Finance

Consumer Internet Barometer Definition

Published: November 1, 2023

Discover the latest trends and insights in finance with the Consumer Internet Barometer. Stay informed and make data-driven decisions for your financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Consumer Internet Barometer Definition in Finance

Finance is a vast field that encompasses various aspects of managing money. From personal budgeting to global market trends, there is no shortage of information and tools available to help us navigate the financial landscape. One valuable resource that is often overlooked is the Consumer Internet Barometer (CIB). In this blog post, we will explore the CIB definition, its significance in the finance world, and how it can benefit you.

Key Takeaways:

- The Consumer Internet Barometer (CIB) measures consumer sentiment and behavior related to internet usage in the finance industry.

- Understanding the CIB can provide valuable insights into consumer preferences and trends, enabling businesses and individuals to make data-driven decisions.

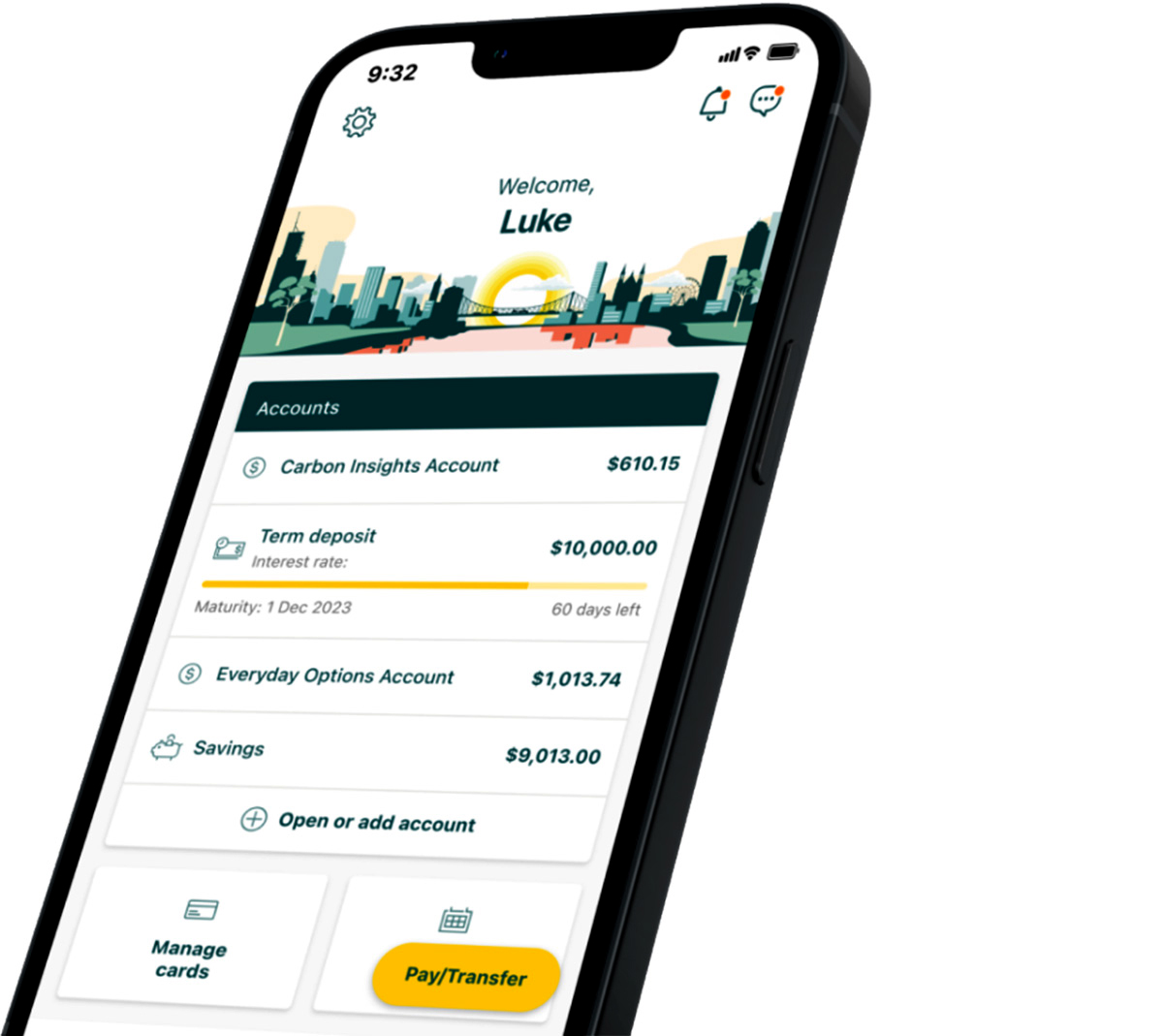

So, what exactly does the Consumer Internet Barometer refer to? In simple terms, it is a tool used to gauge consumer sentiment and behavior regarding internet usage in the finance industry. It collects data on various metrics, such as online banking, mobile payments, investment apps, and e-commerce, to capture insights into how individuals interact with financial services on the internet.

The significance of the CIB lies in its ability to provide a holistic view of consumer preferences and trends. By analyzing the data collected, businesses can identify emerging patterns and make informed decisions to better meet consumer needs. For individuals, understanding the CIB can help make smarter financial choices, such as selecting the most convenient online banking platform or taking advantage of the latest digital payment methods.

Why should you pay attention to the Consumer Internet Barometer?

The Consumer Internet Barometer is not just a tool for experts or market analysts; it can benefit anyone with an interest in finance. Here’s why you should pay attention:

- Stay ahead of the curve: By staying informed about consumer preferences and behaviors, you can anticipate industry shifts and make timely adjustments to your financial strategies.

- Make data-driven decisions: Armed with insights from the CIB, you can make well-informed choices about online banking, investment platforms, and other digital financial services, ensuring that you are maximizing your financial opportunities.

- Improve financial well-being: Understanding how consumers engage with financial services can help you identify beneficial tools and platforms to improve your financial well-being and enhance your financial literacy.

- Follow industry trends: The CIB provides valuable data that reveals broader industry trends. By keeping an eye on these trends, you can position yourself for success in a rapidly evolving financial world.

Ultimately, the Consumer Internet Barometer serves as a compass in the ever-expanding digital finance universe. Embracing the insights it provides can empower individuals and businesses alike to make smarter financial decisions and thrive in an increasingly interconnected world.