Finance

How To Take Money Out Of Chime Savings

Published: January 16, 2024

Learn how to withdraw money from your Chime Savings account and manage your finances effectively. Get expert tips and advice on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

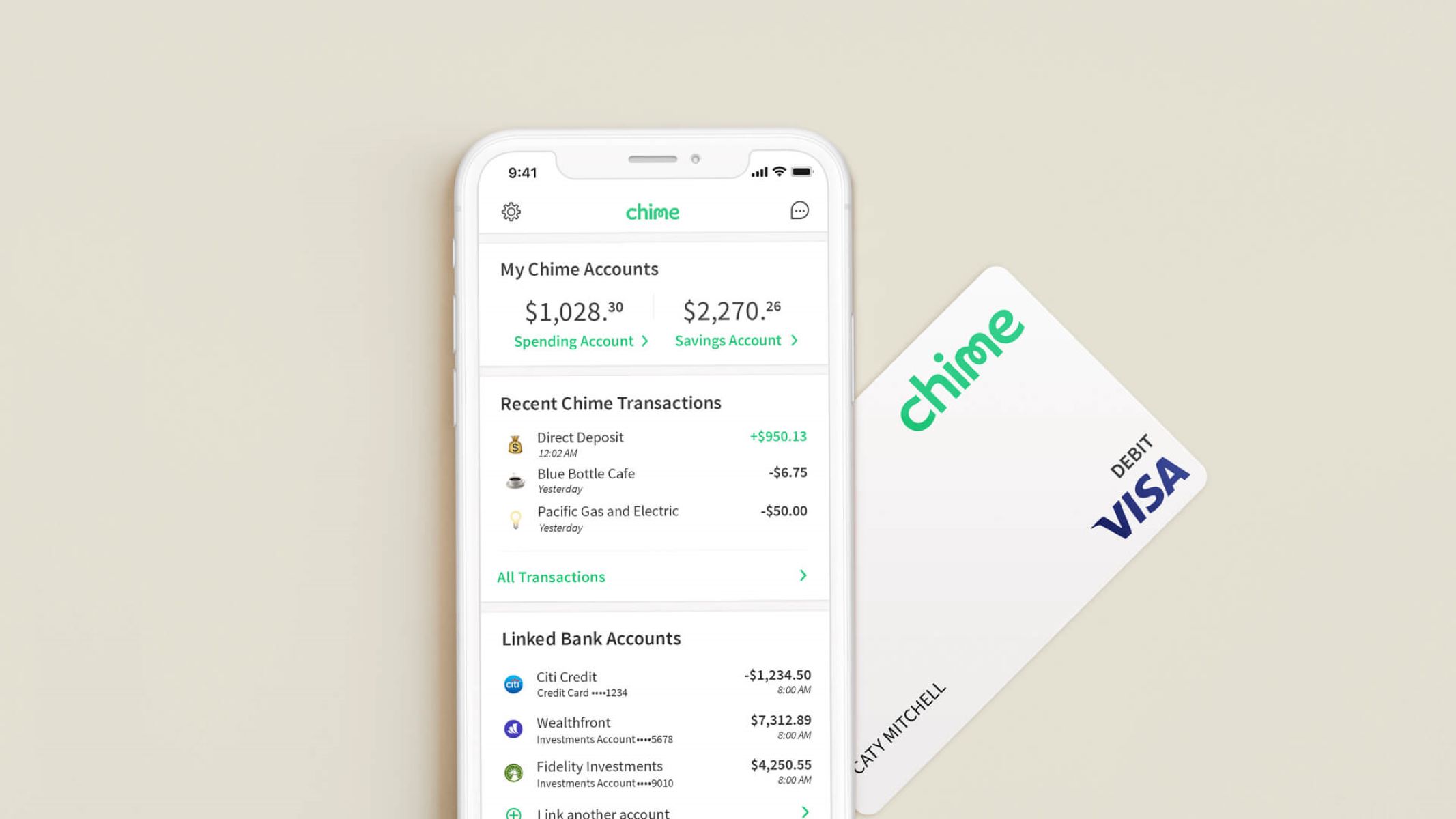

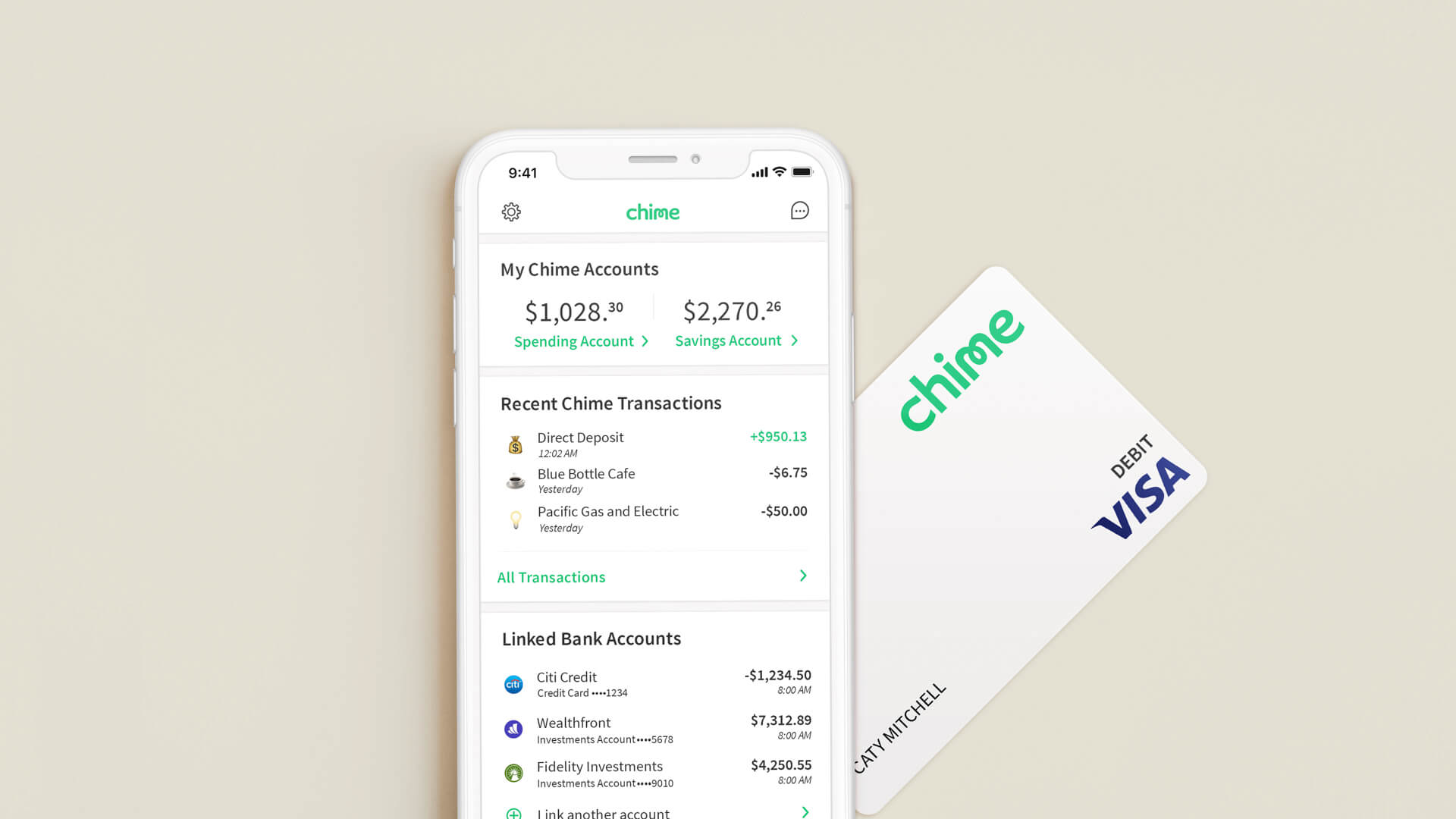

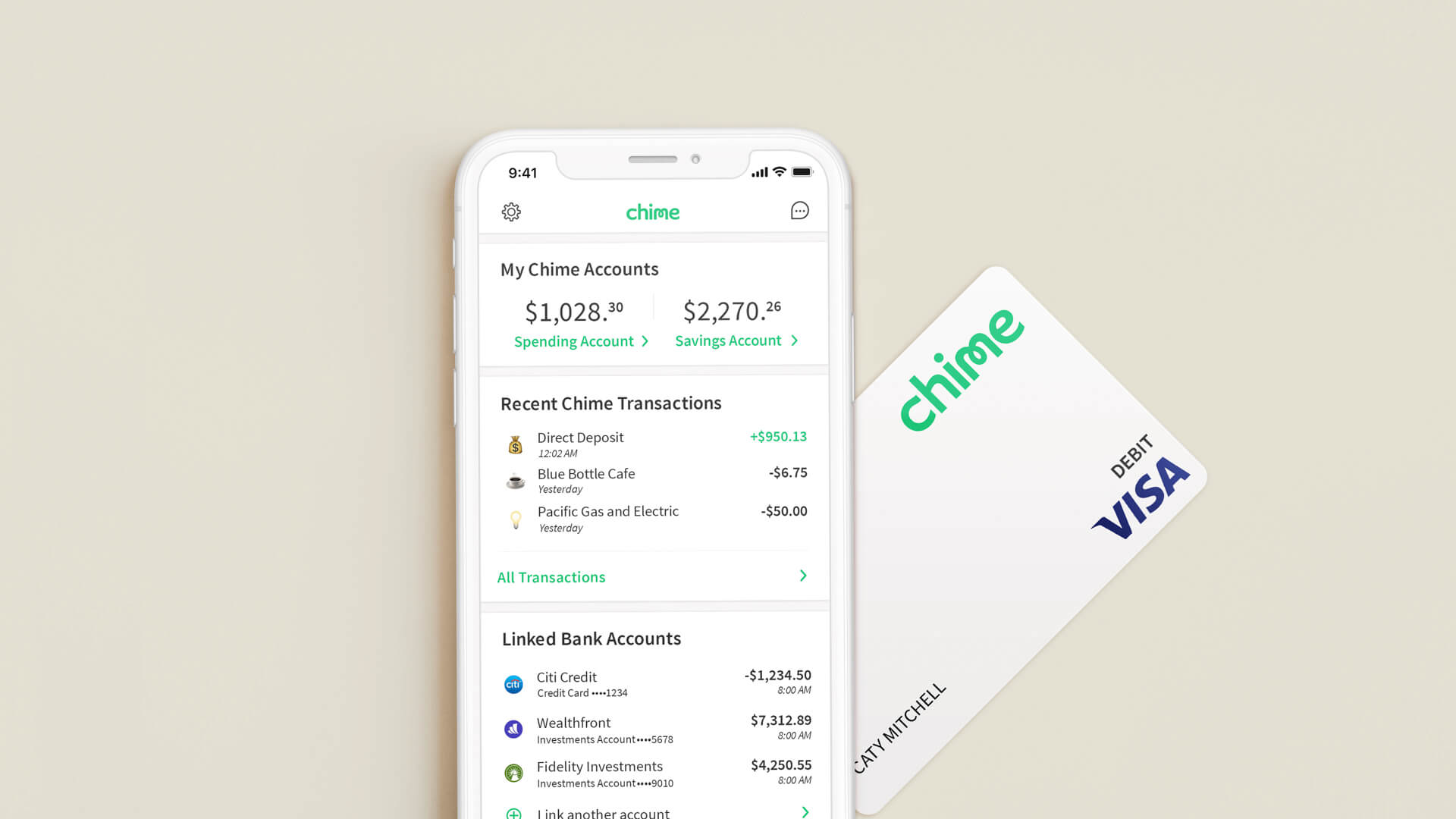

Welcome to the world of Chime Savings! Chime is a popular mobile banking platform that offers innovative and user-friendly financial services. If you are a Chime member, you may be wondering how to take money out of your Chime Savings account. In this article, we will guide you through the process of making withdrawals, transferring funds to external bank accounts, using the Chime debit card, and more.

Chime Savings is a convenient and secure way to save money. With no hidden fees and a competitive annual percentage yield (APY), it’s no wonder that many Chime members choose to keep their savings in this account. However, there may come a time when you need to access your savings for various purposes, such as emergencies, bills, or simply treating yourself to something special.

