Finance

What Is Internet Consumer Finance

Modified: December 30, 2023

Discover the world of internet consumer finance and revolutionize your financial future with our comprehensive guide on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Internet Consumer Finance

- Key Features of Internet Consumer Finance

- Benefits and Risks of Internet Consumer Finance

- Different Types of Internet Consumer Finance Platforms

- The Regulatory Environment for Internet Consumer Finance

- Case Studies of Successful Internet Consumer Finance Companies

- Future Trends in Internet Consumer Finance

- Conclusion

Introduction

Internet consumer finance has revolutionized the way people access and manage their finances. With the proliferation of online platforms and digital technology, consumers now have the convenience of accessing a wide range of financial services at their fingertips. Whether it’s applying for a loan, managing investments, or tracking expenses, internet consumer finance has made financial transactions faster, more convenient, and more accessible than ever before.

By leveraging the power of the internet, traditional financial institutions, as well as fintech startups, have created online platforms that offer a plethora of financial services tailored to the needs of modern consumers. From peer-to-peer lending platforms to online investment platforms, internet consumer finance has reshaped the financial landscape, providing individuals with greater control and flexibility over their financial affairs.

One of the key advantages of internet consumer finance is its ability to reach a wider audience. By eliminating the need for physical locations and face-to-face interactions, financial services can now be accessed by individuals regardless of their location or time constraints. This inclusivity has opened up opportunities for underbanked populations, allowing them to access much-needed financial services that were previously out of reach.

Furthermore, internet consumer finance has also improved the speed and efficiency of financial transactions. With just a few clicks, consumers can apply for loans, open investment accounts, or transfer funds between accounts. This convenience not only saves time but also reduces the paperwork and bureaucracy typically associated with traditional financial institutions.

However, as with any financial endeavor, internet consumer finance comes with its own set of risks and challenges. The digital nature of these services makes them vulnerable to cybersecurity threats and fraud. It’s essential for consumers to exercise caution and ensure they are using secure and reputable platforms when engaging in internet consumer finance.

In the following sections, we will delve deeper into the definition of internet consumer finance, explore its key features, discuss the benefits and risks associated with it, and examine different types of internet consumer finance platforms. We will also take a closer look at the regulatory environment governing internet consumer finance and explore case studies of successful companies in this space. Finally, we will touch on future trends and developments that are shaping the future of internet consumer finance.

