Finance

Buy The Dips Definition

Published: October 21, 2023

Buy the dips in finance with our expert advice and strategies. Maximize your investment opportunities and navigate market fluctuations like a pro.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Why “Buy the Dips” Should Be Your Financial Strategy

Welcome to our Finance category, where we explore various strategies and concepts to help you make the most of your money. In today’s article, we will be discussing the popular investment strategy known as “buy the dips.” If you’re wondering what this term means and how it can benefit your financial goals, you’ve come to the right place.

Key Takeaways:

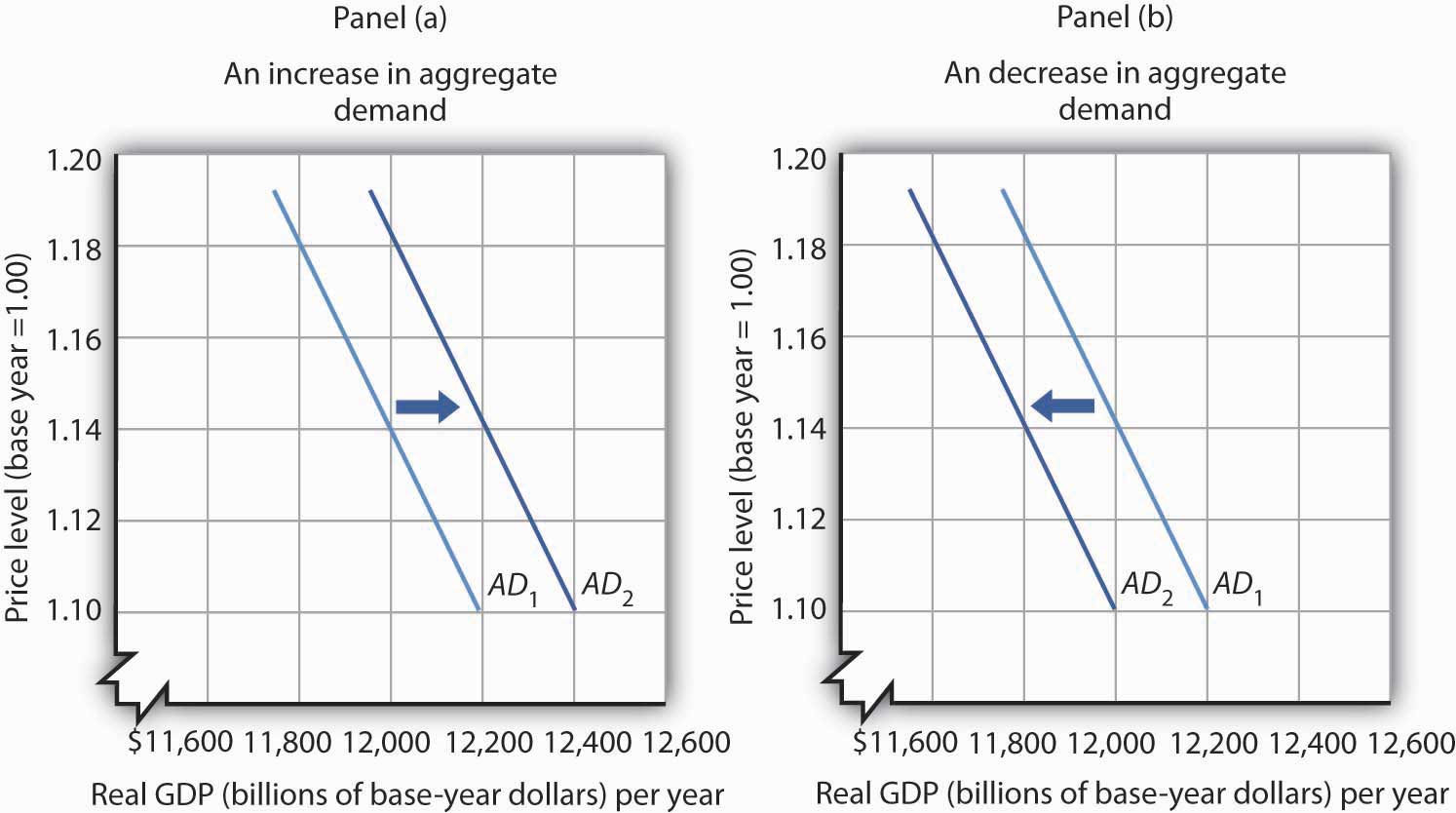

- “Buy the dips” is an investment strategy that involves purchasing securities or assets when their prices experience a temporary decline.

- This strategy takes advantage of market volatility and allows investors to acquire assets at a lower price, potentially leading to higher returns in the long run.

Now, let’s dive deeper into the concept of “buy the dips” and understand its benefits and implications. At its core, this strategy encourages investors to take advantage of temporary price drops in assets, such as stocks, bonds, or cryptocurrencies. Instead of being discouraged by market downturns, knowledgeable investors see them as opportunities to buy quality assets at discounted prices.

But why should you consider implementing the “buy the dips” strategy in your financial endeavors? Let’s explore two key takeaways:

1. Capitalizing on Market Volatility:

Markets are known for their ups and downs. Instead of trying to time the market perfectly, “buy the dips” emphasizes a long-term perspective. By investing consistently and purchasing assets during downturns, you reduce the risk of buying at the peak and potentially increase your overall returns.

For instance, imagine you are eyeing a company’s stock that you believe has strong fundamentals. If the stock experiences a temporary dip due to external factors like economic fluctuations or market sentiment, you would have the opportunity to buy more shares at a lower price. Over time, as the market recovers, your investment may appreciate in value, resulting in higher profits.

2. Building a Diversified Portfolio:

Implementing the “buy the dips” strategy allows you to diversify your investment portfolio. By acquiring assets at different price points, you spread your risk and reduce the impact of any single investment on your overall portfolio performance. This diversification strategy aims to minimize losses and increase the likelihood of long-term growth.

For example, if you have a diversified portfolio that includes stocks and bonds, a downturn in the stock market could present an opportunity to buy more stocks at a lower price. This allows you to rebalance your portfolio by adding more stocks to maintain your desired asset allocation, potentially enhancing your portfolio’s performance when the market recovers.

It’s important to note that the “buy the dips” strategy requires careful analysis and understanding of the asset you’re investing in. Researching the fundamental factors that influence an asset’s value can help you make informed decisions and avoid falling into traps.

In conclusion, implementing the “buy the dips” strategy can be a valuable addition to your financial toolkit. By capitalizing on market volatility and building a diversified portfolio, you position yourself for potential long-term success. Remember to consult with a financial advisor or do thorough research before implementing any investment strategy to ensure it aligns with your specific goals and risk tolerance.

Thank you for joining us in exploring this financial concept. Stay tuned for more informative articles in our Finance category!