Finance

How Often Do You Get A PayPal Late Fee

Published: February 23, 2024

Learn how often you may incur a PayPal late fee and how to avoid it. Get expert tips on managing your finances and avoiding unnecessary charges.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Convenience and Concerns of PayPal Late Fees

PayPal has revolutionized the way people conduct financial transactions, offering a seamless and secure platform for online payments. The platform's user-friendly interface and widespread acceptance have made it a preferred choice for individuals and businesses alike. However, amidst the convenience and efficiency that PayPal provides, users may encounter the unwelcome issue of late fees, which can impact their financial well-being.

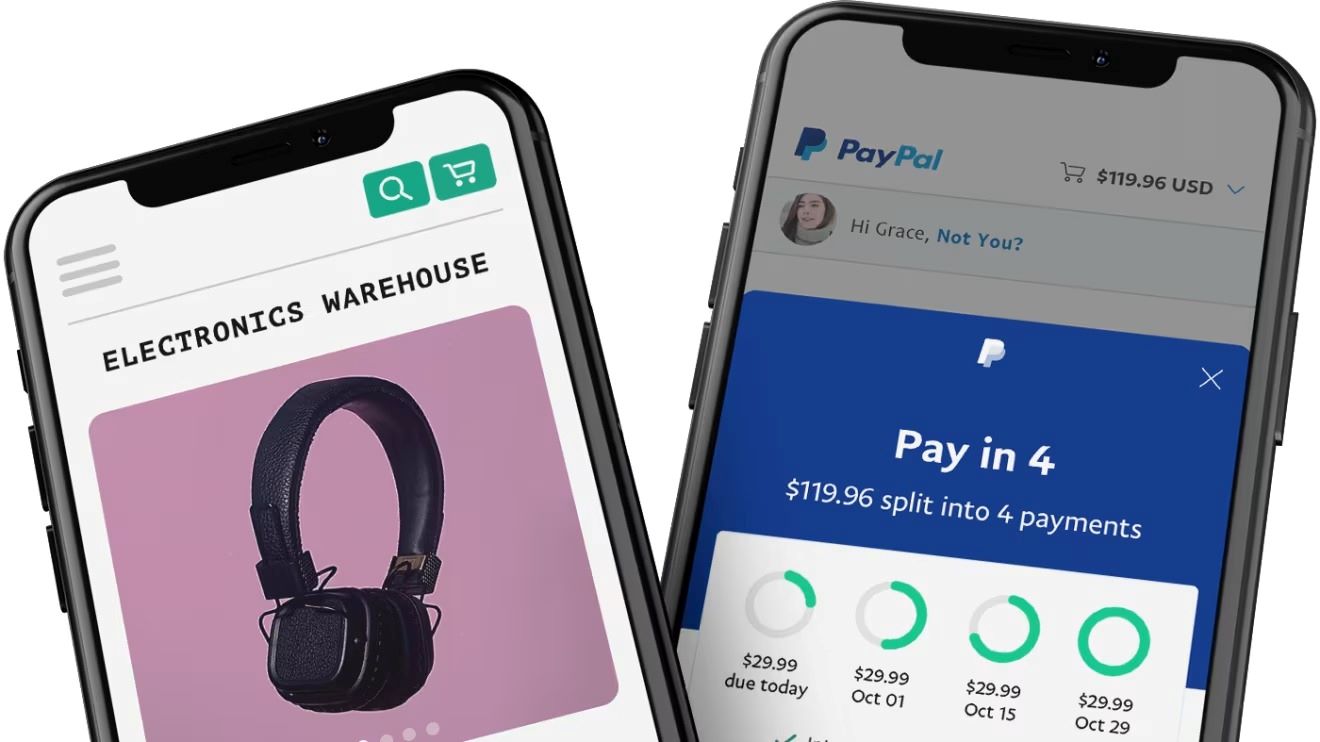

Late fees are charges imposed when a payment is not received by the due date. In the context of PayPal, these fees may apply to various transactions, such as overdue payments on PayPal Credit, missed installment payments, or delayed payments for goods and services. Understanding the implications of PayPal late fees is essential for users to navigate the platform effectively and avoid unnecessary financial setbacks.

In this article, we will delve into the intricacies of PayPal late fees, shedding light on the factors that influence their imposition and providing actionable insights on how to steer clear of these charges. By gaining a comprehensive understanding of PayPal late fees, users can make informed decisions and safeguard their financial standing while leveraging the benefits of this popular payment platform.