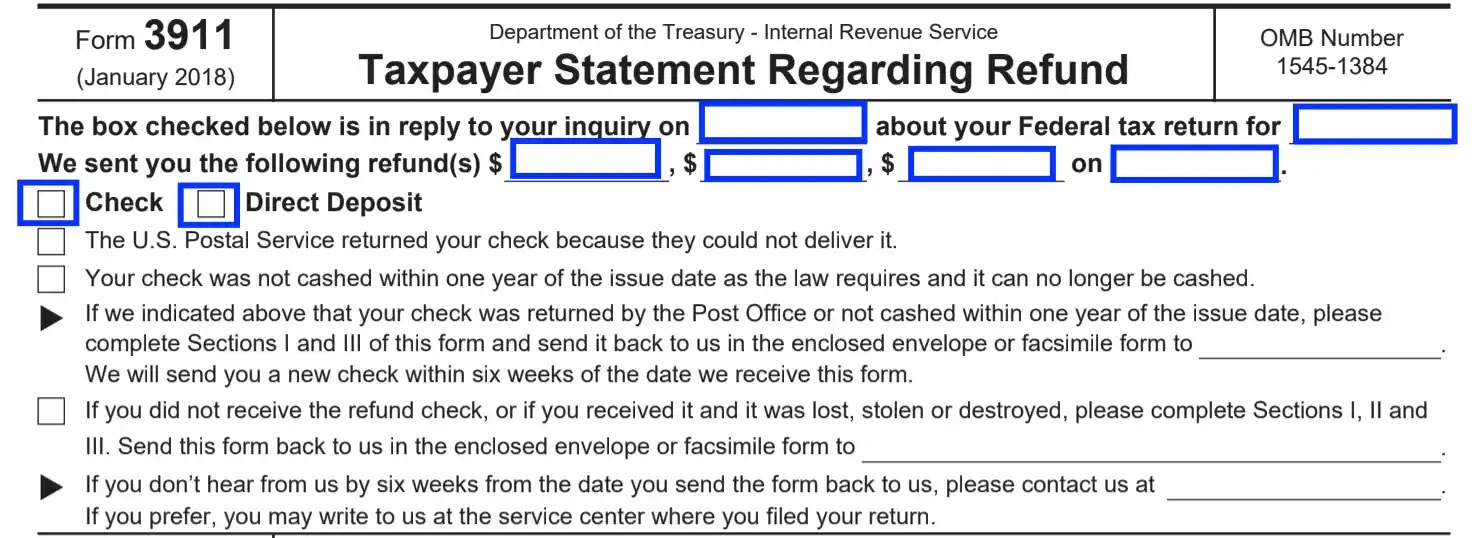

Definition of Internet Consumer Finance

Internet consumer finance, also known as online consumer finance or digital consumer finance, refers to the provision of financial services and products to individual consumers through online platforms. It encompasses a wide range of financial activities, including borrowing, lending, investing, payment processing, and personal financial management.

At its core, internet consumer finance aims to simplify and streamline the traditional financial processes by leveraging digital technology and the internet. It eliminates the need for physical visits to banks or other financial institutions, providing users with the convenience of managing their finances from the comfort of their own homes or on the go using mobile devices.

The advent of internet consumer finance has democratized access to financial services, making them more inclusive and accessible to a broader segment of the population. It has significantly reduced barriers to entry, allowing individuals who may have been previously underserved by traditional financial institutions to overcome those limitations and take control of their financial health.

Various types of internet consumer finance services are available to consumers. These include:

- Online lending: Platforms that connect borrowers with lenders, facilitating the borrowing process and offering a variety of loan options, such as personal loans, mortgages, and student loans.

- Peer-to-peer lending: Platforms that enable individuals to lend money directly to other individuals, bypassing traditional financial intermediaries.

- Digital banking: Online banking services provided by digital banks that offer full-service banking capabilities, including checking accounts, savings accounts, and debit cards.

- Online investment platforms: Platforms that allow individuals to invest in stocks, bonds, mutual funds, and other investment instruments, often with lower fees and minimum investment requirements compared to traditional brokerage firms.

- Payments and money transfer: Online payment services and mobile payment apps that enable users to send and receive money, pay bills, and make online purchases.

- Personal finance management: Web and mobile applications that help users track their spending, create budgets, and monitor their financial health.

Overall, internet consumer finance provides individuals with greater convenience, flexibility, and control over their financial activities. It has disrupted the traditional financial landscape, empowering consumers to make informed decisions and manage their finances on their own terms.

Key Features of Internet Consumer Finance

Internet consumer finance platforms offer a range of key features that differentiate them from traditional financial institutions and make them attractive to consumers. These features provide convenience, accessibility, and flexibility, revolutionizing the way individuals manage their finances. Here are some of the key features of internet consumer finance:

- 24/7 Access: Internet consumer finance platforms are accessible 24 hours a day, 7 days a week, allowing users to manage their finances at their convenience. Whether it’s checking account balances, making payments, or reviewing investment portfolios, users have the flexibility to do so at any time, without being restricted by traditional banking hours.

- Convenience: Internet consumer finance platforms eliminate the need for physical visits to banks or financial institutions. Users can easily access their accounts, make transactions, and receive services through simple and user-friendly interfaces. This convenience saves time and offers a hassle-free experience.

- Wide Range of Services: Internet consumer finance platforms provide a comprehensive suite of financial services in one place. Users can access services like online banking, lending, investing, budgeting, and payment processing, eliminating the need for separate accounts and logins with different financial institutions.

- Personalization: Internet consumer finance platforms leverage technology to personalize the user experience. They use data analytics and algorithms to provide tailored financial recommendations, customized offers, and insights based on individual preferences and financial goals.

- Innovative Tools and Features: Internet consumer finance platforms offer innovative tools and features that empower users to manage their finances effectively. These can include real-time transaction tracking, automated budgeting and savings tools, investment portfolio analysis, and customizable alerts and notifications.

- Enhanced Security: Internet consumer finance platforms invest heavily in security measures to protect users’ financial information. Encryption, multi-factor authentication, and robust fraud detection systems ensure the security and integrity of transactions and personal data.

- Lower Costs: Internet consumer finance platforms often have lower fees and charges compared to traditional financial institutions. This cost advantage is achieved through reduced overhead costs and eliminating the need for physical branches, allowing them to pass the savings onto the consumers.

- Greater Financial Inclusion: Internet consumer finance platforms provide access to financial services for individuals who may have been underserved or excluded by traditional banking systems. These platforms cater to individuals with limited credit history, low income, or lack of proximity to physical bank branches.

