Home>Finance>What Is Different About Buying Stocks And Buying Bonds Quizlet

Finance

What Is Different About Buying Stocks And Buying Bonds Quizlet

Modified: February 21, 2024

Learn the key differences between buying stocks and buying bonds in finance with this informative quizlet. Understand the unique features of each investment option.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing, two prominent options that often come to mind are stocks and bonds. Both have their own unique characteristics and potential for returns. Understanding the differences between buying stocks and buying bonds is crucial for making informed investment decisions.

Stocks represent ownership in a company, while bonds represent debt owed by a company or government entity. The choice between buying stocks or buying bonds depends on an individual’s investment goals, risk tolerance, and time horizon.

In this article, we will explore the definitions of stocks and bonds, highlight the key differences between them, and discuss the factors to consider when buying each. We will also delve into the risks associated with both investments and provide a quizlet to test your knowledge on buying stocks and bonds.

Whether you are a seasoned investor or just starting out in the world of finance, understanding the nuances of stocks and bonds will empower you to make more informed investment choices and maximize your financial opportunities.

Definition of Stocks

At its core, a stock represents ownership in a company. When you buy a stock, you become a shareholder of that company, which means you have a claim on its assets and earnings. The value of a stock is determined by the market and can fluctuate based on various factors, including the company’s financial performance, industry trends, and market conditions.

Stocks are categorized into different types, such as common stock and preferred stock. Common stock grants shareholders voting rights in the company and the potential to receive dividends. On the other hand, preferred stockholders have a higher claim on the company’s assets and earnings, and they typically receive dividends before common stockholders.

Investing in stocks can offer the potential for significant returns, but it also involves a higher level of risk compared to other investment options. The stock market can be volatile, and the value of stocks can increase or decrease rapidly. It is important to carefully consider your risk tolerance and investment goals before buying stocks.

Stocks can be bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. Investors can choose to buy stocks of individual companies or invest in exchange-traded funds (ETFs) or mutual funds, which pool together funds from various investors to invest in a diversified portfolio of stocks.

As an investor, it’s important to research and analyze companies before buying their stocks. Understanding the company’s financial health, industry trends, and competitive landscape can help you make informed investment decisions.

Overall, stocks can provide the potential for capital appreciation and the opportunity to participate in a company’s growth and success. However, they also come with higher risks and uncertainties. It’s essential to have a well-diversified portfolio and a long-term investment strategy when investing in stocks.