Understanding PayPal Late Fees

Unraveling the Implications of Delayed Payments

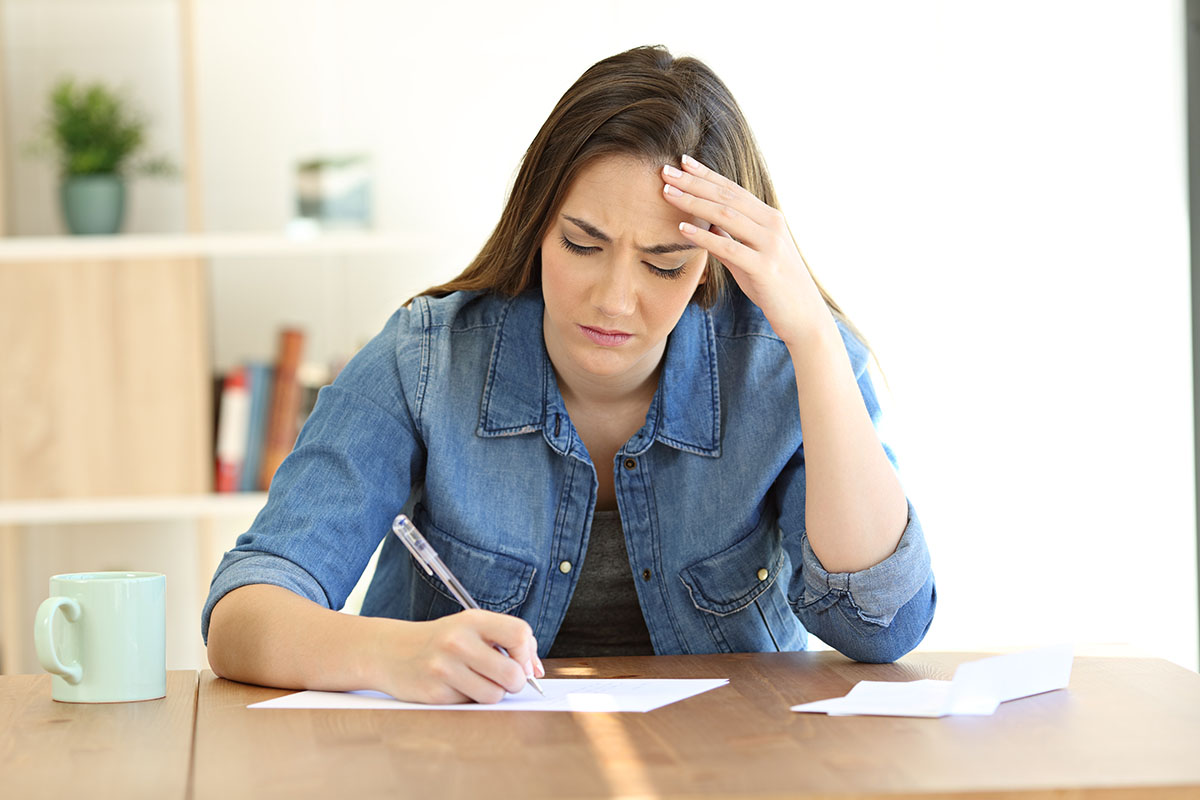

PayPal late fees can have significant ramifications for users, impacting their financial stability and tarnishing their transaction history. When a payment is not made by the specified due date, PayPal may levy late fees, adding an extra financial burden to the original obligation. It is crucial to comprehend the nature of these fees and their potential consequences to navigate the PayPal ecosystem effectively.

One of the primary considerations regarding PayPal late fees is the specific scenarios in which they may be incurred. For instance, individuals utilizing PayPal Credit may face late fees if they fail to meet the payment deadlines for their credit balances. Moreover, businesses engaging in e-commerce through PayPal may encounter late fees if customer payments are delayed, potentially affecting their cash flow and operational efficiency.

Furthermore, understanding the financial implications of PayPal late fees is essential. These fees can accrue over time, compounding the original payment amount and exacerbating the overall financial burden. Additionally, repeated occurrences of late fees can result in a negative impact on the user’s credit score, potentially hindering their future financial endeavors.

It is important to note that the specific details regarding PayPal late fees, including the amount charged and the grace period provided, may vary based on the user’s location and the type of transaction. Therefore, users must familiarize themselves with the terms and conditions applicable to their PayPal account to proactively address and mitigate the risk of incurring late fees.

Factors Influencing PayPal Late Fees

Determining the Dynamics of Late Fee Imposition

Several factors contribute to the imposition of PayPal late fees, encompassing various elements that influence the payment process and its associated timelines. Understanding these factors is pivotal in preempting the occurrence of late fees and maintaining a favorable financial standing within the PayPal framework.