The key features of internet consumer finance make it an appealing choice for individuals seeking convenience, flexibility, and personalized financial services. These platforms have disrupted the traditional financial industry, empowering consumers to take control of their finances and make informed decisions to achieve their financial goals.

Benefits and Risks of Internet Consumer Finance

Internet consumer finance offers several benefits to individuals, ranging from convenience and accessibility to cost savings and financial inclusion. However, it also carries certain risks that users must be aware of. Here, we will explore the key benefits and risks of internet consumer finance:

Benefits of Internet Consumer Finance:

- Convenience: Internet consumer finance platforms provide users with the convenience of accessing their financial services at any time and from anywhere. Whether it’s checking account balances, making payments, or applying for loans, individuals can manage their finances with ease.

- Accessibility: Internet consumer finance platforms have expanded access to financial services, particularly for individuals who may have been underserved by traditional banks. Users can overcome geographical limitations and gain access to a wide range of financial products and services.

- Cost Savings: Internet consumer finance platforms often have lower fees and charges compared to traditional banks. These platforms operate with fewer overhead costs, allowing them to offer competitive interest rates on loans, lower transaction fees, and reduced account maintenance charges.

- Financial Inclusion: Internet consumer finance has played a significant role in promoting financial inclusion by providing services to previously marginalized individuals. People with limited credit history, low income, or lack of access to physical bank branches can now avail themselves of financial services.

- Personalization: Internet consumer finance platforms leverage data analytics and algorithms to provide personalized financial recommendations and customized services based on individual needs and preferences. Users can receive tailored advice, investment suggestions, and budgeting tools to achieve their financial goals.

Risks of Internet Consumer Finance:

- Cybersecurity Threats: Internet consumer finance platforms are susceptible to cybersecurity threats, including hacking, identity theft, and data breaches. Users need to ensure they choose reputable platforms that have robust security measures in place to protect their personal and financial information.

- Fraud: Internet consumer finance has also given rise to fraudulent activities, such as phishing scams, fraudulent investments, and identity theft. Users must be cautious and vigilant when providing sensitive information and be aware of common scams to protect themselves from fraud.

- Dependency on Technology: Internet consumer finance relies heavily on technology and digital infrastructure. Any disruptions in internet connectivity, power outages, or technical glitches could temporarily hamper users’ ability to access their accounts and perform financial transactions.

- Lack of Personal Interaction: Although internet consumer finance offers convenience, it may lack the personal interaction and human touch provided by traditional banks. Some individuals may value the face-to-face communication and guidance that physical branches offer, especially when dealing with complex financial matters.

- Regulatory and Legal Concerns: Internet consumer finance operates under various regulatory frameworks, and users need to ensure that the platforms they choose comply with the necessary laws and regulations. The regulatory environment for internet consumer finance is still evolving, creating potential risks for users.

While internet consumer finance offers numerous benefits, users must be mindful of the associated risks and exercise caution when engaging in online financial transactions. By being aware of the potential risks and taking necessary precautions, individuals can harness the benefits of internet consumer finance while protecting themselves from potential pitfalls.

Different Types of Internet Consumer Finance Platforms

Internet consumer finance encompasses a diverse range of platforms that cater to various financial needs and preferences. These platforms offer different services, targeting specific aspects of consumer finance. Here are some of the different types of internet consumer finance platforms:

- Online Lending Platforms: These platforms facilitate loans between borrowers and lenders without the involvement of traditional financial institutions. Users can apply for personal loans, business loans, student loans, or mortgage loans, and lenders can earn interest by lending their funds to borrowers.

- Peer-to-Peer (P2P) Lending Platforms: P2P lending platforms directly connect individual lenders with individual borrowers. Borrowers can request funding, and lenders can choose to fund all or a portion of the loan. P2P lending platforms typically offer competitive interest rates and faster approval processes than traditional banks.

- Digital Banking Platforms: These platforms provide full-service banking capabilities online. Users can open and manage checking accounts, savings accounts, and certificates of deposit. Digital banks often offer competitive interest rates, lower fees, and innovative features, such as mobile check deposit and mobile wallets.

- Online Investment Platforms: These platforms enable individuals to invest in various financial instruments, such as stocks, bonds, exchange-traded funds (ETFs), or mutual funds. Users can access research tools, perform trades, and monitor their investment portfolios through user-friendly interfaces. Many online investment platforms offer low-cost options, making investing more accessible to the masses.

- Crowdfunding Platforms: These platforms allow individuals or small businesses to raise funds for specific projects or ventures from a large number of people. Crowdfunding can involve donations, rewards, or investments in exchange for a share in the project’s success.

