Home>Finance>How Does A Credit Card Refund Work If I’ve Already Paid My Statement Balance?

Finance

How Does A Credit Card Refund Work If I’ve Already Paid My Statement Balance?

Published: March 2, 2024

Learn how credit card refunds work when you've already paid your statement balance. Understand the process and implications for your finances. Gain insights on managing refunds in your financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit cards have become an integral part of modern-day financial transactions, offering convenience and flexibility to users. However, the process of understanding credit card refunds, especially when you've already paid your statement balance, can be perplexing. In this article, we will delve into the intricacies of credit card refunds and shed light on how they work in such scenarios.

Navigating the nuances of credit card refunds requires a fundamental understanding of the underlying mechanisms and processes. Whether you're a seasoned credit card user or just starting to explore the realm of personal finance, gaining insight into the workings of credit card refunds can empower you to make informed decisions and effectively manage your financial affairs.

As we embark on this exploration, we will demystify the concept of credit card refunds, unravel the intricacies of the refund process, and address the specific considerations that come into play when you've already settled your statement balance. By the end of this article, you will have a comprehensive understanding of how credit card refunds operate, ensuring that you are well-equipped to navigate this aspect of the financial landscape with confidence and clarity.

Understanding Credit Card Refunds

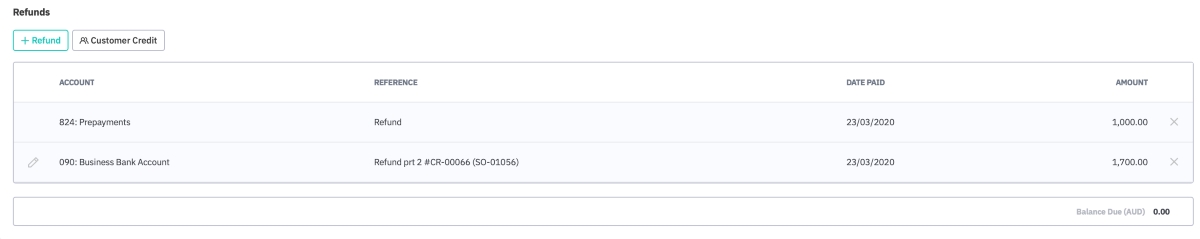

Before delving into the specifics of how credit card refunds work when you’ve already paid your statement balance, it’s essential to grasp the fundamental concept of credit card refunds. A credit card refund occurs when a merchant reimburses the funds for a previous transaction to your credit card account. This can happen for various reasons, such as returning a purchased item, disputing a charge, or receiving a price adjustment.

When you make a purchase using your credit card, the merchant receives the payment, and the corresponding amount is reflected as a charge on your credit card account. In the event that you need to return the purchased item or encounter a billing discrepancy, the merchant initiates a refund transaction to reverse the original charge. This process effectively restores the funds to your credit card account, offsetting the initial purchase.

It’s important to note that the timeline for credit card refunds can vary depending on the merchant’s policies and processing procedures. While some refunds may appear on your account statement relatively quickly, others might take several business days to reflect. Additionally, the manner in which refunds are processed can differ among merchants, with some issuing credits directly to your card and others providing refunds in the form of store credit or gift cards.

Understanding the dynamics of credit card refunds equips you with the knowledge needed to navigate refund scenarios effectively. Whether you’re seeking a refund for a faulty product, contesting a billing error, or capitalizing on a price drop, being aware of the refund process empowers you to assert your consumer rights and manage your finances prudently.

How a Credit Card Refund Works

When a credit card refund is initiated, whether due to a product return, dispute resolution, or other qualifying reasons, the process involves several key steps that culminate in the funds being credited back to your credit card account. Understanding the intricacies of how a credit card refund works can demystify this financial transaction and provide clarity on the underlying mechanisms.

Upon the initiation of a refund by the merchant, the corresponding amount is earmarked for reversal, effectively earmarking the funds to be returned to the cardholder. This initiates a series of communications and transactions between the merchant, the payment processor, and the card issuer to facilitate the refund. The merchant submits the refund request to their payment processor, which, in turn, communicates with the card network to process the refund.

