Home>Finance>10 Powerful Steps To Take Today to Get Out of Debt

Finance

10 Powerful Steps To Take Today to Get Out of Debt

Modified: April 22, 2024

Discover 10 effective strategies to reduce your debt today. Learn practical tips for budgeting, negotiation, and financial planning to achieve freedom from debt.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Debt can feel like a dark cloud looming over your financial life. Credit card bills pile up, student loans linger, and medical debts in Texas lead to endless stressful phone calls from collectors. You know you need to pay it all off, but it seems impossible.

This guide is intended for individuals who feel overwhelmed and powerless against the rising tide of debt. By following these 10 steps, individuals can take control of their finances, develop healthy money habits, and start living debt-free.

Before delving into the steps, it’s crucial to comprehend the reasons behind accumulating debt and the emotional obstacles that hinder our path to debt freedom. This will help you approach debt repayment more thoughtfully and empowered.

Who Can Benefit from This Guide?

This guide is designed for individuals feeling burdened by months or years of accumulated debt and seeking ways to achieve lasting debt freedom. That may include:

- Young adults struggling with burdensome student loan balances and high cost of living

- Families trapped in the cycle of relying on credit cards to pay monthly bills

- Middle-aged professionals buried in mortgage and auto loan debt

- Older individuals facing mounting medical bills and the inability to retire

- Anyone whose finances have been upended due to unexpected life events or circumstances

Different states across the country face debt burdens at both the household and state government levels. While state debts stem largely from budget shortfalls, infrastructure costs, and unfunded pension liabilities over time, citizens face soaring debt levels from credit cards, student loans, and medical bills. Gaining knowledge on potential paths for debt relief in Texas can ease financial strains for those affected.

Key Reasons Why Debt Accumulates

- Unexpected expenses such as medical bills, home or auto repairs, or job loss strain savings and necessitate reliance on credit.

- Lifestyle inflation leads to overspending on wants rather than needs. With credit readily available, it’s easy to spend beyond your means.

- The absence of budgeting and expense tracking makes it challenging to align spending with income and savings objectives.

- Poor financial education around interest, minimum payments, and long-term money management.

- Preference for instant gratification versus delaying purchases until they can be paid in cash.

The Emotional and Psychological Barriers to Debt Repayment

Debt can negatively impact mental health. Common reactions include anxiety about losing income needed for repayment, avoidance, and denial when facing the problem, feelings of shame that prevent seeking help, increased arguments with family about financial constraints, and relying on retail therapy for temporary mood boosts. Not managing your debt wisely can result in financial hardship down the road if you let balances and interest charges spiral out of control.

Confronting debt head-on is critical, but also challenging emotionally. Useful strategies include radical honesty in facing the full scope of debt, forgiving yourself and focusing energy on solutions, and recognizing that little daily progress pays off long-term. Seeking community support and professional financial counseling can provide additional guidance on the path to repayment.

Taking Control: 10 Empowering Steps to Freedom from Debt

Feeling hopeless against the crushing weight of debt is depressing and stressful. But you have more power than you realize to take control of your financial life. By methodically following these 10 important steps, you can develop strategies to increase income, trim expenses, target debts systematically, and leverage every resource at your disposal.

This will help you progressively eliminate what you owe. With focus and discipline, you pave the path to financial freedom step-by-step until you cross the debt finish line for good.

Assess Your Current Financial Situation

The first step is gaining clarity on the full scope of your current financial life. This requires tracking all sources of income, recurring expenses, and outstanding debts. Make a list of your income sources and amounts, including salary, freelance work, investment income, government benefits, etc. Note whether income is fixed or fluctuating.

List all monthly and annual expenses, from rent to gym memberships to streaming services, including both needs and wants. This helps align spending with values. Detail all debts owed including credit cards, personal loans, student loans, back taxes, medical debt, etc.

Note interest rates, minimum payments, and balances for each debt. With this full picture, you can calculate important metrics like your debt-to-income ratio and get a clear sense of cash flow. This puts you in control of all vital information in one place.

Create a Budget That Prioritizes Debt Repayment

Now it’s time to create a budget that channels as much money as possible toward debt repayment. List your income, then essential needs like housing, food, and utilities. Be sure to budget some for savings too.

Allocate percentages of leftover income to debt repayment funds, irregular expenses that don’t recur monthly, and discretionary spending. Automate payments for fixed and essential costs to avoid late fees or lapses in critical services.