Definition of Bonds

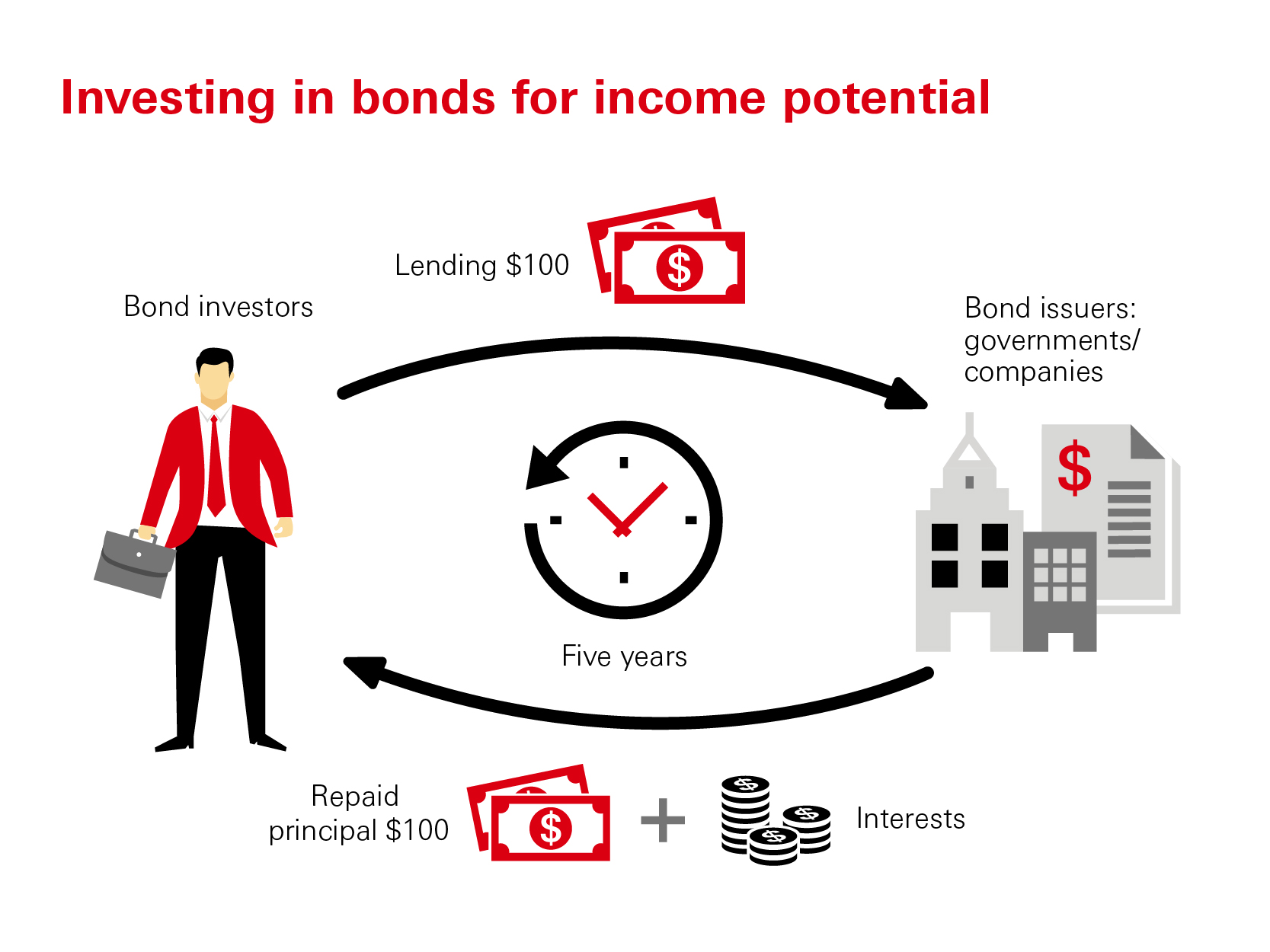

Bonds, unlike stocks, represent debt owed by a company or government entity. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the repayment of the principal amount at maturity.

Bonds are considered fixed-income investments because they provide a fixed stream of income in the form of interest payments. The interest rate, also known as the coupon rate, is determined at the time of issuance and remains constant throughout the life of the bond. Bonds are typically issued with a predetermined maturity date, at which point the face value of the bond is repaid to the investor.

Bonds come in various forms, including government bonds, corporate bonds, municipal bonds, and treasury bonds, each with their own unique characteristics and levels of risk. Government bonds are issued by sovereign entities and are considered to have very low default risk, while corporate bonds are issued by companies and may carry higher levels of risk depending on the company’s financial health.

Investing in bonds can be an attractive option for those seeking a more conservative investment strategy. Bonds offer a fixed income stream and are generally less volatile compared to stocks. They can provide a steady and predictable cash flow, making them suitable for income-focused investors or those looking to preserve capital.

Bonds are traded in the bond market, and their prices can fluctuate based on interest rate movements, credit ratings of the issuer, and market conditions. When interest rates rise, bond prices tend to decline, and vice versa.

Before investing in bonds, it’s important to assess the creditworthiness of the issuer and understand the risks involved. Credit ratings provided by independent rating agencies, such as Standard & Poor’s or Moody’s, can help evaluate the issuer’s ability to repay the debt. Additionally, consider the inflation rate, interest rate environment, and the potential impact on the bond’s value over time.

Overall, bonds offer a more conservative investment option with a fixed income stream and the return of principal at maturity. They can play a crucial role in diversifying an investment portfolio and managing risk. However, it’s essential to carefully consider your investment objectives, risk tolerance, and the prevailing market conditions before investing in bonds.

