Finance

How To Terminate 401K Plan

Published: October 18, 2023

Looking for guidance on terminating your 401K plan? Our comprehensive finance guide will provide you with step-by-step instructions to successfully close your plan and manage your finances efficiently

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of 401(k) Plans

- Reasons for Terminating a 401(k) Plan

- Considerations Before Terminating a 401(k) Plan

- Steps to Terminate a 401(k) Plan

- Communicating with Employees about the Plan Termination

- Distributing Assets and Terminating Plan Contributions

- Compliance and Legal Considerations in Terminating a 401(k) Plan

- Handling Tax Implications and Reporting Requirements

- Common Pitfalls and Challenges in 401(k) Plan Termination

- Conclusion

Introduction

Welcome to this comprehensive guide on terminating a 401(k) plan. As a business owner or Human Resources professional, you may find yourself faced with the decision to terminate your company’s 401(k) plan for various reasons. Whether it be due to shifting business priorities, cost considerations, or changes in employee benefits, terminating a 401(k) plan requires careful planning and execution.

A 401(k) plan is a retirement savings vehicle offered by employers to their employees, allowing them to contribute a portion of their pre-tax income towards their retirement savings. Employers often match a portion of employee contributions, providing them with a valuable benefit for their future.

While 401(k) plans are a critical tool for retirement savings, there are instances where a company may need to terminate a plan. This guide aims to provide you with a step-by-step process on how to terminate a 401(k) plan, as well as important considerations, compliance requirements, and potential challenges that may arise along the way.

It is essential to approach the termination of a 401(k) plan with a thorough understanding of the legal and financial implications involved. By following the appropriate steps and seeking professional guidance, you can ensure that the termination process is handled smoothly, minimizing potential risks and creating a positive experience for both the employer and employees.

Whether you are considering terminating a 401(k) plan or simply looking to broaden your knowledge on the subject, this guide is designed to equip you with the knowledge and insights needed to make informed decisions regarding your company’s retirement benefits.

Now, let’s dive into the details of terminating a 401(k) plan and explore the various aspects you need to consider throughout the process.

