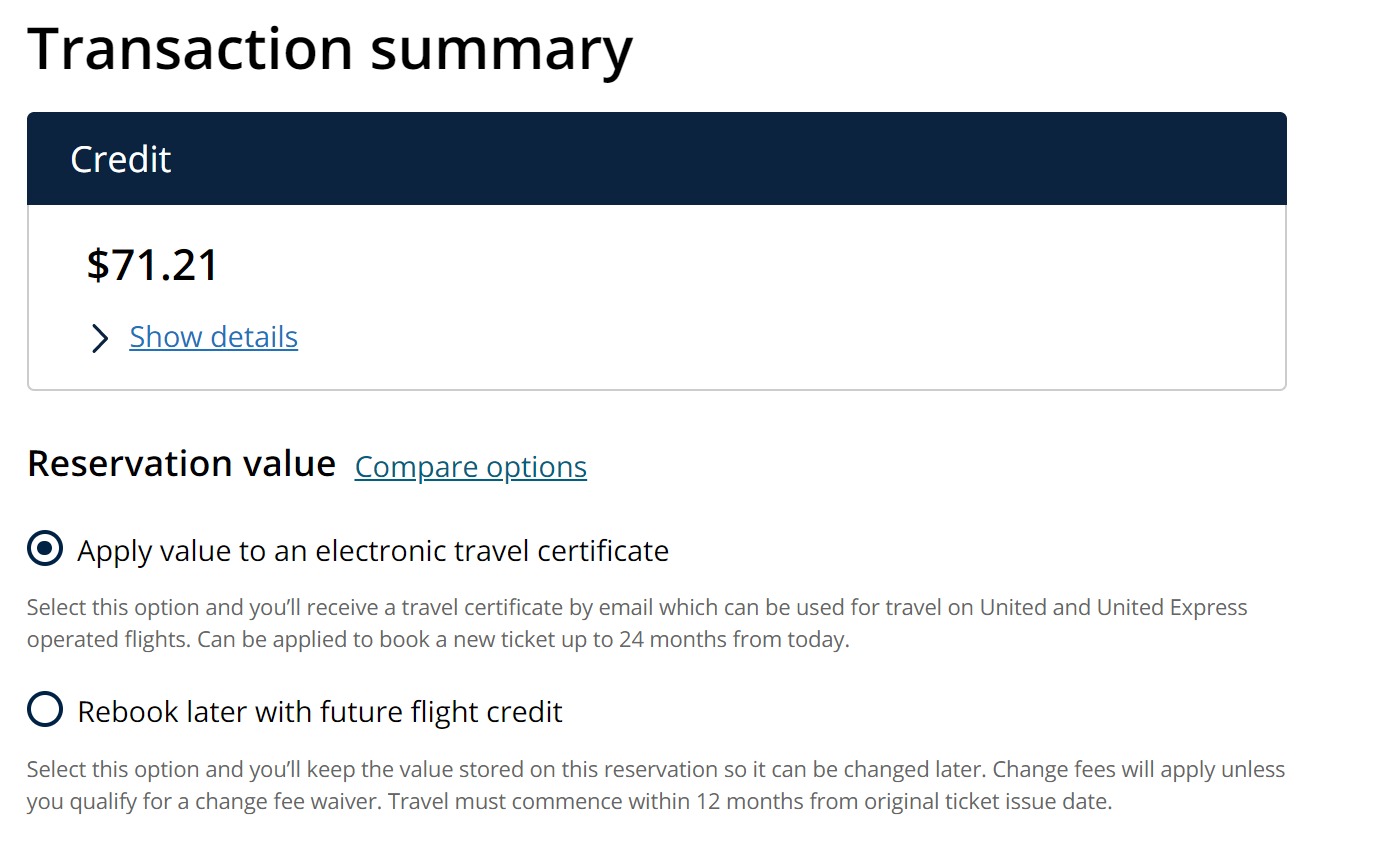

Home>Finance>Auditor’s Opinion: Definition, How It Works, Types

Finance

Auditor’s Opinion: Definition, How It Works, Types

Modified: December 12, 2023

Learn about auditor's opinion in finance, including its definition, how it works, and different types. Gain insights into the importance of auditor's opinion in financial assessments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Auditor’s Opinion: Definition, How It Works, Types