Differences between Stocks and Bonds

While both stocks and bonds are investment options, they have several key differences that investors should be aware of. These differences can impact the potential returns, level of risk, and investor rights associated with each.

Ownership vs. Debt: One of the primary distinctions between stocks and bonds is the nature of the investment. Stocks represent ownership in a company, providing shareholders with voting rights and the potential to participate in the company’s growth and success. Bonds, on the other hand, represent debt owed by a company or government entity to the investor. Bondholders act as lenders and receive periodic interest payments along with the repayment of principal at maturity.

Risk and Return: Stocks are generally considered more volatile and carry a higher level of risk compared to bonds. The value of stocks can fluctuate significantly based on factors such as market conditions, company performance, and industry trends. Bonds, on the other hand, tend to be more stable and offer predictable returns in the form of coupon payments. However, the potential for capital appreciation is generally lower compared to stocks.

Income Stream: Stocks provide potential income in the form of dividends, which are typically paid out of a company’s profits. Dividends are not guaranteed and can fluctuate based on the company’s financial performance. Bonds, on the other hand, offer a fixed income stream in the form of periodic interest payments. Bondholders receive these payments regardless of the company’s profitability, making them an attractive option for income-focused investors.

Priority of Claims: In the event of bankruptcy or liquidation, bondholders have a higher priority of claim on the assets of the company compared to stockholders. Bondholders are typically repaid before stockholders and have a better chance of recovering their investment. This makes bonds a relatively safer option in terms of recovery of principal in the event of a company’s financial distress.

Market Value: The value of stocks is often determined by investor sentiment, supply and demand dynamics, and market conditions. Stock prices can be influenced by a variety of factors, including company performance, economic indicators, and geopolitical events. Bonds, on the other hand, have a predetermined face value and maturity date. While their prices can fluctuate in the secondary market, bondholders are guaranteed the face value of the bond at maturity.

Diversification: Investing in stocks provides the opportunity for greater diversification due to the wide range of companies and industries available in the market. By investing in different stocks, investors can spread their risk across various sectors. Bonds, on the other hand, can also offer diversification benefits by investing in different issuers or types of bonds, such as government and corporate bonds. Diversification can help reduce the overall risk of an investment portfolio.

Understanding these differences is crucial for investors to determine their investment strategy and allocate their funds accordingly. The decision to invest in stocks, bonds, or a combination of both depends on individual risk tolerance, investment goals, and time horizon.

Factors to Consider when Buying Stocks

Buying stocks can be an exciting and potentially rewarding investment strategy. However, it requires careful consideration and analysis to make informed decisions. Here are some key factors to consider when buying stocks:

- Company Financials: Before investing in a stock, thoroughly examine the company’s financial statements, including its revenue, earnings, and debt levels. Look for consistent growth, healthy profitability, and a strong balance sheet. Assess the company’s competitive position, market share, and long-term prospects.

- Industry Analysis: Consider the industry in which the company operates. Look for industries with growth potential, stable demand, and a favorable regulatory environment. Analyze industry trends and competitive dynamics to determine the company’s position within the sector.

- Management Team: Evaluate the company’s management team and their track record. Strong and experienced leadership is essential for a company’s success. Look for management that is capable of executing strategies, adapting to market changes, and creating long-term value for shareholders.

- Competitive Advantage: Assess the company’s competitive advantage or unique selling proposition. Look for factors that differentiate the company from its competitors, such as proprietary technology, strong brand recognition, or a dominant market position. A sustainable competitive advantage can contribute to long-term success.

- Growth Potential: Consider the company’s growth potential. Look for factors that can drive future growth, such as new product launches, expansion into new markets, or innovative business strategies. Evaluate the company’s ability to adapt to changing consumer preferences and technological advancements.

- Valuation: Determine whether the stock is trading at a fair price relative to its intrinsic value. Consider metrics such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. Compare these metrics to industry peers and historical averages to assess the stock’s valuation.

- Dividends: If you are seeking income from your investment, consider whether the company pays dividends. Look for a history of consistent dividend payments and a sustainable dividend payout ratio. Analyze the company’s cash flows and dividend growth potential.

