Home>Finance>Construction Loan: Definition, How It Works, And Example

Finance

Construction Loan: Definition, How It Works, And Example

Published: November 1, 2023

Understand how construction loans work, including definition, process, and an example. Discover the financial aspects of construction projects with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Construction Loans: Everything You Need to Know

When it comes to financing a construction project, a construction loan is an important tool that can help you achieve your goals. Whether you’re planning to build your dream home or undertake a commercial construction project, understanding how construction loans work is crucial to ensure a smooth and successful process. In this article, we’ll delve into the definition of a construction loan, how it works, and provide you with a real-life example to help you grasp the concept in a practical way.

Key Takeaways:

- Construction loans are short-term loans specifically designed to fund the construction or renovation of a property.

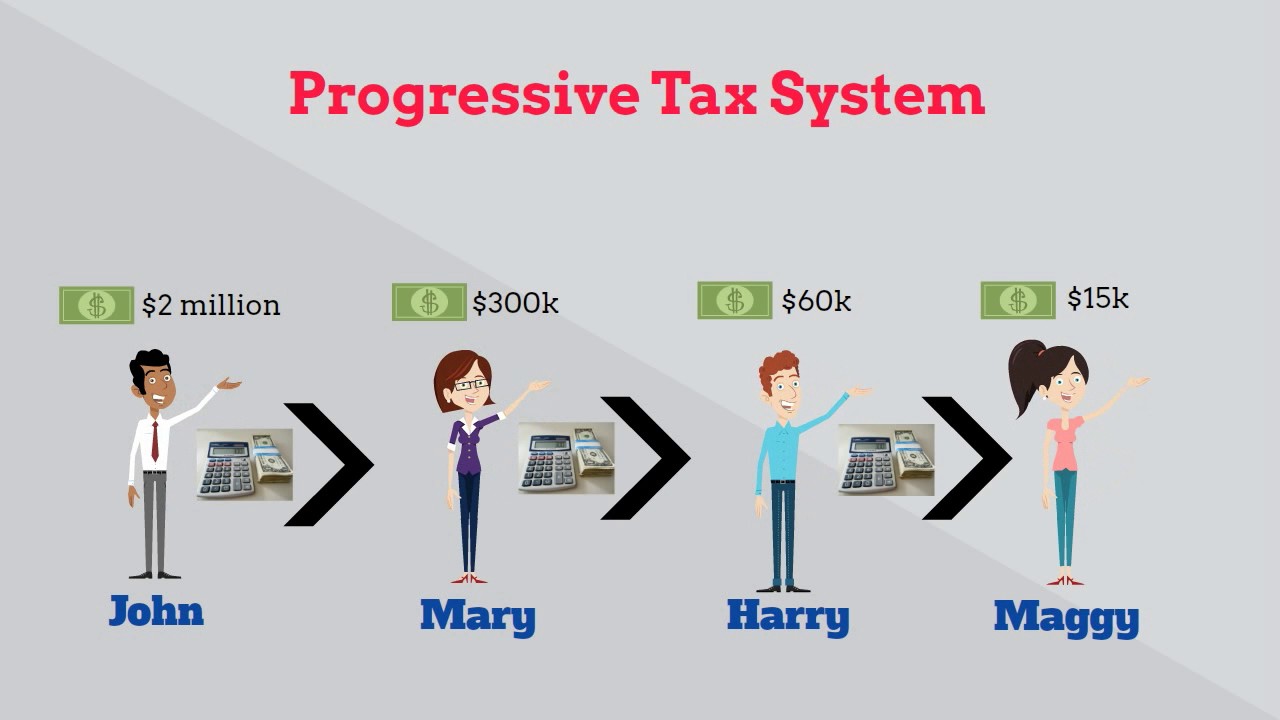

- They typically have a higher interest rate than traditional mortgage loans due to the increased risk and shorter repayment period.

What is a Construction Loan?

A construction loan is a type of financing that is specifically tailored to fund the construction or renovation of a property. Unlike traditional mortgage loans, which are usually used to purchase an already built property, construction loans provide the necessary funds to cover the costs of building a new structure or making significant renovations to an existing one.

Construction loans are typically short-term loans that cover the duration of the construction period, which can range from several months to a few years depending on the scale of the project. Unlike traditional mortgage loans, where the borrower receives the full amount upfront, construction loans are disbursed in stages or “draws,” based on the completion of pre-determined milestones of the construction process.

How Does a Construction Loan Work?

Construction loans follow a different process compared to traditional mortgage loans. Here’s a step-by-step breakdown of how a construction loan typically works:

- Loan Application: The borrower applies for a construction loan with a lender, providing detailed information about the project, such as the estimated construction cost, timeline, and plans.

- Pre-Approval: Upon reviewing the application, the lender assesses the borrower’s creditworthiness, including their credit score, income, and financial history. If approved, the lender will issue a pre-approval letter outlining the terms and conditions of the loan.

- Construction Contract and Plans: The borrower finalizes the construction contract with the builder/contractor and submits the detailed plans and specifications for the project to the lender.

- Valuation and Loan Amount: The lender conducts a valuation of the property based on the plans and specifications provided. The loan amount is then determined based on a percentage of the total project cost, typically ranging from 80% to 95%.

- Loan Disbursement: As the construction progresses, the lender disburses funds to the borrower in several stages or “draws,” based on the completion of specific milestones. The borrower typically needs to provide evidence of the completion of each milestone, such as an inspection report or photographs.

- Interest-only Payments: During the construction period, the borrower usually only needs to make interest payments on the amount disbursed. Once the construction is complete, the loan is converted to a traditional mortgage loan, and the borrower begins making principal and interest payments.

Example of a Construction Loan:

Let’s say you’re planning to build your dream home. The total construction cost is estimated to be $500,000. After reviewing your application and conducting a valuation of the property, the lender agrees to provide you with a construction loan of 90% of the total project cost.

The construction loan is disbursed through several stages or “draws” based on milestones such as the completion of the foundation, framing, plumbing, electrical work, and so on. Each draw is typically a percentage of the total loan amount.

Throughout the construction period, which takes around 12 months, you make interest-only payments on the amount disbursed. Once the construction is completed, the loan is converted to a traditional mortgage loan, and you start making principal and interest payments based on the loan terms and conditions.

By utilizing a construction loan, you were able to finance the construction of your dream home, breaking down the costs into manageable stages while ensuring that funds are available at each step of the process.

In Conclusion

A construction loan is a powerful financing tool that can help fund your construction project, whether it’s a new home, a commercial building, or a renovation. Understanding how construction loans work is crucial to ensure a smooth construction process and achieve your desired outcomes. By following the steps outlined in this article and working closely with a reputable lender, you can turn your construction vision into a reality.