Overview of 401(k) Plans

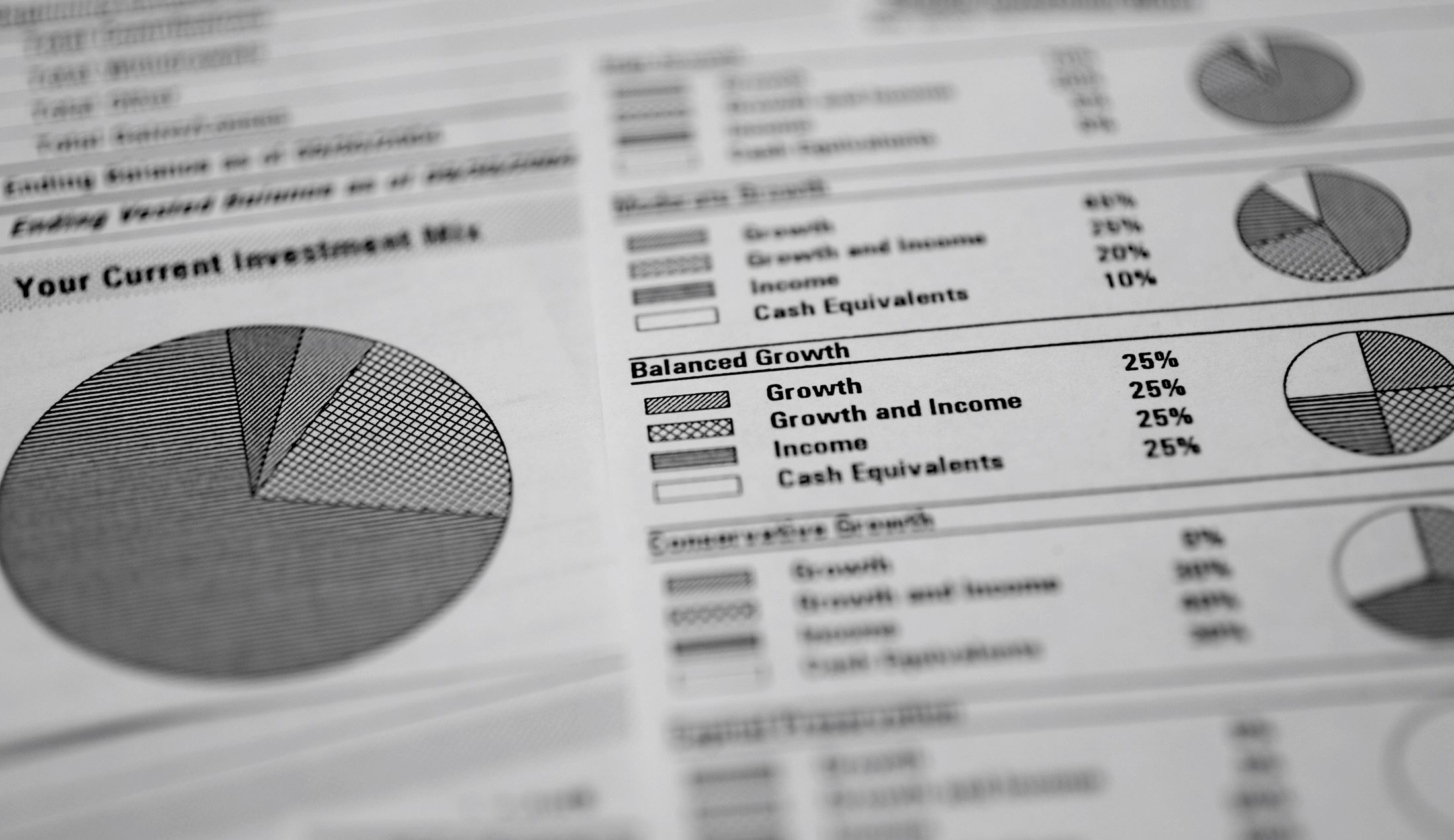

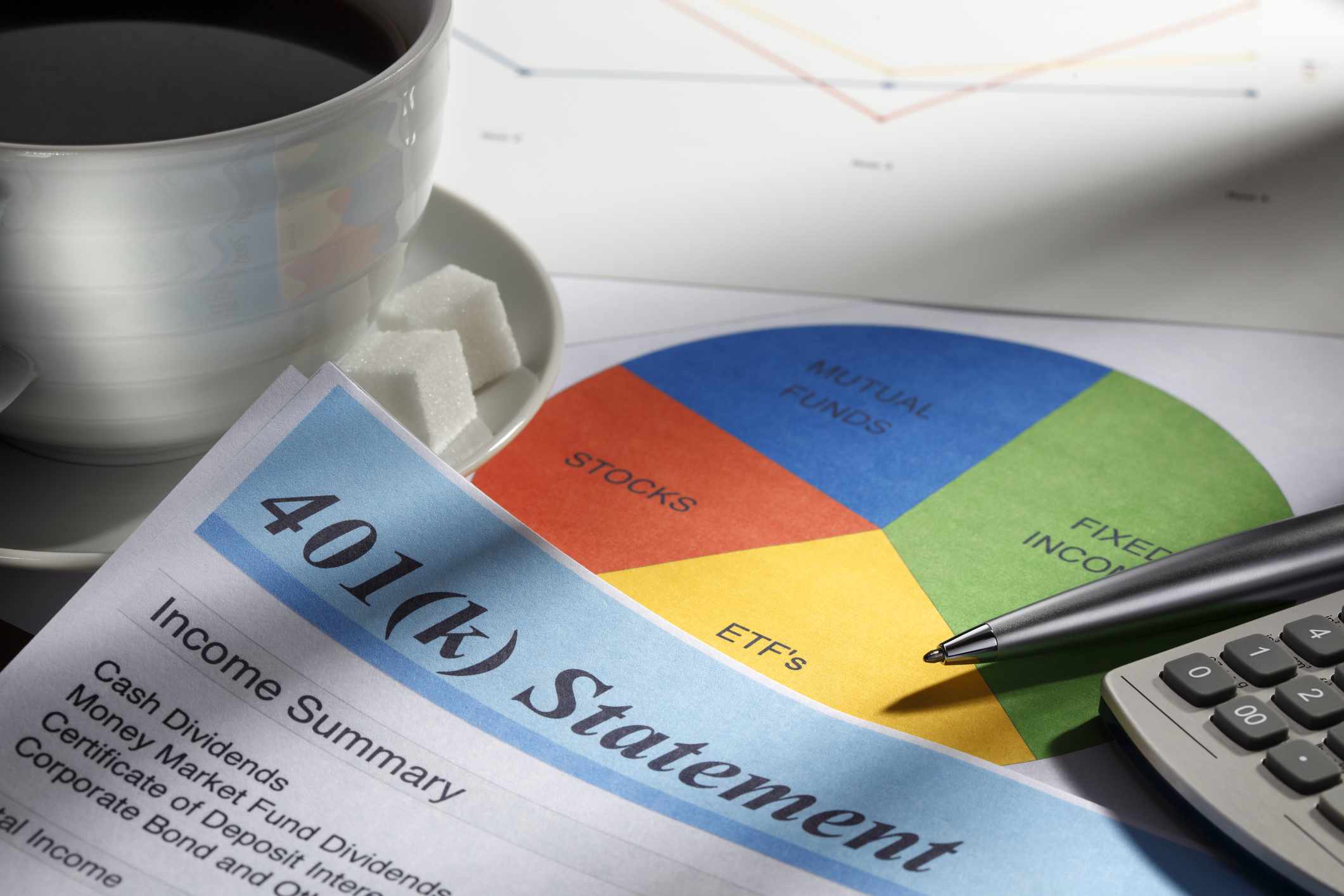

401(k) plans are one of the most popular retirement savings options for employees and employers alike. They are named after the section of the U.S. Internal Revenue Code that governs them. These plans allow employees to contribute a portion of their pre-tax income into a retirement savings account, which is then invested in a variety of available investment options.

One of the primary benefits of a 401(k) plan is the ability for employees to defer taxes on their contributions and any investment gains until they withdraw the money in retirement. This tax advantage, combined with the potential for employer contributions, makes 401(k) plans an attractive and powerful tool for long-term retirement savings.

Employer contributions to a 401(k) plan can take various forms, such as matching a percentage of employee contributions or making discretionary contributions based on company profits. These contributions can significantly boost employees’ retirement savings and provide a valuable incentive for participation in the plan.

Additionally, 401(k) plans offer flexibility to employees by allowing them to choose how much to contribute to their accounts, within certain limits set by the IRS. This flexibility enables employees to customize their savings strategy based on their individual financial goals and circumstances.

Another advantage of 401(k) plans is portability. When an employee leaves their current employer, they can choose to roll over their 401(k) account into an Individual Retirement Account (IRA) or transfer it to their new employer’s 401(k) plan, ensuring that their retirement savings continue to grow without incurring tax penalties.

It is important to note that while 401(k) plans are widely used, they are subject to certain regulations and compliance requirements. Employers must ensure that their plans meet the eligibility criteria, contribution limits, and other rules outlined by the IRS and the Department of Labor.

By understanding the basics of 401(k) plans, including their benefits and compliance obligations, employers can make informed decisions about whether to establish, maintain, or terminate a plan based on their business needs and the needs of their employees.

Reasons for Terminating a 401(k) Plan

There are several reasons why a company may decide to terminate a 401(k) plan. It is important for employers to evaluate their business needs, financial considerations, and employee demographics when making this decision. Here are some common reasons for terminating a 401(k) plan:

- Cost considerations: Maintaining a 401(k) plan involves administrative expenses, including recordkeeping, compliance, and participant communication. In some cases, the costs associated with administering the plan may become burdensome for the company, especially if the plan is not heavily utilized by employees.

