Finance

What Is A Credit Balance Refund

Published: January 13, 2024

Discover what a credit balance refund is and how it impacts your finances. Learn about the process and why it's important to stay informed.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on credit balance refunds. In the world of personal finance, dealing with various transactions, bills, and account balances is an everyday occurrence. One common situation that many individuals come across is having a credit balance on their account. While many people are familiar with the term “credit balance,” not everyone fully understands what it means or what they can do with it. That’s where credit balance refunds come into play.

A credit balance refund is a process through which individuals receive a refund for any excess funds they have on their accounts. This can happen for numerous reasons, such as overpayments, returned purchases, or adjustments made by the service provider. Credit balance refunds can make a significant difference in managing personal finances, as they provide an opportunity to reclaim money that would otherwise remain tied up in an account.

Understanding how credit balance refunds work is crucial for individuals to take full advantage of this opportunity. In this guide, we will delve into the definition of credit balance refunds, explore the reasons why they occur, discuss the process of obtaining a credit balance refund, outline common scenarios where they are applicable, highlight any potential issues that may arise, and emphasize the importance of monitoring credit balances.

Whether you are a seasoned finance enthusiast or just starting to navigate the intricacies of personal finances, this guide will provide you with a comprehensive understanding of credit balance refunds. So, let’s dive in and explore the world of credit balance refunds, empowering you to make the most of your financial resources.

Definition of a Credit Balance Refund

A credit balance refund refers to the process of returning excessive funds that remain on an individual’s account. It occurs when the amount of money in the account exceeds the total amount owed or when a specific transaction results in an overpayment. In simpler terms, it is the reimbursement of surplus money that is rightfully owned by the account holder.

When a credit balance occurs, it essentially represents an unused or unutilized credit that is due to the account holder. This can happen in various scenarios, such as overpaying a bill, receiving a refund for a returned purchase, or having an adjustment made to an account balance. These situations can lead to an accumulation of excess funds, which can be returned to the individual through a credit balance refund.

Credit balance refunds are especially common in financial transactions involving service providers, such as utility companies, telecommunications companies, or online retailers. In these cases, customers often pay in advance or make larger payments than required, resulting in a surplus on their account balance. It is the responsibility of the service provider to identify and rectify these credit balances by issuing the appropriate refund.