- Payment Due Date: The designated due date for a payment is a critical determinant of late fee imposition. If a user fails to submit the required payment by this deadline, PayPal may initiate the assessment of late fees, highlighting the importance of adhering to payment timelines.

- Transaction Type: The nature of the transaction, whether it involves PayPal Credit, e-commerce sales, or peer-to-peer payments, can influence the applicability of late fees. Users must be cognizant of the specific transaction types susceptible to late fee charges.

- Account History: The user’s historical payment behavior and adherence to deadlines can impact the likelihood of incurring late fees. Consistent delays or missed payments may elevate the risk of facing subsequent late fee assessments.

- Regulatory Requirements: Regulatory and legal frameworks governing financial transactions in the user’s jurisdiction can also influence the imposition of late fees. Compliance with these requirements is imperative to mitigate the risk of late fee charges.

Moreover, the presence of extenuating circumstances, such as technical glitches, unforeseen financial constraints, or communication errors, can also play a role in late fee imposition. While PayPal endeavors to provide a fair and transparent payment environment, these factors can inadvertently contribute to the assessment of late fees.

By comprehending the multifaceted elements that influence the imposition of PayPal late fees, users can proactively address potential risk factors and adopt strategic measures to avoid these charges. Additionally, maintaining open communication with PayPal’s customer support channels can provide valuable insights and assistance in navigating payment-related challenges, ultimately mitigating the impact of late fees.

How to Avoid PayPal Late Fees

Proactive Strategies for Mitigating Late Fee Incurrence

Given the potential financial implications of PayPal late fees, implementing proactive measures to avoid their imposition is paramount. By adopting strategic approaches and leveraging the resources available within the PayPal platform, users can safeguard themselves against the burden of late fees and maintain a positive financial standing.

- Payment Reminders: Setting up payment reminders within the PayPal account or utilizing external calendar notifications can serve as effective tools for staying informed about impending payment deadlines, reducing the likelihood of missed payments and subsequent late fees.

- Automated Payments: Leveraging PayPal’s automated payment features, such as scheduled transfers or recurring payments, can streamline the payment process, ensuring timely settlement of financial obligations and minimizing the risk of late fee imposition.

- Financial Planning: Engaging in proactive financial planning and budgeting can empower users to allocate funds for impending PayPal payments, mitigating the potential for cash flow constraints that may lead to delayed payments and associated late fees.

- Clear Communication: In cases where unforeseen circumstances may impact payment timelines, maintaining open communication with relevant parties, such as creditors or PayPal’s customer support, can facilitate the exploration of viable solutions and potentially mitigate the imposition of late fees.

Furthermore, familiarizing oneself with the specific terms and conditions governing PayPal transactions, including the details related to late fees, grace periods, and penalty structures, is instrumental in proactively addressing potential late fee scenarios. By staying informed and adhering to the prescribed guidelines, users can navigate the PayPal ecosystem with heightened awareness and mitigate the risk of incurring late fees.

Embracing a proactive and informed approach to financial management within the PayPal framework empowers users to not only avoid late fees but also cultivate a positive transaction history, fostering trust and reliability in their financial interactions. By integrating these strategies into their financial practices, users can harness the convenience of PayPal while mitigating the potential pitfalls associated with late fee charges.

Conclusion

Navigating Financial Prudence in the PayPal Ecosystem

In conclusion, the prevalence of PayPal late fees underscores the significance of understanding the dynamics of financial transactions within the platform and implementing proactive strategies to mitigate the risk of late fee imposition. The convenience and ubiquity of PayPal as a payment solution are accompanied by the potential for late fees, necessitating a nuanced approach to financial prudence and payment management.

By unraveling the implications of PayPal late fees and comprehending the factors that influence their imposition, users can equip themselves with the knowledge needed to navigate the platform effectively. Proactive measures, such as setting up payment reminders, leveraging automated payment features, and maintaining open communication, serve as invaluable tools in avoiding late fees and fostering a positive transaction history.

Ultimately, the quest to avoid PayPal late fees is intertwined with the broader pursuit of financial responsibility and conscientious payment practices. By integrating these principles into their interactions within the PayPal ecosystem, users can harness the platform’s benefits while mitigating the potential pitfalls associated with late fee charges.

As users strive to optimize their financial management within the realm of digital transactions, cultivating a proactive and informed approach to payment obligations is pivotal. By doing so, individuals and businesses can navigate the PayPal landscape with confidence, safeguarding their financial well-being and fostering a seamless payment experience.

Embracing financial prudence within the PayPal ecosystem not only mitigates the risk of late fees but also cultivates a foundation of trust, reliability, and fiscal discipline, positioning users for sustained success in their digital financial endeavors.