Once the refund request traverses the payment processing network, it reaches the card issuer, which oversees the credit card account. The card issuer verifies the legitimacy of the refund request and processes the credit to the cardholder’s account. This credit effectively offsets the original charge, restoring the funds to the cardholder and adjusting the account balance accordingly.

It’s worth noting that the timeline for the refund to reflect in your credit card account can vary, with some refunds appearing within a few business days and others taking longer, depending on the processing speed of the merchant, payment processor, and card issuer. Additionally, the manner in which the refunded amount is credited to your account, whether as a statement credit or as an adjustment to your available credit limit, can differ based on the card issuer’s policies.

Understanding the intricacies of how a credit card refund works empowers you to navigate refund scenarios with confidence and clarity, enabling you to track the progress of refund requests and ensure that the credited funds are reflected accurately in your credit card account.

What Happens If You’ve Already Paid Your Statement Balance?

When you’ve already paid your credit card statement balance and a refund is issued for a transaction included in that balance, the dynamics of the refund process can introduce unique considerations. Understanding how credit card refunds intersect with a settled statement balance is crucial for navigating this scenario effectively.

If a refund is initiated for a transaction that was part of your already-paid statement balance, the refunded amount essentially results in a credit balance on your credit card account. This credit balance represents an excess of funds that have been refunded but have already been settled through your previous payment. While this may seem straightforward, it can lead to various outcomes based on the card issuer’s policies and your preferences.

One potential outcome is that the credit balance remains on your account and offsets future purchases or charges, effectively reducing your subsequent payment obligations. In this scenario, the refunded amount contributes to covering your future expenses, serving as a prepayment for upcoming transactions until the credit balance is exhausted.

Alternatively, you may opt to request a refund of the credit balance, especially if it represents a substantial amount. Depending on the card issuer’s policies, you can typically contact customer service to request a refund check or an electronic transfer of the credit balance to your linked bank account. This allows you to reclaim the refunded amount and utilize it as needed, providing flexibility and control over the funds.

It’s important to note that maintaining a credit balance on your credit card account, while potentially beneficial in offsetting future expenses, may not align with your financial preferences or goals. As such, proactively managing credit balances resulting from refunds can help you maintain a clear overview of your finances and optimize the utility of the refunded funds in accordance with your financial strategy.

By understanding the implications of receiving a refund for a transaction included in your already-paid statement balance, you can proactively navigate this scenario, leveraging the refunded amount to align with your financial objectives and preferences while staying informed about the impact on your credit card account.

Conclusion

As we conclude our exploration of credit card refunds, particularly in the context of having already paid your statement balance, it becomes evident that a nuanced understanding of the refund process is essential for informed financial management. Credit card refunds, stemming from product returns, dispute resolutions, or price adjustments, play a pivotal role in safeguarding consumer rights and enhancing financial flexibility.

By comprehending the intricacies of credit card refunds, individuals can assert their consumer rights with confidence, navigate refund scenarios effectively, and optimize the utility of refunded funds in alignment with their financial goals. Whether it involves leveraging a credit balance to offset future expenses or reclaiming the refunded amount for immediate use, proactive management of credit card refunds empowers individuals to maintain control over their finances.

Moreover, the interplay between credit card refunds and settled statement balances underscores the importance of staying attuned to the dynamics of one’s credit card account. This awareness enables individuals to make informed decisions regarding the utilization of refunded funds and ensures that the impact of refunds on their financial landscape is managed prudently.

Ultimately, the journey through the realm of credit card refunds unveils a landscape where consumer empowerment, financial acumen, and prudent decision-making converge. Armed with a comprehensive understanding of how credit card refunds operate, individuals are equipped to navigate the ebb and flow of financial transactions with clarity and confidence, harnessing the potential of refunds to fortify their financial well-being.

As you engage with the intricacies of credit card refunds in your financial endeavors, may this knowledge serve as a guiding beacon, empowering you to navigate refund scenarios with astuteness and seize the opportunities they present to bolster your financial resilience and agility.