial markets.

Factors Influenced by Futures Contracts

Futures contracts have a significant influence on various factors within the financial markets. Let’s take a closer look at some of the key factors that are shaped by these contracts:

- Market Prices: One of the most evident effects of futures contracts is their impact on market prices. As futures contracts are actively traded, the buying and selling pressure they generate can lead to price movements in the underlying asset. The price discovery mechanism of futures markets helps establish fair values for commodities, stocks, and currencies.

- Investor Behavior: Futures contracts have the power to influence investor behavior. The availability of futures contracts allows market participants to take positions based on their expectations of future price movements. These contracts provide opportunities for speculation, hedging, and arbitrage, which can influence trading patterns and investment strategies.

- Supply and Demand: The trading activity in futures contracts can impact the supply and demand dynamics of the underlying asset. If market participants anticipate an increase in demand or a shortage of supply, they may take positions in futures contracts accordingly. These actions can affect the overall market equilibrium and potentially impact prices and availability.

- Volatility: Futures contracts can contribute to the volatility of the financial markets. Increased trading activity and speculation in futures contracts can lead to heightened price volatility. This volatility can create opportunities for traders and investors, but it also introduces risk and uncertainty in the market.

- Speculation: Futures contracts provide a platform for speculators to take positions based on their expectations of future price movements. Speculation involves taking on risk with the hope of making significant profits. While speculation can provide liquidity and market efficiency, it also introduces elements of uncertainty and potential market distortions.

These are just a few examples of how futures contracts shape and influence various factors within the financial markets. The interplay between futures contracts and these factors is complex and dynamic, requiring market participants to stay informed and adapt their strategies accordingly.

Market Prices

Futures contracts have a profound influence on market prices of the underlying assets. The buying and selling activities in futures markets can generate significant trading volume and impact the supply and demand dynamics, ultimately leading to price movements.

When traders and investors perceive future price movements or anticipate changes in market conditions, they take positions in futures contracts to profit from these expected price changes. For instance, if there is a widespread belief that the price of crude oil will increase in the future due to geopolitical events or changes in global demand, market participants may buy crude oil futures contracts. This increased demand for futures contracts can push up the price of the contracts and ultimately affect the spot price of crude oil.

The relationship between futures prices and spot prices is essential in the pricing of commodities and other assets. The futures market provides a mechanism for price discovery by reflecting the market’s expectations of future prices. As participants gather information and trade on this information, it contributes to the efficient pricing of the underlying assets.

Moreover, the integration between futures and spot markets allows for arbitrage opportunities. Arbitrageurs can exploit price discrepancies between the futures contracts and the underlying asset to earn risk-free profits. Their actions help align the prices of futures contracts and the underlying assets, contributing to efficient market pricing.

It is important to note that the impact of futures contracts on market prices can be influenced by factors such as market liquidity, trading volume, and the overall sentiment of market participants. Additionally, the level of speculation in the futures market can amplify price movements and introduce volatility.

Market participants closely track futures prices as they provide valuable information about the market’s expectations and sentiment. The ability to anticipate future price movements can support effective risk management, trading strategies, and investment decisions. Understanding the factors that influence futures prices is crucial for investors, traders, and analysts to navigate the financial markets.

Investor Behavior

Futures contracts have a significant impact on investor behavior within the financial markets. These contracts provide investors and traders with a platform to express their views on future price movements and adjust their investment strategies accordingly.

One key aspect of investor behavior influenced by futures contracts is speculation. Speculators are individuals or entities who take positions in futures contracts with the goal of profiting from anticipated price movements. They do not have a commercial interest in the underlying asset but rather seek to capitalize on short-term price fluctuations.

The presence of speculators in futures markets adds liquidity and depth to the market. Their trading activities contribute to price discovery and create opportunities for hedgers to mitigate their risk exposure. However, speculation can also introduce volatility and exacerbate price movements, especially when speculative positions are highly leveraged.