- Changes in business priorities: As companies evolve and adapt to new market conditions, their business priorities may shift. This could include changes in company structure, mergers and acquisitions, or a strategic refocusing that requires reallocating resources. In such cases, terminating a 401(k) plan may be a strategic decision to redirect financial resources and manpower towards other business goals.

- Employee demographics: Employers may find that their workforce has changed over time, with a significant proportion of employees no longer participating in the 401(k) plan. If a large portion of employees are not taking advantage of the retirement savings benefits offered, terminating the plan may be considered as a way to allocate resources more effectively.

- Inadequate participation: If a 401(k) plan experiences consistently low participation rates, it may indicate a lack of interest or understanding among employees. In such cases, terminating the plan can help the company avoid unnecessary administrative costs and focus on other employee benefits that are more valued by the workforce.

- Compliance complexities: Maintaining a 401(k) plan requires adherence to numerous compliance rules and regulations imposed by the IRS and the Department of Labor. Some businesses may find it challenging to navigate the complexities of these regulations, especially if they lack the internal expertise or resources to handle the administrative burden.

It is important for employers to carefully evaluate these factors when considering the termination of a 401(k) plan. While terminating the plan may offer certain advantages, it is essential to also consider the potential impact on employee morale, retention, and overall compensation package competitiveness. Employers may want to explore alternative retirement savings options or communicate the reasons for terminating the plan in a transparent and empathetic manner to mitigate any negative consequences.

Considerations Before Terminating a 401(k) Plan

Before making the decision to terminate a 401(k) plan, employers need to thoroughly evaluate various factors and consider the potential implications. Taking the time to assess these considerations can help ensure a smooth transition and mitigate any negative impact on employees. Here are some key considerations to keep in mind:

- Employee impact: Terminating a 401(k) plan can have a significant impact on employees who have relied on the plan for their retirement savings. It is crucial to consider how the termination will affect their financial goals and how alternative retirement savings options will be provided. Employers may want to provide resources and guidance to help employees navigate the transition and make informed decisions about their retirement savings.

- Legal and regulatory compliance: Employers must comply with all legal and regulatory requirements when terminating a 401(k) plan. This includes providing proper notice to employees, distributing plan assets appropriately, and ensuring compliance with ERISA (Employee Retirement Income Security Act) regulations. It is essential to consult with legal and financial professionals to ensure compliance throughout the termination process.

- Vested employer contributions: Employers need to consider the status of vested employer contributions when terminating a 401(k) plan. Vested contributions are the portions of the employer’s contributions that have become the property of the employee. Employers must adhere to the plan’s vesting schedule and ensure that employees receive their vested contributions upon termination.

- Tax implications: Employers and employees need to understand the tax implications of terminating a 401(k) plan. Employers may need to account for any remaining tax-deferred contributions and ensure that employees receive proper tax reporting for their distributions. Employees may also need to consider potential tax consequences when deciding how to handle their plan assets after termination.

- Communication and employee support: Open and transparent communication with employees is vital when terminating a 401(k) plan. Employers should provide ample notice to employees about the termination, explain the reasons behind the decision, and offer support during the transition. This can include providing educational resources about alternative retirement savings options and offering assistance in transferring or rolling over plan assets.

- Evaluation of alternative retirement savings options: Before terminating a 401(k) plan, employers should evaluate alternative retirement savings options that may better suit their business needs and employee preferences. This could include offering a simplified employee pension (SEP) IRA, a simplified 401(k) plan, or partnering with a financial institution to provide a retirement savings program. Employers should consider factors such as cost, administration ease, and employee appeal when exploring alternative options.

By carefully considering these factors, employers can make informed decisions about terminating a 401(k) plan and ensure a smooth transition for employees. It is crucial to seek guidance from legal, financial, and HR professionals to navigate the complexities of plan termination and to minimize any potential negative impact on employees’ retirement savings.

Steps to Terminate a 401(k) Plan

Terminating a 401(k) plan involves a series of steps to ensure a smooth transition and compliance with legal requirements. While the exact process may vary depending on the specific plan and the company’s circumstances, here are some general steps to consider when terminating a 401(k) plan:

- Review plan documents: Begin by thoroughly reviewing the plan documents, including the adoption agreement and the plan’s termination provisions. Understand the provisions related to distribution of assets, vesting, and employer contributions.