Understanding the different options available for withdrawing money from Chime Savings will give you the flexibility and control over your finances that you need. Whether you want to transfer funds to your external bank account, use the Chime debit card to withdraw cash, or write a check using the Chime checkbook feature, we will walk you through the step-by-step process.

It’s important to note that while Chime offers a variety of convenient options for accessing your savings, you should also be aware of any associated fees or limitations. We will discuss the Chime overdraft protection and fees, as well as the process for closing your Chime Savings account if you choose to do so. By the end of this article, you will have a clear understanding of how to effectively manage your Chime Savings and make withdrawals whenever you need them.

So, let’s dive in and explore the different ways you can take money out of your Chime Savings account!

Understanding Chime Savings

Before we delve into the process of taking money out of your Chime Savings account, it’s important to understand the features and benefits of this account. Chime Savings is a digital savings account offered by Chime, a mobile banking platform that aims to simplify and enhance your banking experience.

Chime Savings offers several key advantages. First and foremost, it provides a high annual percentage yield (APY) on your savings. This means that your money will grow faster compared to a traditional savings account offered by traditional banks. It’s a great option for individuals looking to maximize their savings and earn interest on their money.

Another great feature of Chime Savings is its fee-free policy. Chime prides itself on being a bank that doesn’t charge any hidden fees. This means that you won’t have to worry about monthly maintenance fees, minimum balance requirements, or overdraft fees for your Chime Savings account.

In addition to these benefits, Chime Savings offers automatic savings features that can help you reach your financial goals. With features like Round-Up, Chime helps you save effortlessly by rounding up your everyday purchases to the nearest dollar and depositing the difference into your savings account. This way, you can save without even thinking about it.

Chime Savings also provides a seamless integration with your Chime Spending account, allowing you to easily transfer funds between the two accounts. This feature gives you the flexibility to manage your money efficiently and allocate funds based on your spending and saving needs.

Overall, Chime Savings is designed to provide a convenient and rewarding savings experience. With its high APY, no fees, and various savings features, it’s an excellent option for anyone looking to grow their savings and achieve their financial goals.

Now that we have a good understanding of Chime Savings, let’s move on to exploring how to make withdrawals and access your funds when needed.

Eligibility and Account Setup

To take advantage of Chime Savings and make withdrawals from your account, you need to meet certain eligibility criteria and set up your Chime account correctly. Let’s explore the eligibility requirements and the steps to get started with Chime.

Eligibility for Chime Savings:

- You must be at least 18 years old to open a Chime Saving account.

- You need to have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Chime Savings accounts are available for both U.S. citizens and permanent residents.

Setting up your Chime account:

- Download the Chime mobile app from the App Store (for iOS users) or the Google Play Store (for Android users).

- Open the app and click on “Get Started” to begin the account setup process.

- Provide the required personal information, including your name, date of birth, address, and Social Security number or ITIN.

- Verify your identity by providing a photo of your government-issued ID (such as a driver’s license or passport).

- Once your identity is verified, you can choose to open a Chime Spending account and link it to your Chime Savings account.

- Agree to the terms and conditions, and set up your account password.

- Lastly, Chime will send you a Chime Visa Debit Card, which you can use to access your money.

It’s worth mentioning that Chime Savings is a branchless banking service, which means you can only access your account through the Chime mobile app or website. There are no physical Chime bank branches available for in-person transactions.

Once you have successfully set up your Chime account, including your Chime Savings account, you’re ready to start managing your savings and making withdrawals when needed. In the next sections, we will explore the different options available to withdraw money from your Chime Savings account.

Making Withdrawals from Chime Savings

When it comes to accessing and withdrawing money from your Chime Savings account, Chime offers several convenient options. Let’s explore the different methods you can use to make withdrawals.

1. Transferring Funds to External Bank Accounts: One common method for withdrawing money from your Chime Savings account is by transferring funds to an external bank account. To initiate a transfer, follow these steps:

- Open the Chime mobile app and log in to your account.

- Navigate to the “Move Money” or “Transfers” section.

- Select the option for transferring funds to an external bank account.

- Provide the necessary details, such as the recipient bank’s routing and account numbers, and the amount you wish to transfer.

