Home>Finance>When Do I Get A Late Fee In Utah Housing Payment?

Finance

When Do I Get A Late Fee In Utah Housing Payment?

Published: February 22, 2024

Learn about late fees for Utah housing payments and understand the finance implications. Avoid late fees by managing your housing payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Utah is renowned for its stunning landscapes, vibrant culture, and thriving economy. As more individuals and families seek to establish roots in this beautiful state, the demand for housing continues to grow. Whether you're a long-time resident or a newcomer to Utah, understanding the nuances of housing payments is crucial for maintaining a stable and secure living situation.

Navigating the intricacies of housing payments can be a daunting task, especially when it comes to avoiding late fees. Late fees can significantly impact your financial well-being and disrupt your peace of mind. Therefore, it's essential to comprehend the policies and circumstances surrounding late fees in Utah housing to ensure a smooth and stress-free living experience.

In this comprehensive guide, we will delve into the specifics of Utah housing payments, explore the policies regarding late fees, examine the circumstances that may lead to late fees, and provide valuable insights on avoiding these fees. By the end of this journey, you will be equipped with the knowledge and strategies necessary to manage your housing payments effectively and mitigate the risk of incurring late fees. Let's embark on this enlightening exploration of Utah housing payment late fees and empower ourselves with the wisdom needed to navigate this aspect of residential life with confidence and ease.

Understanding Utah Housing Payment

Utah offers a diverse range of housing options, including apartments, townhouses, single-family homes, and condominiums. When renting or owning a property in Utah, it’s essential to have a clear understanding of the associated payment structure. Typically, housing payments encompass various expenses, such as rent or mortgage payments, utilities, homeowner association (HOA) fees, and property taxes.

Renters in Utah are primarily responsible for paying monthly rent to their landlords or property management companies. This amount is agreed upon in the lease or rental agreement and often includes the cost of accommodation and basic amenities. On the other hand, homeowners make monthly mortgage payments to their lenders, which cover the principal loan amount, interest, and possibly escrow for property taxes and homeowners insurance.

Aside from the core housing expenses, residents in Utah need to consider utilities, including electricity, water, gas, internet, and other essential services. These costs are typically paid directly to utility providers or, in some cases, included in the rent for certain rental properties. Additionally, individuals residing in HOA-governed communities must factor in HOA fees, which contribute to the maintenance and management of shared amenities and common areas.

Understanding the breakdown of housing payments is crucial for budgeting and financial planning. By gaining insight into the components of Utah housing payments, residents can effectively manage their finances and ensure that all obligations are met in a timely manner. This foundational knowledge sets the stage for comprehending the implications of late fees and the importance of adhering to payment deadlines.

