Home>Finance>Conditional Prepayment Rate (CPR): Definition And Calculation

Finance

Conditional Prepayment Rate (CPR): Definition And Calculation

Published: October 31, 2023

Learn about the definition and calculation of Conditional Prepayment Rate (CPR) in finance. Understand how this metric impacts investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Conditional Prepayment Rate (CPR): Definition and Calculation

Welcome to our finance category where we delve into various aspects of the fascinating world of finance. In today’s blog post, we will be exploring the concept of Conditional Prepayment Rate (CPR). If you’ve ever wondered what CPR is, how it’s calculated, and its significance in the financial industry, you’ve come to the right place. By the end of this article, you will have a solid foundation in understanding and applying CPR.

Key Takeaways:

- CPR is a metric used in the mortgage-backed securities market to estimate the rate at which borrowers will prepay their mortgage loans.

- It is essential for investors and financial institutions to understand CPR as it has a direct impact on the expected cash flows and risk assessment of mortgage-backed securities.

What is Conditional Prepayment Rate (CPR)?

Conditional Prepayment Rate (CPR) is a measure commonly used in the mortgage-backed securities market to estimate the rate at which borrowers will prepay their mortgage loans. When homeowners with mortgage loans decide to pay off the loan earlier than the scheduled maturity date, it is known as prepayment. CPR helps investors and financial institutions forecast the likelihood and timing of these prepayments.

CPR is influenced by a variety of factors, including interest rates, changes in housing market conditions, and borrower behavior. As interest rates decrease, borrowers are more likely to refinance their mortgages, leading to higher prepayment rates. Conversely, during periods of rising interest rates, prepayment rates tend to decrease. Understanding CPR is crucial to accurately assess the risk associated with mortgage-backed securities and make informed investment decisions.

Calculating Conditional Prepayment Rate (CPR)

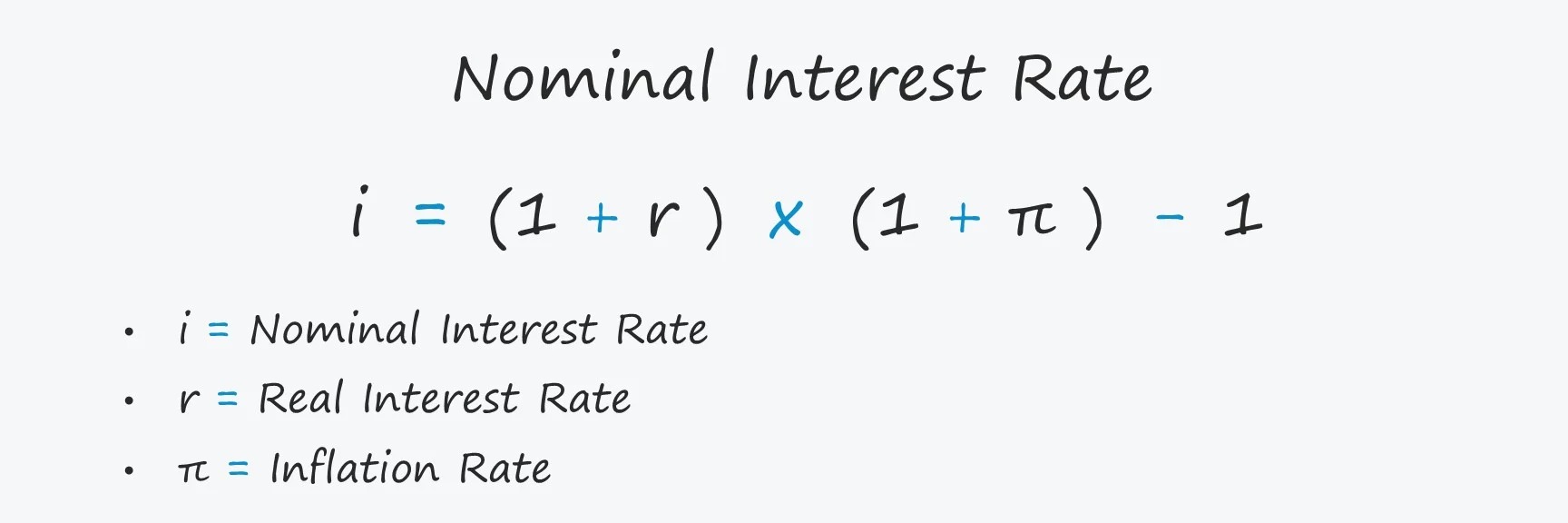

Now that we know what CPR is, let’s dive into its calculation. There are different methods to calculate CPR, but one commonly used formula is the Single Monthly Mortality (SMM) method.

The formula for calculating CPR using the Single Monthly Mortality (SMM) method is:

CPR = (1 – (1 – SMM))^12 – 1

Here, SMM represents the monthly prepayment rate, which is calculated as the ratio of the number of mortgage loans paid off for a particular month to the total outstanding mortgage pool at the beginning of that month. The SMM is then annualized by raising it to the power of 12 and subtracting 1.

Why is Conditional Prepayment Rate (CPR) Important?

Conditional Prepayment Rate (CPR) plays a crucial role in the mortgage-backed securities market. Here are a few reasons why it is important:

- Risk Assessment: CPR helps investors and financial institutions assess the risks associated with mortgage-backed securities. By understanding the likelihood and timing of prepayments, they can make informed decisions about investing in these securities and manage their risk exposure effectively.

- Cash Flow Expectations: CPR provides insights into the expected cash flows from mortgage-backed securities. By estimating prepayment rates, investors can better project the timing and amounts of cash inflows, allowing for more accurate financial planning and forecasting.

- Valuation: CPR is used in the valuation of mortgage-backed securities. Prepayments impact the overall yield and duration of these securities, making CPR a critical factor in pricing and determining their market value.

By considering CPR, investors and financial institutions can make better-informed decisions, manage risks, and ensure efficient cash flow management in the mortgage-backed securities market.

Conclusion

Conditional Prepayment Rate (CPR) is a metric used in the mortgage-backed securities market to estimate the rate at which borrowers will prepay their mortgage loans. By understanding and calculating CPR, investors and financial institutions can effectively assess risks, project cash flows, and determine the value of mortgage-backed securities. It is an essential concept in the finance industry that plays a crucial role in decision-making and risk management.

We hope this article has provided you with a comprehensive understanding of CPR and its significance. Stay tuned for more informative finance articles as we continue to explore different aspects of the financial world.