- Review the information and confirm the transfer. The funds should be deposited into your external bank account within a few business days.

2. Using the Chime Debit Card to Withdraw Money: Another convenient option is to use your Chime Visa Debit Card to withdraw cash from ATMs or make purchases at retail locations. Follow these steps:

- Locate an ATM that is in the Chime network. You can find fee-free ATMs using the ATM Finder feature in the Chime app.

- Insert your Chime Visa Debit Card into the ATM and follow the on-screen prompts.

- Select the option for a cash withdrawal and enter the desired amount.

- Retrieve your cash and Chime Visa Debit Card.

It’s important to note that some ATM operators may charge additional fees for withdrawals. Chime will display any applicable fees before you confirm the transaction so that you can make an informed decision.

3. Chime Checkbook Feature: Chime also offers a checkbook feature that allows you to write paper checks using your Chime Savings account. This can be useful for making payments, especially if the recipients require a physical check. To use this feature:

- Open the Chime mobile app and go to the “Move Money” section.

- Select the option for ordering checks.

- Follow the instructions to order your Chime checkbook. Checkbooks typically arrive within 5 to 10 business days.

- Once you receive your checkbook, simply fill out a check with the necessary details and mail it to the recipient.

With these options available, Chime makes it easy and convenient to access and withdraw your savings whenever you need them. Experiment with different methods until you find the one that suits your needs best.

In the next sections, we will discuss additional features related to Chime Savings, such as overdraft protection and fees, as well as the process for closing your Chime Savings account if necessary.

Transferring Funds to External Bank Accounts

Transferring funds from your Chime Savings account to an external bank account is a straightforward process that allows you to access and utilize your savings wherever you need. Chime offers a simple and user-friendly interface for initiating these transfers. Here’s how you can transfer funds to an external bank account:

- Open the Chime mobile app and log in to your account.

- Navigate to the “Move Money” or “Transfers” section, usually located in the main menu or on the home screen.

- Select the option for transferring funds to an external bank account.

- Provide the necessary details, including the recipient bank’s routing number, account number, and the amount you wish to transfer.

- Review the information for accuracy and to ensure that the correct account is selected.

- Confirm the transfer, and the funds will be sent to your external bank account.

It’s important to note that transfer times can vary depending on the receiving bank’s processing times and any potential hold periods. Generally, transfers from your Chime Savings account to an external bank account should be completed within a few business days.

Chime itself does not charge any fees for transferring funds to external bank accounts. However, it’s always a good idea to check with your receiving bank to determine if they impose any fees on incoming transfers. Additionally, ensure that you have sufficient funds available in your Chime Savings account to cover the transfer amount.

Transferring funds to external bank accounts is a convenient option if you need to use your savings with other banking services or make payments to creditors who do not accept electronic transfers. It provides flexibility and access to your funds beyond the Chime platform.

Keep in mind that Chime also offers integration with your Chime Spending account, allowing you to move funds between your Spending and Savings accounts seamlessly. This feature can be useful if you prefer to keep your funds within the Chime ecosystem or need to transfer money between the two accounts for daily spending.

In the next sections, we will explore using the Chime debit card to withdraw money, as well as the Chime checkbook feature for making payments using your Chime Savings account.

Using the Chime Debit Card to Withdraw Money

One of the most convenient ways to access and withdraw money from your Chime Savings account is by using the Chime Visa Debit Card. As a Chime member, you will receive a debit card that is linked directly to your Chime Spending and Savings accounts. Here’s how you can use your Chime debit card to withdraw cash:

- Find an ATM that is within the Chime network. You can locate fee-free ATMs using the ATM Finder feature in the Chime mobile app.

- Insert your Chime Visa Debit Card into the ATM machine.

- Follow the instructions displayed on the screen to enter your PIN (Personal Identification Number).

- Select the option for a cash withdrawal and enter the desired amount.

- Retrieve your cash and your Chime Visa Debit Card from the machine.

It’s important to note that while Chime strives to provide fee-free ATM access, there may be instances where the ATM operator charges additional fees. Before confirming the transaction, Chime will display any applicable fees so that you can make an informed decision.