- Risk Tolerance: Assess your risk tolerance before investing in stocks. Stocks can be volatile and subject to market fluctuations. Determine how much risk you are willing to take and allocate your investments accordingly. Diversification across different stocks and sectors can help mitigate risk.

- Investment Horizon: Consider your investment horizon and financial goals. Stocks are generally considered a long-term investment, and short-term volatility should not steer you away from a good company. Align your investment strategy with your time frame and review your holdings periodically.

- Research and Analysis: Conduct thorough research and analysis before making any investment decisions. Utilize financial news, analyst reports, and company filings to gather information. Stay updated on market trends and developments that may impact the companies you are interested in.

By carefully considering these factors, you can make more informed decisions when buying stocks. Remember that investing in stocks involves risk, and it’s important to diversify your portfolio and consult with a financial professional before making any investment decisions.

Factors to Consider when Buying Bonds

Buying bonds can be a valuable addition to an investment portfolio, providing stable income and potential capital preservation. Consider the following factors when buying bonds:

- Creditworthiness: Assess the creditworthiness of the bond issuer, typically a company or government entity. Look for credit ratings provided by reputable rating agencies such as Moody’s or Standard & Poor’s. Higher-rated bonds generally indicate lower default risk and may offer lower interest rates compared to lower-rated bonds.

- Yield: Consider the yield or return offered by the bond. Yield is influenced by several factors including the bond’s coupon rate, prevailing interest rates, and credit risk. Compare the bond’s yield to similar bonds in the market to ensure you are getting a competitive return on your investment.

- Maturity: Evaluate the bond’s maturity, which is the period until the bond’s principal amount is repaid. Longer-term bonds usually offer higher yields but come with a higher level of interest rate and inflation risk. Shorter-term bonds typically offer lower yields but may provide more stability and flexibility.

- Interest Rate Risk: Understand the potential impact of changes in interest rates on bond prices. Bond prices generally move in the opposite direction of interest rates. If you expect interest rates to rise, investing in shorter-term bonds or floating-rate bonds may help mitigate the risk of falling bond prices.

- Tax Considerations: Take into account any tax implications when buying bonds. Tax-exempt municipal bonds can provide tax advantages for certain investors. Consult with a tax professional to understand the tax implications of bond investing based on your individual circumstances.

- Callable or Convertible Bonds: Determine if the bond is callable or convertible. Callable bonds can be redeemed by the issuer before maturity, potentially leaving investors with reinvestment risk. Convertible bonds provide the option to convert the bond into a specified number of shares of common stock, offering potential upside if the stock price rises.

- Liquidity: Evaluate the liquidity of the bond. Highly liquid bonds are easier to buy or sell in the secondary market. Less liquid bonds may have limited trading volume, which could impact your ability to sell the bond at a desired price.

- Diversification: Consider diversifying your bond portfolio by investing in bonds from different issuers, industries, and maturities. Diversification helps spread risk and reduce the impact of any individual bond default.

- Inflation Protection: Assess whether the bond offers protection against inflation. Treasury Inflation-Protected Securities (TIPS) and certain corporate bonds may provide inflation-adjusted returns to safeguard against the eroding effects of inflation.

- Investment Objective: Align your bond purchases with your investment objectives. If you’re seeking income, focus on bonds with higher coupon rates. If you’re focused on capital preservation, look for high-quality, low-risk bonds.

It’s crucial to conduct thorough research and analysis before buying bonds. Consider consulting with a financial advisor who can help assess your risk tolerance, evaluate bond options, and construct a bond portfolio that aligns with your investment goals and objectives.

Risks Associated with Buying Stocks

Investing in stocks can offer significant potential for returns, but it also comes with various risks that investors should be aware of. Understanding these risks is crucial for making informed investment decisions. Here are some of the risks associated with buying stocks:

- Market Volatility: The stock market can be volatile, with prices fluctuating on a daily basis. Market volatility can be influenced by factors such as economic conditions, geopolitical events, and investor sentiment. Prices of stocks can rise or fall rapidly, potentially resulting in significant gains or losses.