- Consider fiduciary obligations: Ensure that all fiduciary duties are fulfilled when terminating the plan. This includes acting in the best interests of plan participants, providing proper notice, and following the appropriate legal and regulatory requirements.

- Notify plan participants: Notify employees of the plan termination well in advance. Provide clear and concise communication, explaining the reasons behind the termination, any alternative retirement savings options available, and the timeline for the termination process.

- Communicate with service providers: Inform the plan’s service providers, such as the recordkeeper and investment manager, of the plan termination and coordinate with them to ensure a smooth transition. Obtain any necessary documents or information required for the termination process.

- Distribute plan assets: Determine how and when to distribute plan assets to participants. This could include providing options for direct rollovers into individual retirement accounts (IRAs) or facilitating transfers to new employer-sponsored retirement plans, if applicable. Ensure compliance with applicable laws and provide all required tax information to participants.

- Terminate employer contributions: Cease all employer contributions to the plan and ensure that payroll processes are updated accordingly. Communicate this change with employees and make any necessary adjustments to their compensation packages.

- File necessary forms and reports: Complete all required paperwork and filings related to the plan termination. This can include filing a final Form 5500 with the Department of Labor and providing appropriate notifications to regulatory agencies.

- Terminate the plan officially: Once all required steps have been completed, formally terminate the 401(k) plan. This typically involves adopting a resolution to terminate the plan and updating plan documents to reflect the termination.

- Provide support and resources: Throughout the termination process, continue to offer support and resources to employees. This can include educational materials about alternative retirement savings options and guidance on how to manage their plan assets after termination.

It is crucial to consult with legal, financial, and HR professionals throughout the termination process to ensure compliance with all legal requirements and to efficiently handle the logistical aspects of terminating a 401(k) plan. By following these steps, employers can ensure a smooth transition and minimize any potential negative impact on employees.

Communicating with Employees about the Plan Termination

Effective communication with employees is crucial when terminating a 401(k) plan. Open and transparent communication can help alleviate concerns, manage expectations, and provide employees with the necessary information and resources to make informed decisions about their retirement savings. Here are some key considerations when communicating with employees about the plan termination:

- Provide early notice: It is important to inform employees well in advance about the plan termination. This allows them sufficient time to understand the implications, explore alternative retirement savings options, and make any necessary adjustments to their financial plans.

- Explain the reasons: Clearly communicate the reasons behind the decision to terminate the 401(k) plan. Whether it is due to financial considerations, changes in business priorities, or compliance complexities, providing a transparent explanation can help employees understand the rationale and minimize uncertainty.

- Offer alternative retirement savings options: Educate employees about alternative retirement savings options that will be available to them after the plan termination. This could include information about individual retirement accounts (IRAs), simplified employee pension (SEP) IRAs, or potential options through a new employer-sponsored retirement plan. Provide resources and guidance to help employees make informed decisions based on their individual circumstances.

- Address vested employer contributions: Clearly communicate how the termination will impact vested employer contributions. Explain the distribution process and provide information on how employees can access their vested funds. Emphasize the importance of reviewing their options and making appropriate decisions to ensure their retirement savings continue to grow.

- Offer financial education: Many employees may not have extensive knowledge about retirement savings and investment options. Provide educational materials, workshops, or access to financial advisors to help employees understand the various retirement savings options available to them. Empower them to make informed decisions about their future financial well-being.

- Address tax implications: Inform employees about any potential tax implications associated with the plan termination. This could include information on how plan distributions may be taxed and the importance of consulting with tax professionals to navigate any tax-related matters.

- Provide ongoing support: Offer ongoing support to employees during the transition period and beyond. This can include access to a dedicated HR representative or retirement plan specialist who can answer questions, provide guidance, and address any concerns that arise.

