Home>Finance>Independent Auditor: Definition, Rules, Importance

Finance

Independent Auditor: Definition, Rules, Importance

Published: December 8, 2023

Learn about the definition, rules, and importance of an independent auditor in the realm of finance. Enhance your financial expertise and decision-making with this key concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Independent Auditor: Definition, Rules, Importance

Welcome to the “FINANCE” category of our blog! In this post, we will dive into the world of independent auditors, exploring their definition, rules, and why they are of crucial importance in the financial industry. Whether you are a business owner, investor, or simply curious about the inner workings of the financial world, this article will provide valuable insights into the role of independent auditors.

Key Takeaways:

- Independent auditors are professionals who assess and verify the accuracy and integrity of a company’s financial statements.

- They follow established rules and regulations to ensure their independence and objectivity in their evaluations.

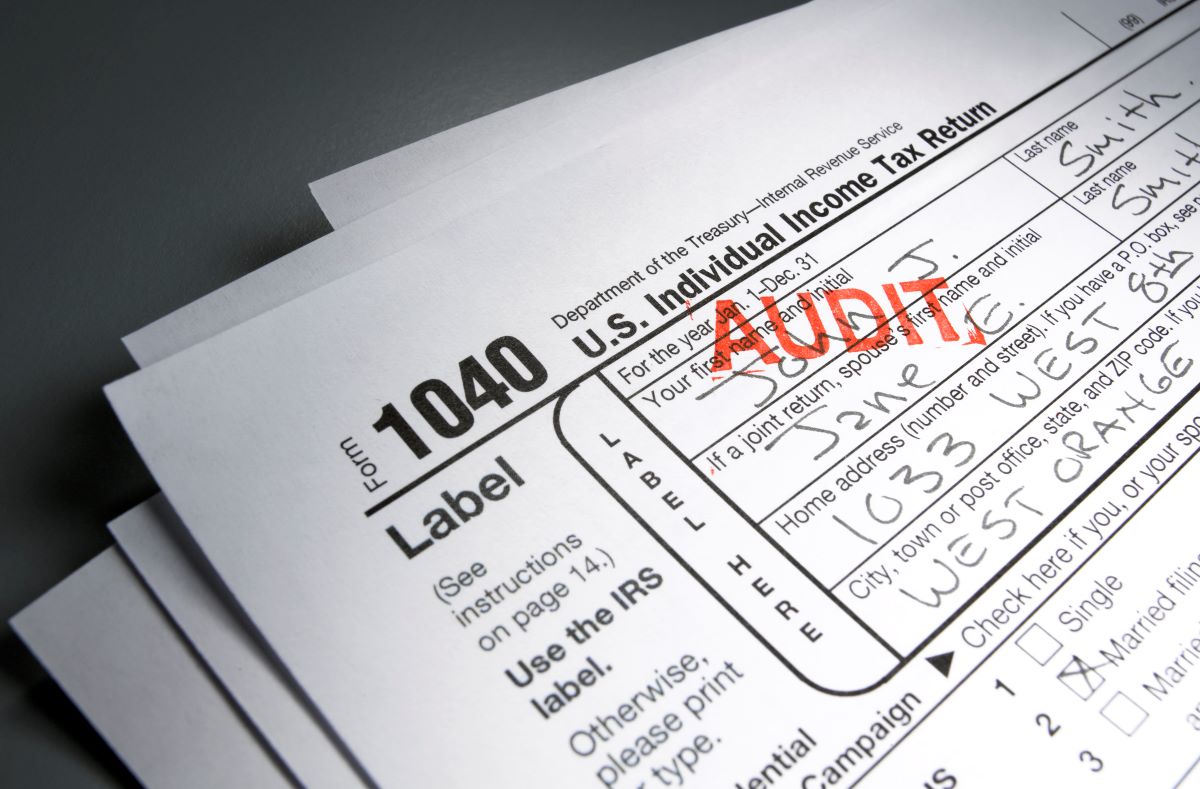

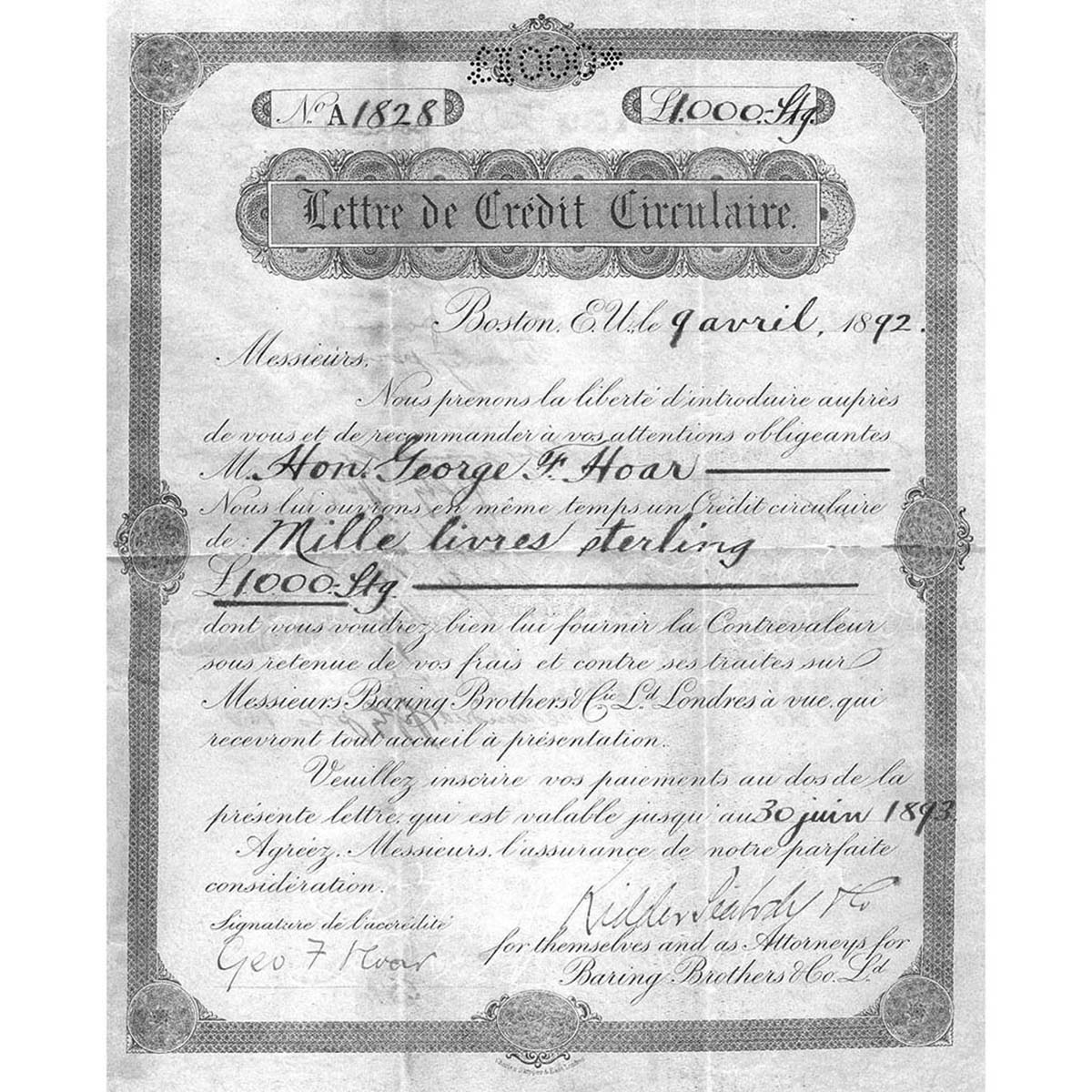

Now, let’s delve deeper into the topic. So, what exactly is an independent auditor? In simple terms, an independent auditor is a qualified individual or firm responsible for examining the financial records of a company. Their primary goal is to provide an unbiased and trustworthy evaluation of a company’s financial statements.

Independent auditors play a crucial role in ensuring the transparency and reliability of financial information. Here are some key reasons why they are important:

1. Financial Statement Verification:

One of the primary responsibilities of an independent auditor is to verify the accuracy and completeness of a company’s financial statements. This involves examining documents, reconciling balances, and conducting detailed tests to validate the information presented in the financial reports. By doing so, they provide assurance to investors, creditors, and other stakeholders that the financial statements are reliable and represent a true and fair view of the company’s financial position.

2. Maintaining Independence and Objectivity:

To ensure the auditors’ independence and objectivity, strict rules and regulations are in place. These rules require auditors to remain independent from the company being audited, avoiding any conflicts of interest that may compromise their judgment. Auditors are also required to follow a set of professional standards and ethical guidelines, which aim to maintain the highest level of integrity and objectivity in their assessments.

By hiring an independent auditor, companies demonstrate their commitment to transparency and accountability. It helps build trust in the financial markets and gives stakeholders confidence in the company’s financial health.

In conclusion, independent auditors play an essential role in the financial world. Their evaluations provide credibility to a company’s financial statements, giving stakeholders confidence in the accuracy and reliability of the reported information. By adhering to established rules and regulations and maintaining independence and objectivity, independent auditors ensure the integrity of the financial industry.

Thank you for joining us in exploring the significance of independent auditors. Stay tuned for more insightful articles in our “FINANCE” category!