Home>Finance>Child Tax Credit Definition: How It Works And How To Claim It

Finance

Child Tax Credit Definition: How It Works And How To Claim It

Published: October 27, 2023

Learn about the Child Tax Credit in finance, including how it works and how to claim it. Maximize your tax benefits with this helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Finance Category – Child Tax Credit Definition: How It Works and How to Claim It

Welcome to our Finance category, where we cover a wide range of topics related to personal finance, taxes, and financial planning. In this article, we will be delving into the Child Tax Credit, explaining what it is, how it works, and how you can claim it for your family.

Key Takeaways:

- The Child Tax Credit is a tax benefit designed to provide financial support to families with dependent children.

- Eligible taxpayers can claim a credit of up to $2,000 per qualifying child on their federal tax return.

Now, let’s dive into the details of the Child Tax Credit and understand how it can benefit you and your family.

What is the Child Tax Credit?

The Child Tax Credit is a tax benefit provided by the Internal Revenue Service (IRS) to assist families with the cost of raising children. It is intended to help offset some of the expenses associated with raising children and providing for their well-being.

To be eligible for the Child Tax Credit, you must have a qualifying child who meets certain criteria. A qualifying child must be under the age of 17 and meet the relationship, residency, and support requirements set by the IRS.

How Does the Child Tax Credit Work?

The Child Tax Credit allows eligible taxpayers to claim a credit of up to $2,000 per qualifying child on their federal tax return. This means that if you have two qualifying children, you may be eligible for a credit of up to $4,000.

It is essential to note that the Child Tax Credit is a refundable credit, which means that if the credit exceeds the amount of taxes owed, you may be eligible for a refund of the remaining credit amount. This can provide a significant financial boost to families who may be struggling to cover the costs of raising children.

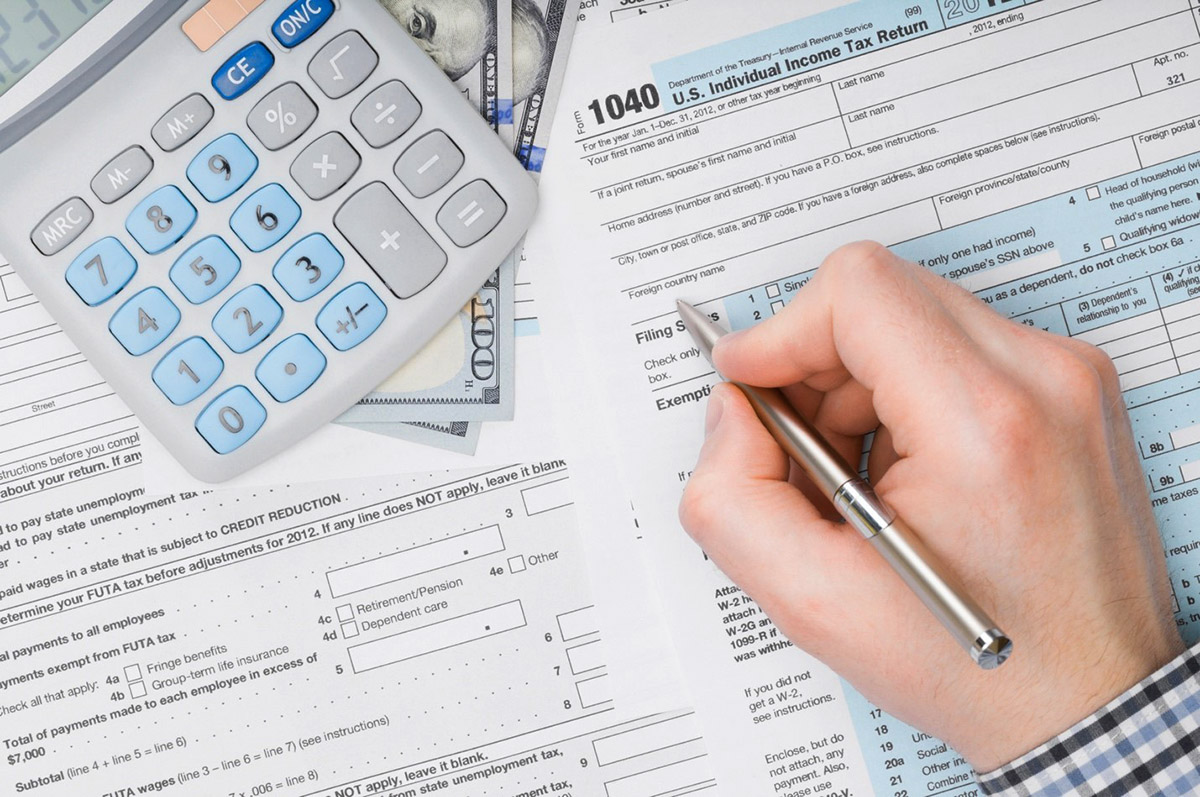

How to Claim the Child Tax Credit

To claim the Child Tax Credit, you will need to complete the appropriate sections on your federal tax return. This will generally involve providing information about your qualifying child, such as their name, Social Security number, and relationship to you.

It is crucial to keep accurate records and documentation to support your claim for the Child Tax Credit. This includes maintaining proof of your child’s age, residency, and any other requirements set by the IRS. This documentation will help ensure that your claim is accurate and can help prevent any potential issues or audits from the IRS.

Additionally, it is essential to stay informed about any updates or changes to the Child Tax Credit, as tax laws and regulations can change over time. Consulting with a tax professional or utilizing reputable online resources can help you stay up-to-date and ensure that you are maximizing your tax benefits.

Conclusion

The Child Tax Credit is a valuable tax benefit provided by the IRS to assist families with the costs associated with raising children. Understanding how this credit works and how to claim it can help families maximize their tax benefits and provide financial support during these critical years.

So, whether you are a new parent or have been raising children for years, make sure to take advantage of the Child Tax Credit and provide some financial relief for you and your family.