In addition to cash withdrawals, your Chime Visa Debit Card can also be used to make purchases at retail locations wherever Visa cards are accepted. Simply swipe or insert your card and authorize the transaction using your PIN or a signature, depending on the merchant’s requirements. The purchase amount will be deducted from your Chime Spending account.

Using your Chime debit card offers the advantage of quick and easy access to your savings, whether it’s for withdrawing cash for daily expenses or making purchases at your favorite stores. Plus, with Chime’s fee-free ATM network and the ability to make purchases without worrying about fees, you can have peace of mind knowing that you won’t incur unnecessary charges.

In the next section, we will explore another feature related to Chime Savings – the Chime checkbook feature, which allows you to write physical checks using your Chime Savings account.

Chime Checkbook Feature

The Chime checkbook feature is a convenient option that allows you to write physical checks using your Chime Savings account. While digital and electronic payments have become increasingly prevalent, there are still occasions where a physical check may be necessary. Here’s how you can utilize the Chime checkbook feature:

- Open the Chime mobile app on your device.

- Navigate to the “Move Money” section, usually located in the main menu or on the home screen.

- Select the option to order checks.

- Follow the instructions provided to order your Chime checkbook.

- Once you receive your checkbook, simply fill out a check with the necessary details, including the payee’s name, the payment amount, and the date.

- Optional: You can record the check details in the Chime mobile app to help you track your transaction history and maintain accurate records of your spending.

- Mail or hand-deliver the check to the intended recipient.

The Chime checkbook feature provides the flexibility to make payments to individuals or businesses that require a physical check, such as landlords, service providers, or other entities that may not accept electronic payments. By ordering and using Chime checks, you can make payments directly from your Chime Savings account, utilizing the funds you have saved.

It’s important to note that writing a physical check deducts the corresponding amount from your Chime Savings account, so ensure that you have sufficient funds available before writing a check. You can easily track and monitor your Chime Savings balance through the mobile app to avoid any potential overdrafts.

Additionally, using the Chime checkbook feature allows you to retain a paper trail of your transactions, making it easier to monitor and reconcile your expenses. It is recommended to record each check you write in the Chime mobile app, if available, or in a personal transaction register to keep track of your spending and maintain accurate records.

The Chime checkbook feature provides a convenient way to make payments when electronic methods are not feasible or accepted. By using your Chime Savings account funds to write checks, you can effectively manage your finances while still embracing the benefits of digital banking.

In the next section, we will discuss Chime overdraft protection and fees, as well as the process for closing your Chime Savings account if necessary.

Overdraft Protection and Fees

One of the key features that Chime provides is its commitment to no hidden fees. When it comes to Chime Savings, it’s important to understand how overdrafts are handled and any associated fees. Let’s explore Chime’s approach to overdraft protection and potential fees:

Overdraft Protection: Chime’s policy is to not allow overdrafts on the Chime Savings account. This means that if you don’t have sufficient funds in your account to cover a transaction or withdrawal, the transaction will typically be declined. This ensures that you won’t incur overdraft fees or negative balances on your Chime Savings account.

Spending Account and Overdraft Policy: Chime does offer an optional Spending Account that is linked to your Savings Account. The Spending Account comes with an automatic savings feature known as SpotMe. When you activate SpotMe, Chime may cover certain qualifying debit card purchases beyond your available balance, up to a specific limit. However, this feature is not applicable to Chime Savings accounts, as overdraft protection is not enabled for this particular account.

Fees to be Aware of: While Chime prides itself on its fee-free policy, there are a few fees that you should be aware of:

- ATM Fees: Although Chime offers a network of fee-free ATMs, there may be instances where the ATM operator charges additional fees. Before confirming a transaction, Chime will display any applicable fees so that you can make an informed decision.

- Out-of-Network ATM Fees: If you use an ATM outside of Chime’s fee-free network, both the ATM operator and Chime may charge fees. These fees vary depending on the ATM and location, so it’s important to keep this in mind when accessing your funds.

- Expedited Transfer Fee: Chime offers the option to expedite the transfer of funds from your Chime Savings account to an external bank account for a fee. This fee ensures that the transfer is processed promptly, providing quicker access to your funds.

It’s important to review Chime’s current fee schedule and terms of service periodically, as fees and policies are subject to change. By staying informed, you can make financial decisions that align with your needs and preferences.