Manually manage variable discretionary spending. Reassess and adjust the budget monthly as income and expenses evolve. Committing to a budget provides structure and accountability. Seeing debts steadily get paid off will motivate you to stick to the budget.

Choose the Right Debt Repayment Strategy

When it comes to approaches for tackling your debts, two popular options are the debt snowball method and the debt avalanche method:

|

Method |

Description |

Pros |

Cons |

|

Debt Snowball |

Focuses on paying off debts from smallest to largest, regardless of interest rate |

Provides psychological wins as you eliminate debts quickly |

May cost more in interest over time |

|

Debt Avalanche |

Prioritizes paying off debts with the highest interest rates first |

Mathematically optimal for reducing interest fees |

Can take longer to feel progress |

In addition to these strategies, also consider debt consolidation loans or debt settlement which may be appropriate ways to reduce interest rates or negotiate discounted payoffs on unsecured debts.

Increase Your Income to Accelerate Debt Repayment

Boosting your income is the fastest way to speed up debt repayment. Trimming expenses help, but making more money each month provides fuel for rapid debt elimination. Consider these options:

Side Hustles

Getting a flexible side gig in addition to your regular job can generate crucial extra income for making bigger debt payments. Great options include driving for a rideshare company like Uber or Lyft, taking on freelance writing or virtual assistant jobs, or leveraging other skills. Even an extra $500 per month from strategic side work can accelerate debt payoff dates.

Ask for a Raise

If you have added value in your current role, make the case to your manager for a raise during your next review. Outline your positive impact and take on additional responsibilities. Earning higher pay in each paycheck provides ongoing funds to allocate toward debt freedom.

Find a Better-Paying Job

Research open jobs in your field that may pay significantly more given your current skills and experience. Polish your resume and interview for positions advertising strong salaries. Alternatively, leverage offers with higher compensation into a raise from your employer.

Overtime Hours

Working paid overtime shifts during busy periods can quickly increase your income. While avoiding burnout, use overtime strategically as increased earnings to eliminate debt faster.

With focused effort, dedicating extra income fuels the capacity to pay off debt years faster, saving money on interest payments. Determine the income-boosting options at your disposal to accelerate your debt-free date.

Negotiate Lower Interest Rates

Pick up the phone and call your credit card companies and other lenders. Politely make a case for why you deserve a lower interest rate on your debts.

- Mention that you have been a loyal customer and ask them to reduce your APR to help you meet your financial goals.

- If your credit score has improved, note this as justification for a rate decrease.

- Stress that a lower interest rate will allow you to pay off the balance faster.

Every percentage point reduction saves money that can be allocated towards eliminating debt instead of interest fees.

Consider Debt Consolidation or Refinancing Options

Debt consolidation loans and balance transfer credit cards enable you to consolidate multiple loan payments into one monthly bill, often with a lower interest rate, simplifying the repayment process. This makes payments more manageable, reduces the total interest paid over time, and simplifies visualizing a path to becoming debt-free.

However, these options have risks to consider, such as extension of loan terms. If you miss payments on the consolidated loan, penalties and fees can pile on quickly. Be sure to thoroughly research lenders and understand all the fine print in any agreements before committing.

Lenders will check your credit score and require a steady income to qualify for the best rates.

Weigh the pros and cons carefully for your situation before deciding if consolidation makes sense. The goal is to pay off debt faster, not complicating finances further.

Build an Emergency Fund to Avoid New Debt

Once you’ve begun making progress on debt repayment, a top priority should be establishing a rainy-day fund with 3-6 months’ worth of living expenses. Emergency funds prevent scenarios where illness, job loss, car breakdowns, or other unexpected crises drive you back into unmanageable debt.

Try to keep your emergency money in an accessible high-yield savings account that still allows withdrawals. Start by socking away even $25 or $50 at a time from monthly budgets until momentum builds. Resist tapping this fund for non-emergencies so it remains available when truly needed.