- Individual Stock Risk: Investing in individual stocks carries the risk of company-specific factors. These factors include poor financial performance, management issues, regulatory changes, or a decline in the company’s competitive position. These risks can lead to a decrease in the stock’s value and potential losses.

- Industry Risk: Certain industries may be more susceptible to economic downturns or other external factors. Investing heavily in a specific industry exposes investors to industry-related risks. Factors such as technological advancements, changes in consumer preferences, or regulatory developments can impact an entire industry and the performance of its stocks.

- Liquidity Risk: Liquidity refers to the ease of buying or selling an investment. Some stocks may have less liquidity and trading volume, making it difficult to execute trades at desired prices. Illiquid stocks can result in limitations and delays in buying or selling, potentially impacting an investor’s ability to react quickly to market conditions.

- Diversification Risk: Lack of diversification in a stock portfolio increases the risk exposure. Concentrating investments in a few stocks or industries can amplify the impact of individual stock or sector volatility. Diversification across different stocks and sectors helps spread risk and mitigate the impact of any single stock’s performance.

- Market Timing Risk: Timing the market, attempting to buy stocks at the lowest prices and sell at the highest, is challenging. The stock market’s movements are difficult to predict, and trying to time the market can lead to missed opportunities or buying/selling at unfavorable prices, potentially resulting in lower returns or losses.

- Inflation Risk: Inflation erodes the purchasing power of money over time. While stocks have the potential to provide returns that outpace inflation, there is still a risk that the returns may not effectively preserve wealth. High or unexpected inflation can impact corporate profitability and consumer spending, which can, in turn, affect stock prices.

- Systemic Risk: Systemic risks are risks that affect the entire financial system or multiple sectors simultaneously. Examples include economic recessions, financial crises, or geopolitical events. Unforeseen systemic risks can result in broad market declines and impact the value of individual stocks.

- Emotional Bias: Investors’ emotions, such as fear and greed, can influence investment decisions and lead to poor outcomes. Emotional bias can cause investors to buy stocks at high prices during market exuberance or sell stocks at low prices during market downturns, neglecting the long-term fundamentals of the investments.

It’s essential to carefully assess and manage these risks when buying stocks. Investors should diversify their portfolio, conduct proper research, set realistic expectations, and maintain a long-term investment perspective. Consulting with a financial advisor can provide guidance in navigating these risks and developing a suitable investment strategy.

Risks Associated with Buying Bonds

Although bonds are generally considered less risky than stocks, they still carry certain risks that investors should consider. Understanding these risks is important for making informed decisions when buying bonds. Here are some risks associated with buying bonds:

- Interest Rate Risk: Bonds are sensitive to changes in interest rates. When interest rates rise, bond prices tend to fall, and vice versa. This can result in fluctuations in the market value of bonds, which may impact their resale or marketability. Longer-term bonds generally have higher interest rate risk than shorter-term bonds.

- Credit Risk: Credit risk refers to the risk of default by the bond issuer. Bonds issued by companies with lower credit ratings or higher levels of debt carry a higher risk of default. Government bonds are generally considered to have lower credit risk compared to corporate bonds. It’s important to assess the creditworthiness of the issuer before investing in bonds.

- Liquidity Risk: Some bonds may have low trading volume or limited liquidity in the secondary market. This can make it difficult to buy or sell bonds at desired prices. Illiquid bonds may also result in delays or limitations when attempting to liquidate or exit bond positions.

- Reinvestment Risk: When interest rates decline, bondholders may face reinvestment risk. This risk arises when coupon payments or principal repayments are reinvested at lower interest rates, potentially resulting in lower yields or returns. Reinvestment risk is more relevant for bonds with longer maturities or for fixed-income investors relying on bond income.

- Call Risk: Callable bonds give the issuer the option to redeem the bonds before their maturity date. This introduces call risk, where the bondholder may face early repayment and the need to reinvest funds at potentially lower interest rates. Callable bonds generally offer higher coupon rates compared to non-callable bonds to compensate investors for this risk.