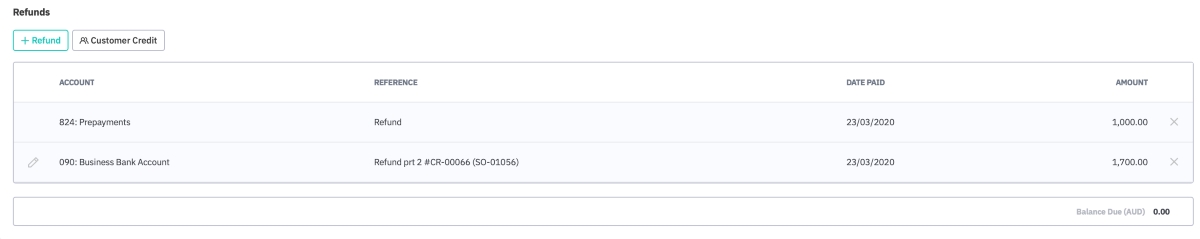

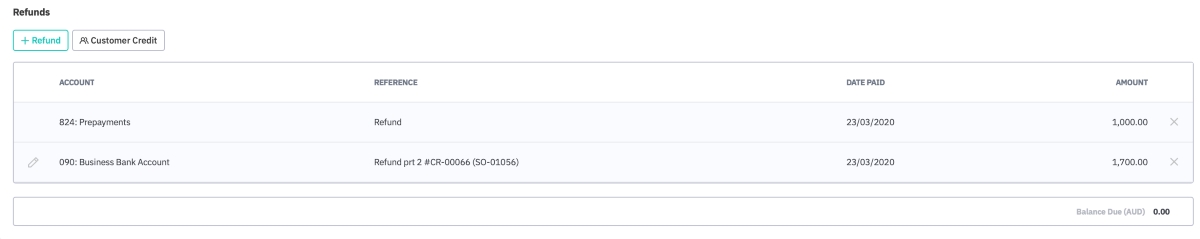

The process of obtaining a credit balance refund typically involves initiating a request with the service provider. This can be done through various channels, such as customer service hotlines, email, or online portals. Once the request is received and verified, the service provider will proceed with the refund, either by directly issuing a refund check or by crediting the excess amount back to the individual’s account.

It is important to note that credit balance refunds are not automatically generated. Account holders must proactively monitor their balances, identify any credit balances, and initiate the refund request with the respective service provider. Failure to do so may result in the funds remaining unclaimed or tied up in the account.

By definition, a credit balance refund exists to rectify any overpayment or excess funds on an account. It aims to ensure fairness and provide individuals with the opportunity to reclaim their rightfully owned money. Monitoring credit balances and promptly requesting refunds help individuals maintain control over their finances and avoid unnecessary financial complications.

Reasons for Credit Balance Refunds

There are several common reasons why credit balance refunds may occur. Understanding these reasons can help individuals identify if they are eligible for a refund and take the necessary steps to initiate the process. Here are some of the primary reasons for credit balance refunds:

- Overpayment: One of the most common reasons for credit balance refunds is overpayment. This can happen when individuals pay more than the required amount for bills or services, either intentionally or unintentionally. For example, if you miscalculate your monthly utility bill and make a payment that exceeds the actual amount, the excess funds will accumulate as a credit balance on your account.

- Returned purchases: Another reason for credit balance refunds is when individuals return purchases that were previously paid for. In situations where a refund is issued for a returned item or canceled service, the original payment may result in a credit balance on the account. The service provider is responsible for issuing the appropriate refund to reconcile the credit.

- Account adjustments: Sometimes, service providers make adjustments to account balances for various reasons. This can include correcting billing errors, applying promotional discounts, or resolving disputes. These adjustments can result in credit balances on the account, which then need to be refunded to the account holder.

- Prepaid services: Paying for services in advance, such as yearly subscriptions or prepayment plans, can also lead to credit balance refunds. If an individual decides to cancel the service before the prepaid period ends, they may be eligible for a refund of the unused portion of the prepayment.

It’s essential to keep in mind that these are just a few examples of common reasons for credit balance refunds. The specific circumstances can vary depending on the industry, service provider, or individual agreements. Regardless of the reason, it is crucial to recognize when a credit balance exists and take prompt action to ensure that you receive the appropriate refund.

Process of Obtaining a Credit Balance Refund

Obtaining a credit balance refund involves a series of steps to ensure a smooth and efficient process. While the exact procedure may vary depending on the service provider, here is a general outline of the typical steps involved in obtaining a credit balance refund:

- Identify the credit balance: The first step is to monitor your account balance and identify if there is a credit balance present. This can be done by reviewing your billing statements, online account portals, or contacting the customer service department of the service provider to inquire about your account balance.

- Confirm the credit balance: Once you have identified a credit balance, it’s essential to verify the accuracy of the amount. Double-check the invoices, payments made, and any recent transactions to ensure that the credit balance is legitimate and not due to an error.

- Contact the service provider: Next, you should reach out to the service provider to initiate the credit balance refund process. This can be done by contacting their customer service department via phone, email, or through their online portal. Provide them with the necessary details, such as your account number, any relevant invoices, and a clear explanation of the credit balance.

- Follow the provider’s instructions: The service provider will guide you through their specific refund process. They may require you to fill out a refund request form, provide supporting documentation, or complete any other necessary paperwork. Follow their instructions carefully to ensure that your refund request is processed smoothly.

- Confirm refund issuance: After submitting the refund request, confirm with the service provider that they have received it and that it is being processed. Keep a record of any communication or reference numbers provided to you during this stage.