Additionally, futures contracts offer investors and traders the ability to hedge their positions. Hedging involves taking positions in futures contracts to offset potential losses in the underlying asset. For example, a farmer can hedge against a decline in crop prices by selling futures contracts for that crop. This strategy allows the farmer to lock in a predetermined price and protect against potential losses resulting from price declines.

Investors also use futures contracts to gain exposure to different asset classes. For instance, an investor interested in commodities may choose to invest in commodity futures contracts rather than physically holding the underlying assets. This provides a convenient and cost-effective way to diversify their portfolio and potentially benefit from price movements in the commodity markets.

Furthermore, investor behavior in futures markets is closely tied to market sentiment and economic factors. Positive or negative news regarding the economy, geopolitical events, or government policies can shape investor sentiment and influence their decisions regarding futures contracts. Changes in investor behavior can also impact trading volumes, market liquidity, and the overall dynamics of the futures market.

Understanding investor behavior in the context of futures contracts is crucial for market participants. By monitoring market sentiment and analyzing the actions of speculators and hedgers, investors can gain insights into market trends and make informed trading and investment decisions.

Supply and Demand

One of the key factors influenced by futures contracts is the supply and demand dynamics of the underlying asset. The trading activity in futures markets can impact the overall supply and demand balance, which in turn can affect prices and availability in the market.

When market participants anticipate changes in demand or supply conditions, they often take positions in futures contracts to capitalize on these expected changes. This can create buying or selling pressure on the contracts, subsequently influencing the supply and demand dynamics of the underlying asset.

For example, if there is an expectation of increased demand for a particular commodity in the future, market participants may buy futures contracts for that commodity. This increased demand for the contracts can have a spillover effect on the physical market, leading to an actual increase in demand for the underlying asset. As a result, the price of the asset may rise, incentivizing producers to increase their supply.

Conversely, if there is an expectation of a decrease in supply of a certain asset, market participants may sell futures contracts, anticipating a potential price increase in the future. This selling pressure on the contracts can influence the supply dynamics of the underlying asset, potentially causing a decrease in supply and subsequently impacting prices.

The interplay between futures contracts and supply and demand is not limited to commodities. It extends to other asset classes such as stocks and currencies. The trading activity in stock index futures can provide insights into the future supply and demand for stocks in a particular market. Similarly, currency futures contracts can reflect market expectations about future exchange rates, influencing the supply and demand dynamics of currencies.

The impact of futures contracts on supply and demand is not only limited to short-term price movements but can also have long-term effects. Changes in expectations and trading positions can shape investment decisions, production plans, and inventory management for market participants. This, in turn, can impact market equilibrium, prices, and the overall availability of the underlying asset.

Understanding the relationship between futures contracts and supply and demand dynamics is crucial for market participants. By analyzing trading activity and monitoring changes in demand and supply expectations, investors, producers, and traders can make informed decisions and effectively manage their exposure to price fluctuations and market conditions.

Volatility

Futures contracts can have a significant impact on the volatility of the financial markets. Volatility refers to the degree of price fluctuations experienced by an asset or market over a certain period of time. Increased trading activity and speculation in futures contracts can contribute to heightened volatility levels.

One of the main drivers of volatility in the futures market is the presence of speculators. Speculators, who aim to profit from short-term price movements, often take highly leveraged positions in futures contracts. Their actions can amplify price swings and introduce volatility into the market.

Additionally, the availability of futures contracts enhances market liquidity and allows for more efficient price discovery. However, this increased liquidity can also contribute to volatility. Large trading volumes and rapid price movements in futures markets can spill over to the spot market, impacting the price of the underlying asset.

Futures contracts also play a role in influencing volatility through their role in risk management. Hedgers, such as producers and other market participants, use futures contracts to hedge against potential price fluctuations. Their trading actions in response to changing market conditions can affect market volatility. For example, if producers anticipate a decrease in prices, they may increase their selling activity in futures contracts, potentially contributing to higher market volatility.