- Payment Processing Platforms: These platforms facilitate online payments and money transfers. Users can send or receive funds, make purchases, and pay bills electronically through secure payment gateways. Popular examples include PayPal, Venmo, and Square.

- Personal Finance Management Apps: These mobile and web applications help individuals track their income, expenses, and budgets. Users can set financial goals, categorize expenses, receive spending alerts, and analyze their financial health. Personal finance management apps often feature powerful tools to aid in budgeting, goal setting, and financial planning.

It’s important for users to assess their financial needs, goals, and risk tolerance to choose the most appropriate internet consumer finance platform. Researching and understanding the features, fees, and security measures of each platform is crucial to ensure a seamless and secure financial experience.

The Regulatory Environment for Internet Consumer Finance

The dynamic nature of internet consumer finance has prompted the need for regulatory frameworks to ensure consumer protection, market stability, and fair practices. The regulatory environment governing internet consumer finance varies across countries and is continuously evolving to keep pace with technological advancements. Here are some key aspects of the regulatory environment for internet consumer finance:

Consumer Protection:

Regulators aim to protect consumers from fraudulent practices, unfair treatment, and privacy breaches. They enforce rules regarding transparency, disclosure, and consumer rights. Regulations often require internet consumer finance platforms to provide clear information about fees, interest rates, terms and conditions, and data security practices to enable consumers to make informed decisions.

Know Your Customer (KYC) and Anti-Money Laundering (AML):

Regulations mandate that internet consumer finance platforms implement robust KYC procedures to verify the identity of their users and prevent money laundering and terrorist financing. These procedures involve collecting and verifying personal and financial information, such as identification documents and proof of address.

Data Protection and Privacy:

Regulatory frameworks focus on safeguarding personal data and ensuring that internet consumer finance platforms handle user information appropriately. Compliance with data protection and privacy laws is crucial, as platforms collect and process sensitive financial and personal data. Regulations may require platforms to obtain user consent, maintain data security measures, and implement procedures for data breach notification.

Licensing and Registration:

Many countries require internet consumer finance platforms to obtain licenses or register with relevant regulatory authorities. These licenses ensure that platforms operate within legal frameworks, adhere to regulatory standards, and maintain financial stability. The licensing process often involves scrutiny of the platform’s business model, risk management practices, and compliance with regulatory requirements.

Cross-Border Transactions:

The cross-border nature of internet consumer finance introduces additional regulatory challenges. Regulators strive to ensure that platforms offering cross-border services comply with regulations in both the home and target jurisdictions. International cooperation between regulatory bodies may be necessary to address jurisdictional issues and establish regulatory consistency.

Fintech Sandboxes:

To promote innovation while maintaining regulatory oversight, some regulatory bodies have established fintech sandboxes. These sandboxes provide a controlled environment for fintech startups to test their products and services under regulatory supervision. This allows regulators to better understand and adapt to new business models and technologies while ensuring consumer protection.

It’s important for both users and internet consumer finance platforms to stay updated on the regulatory landscape and comply with applicable regulations. Adhering to regulatory requirements not only ensures compliance but also helps establish trust and credibility among users.

Case Studies of Successful Internet Consumer Finance Companies

The rise of internet consumer finance has given birth to several successful companies that have disrupted the traditional finance industry and revolutionized the way people access financial services. Here are three notable case studies of successful internet consumer finance companies:

1. LendingClub

Founded in 2006, LendingClub is one of the pioneers in the peer-to-peer lending industry. It operates an online marketplace that connects borrowers and investors, bypassing traditional financial intermediaries. LendingClub utilizes technology and data analysis to assess borrowers’ creditworthiness and assign interest rates.

LendingClub has transformed the lending landscape by offering a convenient and efficient way for individuals to obtain loans and for investors to earn attractive returns. The platform’s sophisticated credit assessment algorithms, streamlined loan processing, and broad borrower and investor base have contributed to its success.

2. Robinhood

Robinhood is a popular online investment platform that offers commission-free trading for a wide range of financial instruments, including stocks, options, ETFs, and cryptocurrency. Launched in 2013, Robinhood disrupted the brokerage industry by eliminating fees that had been a barrier to entry for many retail investors.

The platform’s user-friendly interface, accessible investment options, and innovative features like fractional shares and dividend reinvestment have attracted a large user base, particularly among millennial investors. Robinhood’s disruptive model has forced traditional brokerages to rethink their fee structures and cater to a new generation of digital-savvy investors.