- Inflation Risk: Inflation erodes the purchasing power of future bond payments. Bonds that offer fixed coupon payments may not provide adequate protection against inflation. Inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS), provide some hedge against inflation as their principal value adjusts with changes in the consumer price index.

- Political and Regulatory Risk: Bonds can be exposed to political and regulatory risks. Changes in government policies, regulations, or political stability can impact the financial health of issuers and the value of their bonds. Investors should assess the potential impact of political and regulatory factors on bond investments.

- Currency Risk (for international bonds): Investing in foreign bonds introduces currency risk. Fluctuations in currency exchange rates can impact the returns earned on international bonds when converted back to the investor’s home currency. Currency risk can add volatility and uncertainty to bond returns.

Managing these risks involves careful analysis, diversification, and understanding your investment goals. It’s essential to evaluate each bond’s unique risks before making investment decisions. Consider consulting with a financial advisor or bond specialist to assess risk factors and determine the suitability of bonds for your investment portfolio.

Quizlet Questions on Buying Stocks and Buying Bonds

Now, let’s test your knowledge on buying stocks and buying bonds! Answer the following quizlet questions to assess your understanding of these investment options:

- What does buying a stock represent?

- Ownership in a company

- Debt owed by a company

- Investment in government securities

- Investment in mutual funds

- Which of the following is generally considered more volatile and carries a higher level of risk?

- Stocks

- Bonds

- Both have equal levels of risk

- Neither carries any risk

- What are some factors to consider when buying stocks?

- Company financials, industry analysis, and management team

- Bond credit ratings, interest rates, and maturity

- Market volatility, inflation risk, and liquidity

- Political events, market timing, and dividend payments

- True or False: Bonds provide a fixed income stream in the form of periodic interest payments.

- True

- False

- What are potential risks associated with buying stocks?

- Market volatility, individual stock risk, and emotional bias

- Interest rate risk, credit risk, and inflation risk

- Political risk, liquidity risk, and reinvestment risk

- Call risk, market timing risk, and diversification risk

- What is the primary risk associated with buying bonds when interest rates rise?

- Interest rate risk

- Credit risk

- Liquidity risk

- Inflation risk

- How can investors mitigate risk when buying stocks or bonds?

- Diversification and thorough research

- Timing the market and emotional decision-making

- Investing in one specific industry or company

- Ignoring risk and focusing solely on potential returns

Take your time and choose the best answer for each question. Once you’re ready, check your answers to see how well you’ve understood the concepts of buying stocks and buying bonds!

Conclusion

Understanding the differences between buying stocks and buying bonds is essential for making informed investment decisions. Stocks represent ownership in a company, providing the potential for capital appreciation and the opportunity to participate in a company’s growth. Bonds, on the other hand, represent debt owed by a company or government entity, offering a fixed income stream in the form of periodic interest payments and the return of the principal amount at maturity.

When buying stocks, it’s important to consider factors such as the company’s financials, industry analysis, and management team. Evaluating these aspects can help assess the company’s growth potential, competitive advantage, and overall risk exposure. On the other hand, when buying bonds, factors like creditworthiness, yield, maturity, and interest rate risk should be taken into account. Assessing these factors can help determine the bond’s return potential, default risk, reinvestment risk, and sensitivity to changes in interest rates.

Both stocks and bonds come with their own set of risks. Stocks are generally more volatile and carry individual stock and market-related risks. Bonds, while considered less risky compared to stocks, still face risks such as interest rate risk, credit risk, and reinvestment risk. Managing and mitigating these risks involve practices like diversification, careful research and analysis, risk assessment, and consulting with financial professionals as needed.

By understanding these concepts and diligently considering the factors involved, investors can make well-informed decisions when buying stocks and bonds. Additionally, it’s vital to review and adjust investment strategies periodically to align with changing market conditions, personal financial goals, and risk tolerance.

Remember, investing in stocks and bonds involves risk, and it’s important to conduct thorough research, exercise patience, and maintain a long-term perspective. Consultation with financial advisors or professionals can provide valuable insights and guidance tailored to individual circumstances.

With a solid understanding of stocks and bonds, investors can confidently navigate the world of finance and work towards achieving their financial goals.