Late Fee Policies in Utah Housing

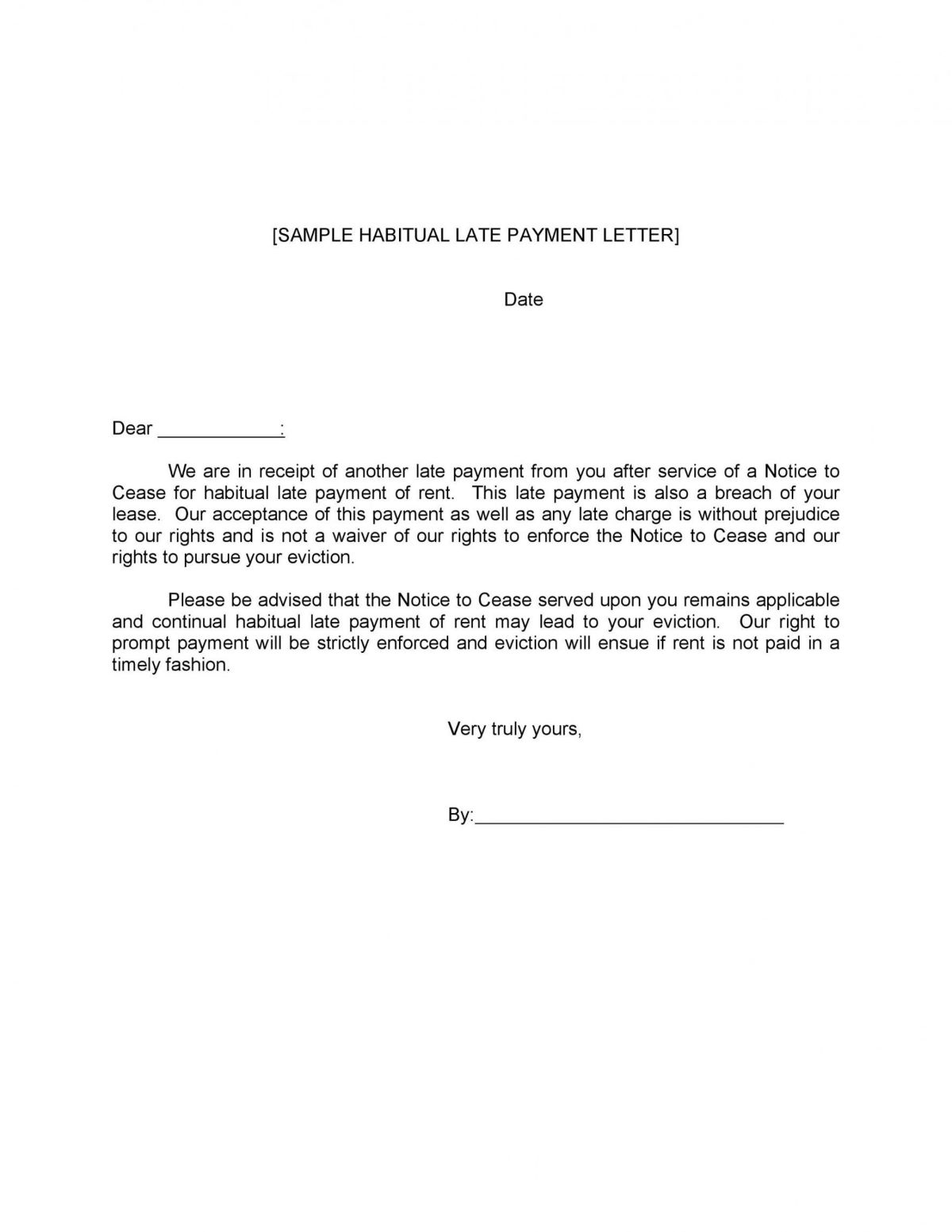

When it comes to housing payments in Utah, late fee policies serve as a mechanism to encourage timely payment and mitigate the impact of delayed remittances on landlords, property management companies, and homeowners’ associations. These policies outline the penalties and repercussions associated with failing to submit housing payments by the specified due date.

In Utah, late fee policies are typically detailed in the lease or rental agreement for tenants, while homeowners can find relevant information in their mortgage documents or HOA regulations. It’s important to review these documents carefully to gain a clear understanding of the late fee structure, including the amount of the late fee, the grace period (if any), and the frequency of late fee assessments.

Landlords and property management companies often impose a late fee when renters fail to pay their rent on time. The amount of the late fee is predetermined and disclosed in the lease agreement. Commonly, late fees are calculated as a fixed sum or a percentage of the overdue rent. Additionally, landlords may specify a grace period, allowing tenants a brief extension beyond the due date before the late fee is incurred.

For homeowners with mortgages, late fee policies are established by their respective lenders. Mortgage agreements typically stipulate the late fee amount and the grace period, providing homeowners with a window of time after the due date to submit their payment without incurring a penalty. Similarly, individuals residing in HOA-governed communities must adhere to the late fee policies outlined in the HOA regulations, which detail the consequences of delayed HOA fee payments.

Understanding the specific late fee policies applicable to your housing situation in Utah is crucial for avoiding unnecessary financial strain. By familiarizing yourself with these policies and proactively adhering to payment deadlines, you can steer clear of late fees and maintain a positive relationship with your landlord, lender, or HOA.

Circumstances for Late Fee in Utah Housing

Several circumstances can lead to the imposition of late fees in Utah housing, emphasizing the importance of understanding and proactively addressing potential challenges that may arise in meeting payment deadlines. It’s essential for residents to be aware of these circumstances to avoid unintended delays and the associated financial penalties.

One common circumstance that may result in late fees is financial hardship or unexpected expenses. In some instances, individuals may encounter unforeseen financial challenges, such as medical emergencies, car repairs, or temporary job loss, which can temporarily disrupt their ability to make timely housing payments. While facing such circumstances, it’s crucial to communicate openly and promptly with landlords, lenders, or property management companies to explore feasible solutions and potentially negotiate alternative payment arrangements.

Another circumstance that can contribute to late fees is the mismanagement of personal finances. Poor budgeting, overspending, or overlooking payment due dates can lead to missed deadlines and the subsequent imposition of late fees. To mitigate this risk, residents should prioritize effective financial planning, utilize reminders or automatic payment systems, and maintain a vigilant approach to managing their housing expenses.

Additionally, life events such as relocation, family emergencies, or unexpected travel can inadvertently disrupt the payment process, potentially resulting in late fees. During such times, individuals should make every effort to plan ahead, notify relevant parties in advance, and arrange for alternative payment methods or authorized representatives to ensure that housing payments are made on time.

Furthermore, administrative errors, banking issues, or delays in processing payments can contribute to late fees in Utah housing. It’s imperative for residents to monitor their payment transactions closely, promptly address any discrepancies or issues, and maintain accurate records to rectify potential errors and prevent the accrual of late fees.

By recognizing these circumstances and taking proactive measures to mitigate their impact, residents can navigate the complexities of Utah housing payments with greater resilience and foresight. Understanding the potential triggers for late fees empowers individuals to implement strategic solutions and safeguards, ultimately fostering a more secure and harmonious housing payment experience.