Effective communication is key to ensuring that employees understand the plan termination, feel supported throughout the process, and have the necessary information to make informed decisions about their retirement savings. By being transparent, empathetic, and providing resources, employers can help employees navigate the transition confidently and mitigate any potential negative impact on their financial future.

Distributing Assets and Terminating Plan Contributions

When terminating a 401(k) plan, it is essential to determine how the plan’s assets will be distributed and to cease all future contributions. Properly managing the distribution of assets and terminating plan contributions is crucial to ensure compliance with legal requirements and a smooth transition for employees. Here are the key considerations when distributing assets and terminating plan contributions:

- Determine distribution options: Evaluate the available distribution options for plan participants. This could include offering direct rollovers into individual retirement accounts (IRAs), facilitating transfers to a new employer-sponsored retirement plan, or providing lump-sum cash distributions. Ensure that the options offered comply with the plan’s provisions and regulatory requirements.

- Communicate distribution process: Clearly communicate the process and timeline for distributing plan assets to participants. Provide participants with the necessary forms, instructions, and any required tax reporting information. Address any questions or concerns they may have regarding their options and guide them through the distribution process.

- Coordinate with service providers: Collaborate with the plan’s service providers, such as the recordkeeper and custodian, to facilitate the smooth transfer or distribution of plan assets. Ensure that all necessary paperwork and instructions are properly communicated to the service providers to avoid delays or errors in the distribution process.

- Terminate employer contributions: Cease all future employer contributions to the plan. Ensure that payroll systems and processes are updated promptly to reflect the termination of employer contributions. Communicate this change clearly to employees to manage their expectations regarding any changes to their compensation packages.

- Maintain compliance with distribution deadlines: Adhere to the required distribution deadlines imposed by the Internal Revenue Service (IRS) and the Department of Labor. Failure to meet these deadlines may result in penalties and potential legal issues. Ensure that all necessary forms, notifications, and tax reporting are completed within the specified timeframes.

- Address outstanding loans: If the plan allows for participant loans, address any outstanding loan balances. Determine whether participants must repay the loan in full before the plan termination or if there are provisions for loan offset or rollover options. Communicate the requirements and options to participants to ensure a smooth resolution of any outstanding loan balances.

- Adjust plan administration and payroll processes: Update plan administration processes and systems to reflect the termination of the 401(k) plan. This includes ensuring that payroll systems no longer deduct employee contributions and that any administrative requirements, such as recordkeeping and reporting, are adjusted accordingly.

- Document plan termination: Keep detailed documentation of the termination process, including correspondence with service providers, distribution records, and compliance filings. This documentation serves as proof of compliance and can be valuable in the event of an audit or the need for future reference.

By carefully managing the distribution of plan assets and terminating contributions in accordance with legal requirements, employers can ensure a smooth transition and uphold their fiduciary responsibilities to plan participants. Working closely with legal, financial, and administrative professionals can help navigate the complexities of this process and minimize any disruption to employees’ retirement savings.

Compliance and Legal Considerations in Terminating a 401(k) Plan

When terminating a 401(k) plan, employers must carefully navigate the compliance and legal requirements associated with the process. Failure to comply with these regulations can result in penalties, legal issues, and potential liability. Here are the key compliance and legal considerations to keep in mind when terminating a 401(k) plan:

- Review plan documents: Thoroughly review the plan documents, including the plan’s adoption agreement and summary plan description. Understand the provisions related to termination, distribution of assets, vesting, and employer contributions.

- Notification requirements: Provide proper notice to plan participants about the termination of the 401(k) plan. The notice should include the reasons for termination, distribution options, vesting information, and any applicable deadlines. Adhere to the notification timeline required by the Employee Retirement Income Security Act (ERISA) and communicate the termination in accordance with the plan’s provisions and any regulatory requirements.

- Comply with ERISA regulations: Ensure compliance with ERISA regulations throughout the termination process. This includes fulfilling fiduciary responsibilities, acting in the best interest of plan participants, and providing appropriate disclosures and notifications. Employers must document their decisions, actions, and communications to demonstrate compliance with ERISA obligations.