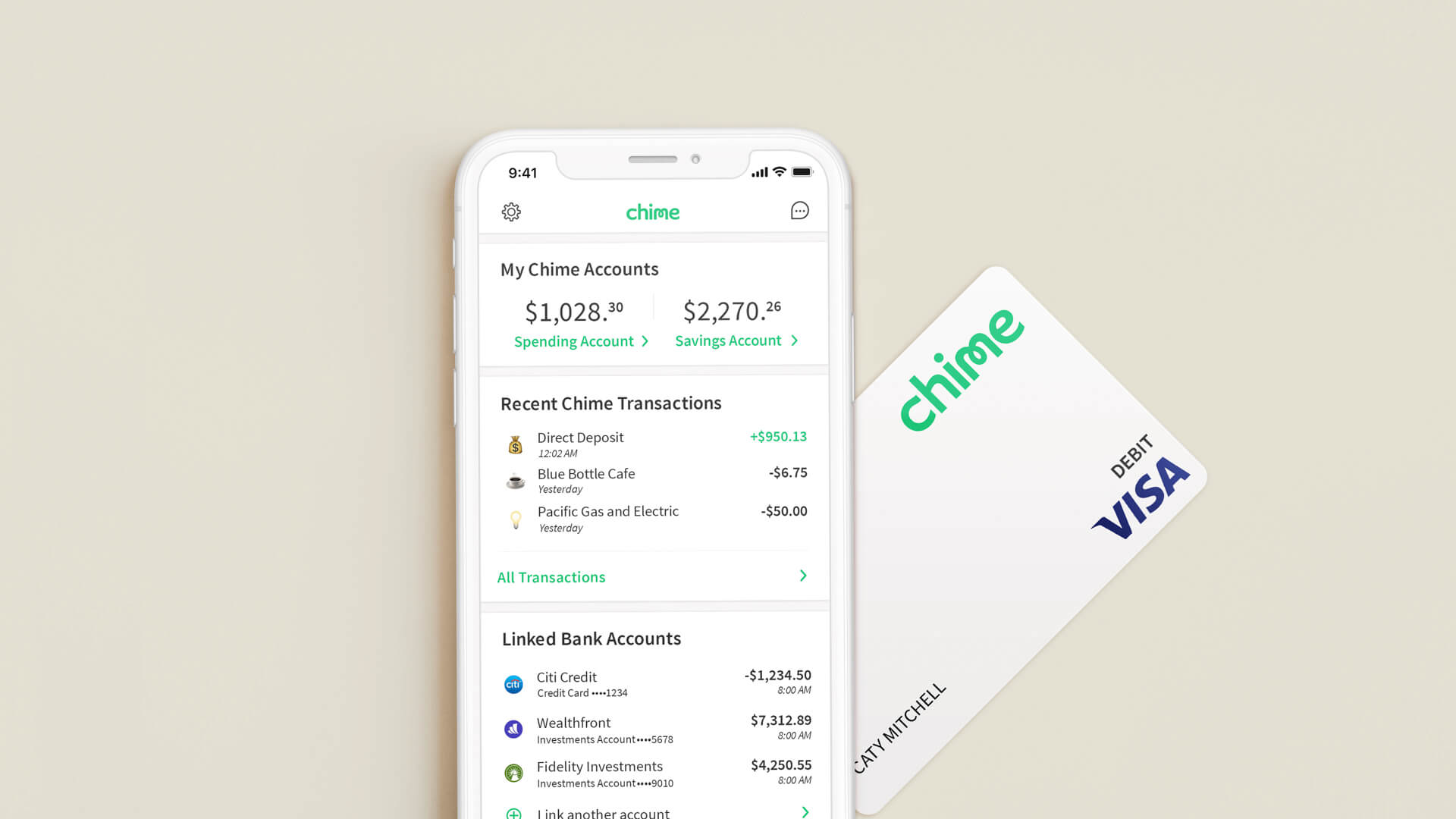

Leverage Financial Tools and Resources

You don’t have to tackle debt alone. Take advantage of budgeting apps, debt repayment calculators, non-profit credit counseling services, and other resources to analyze your financial situation, direct payments, and provide guidance.

Be wary, however, of certain credit repair agencies charging upfront fees or guaranteeing results. There are no quick fixes – the path to financial freedom requires changed habits and often sacrifice over an extended timeframe. With discipline, commitment to pay down debts each month, and the use of the many helpful tools now available, you can take control of your financial life.

Stay Motivated and Keep Track of Your Progress

Track Your Progress

As you make extra payments each month and save on interest fees, closely monitor your progress. Use a debt-tracking app or spreadsheet to update balances. Celebrate important milestones – every debt that gets fully paid off, hitting certain totals of interest/fees saved, crossing key repayment percentage thresholds.

Highlighting incremental progress helps visualize all the hard work paying off. Share wins on social media or with your support community. Sign up for debt repayment forums to exchange tips and encouragement with others on the journey.