Moreover, the interplay between futures contracts and other market factors can impact volatility as well. Economic events, political developments, and changes in market sentiment can create uncertainty and lead to increased volatility. Futures contracts act as a vehicle for market participants to express their views and adjust their positions accordingly, potentially exacerbating price swings.

It’s essential to note that while increased volatility can present risks, it also presents opportunities for traders and investors. Volatile markets can offer the potential for higher profits, especially for those skilled at short-term trading or using derivative strategies.

Understanding the impact of futures contracts on volatility is crucial for market participants. By considering the influence of speculators, liquidity, risk management practices, and overall market dynamics, investors can develop strategies to effectively manage and capitalize on volatility in the financial markets.

Speculation

Speculation plays a significant role in the dynamics of futures contracts and has a profound impact on the financial markets. Futures contracts provide an avenue for speculators to take positions based on their expectations of future price movements, without the intention of owning or delivering the underlying asset.

Speculation in futures markets involves taking on risk with the aim of making profits from short-term price fluctuations. Speculators can take both long (buying) and short (selling) positions in futures contracts, depending on their outlook for the market. They often leverage their positions, amplifying potential gains or losses.

The presence of speculators in futures markets adds liquidity and depth, contributing to efficient price discovery. Their buying and selling activity helps to bridge the gap between buyers and sellers, ensuring smooth trading operations. Additionally, speculation can increase market participation and trading volumes, leading to enhanced market efficiency.

Speculation also has the potential to introduce volatility into the market. As speculators take positions in futures contracts, their actions can amplify price movements and create short-term market distortions. This volatility can present both opportunities and risks for market participants.

Furthermore, speculators provide valuable information to the market. Their trading activity and positions reflect their expectations and sentiments about future price movements. This information can be used by other market participants to assess market trends, adjust their strategies, and make informed investment decisions.

However, it’s important to note that speculation has its downsides as well. Excessive speculation can lead to market disruptions and price bubbles. If a significant number of participants take speculative positions based on unrealistic expectations, it can inflate prices and create artificial market conditions.

Regulatory authorities often monitor and regulate speculation to promote market stability and protect against excessive speculation. Position limits, margin requirements, and surveillance systems are implemented to ensure that speculation does not become detrimental to the overall functioning of the futures markets.

Overall, speculation is an integral part of futures markets. It provides liquidity, price efficiency, and valuable market insights. However, it should be approached with caution and monitored closely to maintain market integrity and stability.

Conclusion

Futures contracts have a significant influence on various aspects of the financial markets. From market prices to investor behavior, supply and demand dynamics to volatility, and speculation, these contracts play a vital role in shaping the overall landscape of finance.

The trading activity in futures contracts has a direct impact on market prices, contributing to price discovery and ensuring efficient market pricing. Investors closely monitor futures prices as they provide valuable information about market expectations and sentiment.

Moreover, investor behavior is influenced by futures contracts, with speculators taking positions based on their expectations of future price movements. Hedging strategies and exposure to different asset classes are also influenced by futures contracts.

Futures contracts have the power to affect the supply and demand dynamics of the underlying assets. Trading activities can create buying or selling pressure, potentially impacting prices and availability in the market.

In addition, futures contracts contribute to market volatility. The presence of speculators, increased liquidity, and risk management strategies all play a role in shaping market volatility, presenting both opportunities and risks for market participants.

Finally, speculation in futures contracts adds liquidity, enhances price discovery, and provides valuable market insights. However, reasonable regulation is necessary to prevent excessive speculation that can lead to market disruptions and artificial market conditions.

Understanding the factors influenced by futures contracts is crucial for investors, traders, and financial institutions to make informed decisions and manage risks effectively. By closely monitoring market prices, investor behavior, supply and demand dynamics, volatility, and speculation, market participants can navigate the financial markets with greater confidence and seize profitable opportunities.

In conclusion, the impact of futures contracts extends far beyond their immediate participants, shaping the broader financial landscape and contributing to the overall efficiency and functioning of the markets.