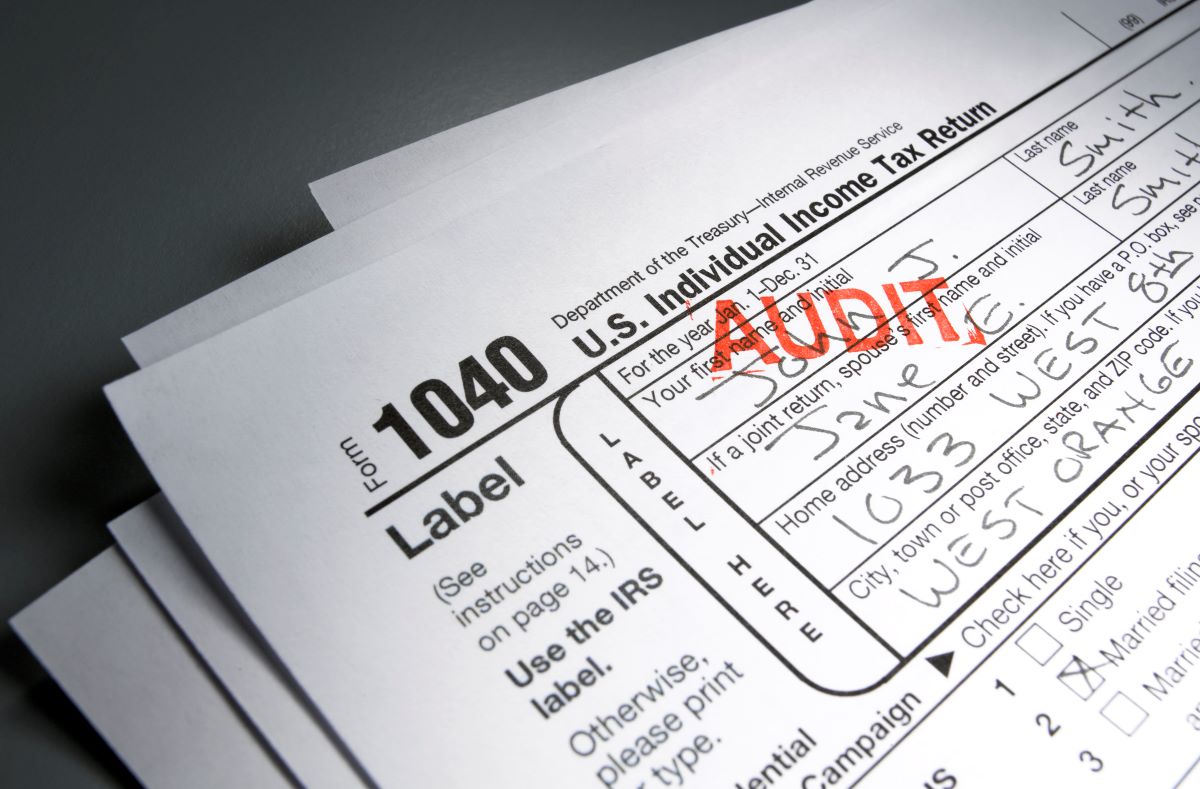

When it comes to finance, having reliable financial statements is crucial for businesses and stakeholders alike. To ensure the accuracy and credibility of these statements, companies often enlist the help of independent auditors. But what exactly is an auditor’s opinion and how does it work? In this blog post, we’ll delve into the definition of an auditor’s opinion, explore how it works, and discuss the various types of opinions that auditors can provide.

Key Takeaways:

- An auditor’s opinion is a professional assessment of a company’s financial statements provided by an independent auditor.

- It helps stakeholders understand the reliability and accuracy of financial information, highlighting any potential issues or red flags.

What is an Auditor’s Opinion?

An auditor’s opinion, also known as an audit opinion or audit report, is a formal statement made by an independent auditor regarding their assessment of a company’s financial statements. The opinion outlines the auditor’s evaluation of whether the financial statements provide a true and fair representation of the company’s financial position and performance.

An auditor’s opinion acts as a seal of approval, providing credibility and assurance to stakeholders, including potential investors, creditors, and regulators. It plays a crucial role in maintaining trust and confidence in financial markets.

How Does an Auditor’s Opinion Work?

During an audit, auditors gather evidence and examine a company’s financial records, transactions, and internal controls. Based on their findings, auditors form an opinion on the financial statements, determining whether they comply with generally accepted accounting principles (GAAP) or other applicable financial reporting standards.

The auditor’s opinion typically consists of several components, including:

- An introductory paragraph indicating the responsibilities of management and the auditor.

- A description of the scope of the audit, including the procedures performed and the period covered.

- An assessment of the company’s internal controls and their impact on the audit scope.

- An evaluation of the company’s accounting policies and practices.

- A statement regarding the overall fairness and reliability of the financial statements.

- A concluding paragraph expressing the auditor’s opinion on the financial statements.

Based on their assessment, auditors can provide different types of opinions, helping stakeholders gauge different levels of confidence in the financial statements.

Types of Auditor’s Opinions

There are several types of auditor’s opinions that can be issued, depending on the findings and conclusions of the audit. These include:

- Unqualified Opinion: This is the most desirable outcome, indicating that the financial statements present a true and fair view of the company’s financial position and performance.

- Qualified Opinion: This opinion suggests that the financial statements are fairly presented, except for certain issues identified by the auditor. These issues could be related to the application of accounting principles or limitations in the scope of the audit.

- Adverse Opinion: An adverse opinion is given when the auditor determines that the financial statements are materially misstated and do not comply with accounting standards. This type of opinion raises serious concerns about the company’s financial health and reliability.

- Disclaimer of Opinion: When the auditor is unable to express an opinion due to insufficient evidence or other limitations, a disclaimer of opinion is issued. This may occur if the auditor encounters significant uncertainties or restrictions during the audit process.

Each type of opinion carries a different level of significance and should be carefully considered by stakeholders when making financial decisions.

In Conclusion

Auditor’s opinions are vital in ensuring the integrity of financial statements and providing stakeholders with a clear understanding of a company’s financial position and performance. Understanding the definition, process, and types of auditor’s opinions can help individuals and organizations make informed decisions based on the credibility and reliability of a company’s financial information. As an SEO expert, we hope this blog post has provided valuable insights into the world of auditing and the importance of auditor’s opinions in the finance industry.