Now that we’ve covered overdraft protection and fees, let’s move on to discuss the process for closing your Chime Savings account if necessary.

Closing Chime Savings Account

If you no longer wish to keep your Chime Savings account, it is possible to close it. Closing your Chime Savings account is a simple process that can be done through the Chime mobile app or by contacting Chime’s customer support. Here’s how you can close your Chime Savings account:

- Open the Chime mobile app and log in to your account.

- Navigate to the “Settings” or “Account” section, usually located in the main menu or on the home screen.

- Look for the option to “Close Account” or “Close Savings Account.”

- Follow the instructions provided on the screen to confirm your decision to close your Chime Savings account.

- Once the account closure is confirmed, Chime will transfer any remaining funds in your Chime Savings account to your linked Chime Spending account.

It’s important to note that closing your Chime Savings account does not automatically close your Chime Spending account. If you also wish to close your Chime Spending account, you will need to follow separate steps to do so.

Before closing your Chime Savings account, consider a few important factors:

- Review your account for any pending transactions or scheduled transfers to ensure they are completed before closing the account.

- Make sure to transfer any funds you want to keep to an external bank account or spend them before closing your Chime Savings account.

- Once the account is closed, you will no longer have access to the Chime Savings features, such as earning interest on your savings or utilizing Chime-specific savings tools.

- Keep in mind that any recurring deposits or direct deposits that were linked to your Chime Savings account will need to be updated with your new banking information if you choose to open a savings account elsewhere.

If you have any questions or encounter difficulties while attempting to close your Chime Savings account, you can reach out to Chime’s customer support for assistance. They will be able to guide you through the process and address any concerns you may have.

Before making the decision to close your Chime Savings account, be sure to consider your financial goals and needs. If you require a savings account in the future, you may find it beneficial to keep your Chime Savings account open, taking advantage of its competitive interest rates and user-friendly features.

Now that we’ve covered closing your Chime Savings account and the various aspects of Chime’s services, let’s conclude our discussion.

Conclusion

Congratulations! You now have a comprehensive understanding of how to effectively manage your Chime Savings account and make withdrawals when needed. We explored the features and benefits of Chime Savings, including its high annual percentage yield (APY) and fee-free policy. Chime Savings offers a convenient and secure way to save money and grow your savings faster.

We discussed the eligibility criteria and steps to set up your Chime account, ensuring you meet the requirements and have a smooth account setup process. Once you’re all set up, you can explore the various methods to withdraw money from your Chime Savings account.

We covered transferring funds to external bank accounts, which provides flexibility and access to your savings beyond the Chime platform. You can easily initiate transfers through the Chime mobile app, ensuring quick and seamless transactions.

The Chime debit card proved to be another reliable option for accessing your funds. With the ability to withdraw cash from ATMs within the Chime network and make purchases at retail locations, you can conveniently use your Chime Savings account wherever Visa cards are accepted.

We also introduced the Chime checkbook feature, allowing you to write physical checks using your Chime Savings account. This feature provides a versatile payment method, as there are still occasions where physical checks may be necessary.

Furthermore, we touched on Chime’s approach to overdraft protection and fees. With Chime’s policy of not allowing overdrafts on Chime Savings accounts, you can have peace of mind knowing that you won’t incur overdraft fees or negative balances. We discussed potential fees related to ATM usage and expedited transfers, always emphasizing the importance of staying informed with Chime’s fee schedule and terms of service.

Lastly, we covered the process for closing your Chime Savings account if necessary. We highlighted the steps to take, such as ensuring pending transactions are completed, transferring funds, and considering the impact on recurring deposits or direct deposits.

Chime Savings offers a range of convenient options for accessing and managing your savings. Whether you prefer transferring funds to external banks, using the Chime debit card, or writing physical checks, Chime provides the flexibility and control you need in your financial journey.

Remember to regularly evaluate your financial goals and needs to ensure Chime Savings aligns with your long-term plans. Whether you choose to keep your Chime Savings account open or make the decision to close it, Chime’s user-friendly features and commitment to customer service can help you achieve your financial aspirations.

Thank you for joining us on this Chime Savings account journey. Happy saving and happy spending!