Finance

Autex Definition

Published: October 10, 2023

Discover the meaning of Autex in the world of Finance. Explore the various applications and benefits of Autex in the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Finance: The Key to a Secure Financial Future

When it comes to our personal and business finances, it’s essential to have a solid understanding of finance and its various components. Whether you’re just starting out on your financial journey or looking to enhance your money management skills, gaining knowledge in this field can make a significant difference in securing a stable financial future. In this blog post, we’ll delve into the world of finance, explain its importance, and provide you with practical ways to improve your financial literacy.

Key Takeaways:

- Finance is the study of money management, investments, and financial instruments.

- A strong understanding of finance helps individuals and businesses make informed financial decisions and achieve their financial goals.

What is Finance?

Finance is the field that deals with the management of money, investments, and financial instruments. It encompasses a wide range of activities, including budgeting, investing, lending, borrowing, and analyzing financial data. The primary goal of finance is to allocate resources efficiently to maximize returns and minimize risk.

Whether you’re an individual or a business entity, finance plays a crucial role in your day-to-day life. It empowers you to make informed decisions about spending, saving, and investing, influences economic growth, and helps in creating a robust financial ecosystem.

The Importance of Financial Literacy

Financial literacy refers to the knowledge and understanding of financial concepts necessary to manage money wisely. It is a vital skill set that everyone should strive to develop. Here’s why:

- Empowerment: When you have a good grasp of financial literacy, you gain control over your financial decisions. You can evaluate the pros and cons of different financial choices and make informed decisions that align with your goals.

- Long-term Stability: Financial literacy helps you plan for the future and build a strong foundation for long-term financial stability. By understanding concepts such as budgeting, saving, and investing, you can navigate through financial challenges and secure your financial future.

- Protect Against Scams: With financial literacy, you can identify and protect yourself against financial scams and fraud. Being knowledgeable about basic financial concepts will enable you to make smart choices, avoid pitfalls, and safeguard your hard-earned money.

- Entrepreneurial Success: For business owners, financial literacy is crucial for managing their company’s finances effectively. Understanding concepts such as cash flow, profitability, and risk management ensures a solid financial foundation and increases the chances of entrepreneurial success.

Improving Your Financial Literacy

Now that you understand the importance of financial literacy, it’s time to take steps to enhance your understanding of finance. Here are some practical ways to do so:

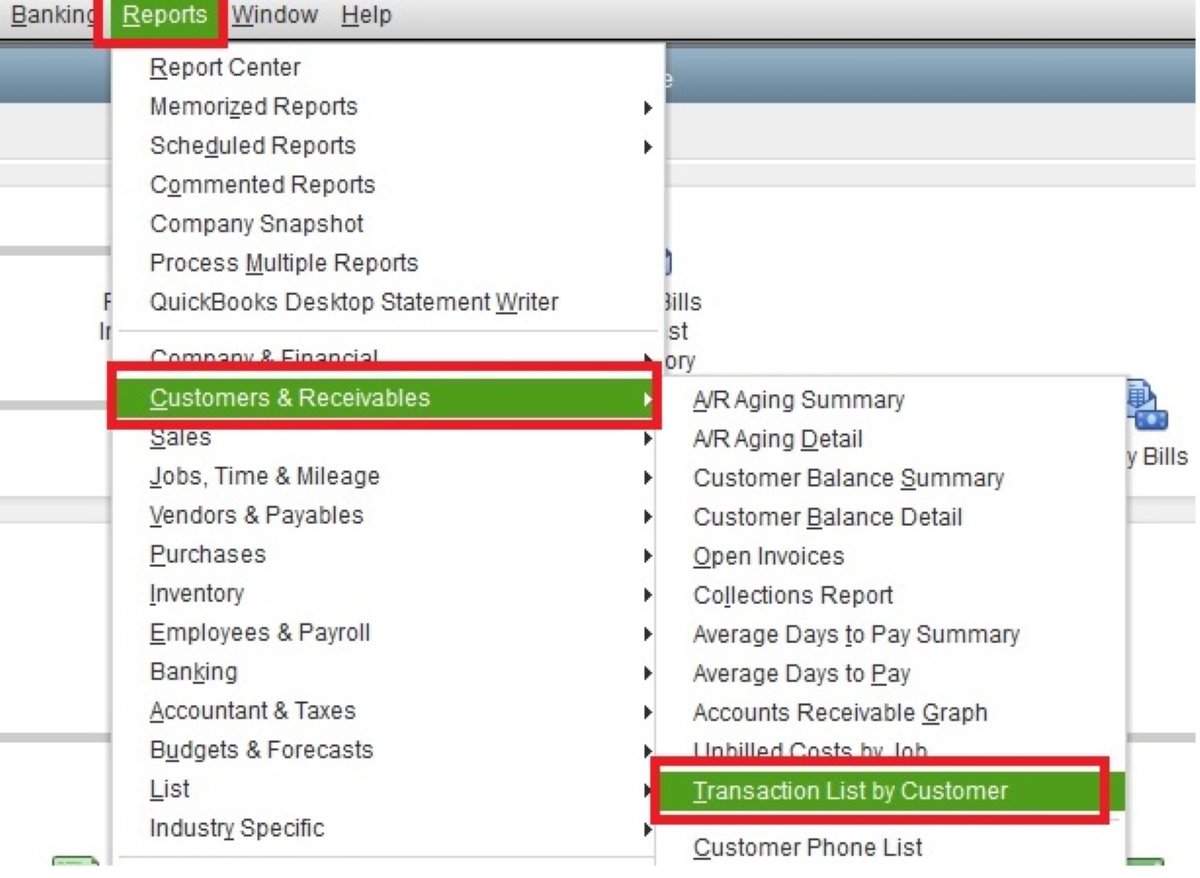

- Read Widely: Stay up-to-date with finance-related news, blogs, and books. Knowledgeable authors and experts write about personal finance, investing, and money management. Regularly reading these resources can help you expand your knowledge.

- Attend Workshops and Courses: Many institutions and organizations offer workshops, seminars, and online courses on finance and investing. These educational opportunities provide structured learning and allow you to interact with experts in the field.

- Seek Professional Advice: If you have complex financial situations or investment decisions, consider consulting with a financial advisor. They can provide personalized guidance and help you make well-informed choices.

- Practice Smart Financial Habits: Implement good financial habits into your daily life, such as budgeting, saving, and tracking expenses. These habits not only improve your financial situation but also reinforce your understanding of finance.

By actively engaging in these practices and continuously seeking to expand your financial knowledge, you’ll be well on your way to achieving financial literacy and securing a solid financial future.

In Conclusion

Having a strong foundation in finance is crucial for making informed financial decisions and achieving long-term financial stability. By prioritizing financial literacy and actively seeking ways to expand your knowledge, you can gain control over your finances, protect yourself from scams, and pave the way to a brighter financial future.