- Receive the refund: Depending on the service provider, you will receive your credit balance refund in different forms. It can be issued as a refund check, direct deposit, or credited back to the original payment method. The timeline for receiving the refund may vary, so be sure to inquire about the expected timeframe when contacting the service provider.

- Monitor your account: Once the refund has been issued, monitor your account to ensure that the credit balance has been correctly adjusted. Verify that the refund amount matches the credit balance and that your account reflects the update.

It is important to remain proactive throughout the process and follow up with the service provider if any delays or issues arise. By staying engaged and persistent, you can ensure a successful credit balance refund and reclaim your rightful funds.

Common Scenarios for Credit Balance Refunds

Credit balance refunds can occur in various scenarios across different industries and services. Understanding these common scenarios can help individuals identify when they may be eligible for a refund and make sure they do not miss out on reclaiming their surplus funds. Here are some of the most common scenarios where credit balance refunds may arise:

- Utility bills: Overpayment of utility bills is a prevalent scenario for credit balance refunds. Individuals who pay more than the actual amount due or make advanced payments may end up with a credit balance on their utility account. Examples include overpaying electricity, water, or gas bills.

- Telecommunications: Similar to utility bills, telecommunications services such as phone, internet, or cable TV often result in credit balances. This can occur when individuals make overpayments or if they cancel services before the billing cycle ends and have prepaid for the unused portion.

- Online shopping: When purchasing items online, there may be instances where customers receive a refund for returned or canceled purchases. Such refunds can generate credit balances on their accounts, which should be refunded by the online retailer.

- Insurance premiums: Insurance companies may issue credit balance refunds if individuals overpay their premiums or make adjustments to their policies. This can happen when policyholders cancel policies or modify coverage, resulting in a surplus in their account balance.

- Subscription services: Many subscription-based services, such as streaming platforms, software licenses, or monthly memberships, require upfront or recurring payments. If individuals cancel their subscriptions before the end of a prepaid period, they may be eligible for a credit balance refund for the unused portion of the subscription.

- Healthcare services: Credit balance refunds can also occur in the healthcare industry. This may include overpayment of medical bills, refunds for canceled appointments, or adjustments made after insurance claims have been processed.

These are just a few examples of the common scenarios where credit balance refunds can arise. It’s essential to be vigilant in monitoring your account balances and recognizing when a credit balance exists. By understanding these scenarios, individuals can proactively request refunds and ensure the proper handling of their surplus funds.

Potential Issues with Credit Balance Refunds

While credit balance refunds are intended to resolve overpayments and surplus funds, there can be potential issues that individuals may encounter during the refund process. Being aware of these issues can help individuals navigate the refund process more effectively and address any challenges that may arise. Here are some potential issues to keep in mind:

- Account verification: Service providers may require individuals to verify their identities or provide additional documentation before processing a credit balance refund. This is done to ensure the security of the refund process and prevent fraudulent activities. It is important to comply with any verification requests promptly to avoid delays in receiving the refund.

- Refund processing time: The time it takes for a credit balance refund to be processed can vary depending on the service provider. Some refunds may be issued promptly, while others may take several weeks to process. It is advisable to inquire about the expected timeframe for receiving the refund and follow up with the provider if it exceeds the estimated time.

- Communication challenges: It is not uncommon for individuals to experience challenges in communication with the service provider during the refund process. These challenges can include long wait times on customer service hotlines, unresponsive email support, or difficulty reaching the appropriate department. Persistence and clear communication are key to overcoming these challenges and ensuring a resolution.

- Incomplete refund amount: In some instances, individuals may receive a partial credit balance refund instead of the full amount they were expecting. This can happen if there are outstanding fees, penalties, or charges that are deducted from the credit balance before issuing the refund. It is essential to review the refund details and contact the service provider if there are any discrepancies.