3. PayPal

PayPal has become a household name in online payments since its inception in 1998. Initially serving as a digital wallet for online purchases, PayPal has evolved into a comprehensive online payment platform that enables individuals and businesses to send and receive money, make online purchases, and conduct mobile transactions.

PayPal’s user-friendly interface, robust security measures, and widespread acceptance have made it one of the most trusted and widely used payment platforms globally. Its acquisition of popular peer-to-peer payment app Venmo further expanded its reach and solidified its position as a dominant player in the online payment industry.

These case studies demonstrate the power of internet consumer finance in disrupting traditional financial systems and creating innovative solutions. Companies like LendingClub, Robinhood, and PayPal have leveraged technology and user-centric approaches to redefine how individuals access and interact with financial services, paving the way for a more inclusive and accessible financial ecosystem.

Future Trends in Internet Consumer Finance

The world of internet consumer finance is constantly evolving, driven by technological advancements and changing consumer preferences. Here are some key future trends that are shaping the landscape of internet consumer finance:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies are set to play a significant role in the future of internet consumer finance. These technologies can analyze vast amounts of data to offer personalized financial recommendations, improve risk management, automate customer interactions, and enhance fraud detection. AI-powered chatbots and virtual financial advisors are likely to become more prevalent, providing users with real-time assistance and tailored financial guidance.

2. Open Banking and API Integration

Open banking initiatives and the integration of application programming interfaces (APIs) are creating opportunities for seamless connectivity between different financial institutions and platforms. Open banking enables users to securely share their financial data across multiple platforms, allowing for more holistic financial management and personalized product offerings. APIs also facilitate collaboration between fintech startups and traditional financial institutions, leading to innovative solutions and improved user experiences.

3. Mobile-first Approach

The shift to mobile devices as the primary channel for accessing internet consumer finance services is expected to continue. Mobile apps are becoming more sophisticated, offering a wide range of features, from banking and payments to budgeting and investing. With the increased adoption of smartphones and the growing popularity of mobile payment systems, the mobile-first approach will be crucial for internet consumer finance companies to reach and engage with users effectively.

4. Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies have the potential to disrupt traditional financial systems and provide secure, decentralized alternatives. Blockchain can improve transparency in transactions and offer enhanced security. Cryptocurrencies, such as Bitcoin and Ethereum, are gaining acceptance as a means of payment and investment. As the regulatory environment around cryptocurrencies evolves, they are likely to play a more prominent role in internet consumer finance, providing new avenues for fundraising, cross-border transactions, and decentralized financial services.

5. Personalized Financial Experiences

Internet consumer finance will continue to prioritize personalization, tailoring financial products and services to individual needs and preferences. Through data analysis and AI, platforms will offer personalized recommendations, customized investment portfolios, and targeted financial advice. This focus on personalization will empower users to make informed financial decisions and achieve their individual financial goals.

As technology continues to advance and consumer expectations evolve, the future of internet consumer finance holds immense potential. It will be characterized by increased connectivity, enhanced user experiences, personalized services, and the integration of emerging technologies. By embracing these trends, internet consumer finance companies can stay ahead of the curve and provide innovative solutions to meet the ever-changing needs of consumers.

Conclusion

Internet consumer finance has transformed the way individuals access and manage their finances, offering convenience, accessibility, and a wide range of financial services at their fingertips. Through online platforms, individuals can apply for loans, invest in stocks, make payments, and manage their budgets with ease. The key features of internet consumer finance, such as 24/7 access, convenience, and personalization, have reshaped the financial landscape and empowered individuals to take control of their financial health.

While internet consumer finance brings numerous benefits, it also poses risks that users must be aware of, including cybersecurity threats, fraud, and reliance on technology. It is essential for users to choose reputable platforms, exercise caution when sharing personal information, and stay informed about regulatory requirements and best practices.

The future of internet consumer finance holds tremendous potential. Trends such as AI and ML, open banking, mobile-first approaches, blockchain, and cryptocurrencies are reshaping the industry and paving the way for personalized experiences, enhanced security, and innovative financial solutions. As the regulatory environment evolves to ensure consumer protection and market stability, internet consumer finance will continue to drive financial inclusion and offer new opportunities for individuals to manage their finances efficiently.

In conclusion, internet consumer finance has revolutionized the financial industry, offering individuals greater accessibility, convenience, and control over their finances. By embracing the benefits of this digital transformation while being mindful of the associated risks, individuals can leverage internet consumer finance to optimize their financial well-being and achieve their financial goals in an increasingly connected and technologically advanced world.