- Vesting considerations: Evaluate the vesting status of plan participants’ accounts. Determine the vested portion of employer contributions and ensure proper distribution based on the plan’s vesting schedule. Comply with ERISA requirements regarding participant vesting rights and ensure proper documentation of vesting calculations and distribution processes.

- Tax implications and reporting: Understand the tax implications of terminating the plan and ensure proper tax reporting for participants. Provide timely Form 1099-R to participants, indicating any plan distributions made. Communicate with participants about the potential tax consequences of their distributions and advise them to consult with tax professionals to fully understand their individual tax obligations.

- Distribution deadlines: Adhere to distribution deadlines imposed by the Internal Revenue Service (IRS) and other regulatory agencies. Failure to comply with these deadlines can result in penalties and legal issues. Ensure that all necessary paperwork, such as distribution forms and tax reporting documentation, is properly completed within the specified timeframes.

- Consult legal and financial professionals: Seek guidance from legal, financial, and compliance professionals with expertise in retirement plan termination. These professionals can help ensure compliance with all applicable laws and regulations, provide advice on avoiding potential legal pitfalls, and assist with the completion of necessary filings and reports.

- Documentation and record-keeping: Maintain comprehensive documentation throughout the termination process. Keep records of all communications, distribution requests, compliance filings, and any other relevant documentation. These records serve as proof of compliance and can be valuable in the event of an audit or future reference.

By thoroughly understanding and complying with the compliance and legal considerations in terminating a 401(k) plan, employers can navigate the process effectively and mitigate potential risks and legal issues. Seek professional guidance and ensure proper documentation to demonstrate adherence to all regulatory requirements throughout the termination process.

Handling Tax Implications and Reporting Requirements

When terminating a 401(k) plan, employers must carefully navigate the tax implications and reporting requirements associated with the process. It is important to understand the various tax considerations to ensure compliance and provide accurate information to plan participants. Here are the key factors to consider in handling tax implications and reporting requirements when terminating a 401(k) plan:

- Plan distributions: Plan participants may receive distributions of their vested plan assets upon the termination of the 401(k) plan. It is important to communicate to participants the tax consequences of these distributions. Generally, distributions are subject to ordinary income tax in the year they are received.

- Form 1099-R: Employers are required to issue Form 1099-R to participants who receive distributions from the terminated 401(k) plan. Form 1099-R reports the amount of the distribution and any applicable taxes withheld. Ensure that accurate and timely Form 1099-Rs are provided to participants, following the guidelines set by the Internal Revenue Service (IRS).

- Tax withholding: Employers need to consider the appropriate tax withholding requirements for plan distributions. This includes federal income tax withholding as well as any state or local income tax obligations. Communicate with participants about the tax withholding options and advise them to consult with tax professionals to determine the appropriate withholding amount.

- Rollover options: Inform participants about the option to rollover their plan distributions into another tax-advantaged retirement account, such as an Individual Retirement Account (IRA) or a new employer-sponsored plan. This allows participants to avoid immediate taxation on the distribution and continue their retirement savings without penalties.

- Timing of distributions: Distributions from the terminated 401(k) plan must generally be completed within a reasonable timeframe following the plan termination. Ensure that all necessary paperwork and processes are in place to facilitate the timely distribution of plan assets to participants.

- Early withdrawal penalties: In some cases, participants may be subject to early withdrawal penalties if they receive a distribution before reaching the age of 59 ½. Educate participants about the potential penalties and exceptions to early withdrawal penalties, such as those related to disability or financial hardship.

- Tax reporting: Properly report the plan termination and any plan distributions to the appropriate tax authorities. This includes filing the final Form 5500 with the Department of Labor and providing appropriate notifications to the IRS. Timely and accurate tax reporting is crucial to ensure compliance and avoid potential penalties.

When handling tax implications and reporting requirements, it is highly recommended to consult with tax professionals or specialized advisors who can provide expert guidance on the specific tax obligations associated with the termination of a 401(k) plan. By understanding these tax considerations and fulfilling reporting obligations, employers can ensure compliance and help plan participants navigate the tax implications of their plan distributions.