Consequences of Late Payment in Utah Housing

Late payment of housing expenses in Utah can have significant repercussions, impacting both tenants and homeowners. Understanding the potential consequences of late payments is essential for fostering financial responsibility and maintaining a positive housing relationship.

For tenants renting properties in Utah, late payment of rent can lead to the imposition of late fees as outlined in the lease agreement. These fees add to the overall financial burden and may strain the tenant’s budget. Additionally, repeated late payments can erode the trust between tenants and landlords, potentially leading to strained relationships and jeopardizing the possibility of lease renewals or favorable rental references in the future.

Moreover, consistent late payments may prompt landlords to initiate eviction proceedings in accordance with Utah’s landlord-tenant laws. Eviction processes can be emotionally distressing, financially draining, and tarnish a tenant’s rental history, making it challenging to secure future housing opportunities. Therefore, tenants must recognize the gravity of late payments and prioritize fulfilling their rental obligations in a timely manner.

For homeowners with mortgages, late payments can result in adverse effects on their credit scores and financial stability. Lenders typically report late payments to credit bureaus, potentially lowering the homeowner’s credit score and hindering their ability to access favorable financing terms in the future. Furthermore, repeated late payments may trigger additional penalties, escalate the risk of foreclosure, and amplify the overall cost of homeownership.

Individuals residing in HOA-governed communities face consequences such as fines, penalties, and potential restrictions on accessing community amenities or participating in HOA activities due to late HOA fee payments. These consequences can diminish the overall residential experience and strain relationships with the HOA board and fellow community members.

Understanding the potential consequences of late payments underscores the importance of prioritizing timely housing remittances and maintaining open communication with landlords, lenders, and HOAs. By honoring payment deadlines and proactively addressing challenges, residents can uphold their financial integrity and sustain a positive and harmonious housing environment in Utah.

Avoiding Late Fees in Utah Housing

Effectively managing housing payments in Utah requires proactive strategies to avoid incurring late fees and maintain financial stability. By implementing practical approaches and fostering responsible financial habits, residents can navigate their housing obligations with confidence and reliability.

One fundamental step in avoiding late fees is to establish a comprehensive budget that encompasses all housing-related expenses, including rent or mortgage payments, utilities, HOA fees, and other relevant costs. By gaining a clear overview of financial obligations, individuals can allocate funds appropriately and prioritize timely payments.

Utilizing digital tools and resources, such as calendar reminders, automatic payments, or mobile banking applications, can serve as valuable aids in managing housing payments. Setting up automated reminders or payments helps ensure that deadlines are not overlooked and payments are processed efficiently, reducing the risk of incurring late fees.

Open communication with landlords, lenders, and HOAs is pivotal in addressing potential challenges that may impact payment timelines. In the event of financial hardship, unexpected circumstances, or logistical issues, residents should proactively engage with relevant parties to explore feasible solutions, negotiate payment arrangements, or seek temporary accommodations to prevent late fees.

Regularly reviewing lease agreements, mortgage documents, and HOA regulations enables residents to stay informed about late fee policies, grace periods, and other pertinent details. This knowledge empowers individuals to anticipate payment deadlines and adhere to the specified terms, minimizing the likelihood of late fees.

Practicing prudent financial management, including maintaining an emergency fund, monitoring expenses, and avoiding unnecessary expenditures, can fortify individuals against potential setbacks that may lead to late payments. By cultivating responsible financial habits, residents can safeguard themselves against the risk of incurring late fees and maintain greater financial resilience.

Ultimately, a proactive and disciplined approach to managing housing payments is integral to avoiding late fees in Utah. By embracing financial diligence, leveraging available resources, and fostering open communication, residents can uphold their financial commitments and nurture a positive and harmonious housing experience.

Conclusion

Navigating the intricacies of housing payments in Utah necessitates a comprehensive understanding of late fee policies, potential consequences, and proactive measures to avoid financial penalties. Whether renting a property, owning a home, or residing in an HOA-governed community, residents must prioritize timely payments and foster responsible financial habits to sustain a harmonious housing experience.

By comprehending the nuances of Utah housing payments, individuals can proactively address potential challenges, such as financial hardship, administrative errors, or unexpected life events, that may lead to late fees. Open communication with landlords, lenders, and HOAs, coupled with diligent financial planning, serves as a cornerstone for mitigating the risk of late payments and fostering positive relationships within the housing landscape.

Furthermore, leveraging digital tools, maintaining clear communication, and adhering to the terms outlined in lease agreements, mortgage documents, and HOA regulations are essential components of a proactive approach to avoiding late fees. These strategies empower residents to uphold their financial integrity, mitigate the impact of late payments, and sustain a stable and secure housing environment.

Ultimately, the conscientious application of these insights equips individuals with the knowledge and tools necessary to navigate Utah housing payments with confidence and reliability. By prioritizing timely remittances, embracing financial diligence, and fostering open communication, residents can minimize the risk of late fees and cultivate a positive and sustainable housing experience in the vibrant and dynamic state of Utah.