- Lost refunds: Occasionally, credit balance refunds may get lost in transit, particularly if they are issued as refund checks. If a refund does not arrive within a reasonable timeframe, it is crucial to contact the service provider and request assistance in locating or reissuing the refund.

- Refund policies: Each service provider may have different refund policies and procedures. It is important to familiarize yourself with these policies, including any terms and conditions regarding credit balance refunds. Understanding the refund policy can help you navigate the process more confidently and prevent any misunderstandings or conflicts.

While these issues may present challenges, they are not insurmountable. By staying vigilant, following up with the service provider, and maintaining clear communication, individuals can address any potential issues and ensure a smooth credit balance refund process.

Importance of Monitoring Credit Balances

Monitoring credit balances is a crucial aspect of managing your personal finances. It ensures that you are aware of any excess funds or credit on your accounts and enables you to take advantage of credit balance refunds when they are applicable. Here are some reasons why monitoring credit balances is important:

- Reclaiming your money: A credit balance indicates that you have paid more than what was actually owed. By actively monitoring your credit balances, you can identify these surplus funds and initiate the refund process to reclaim your money. This can be especially important in cases where the amount may be significant, and leaving it unclaimed would mean losing out on funds that rightfully belong to you.

- Financial efficiency: Monitoring credit balances promotes financial efficiency by allowing you to spot any overpayments or duplication of payments promptly. By catching these errors early on, you can rectify them and avoid unnecessary financial strain. It also helps you ensure that your money is used efficiently, as you can redirect excess funds to other financial goals or investments.

- Preventing credit complications: Unchecked credit balances can potentially lead to credit complications. For example, if you have a credit balance on your credit card account, it may impact your credit utilization ratio, which is a key factor in determining your credit score. Monitoring and resolving these credit balances can prevent any negative effects on your creditworthiness.

- Avoiding financial disputes: Regularly monitoring credit balances can help prevent financial disputes with service providers. By identifying any discrepancies or errors in your account balances, you can address them proactively and avoid potential conflicts or misunderstandings. This ensures a smoother and more amicable relationship with your service providers.

- Staying organized: Monitoring credit balances is an excellent practice for staying organized in your personal finances. It allows you to maintain accurate records of your transactions and ensures that you have a comprehensive understanding of your financial standing. By being organized, you can make more informed financial decisions and have a better overall financial outlook.

Overall, monitoring credit balances is a proactive approach to managing your finances. It empowers you to take control of your accounts, identify any excess funds, and seek credit balance refunds when applicable. By doing so, you can optimize your financial resources, prevent unnecessary complications, and maintain a healthier and more efficient financial picture.

Conclusion

Credit balance refunds play a significant role in the world of personal finance, providing individuals with the opportunity to reclaim excess funds that are rightfully theirs. By understanding the definition, reasons, and process of obtaining a credit balance refund, individuals can take full advantage of this financial opportunity.

Monitoring credit balances is essential to ensuring that you are aware of any surplus funds on your accounts. By actively monitoring these balances, you can reclaim your money, maintain financial efficiency, prevent credit complications, avoid disputes, and stay organized in your personal finances.

Although issues may arise during the credit balance refund process, such as account verification, processing time, communication challenges, or incomplete refunds, persistence and clear communication can help resolve these issues. It is important to familiarize yourself with the refund policies of service providers to navigate the process smoothly.

In conclusion, credit balance refunds provide individuals with a valuable opportunity to recoup their funds and optimize their financial resources. By staying proactive, monitoring credit balances, and promptly initiating the refund process, individuals can maintain control over their finances and avoid unnecessary financial complications.

Whether it’s a credit balance from utility bills, telecommunications services, online shopping, insurance premiums, subscription services, or healthcare bills, understanding when you are eligible for a credit balance refund and taking necessary action ensures that your surplus funds are not left unclaimed.

Ultimately, by taking advantage of credit balance refunds, individuals can maximize their financial resources, resolve overpayments, and maintain a healthier and more efficient financial outlook.