Common Pitfalls and Challenges in 401(k) Plan Termination

Terminating a 401(k) plan can be a complex process, and there are several common pitfalls and challenges that employers may encounter. It is crucial to be aware of these potential issues to mitigate risks and ensure a successful plan termination. Here are some of the common pitfalls and challenges associated with 401(k) plan termination:

- Inadequate planning: Insufficient planning can lead to delays, errors, and unexpected costs during the plan termination process. It is important to establish a clear timeline, identify the necessary steps, and coordinate with key stakeholders and service providers well in advance of the termination.

- Improper participant communication: Failing to effectively communicate with plan participants about the plan termination can result in confusion, frustration, and potential legal issues. Employers must provide timely and clear communication to participants, explaining the reasons for termination, outlining distribution options, and addressing any concerns or questions.

- Non-compliance with legal requirements: Terminating a 401(k) plan involves complying with various legal requirements, including proper notification, distribution of assets, and filing necessary forms and reports. Failure to meet these requirements can result in penalties, legal issues, and potential liability for the employer.

- Mismanagement of plan assets: Mishandling or mismanaging plan assets during the termination process can lead to errors, delays, and potential legal consequences. It is crucial to coordinate with service providers and ensure accurate, timely, and compliant distribution of assets to plan participants.

- Incorrect tax reporting: Improper reporting of plan distributions and tax withholding can lead to penalties and legal issues. Employers must accurately report plan distributions on Form 1099-R, provide participants with the necessary tax documents, and ensure compliance with applicable tax laws and regulations.

- Incomplete record-keeping: Inadequate documentation and record-keeping can create challenges in the event of an audit or future reference. Employers need to maintain comprehensive records of the plan termination process, including communications, distribution requests, compliance filings, and any other relevant documentation.

- Lack of expertise and professional guidance: Terminating a 401(k) plan requires in-depth knowledge of legal, tax, and compliance regulations. Employers who lack the necessary expertise may encounter difficulties in navigating the complexities of the termination process. Seeking guidance from legal, financial, and HR professionals can help ensure a successful plan termination.

By proactively addressing these common pitfalls and challenges, employers can mitigate risks, streamline the plan termination process, and ensure compliance with legal and regulatory requirements. Thorough planning, effective communication, and professional guidance are key to navigating these challenges successfully and terminating the 401(k) plan efficiently.

Conclusion

Terminating a 401(k) plan is a significant decision for employers, requiring careful planning, compliance with legal requirements, and effective communication with plan participants. While the process may pose challenges and potential pitfalls, with proper guidance and a thorough understanding of the steps involved, employers can navigate the termination process successfully.

Throughout this comprehensive guide, we have explored various aspects of terminating a 401(k) plan, including an overview of 401(k) plans, reasons for termination, considerations before termination, steps to terminate a plan, communicating with employees, distributing assets, compliance and legal considerations, handling tax implications, and common pitfalls and challenges.

By evaluating the unique needs and circumstances of their organization, employers can make informed decisions regarding the termination of their 401(k) plan. It is crucial to consider the impact on employees, explore alternative retirement savings options, and ensure compliance with fiduciary responsibilities and legal obligations. Effective communication is vital to manage employee expectations, provide support, and guide employees through the transition.

Consulting with legal, financial, and HR professionals is highly recommended throughout the plan termination process. These professionals can provide expert advice on compliance, tax considerations, and the complex regulatory landscape associated with terminating a 401(k) plan. Their guidance can help employers avoid common pitfalls and ensure a seamless transition for plan participants.

Remember, terminating a 401(k) plan is not the end of the road for employees’ retirement savings. By offering alternative retirement savings options, providing educational resources, and maintaining ongoing support, employers can help their employees continue building their retirement nest eggs.

In conclusion, terminating a 401(k) plan requires careful attention to legal requirements, thoughtful planning, effective communication, and professional guidance. Through proper preparation and execution, employers can navigate the termination process successfully, minimize risks, and ensure compliance while safeguarding the financial well-being of their employees.