Reward Yourself

When you reach certain goals, celebrate your discipline with fun free activities, like hiking, beach days, picnics, game nights, or movie marathons. Avoid spending money on treats, but leverage milestones as a way to practice gratitude and work/life balance on your path to freedom.

Plan for the Future Once Debt-Free

During stressful times or moments of frustration, reconnect to the feelings of relief and accomplishment you’ll have when all debts are repaid. Financial freedom will lift a heavy burden and open new possibilities. Read old journal entries from when debts felt crushing to keep urgency.

Additionally, maintain motivation by planning thoughtfully for life after debt. How will you spend, save, and invest once your income is freed up? What does that long-term lifestyle look like? Smart budgeting and money management now will enable more wealth-building later.

With consistent effort and an eye towards living debt-free, you can get there! Celebrate small wins, visualize future freedom, and think critically about how your financial life should look post-repayment. The finish line will come sooner than you know it.

Conclusion

Becoming debt-free is a long journey that demands continuous commitment and sacrifice. But, the sense of empowerment and financial freedom it brings is invaluable. Assess your full financial situation. Craft a targeted budget and repayment strategy. Methodically eliminate debts one by one. Steadily increase income through side hustles or career moves.

Leverage every resource and motivation tool. The road to financial independence starts with a single step. Recognize the progress made with each small milestone met, and remain focused on the life you envision for yourself, free from the burden of debt. With concerted effort and an eye always on your goals, you will get there.

Key Takeaways

- Honestly confront the full scope of your current debt and craft a detailed budget aligned with repayment priorities

- Pick a debt repayment strategy that plays to your psychological strengths and motivation style

- Aggressively boost income through side hustles, raises, and overtime – more cash flow means faster debt freedom

- Maintain an emergency fund buffer so unexpected expenses never derail repayment momentum

- Leverage apps, calculators, and communities to analyze finances and stay on track

- Measure and celebrate small wins frequently for an emotional lift to persevere

Frequently Asked Questions

Should I use my savings to pay off credit card debt?

Avoid raiding savings to pay debt unless you’ve built up at least 6 months of living expenses and have a plan to rapidly replenish. Maintain some emergency buffer and focus on increasing income to dedicate to debt instead.

Which debt repayment strategy is the fastest?

The debt avalanche method is mathematically optimal, saving the most in interest over time. But for some, the debt snowball method provides more emotional motivation to stay consistent via small wins. Choose the strategy you’re most likely to stick to diligently.

Is debt consolidation wise?

Debt consolidation can simplify repayment through a single lower-interest fixed loan. But use caution – it’s still additional debt, doesn’t address overspending issues, and incurs origination fees. Seek qualified guidance before pursuing.

Should I pause retirement account contributions temporarily?

Halt retirement savings temporarily only as a very last resort. You lose out on employer matching funds and compound growth. Stop overspending first, increase income, lower rates – and keep retirement contributions steady before resorting to pauses.

How do I avoid feeling deprived and resentful living frugally?

Reframe frugality as empowering – you’re choosing to reject consumer culture and marketers telling you to spend. Feel proud about saving toward goals that align with your values. Stay focused on the freedom debt repayment will ultimately provide.

How can I incentivize my partner or family to support my debt repayment goals?

Have honest and vulnerable conversations about why becoming debt-free matters to you. Help them see how reducing this financial burden can improve family relationships. Involve them in budgeting discussions and celebrate mutual wins like cutting monthly expenses.

I feel completely overwhelmed. Where should I even start?

Just take the first step – list all your debts and monthly payments. Small progress is still progress. Then set one manageable goal for this week, like calling one creditor to negotiate rates or saving $50. Momentum builds slowly. You’ve got this!

I feel ashamed about my debt. How do I overcome this?

It’s understandable, but don’t be too hard on yourself. Debt can happen due to many factors outside your control. Focus on the positive steps you’re taking now to regain control. Confide in trusted friends for support. Be proud you’re facing this head-on with a plan.

How long will debt repayment realistically take?

For most people, becoming debt-free takes 2-5 years depending on total debts, income, budget, and repayment strategy. Use calculators to estimate your timeline. Stay focused – you’ll get there through consistent diligence.

What if I still struggle with debt despite my best efforts?

If you’ve made every effort but still face unmanageable debt, consult a credit counseling agency. Bankruptcy legally discharges debts but also damages credit. While difficult, accepting the need for extreme measures like bankruptcy takes wisdom. Don’t prolong futile efforts that leave you overwhelmed. Prioritize your health and seek professional guidance.